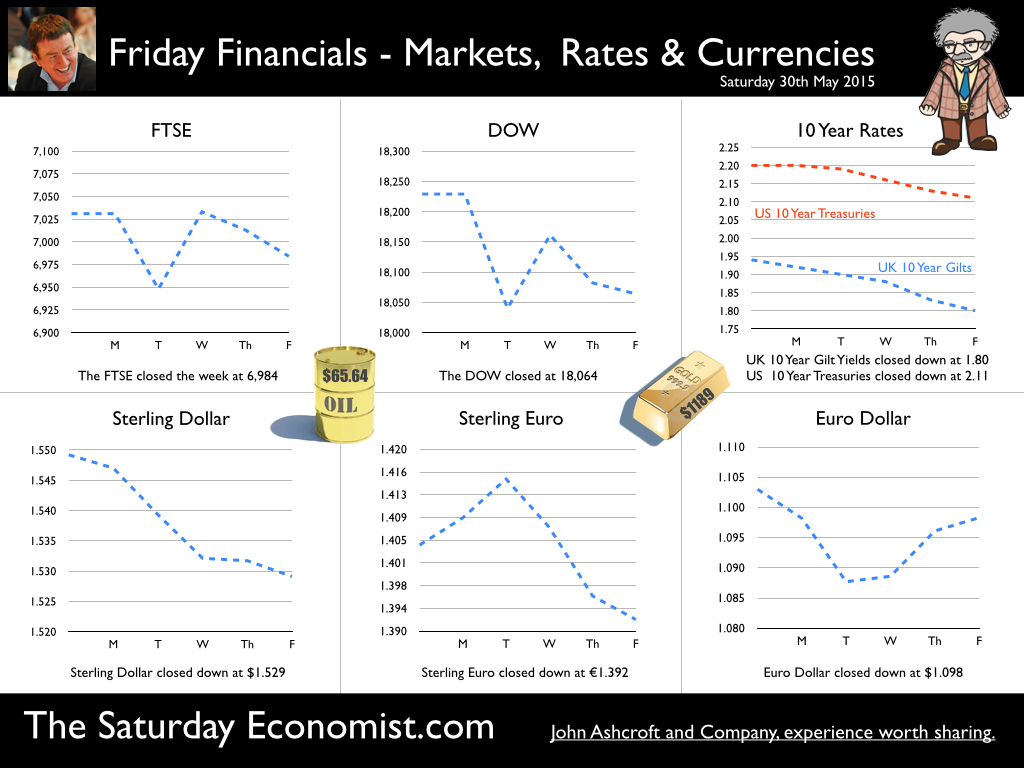

The second estimate of GDP was released this week. To the disappointment of many, growth of 2.4% was confirmed in the first quarter. Many analysts had expected an upgrade as a result of recent survey data but it was not to be. Service Sector … The service sector continues to drive recovery, with growth in private sector services increasing by almost 4%. Leisure, distribution, hotels, restaurants, transport, storage and comms are creating jobs at great pace, as sector growth impacts at over 4.5%. As we explained in our sectoral analysis of productivity, much of the job growth offers low productivity gains. Until robots deliver food to the table, or we all dine sushi mobile style, productivity gains to the economy will not be achieved. So why should we worry! It is time to realise, in a service sector economy, productivity is an output of growth divided by employment. It is not a driver of growth per se. The days of the Spinning Jenny yields are long passed. The sectoral adjusted trend rate of productivity is around 1.5% much lower than the long term average rate just over 2%. Time to stop worrying about productivity and man up to the reality of growth in a service sector economy! Business services increased at a slower rate of 3.3%. Public sector i.e. education and health increased by just 0.8%. Overall the service sector grew at a rate of 3.0%. Manufacturing, construction and investment … So what of the re balancing agenda? Manufacturing output increased by just 1.3% in the quarter. We analyse over sixty sub sectors in our manufacturing model. We had expected growth of 2.5% this year and next. The Q1 data has to be a blip! Even furniture output is enjoying a recovery. There may be some impact on capital goods output as a result of the investment slowdown. In turn that may be due to some election uncertainty and cutbacks in the North Sea. But overall we are obliged to reduce our forecast this year to manufacturing growth of just 2.1% this year rising to 2.5% next year. And what of construction … Construction output fell in the first quarter apparently! The ONS construction data is becoming as credible as Sepp Blatter statements on ethics within FIFA. There is something adrift in the seasonal adjusted data. We had expected growth of over 5% this year and next. We are obliged to revise down our estimate of construction growth this year to just 3.6%, rising to 5.1% next. We made the same mistake last year. In the end, construction growth in 2014 was 7.5%. And what of investment … Investment increased by 3.4% in the quarter, we had expected growth around 5%. Business investment increased by 3.7% and investment in plant and machinery increased by just 2%. So what of the rest of the year? We expect growth of 5% this year rising to 5.8% in 2016. We model investment as a function of growth and survey data. (Capacity and investment intentions). There is still widespread misunderstanding about investment. Two thirds of investment in the UK is property related. Commercial real estate and housing dominate the overall spend. Less than 30% is related to “productive capacity” including machinery and transport. Our four year “capital stock model” confirms there was no real fall in output capacity as a result of the apparent investment slow down. No need to “fret” about lost capacity. And what of trade … The trade deficit had a negative impact on the overall growth figures as the deficit, trade in goods, was offset by the surplus in services. No surprise to readers of The Saturday Economist! We forecast the deficit trade in goods to rise to £124.2 billion in 2015 and £130 billion in 2016. The trade in services surplus increased to £85.9 billion in 2014. We forecast a service sector trade surplus of £88.0 billion in 2015 and £91.7 billion in 2016. The central forecast is for the overall deficit (trade in goods and services) to increase to £36.2 billion in 2015 rising to £38.8 billion in 2016. No real surprises in the first quarter data. So what of growth this year … Overall we expect growth 2.8% this year rising to 2.9% in 2016. Our Quarterly Economic Outlook will be finalised this week-end with detailed forecasts and analysis available on line early next week. Don’t miss that! So what of rates? There is something strange in the way data is presented in the USA! The Bureau of Economic Analysis headline suggested US GDP decreased at an annual rate of 0.7 percent in the first quarter of 2015. The actual year on year growth was 2.7%, revised down from a first estimate of 3%. Hardly a huge setback. Janet Yellen made it clear last week, the Fed will look through the soft data in the first quarter. The revisions to US data for Q1 should not change this view. US rates will rise before the end of the year. Once the Fed makes a move, the MPC will surely follow within the six months framework. So what happened to Sterling this week? Sterling moved down against the Dollar to $1.529 from $1.549 and moved down against the Euro to €1.392 from €1.404. The Euro moved down against the Dollar to €1.098 from 1.103. Oil Price Brent Crude closed at $65.64 from $64.67. The average price in May last year was $109.54. The deflationary push continues. Our forecasts of a $75 - $80 recovery by Q4 remains the base case. Markets, moved down on latest growth data. The Dow closed down at 18,064 from 18,229 and the FTSE closed down at 6,984 from 7,031. Gilts moved down. UK Ten year gilt yields moved to 1.80 from 1.94 US Treasury yields moved to 2.11 from 2.20. Gold moved down to $1,189 ($1,206). That’s all for this week. Don’t miss the Big Social Media Conference in July and the Great Manchester Economics Conference in October. It’s a great line up for all events! The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed