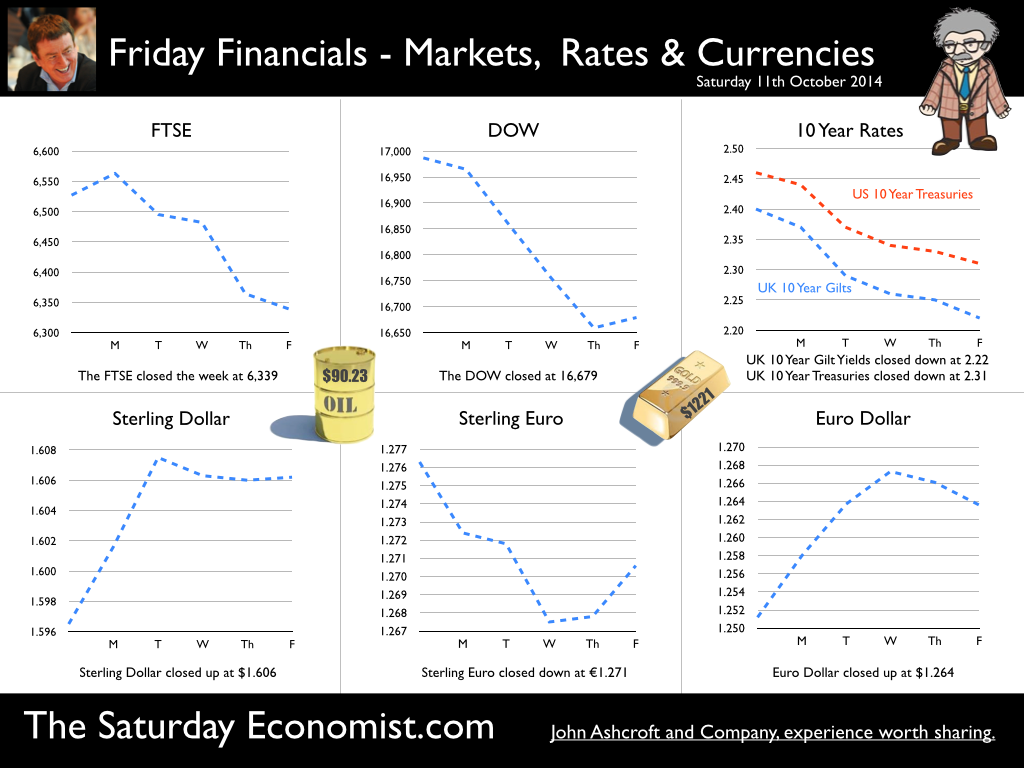

Christine Lagarde head of the IMF set the mood for the markets this week. Global growth disappoints, the pace of recovery is uneven and we are all beginning to worry about the Germans, the IMF included. Lacklustre domestic demand, increasing tensions to the East and fears for the French are beginning to undermine the European and world recovery. The IMF expects world growth to be just 3.3% this year rising to 3.8% next. In our own quarterly economics outlook released this week, we are even more pessimistic. We expect the world economy to grow by 2.7% in 2014 and 3.2% in 2015. We expect the volume of world trade to increase by just 3.1% in 2014 and 3.5% in 2015. In some part this explains the slump in world trade and commodity prices. Inflation (or lack of it) is always and everywhere an international phenomenon. World trade prices fell by 1.0% in 2013 after falls of 2% in 2012. We expect world trade prices to increase by 0.5% in 2014 rising to 1.5% and 2.5% over the subsequent two years. It is a slow recovery. The Fed holds its nerve … In the West the Fed cheered markets with minutes of the FOMC meeting in September. Somewhere in the 26 pages of minutes, analysts found comfort in a belief the Fed would not be increasing rates anytime soon, despite the strong job creation in September. Fed forecasts for growth this year remain modest at just over 2% with the unemployment rate expected to fall below 6%. Markets still expect rates to rise in June but the spread on the Fed “blue dot” forecasts vary dramatically. The MPC votes to hold rates … No surprise on Thursday as the MPC decided to keep rates on hold. A rate rise this year is ruled out with odds increasing against a pre-election hike given the trauma in Europe and the Fed delay to the West. In the UK …Manufacturing In the UK, the data was mixed this week. Manufacturing output increased by almost 4% in August following growth of 3% in the first half of the year. The pattern of recovery is mixed. Automotive, Transport, Aerospace, Marine, Engineering and Capital Investment Goods continue to drive growth in the sector. Food drink and utilities offer stability but too many sectors including chemicals, pharmaceuticals and building products remain shocked and await recovery. For others, including textiles and tobacco evidence of long term decline persists. Check out our Ten Slides to Understand Recovery in the UK Manufacturing Sector for more detail. Construction ... Construction output slumped in August according to the news headlines. Actually, growth year on year was down by just 0.3%. Don’t fire the “brickies” just yet. We still expect growth of over 5% this year. The ONS monthly data is remarkably volatile, subject to revision and at odds with wider survey data. Trade Figures August ... The trade figures improved in August. There was a deficit of £9.1 billion on goods partly offset by a surplus of £7.2 billion on services. The trade in goods deficit narrowed by £1.3 billion compared with July 2014. The main factor was not an increase in exports but a large fall in imports from non-EU countries. We suspect someone failed to take delivery of a luxury yacht in the month, maintaining for some, hopes of re-balancing. Our overall forecasts for the year unchanged. We continue to warn of the twin deficit dilemma and the 5% deficit on current account. Quarterly Economics Review Q3 Our quarterly economic review for Q3 was released this week. We still expect growth of 3.1% this year slowing to 2.8% next. The outlook for employment remains strong in contrast to a subdued inflation outlook. Worth a read you can download the full review here. So what happened to sterling this week? Sterling slipped against the dollar to $1.606 from $1.696 and down against the Euro at 1.264 from 1.276. The Euro closed up against the dollar at 1.264 (1.251). Oil Price Brent Crude closed down at $90.23 from $92.01. The average price in October last year was $109.08 Markets, moved down. The Dow closed at 16,679 from 16,987 and the FTSE closed down at 6,339 from 6,527. UK Ten year gilt yields moved down to 2.31 from 2.40 and US Treasury yields closed at 2.31 from 2.46. Gold moved sideways back to $1,221 from $1,191. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here *|MC:SHARE|*

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed