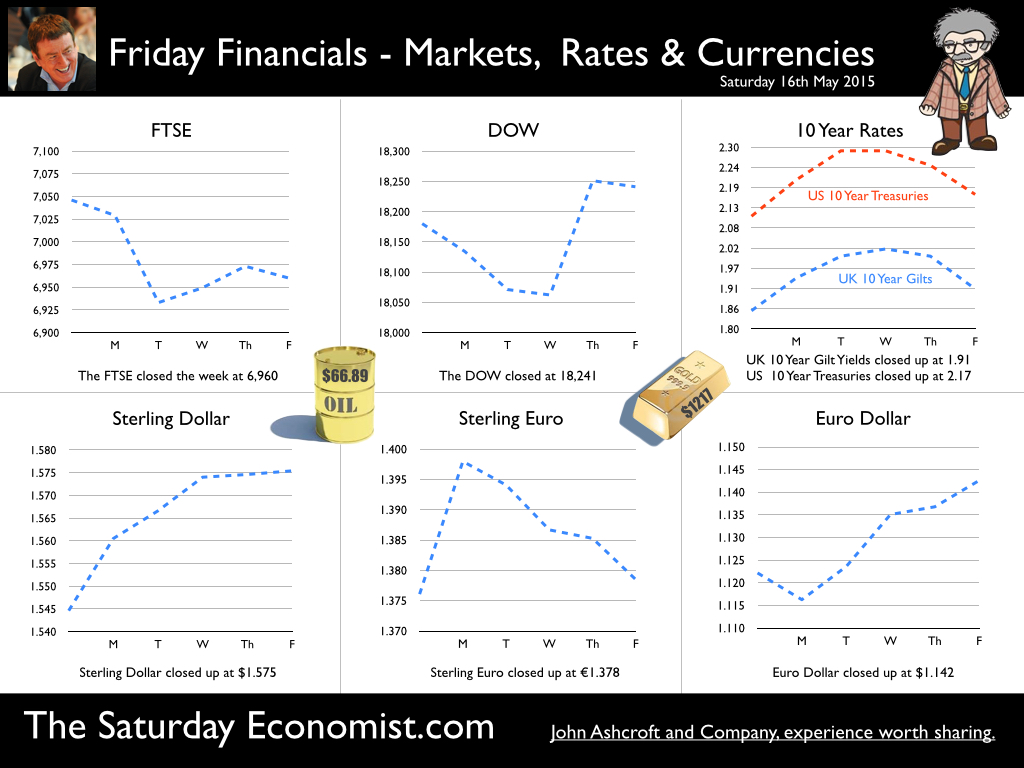

The Bank of England was pretty sanguine about growth in the latest Inflation Report this week. The projection is for solid demand growth, the boost to household spending from lower energy and food prices sustained by a pickup in wage growth and higher levels of employment. Business investment will remain robust, reflecting the recovery in the economy generally. The Bank GDP growth forecast has been downgraded to around 2.5% this year and over the next few years. Inflation is expected to return to the 2% target over the next two years. The path implied by forward market rates suggests interest rates are expected to rise to just 1.4% by Q2 2018. So what can we make of it all? In one sense the Bank is right to downgrade forecasts for the year. Growth in the first quarter is estimated to be just 2.4%. The latest data on manufacturing and construction continue to disappoint … March of the makers slows to a standstill in March … According to the latest data from the Office for National Statistics, manufacturing output increased by just 1.1% in March and by just 1.3% in the first quarter of the year. After strong growth in the final quarter of 2014 (3.3%) manufacturing output, the march of the makers, has slowed to a standstill. Consumer durables output increased by 2.8% in the month, buoyed by the strength of the consumer confidence and a strong housing market. The strong pattern of investment and capital goods growth experienced in 2014 slowed to just 0.5% in the first quarter. So what is going on? The slowdown in the oil and gas market may be impacting on overall production output in the short term. Output in the energy sector fell by 5% on the quarter. This in turn is having an impact on the manufacturing related sectors and investment goods in particular, according to feedback from The Saturday Economist Readers. So what are the prospects for the rest of the year? We analyse over sixty manufacturing sectors in the preparation of our forecasts. We had forecast growth of 2.5% in 2015 which we would expect to fall to 2.2% based on the short run data. However in the main quarterly forecast due later this month, we expect strong growth in transport, engineering and consumer goods to continue, so too with food and drink. Even furniture is experiencing a change in fortunes following the strength of the housing market. A rally in investment and capital goods into the second half of the year may well mean our forecast for the year is unchanged. So what of construction … Construction output falls despite strong housing growth … Construction output was flat in the first quarter of the year compared to the first quarter last year. Despite strong growth in private housing (up 8%) and industrial building (up 11%), weak growth in commercial and repair and maintenance damaged the overall output figures. For the year as a whole we had expected construction growth of over 5% in our February forecast following the growth of over 7% last year. Based on Q1 data, that no longer makes sense. The construction data is incredibly volatile. The fall in commercial output and repair and maintenance may be reversed in the months ahead. Our model suggests zero growth this year but common sense says otherwise. 5% growth could still be a possibility. So what of jobs and pay…? Employment continues to rise … Employment continued to rise and unemployment continued to fall in the latest data from the Office for National Statistics for the first quarter of the year. There were 31.1 million people in work, 564,000 more than for a year earlier. Most of the jobs created are now full time employment, predominantly in the service sector. (With a zero productivity yield). There were 1.83 million unemployed, a rate of 5.5%, down by almost 400,000 on a year earlier according to the Labour Force Survey Data. The claimant count fell to 763,000, a rate of 2.3% in April. This is now lower than pre recession levels in 2008. Vacancies fell slightly to 733,000 but the U:V ratio fell to just 1.04 well below the average levels for 2005 to 2008. The labour market is tightening. Wages start the big move … Comparing January to March 2015 with a year earlier, pay for employees in Great Britain increased by 2.2% excluding bonuses. Doesn’t sound too bad! In March, average earnings increased by 3.3% with a 4.3% surge in private sector earnings. Construction workers enjoyed a 6% plus pay rise and leisure sector workers enjoyed a 7% increase in earnings. Earnings have reached the tipping point … as recruitment difficulties increase. So what do we expect for the rest of the year? … We think the Inflation Report is too conservative with an outlook, beset with an outdated fixation on productivity constraint. We expect the economy to grow by 2.9% this year with a strong continuation of employment growth and continued falls in unemployment. Recruitment difficulties will persist in manufacturing, construction and the service sector. The pressure on earnings will increase. The inflation outlook will look radically different by the end the year. World recovery will continue, the pressure on commodity prices will increase. The oil price will rise by Q4 this year offset in part by the strength of Sterling. So what of rates … So what of rates? Markets still believe the Fed will begin to increase rates in Q3 this year. We expect US growth of almost 3% in 2015. The recovery in Europe continues. The Fed will make a move this year. June no longer the favourite. September the hot month. Once the Fed makes a move, the MPC will surely follow. Gilt yields are moving up. We could well be leaving Planet ZIRP before Christmas … You know it makes sense … Buckle Up! So what happened to Sterling this week? Sterling moved up against the Dollar to $1.575 from $1.545 and moved up against the Euro to €1.378 from €1.376. The Euro moved up against the Dollar at €1.142 from 1.122. Oil Price Brent Crude closed at $66.89 from $65.30. The average price in May last year was $109.54. The deflationary push continues. Our forecasts of a $75 - $80 recovery by Q4 remain as the base case. Markets, moved in different directions. The Dow closed up at 18,241 from 18,180 and the FTSE closed down at 6,960 from 7,046. UK Ten year gilt yields moved up to 1.91 from 1.85. US Treasury yields moved up, to 2.17 from 2.11. Gold moved up to $1,217 ($1,186). That’s all for this week. Don’t miss The Big Social Media Conference in July and The Great Manchester Economics Conference in October. It’s a great line up for all events! The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed