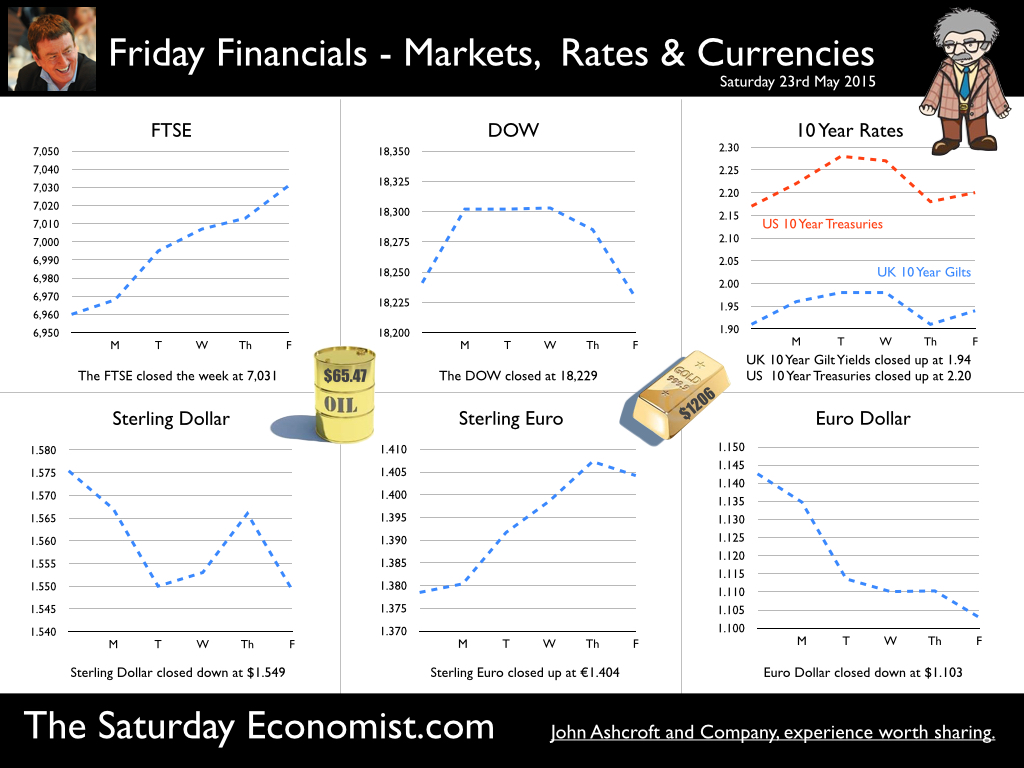

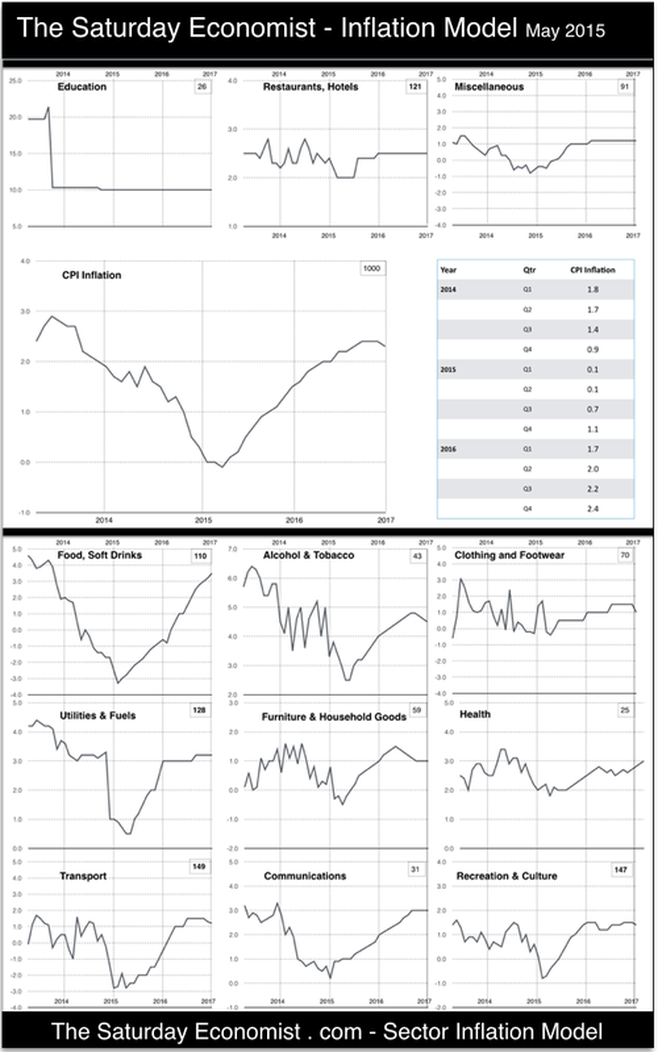

Of Retail Sales, Inflation and Borrowing … Public Sector Borrowing is off to a fine start for the year … the Chancellor is on track to meet the OBR borrowing target of £75.3 billion in the current year! According to the latest data from the ONS, April Public Sector Net Borrowing was £6.8 billion, a decrease of £2.5 billion compared to April 2014. Income and corporation tax payments were up by 3.7% and 11.3% respectively. Expenditure was lower, as were debt interest payments. In the financial year ending March 2015, public sector net borrowing was £87.7 billion, 4.8% of Gross Domestic Product. Year on year, the deficit was reduced by £10.8 billion. Public sector net debt was £1,487.7 billion (80.4% of GDP), up by £83.6 billion compared to prior year. So what does this mean for the rest of the year? The Chancellor is on track to meet the OBR projection of a reduction in borrowing to £75.3 billion this year. There is still much to be done if the targets are to be met. The cost reduction targets will be difficult as public sector earnings rise and gilt yields rally, putting pressure on borrowing costs. Increases in growth, jobs and inflation will assist the revenue task. Strong retail sales will assist the process … Retail Sales Boom Continues in April … Retail sales volumes increased by 4.7% in April following growth of 5.1% in the first quarter of the year, according to the latest data from the ONS [Office for National Statistics]. Sales values increased by 1.8% in the month following growth of 1.7% in Q1. The strong level of retail sales continues, as consumer confidence continues to improve. Household goods stores enjoyed strong sales growth up by almost 12%. Textile, clothing and footwear stores increased by almost 9%. Food sales were flat as food values fell by 1.4%. Omni channel is now the key word in retail. Online sales increased by 13.1% compared with April last year, accounting for 12.2% of all retail sales in the month. So what does this mean for the rest of the year? We expect the strong retail sales growth to continue into 2015 slowing into the second half as prices increase. We anticipate sales volume growth of 4.2% for the year as a whole, compared to 4% last year. So what of inflation … Inflation CPI basis fell to -0.1% in April, down from 0.0% in March according to ONS data. Reductions in transport costs and food provided the largest contribution. In the year to April, food prices fell by 3.0% and prices of motor fuels fell by 12.3%. There were smaller downward price movements for housing and household services, clothing and footwear, furniture and household equipment. Overall goods inflation fell by 2% offset by a 2% rise in service sector inflation. Restaurant costs increased by 2% and education costs increased by 10%. Producer Prices … Output prices for UK manufacturers fell by 1.7% in the year to April 2015, unchanged since February 2015. Total input prices, the overall price of materials and fuels bought by UK manufacturers fell by 11.7% in the year to April 2015, a modest recovery from a fall of 12.8% in the year to March 2015. Output prices were largely affected by petroleum prices, down by just over 16% and food prices down by 3%. Input costs were dominated by a near 40% fall in oil prices. Home food prices fell by 12% and imported materials (metals and chemicals) fell by 5% approximately. So what does this mean for the rest of the year? Oil prices, food prices and earnings will hold the key to the out turn by the end of the year. The Bank of England Inflation Report released last week, suggests inflation will return to target 2% over a two year period. Most analysts expect inflation to average just under 1% during the last quarter of the year and just under 2% by the end of 2016. Our disaggregated model (below) suggest inflation will average just over 1% by the end of the year and return to target by the second quarter of 2016. Oil prices are recovering and earnings are beginning to rise rapidly. In farming, it is said the best remedies for low prices are low prices. The best remedies for high prices - high prices. The Californian drought should serve as a warning, the food price outlook could change rapidly. Oil prices are 40% below a market norm. World commodity prices, excluding oil, are 30% below linear trend rate. So what of rates? Janet Yellen made it clear this week, the Fed will look through the soft US data in the first quarter. US rates will rise before the end of the year. Once the Fed makes a move, the MPC will follow. Gilt yields are moving up. We could well be leaving Planet ZIRP before Christmas … but there may be time for a ski trip (in Europe, it will be cheaper) first. So what happened to Sterling this week? Sterling moved down against the Dollar to $1.549 from $1.575 and moved up against the Euro to €1.404 from €1.378. The Euro moved down against the Dollar to €1.103 from 1.142. Oil Price Brent Crude closed at $65.47 from $66.89. The average price in May last year was $109.54. The deflationary push continues. Our forecasts of a $75 - $80 recovery by Q4 remains the base case. Markets, moved in different directions. The Dow closed slightly down at 18,229 from 18,241 and the FTSE closed up at 7,031 from 6,960. UK Ten year gilt yields moved up to 1.94 from 1.91 US Treasury yields moved up, to 2.20 from 2.17. Gold moved down to $1,206 ($1,217). That’s all for this week. Don’t miss the Big Social Media Conference in July and the Great Manchester Economics Conference in October. It’s a great line up for all events! The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed