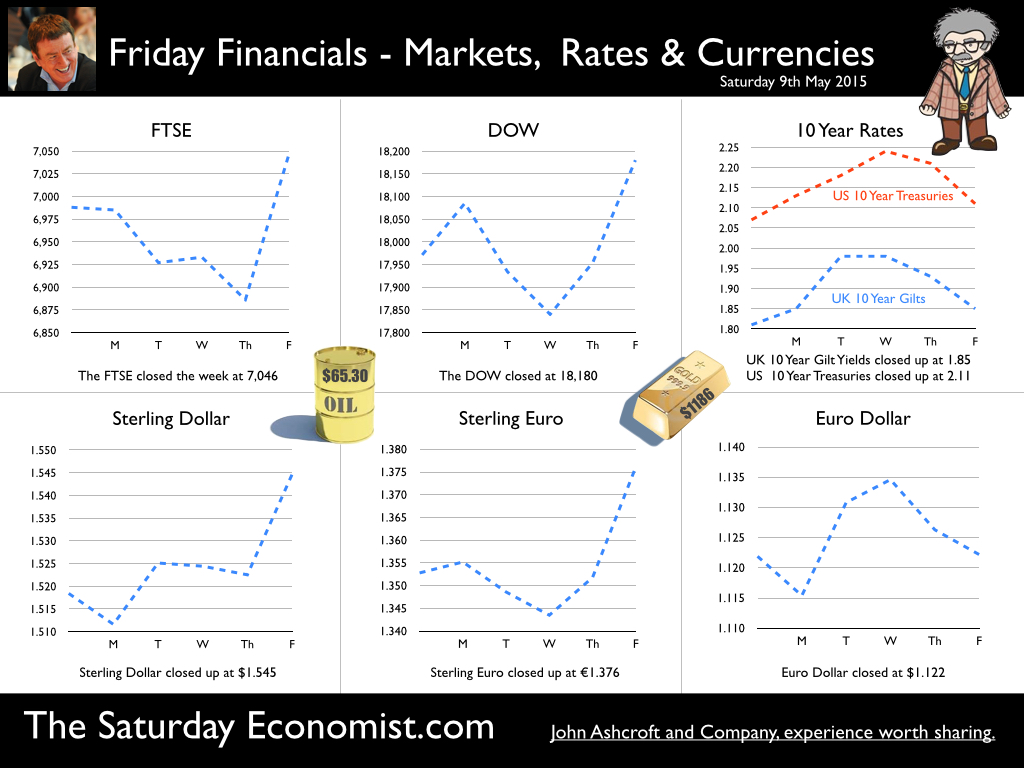

Markets bounce on Cameron win … News of the Tory majority boosted business sentiment this week. The FTSE closed above the critical 7,000 mark and Sterling moved higher against the Dollar and the Euro on news of the Tory win. The dream team continues with the Cameron Osborne alliance. There will be no change in Downing Street occupancy. Osborne will remain as Chancellor. Policy will no longer hampered by the Lib Dem coalition. Constituency casualties will bring an end to the mayhem in BIS created by the interventionist Cable. OK it’s a small majority! But anything is better than another coalition run. Dissident Tory backbenchers will never be forgiven if they upset the front bench with too much angst about Europe. The Tories can lay the platform for ten years in office, if they play their cards right. As for Europe, it is time to bring on the referendum. Sooner rather than later. The dream duo will secure the best deal on the Euro table and put it to the resounding yes vote. We don’t want years of uncertainty overhanging the great opportunity for growth in the years ahead. And we don’t want Brexit! So what about Scotland? The Scots have all but driven Labour out. It is difficult to see a return. The Conservatives have little political ambition across the border. Accommodation with Nicola Sturgeon will secure much of the SNP agenda, no need for break up. In London the Tory prize would secure SNP abstention or a removal from the vote on domestic issues. RealPolitik rules in the shadows of formal alliance. So what of the economy this week? Car Sales continue to flourish … April car sales increased by just over 5% in April with the strongest performance in the month for over ten years. Sales of 185,778 units increased sales in the first four months of the year to over 920,000 units, up by 6.4% on the same period last year. Mike Hawes, SMMT Chief Executive, said, "The figures highlight the current strength of consumer confidence, even at a time of such political uncertainty. We are confident that the UK’s new car market – so symbolic of economic mood – will continue to thrive.” And so it will. The latest GfK figures for April highlight the strength of consumer confidence in the national economic situation and of household finances in general. The worrying factor is the weak growth in car manufacturing at a time of strong growth in the markets both in the UK and in Europe. Trade Data … Trends in the car market will impact on the trade deficit. So it proved with the March data. Seasonally adjusted, the UK’s deficit on trade in goods and services was estimated to have been £2.8 billion in March 2015, compared with £3.3 billion in February 2015. This reflects a deficit of £10.1 billion on goods, partially offset by an estimated surplus of £7.3 billion on services. Doesn’t sound so bad but … In the first quarter, the UK's deficit on trade in goods and services was estimated to have been £7.5 billion, widening by £1.5 billion from the previous quarter. The deficit trade in goods was almost £30 billion. For the year as a whole, we expect the trade in goods deficit to be £124 billion offset by a surplus in services of almost £90 billion. The residual trade deficit of £35 billion is less than 2% of GDP and is not a threat nor constraint to growth. Service Sector Growth continues … For those who still believe in the “March of the Makers” rebuilding the workshop of the world, to rebalance the UK economy … Or for those who still believe in “onshoring” the repatriation of manufacturing from the Far East and “Homespun from India” it is time to wake up and smell the imported coffee. It ain’t going to happen. There will be no manufacturing resurgence and no trade in goods rebalancing no matter what happens to Sterling. The latest Markit/CIPS UK Services PMI® Index hit an eight-month high in the April data released this week. The Business Activity Index rose for the second month running in April to 59.5, from 58.9, signalling the fastest rate of service sector expansion since August 2014. Activity in the sector has now risen for 28 successive months, the longest sequence of growth in seven years. The Index remained comfortably above its long-run average of 55. The (private) service sector is the driver of growth. We expect growth of over 4% this year in this dominant sector within the economy. So what of rates? Markets still believe the Fed will begin to increase rates in Q3 this year. In April the US economy created 223,000 jobs in the month. We expect US growth of almost 3% in 2015. The Fed will make a move soon. June no longer the favourite. Once the Fed makes a move, the MPC will surely follow. The inflation outlook will look completely different by the end of the year as oil and commodity prices rally. Brent Crude tested the $70 level this week. The recovery in the US and Europe will continue! Gilt yields are moving up. We could well be leaving Planet ZIRP before Christmas … You know it makes sense … Buckle Up! So what happened to Sterling this week? Sterling moved up against the Dollar to $1.545 from $1.518 and moved up against the Euro to €1.376 from €1.353. The Euro held against the Dollar at €1.122 unchanged. Oil Price Brent Crude closed at $65.30 from $66.07. The average price in May last year was $109.54. The deflationary push continues. Our forecasts of a $75 - $80 recovery by Q4 no longer so far fetched. Brent Crude tested $70 intra week. Markets, bounced on UK election result and US jobs news. The Dow closed at 18,180 from 17,971 and the FTSE closed down at 7,046 from 6,988. UK Ten year gilt yields moved up to 1.85 from 1.81. US Treasury yields moved up, to 2.11 from 2.07. Gold slipped to $1,186 ($1,173). That’s all for this week. Don’t miss the Big Social Media Conference in July and the Great Manchester Economics Conference in October. It’s a great line up for all events! The Saturday Economist - now mailing to 50,000 businesses every month! Later this month we release our Quarterly Economic update. Don't miss that! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed