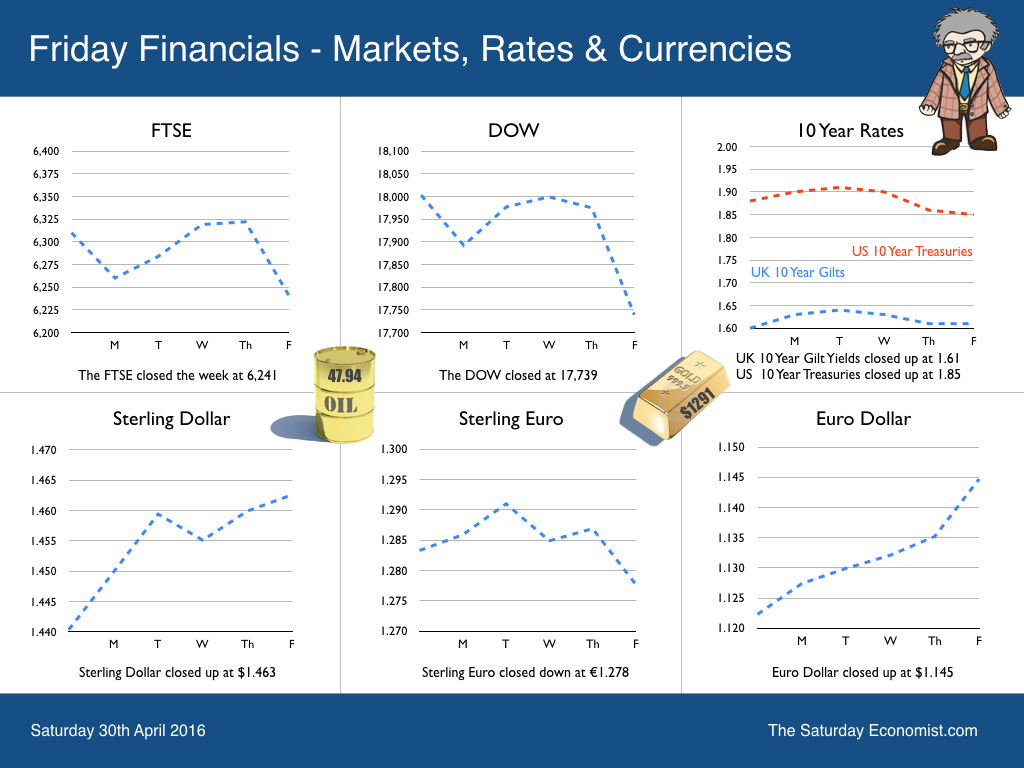

UK growth in the first quarter of the year was 2.1% following growth of 2.1% in the final quarter of last year. The service sector continues to drive growth in the economy with leisure and distribution the main drivers of growth, up by over 4% year on year. Business service activity increased by just 2.1% and government activity increased by just 1.6%. Service sector growth of 2.7% contrasted with the disappointing performance of manufacturing (down by 1.3%) and construction (down by 1.7%). For the year as a whole we now expect growth of 2.4% compared to growth of 2.3% last year and our earlier forecast of 2.6% in our March update. The May economics update will reflect the second estimate of GDP from the ONS due next month. Strong jobs growth and household income expansion would confirm a positive outlook for the UK economy. The key question remains ... who is making the cocktails to sustain consumption over the medium term! For the moment, world growth is steady and growth in Europe continues the path of recovery … Growth in Europe … The latest data from the European Union suggests growth was 1.7% in the first quarter of the year compared to growth of 1.9% in 2015. We expect EU growth to continue into the year with growth of around 1.9% for the year as a whole. EU unemployment was down to 10.2% in March and inflation fell to -0.3% in the month, the latter driven lower by falling energy costs. We expect inflation to bounce back in the second half of the year as energy costs unwind and the economic recovery continues. Across the EU area, performance is varied. In Germany, unemployment at 4.2% is lower than the UK and less than half the rate in France (10%). Spain (20.4%) and Greece (24.4%) remain the troubled regions despite the 3% plus growth in Spain in 2015. Growth in the USA … In the US, the Fed held rates in April. Job gains averaged 230,000 per month in the first three months of the year. The unemployment rate has fallen to 4.9%. The labor force participation rate is rising but wage growth is yet to show a sustained pickup according to Janet Yellen this week. Household spending is increasing but investment is falling as a result primarily of oil exploration cut backs. Net exports are weaker attributed to weak world growth and the sluggish pattern of world trade. Inflation increased to 1.25% in March with oil prices and the vagaries of the dollar pertinent to the increase in headline and core inflation. The latest data for The Bureau of Economic Analysis confirms GDP growth was 1.9% in the first quarter of 2016 compared to 2.0% in the final quarter of 2015 and 2.4% for the year 2015 as a whole. We expect US growth of 2.4% in the year compared to the consensus forecasts of just 2%. Why so gloomy? Even the Fed expects growth of 2.2% in 2016, with unemployment falling to 4.7% by the end of the year. The Saturday Economist on Brexit … This week we had a surprise visit into the office from Lord Hill, EU Commissioner for Financial Stability, Financial Services and Capital Markets. Charged with the responsibility for financial regulation and capital markets union, Lord Hill was keen to listen to any concerns about the EU's role in regulation but also to explain the most valuable aspects of the Single Market. We didn’t take about Brexit over much but Lord Hill cautioned on the potential difficulties and protracted negotiations that would follow from a decision to leave the EU. It won't be easy or axiomatic to secure a free trade deal in goods or services. To date, we have had over 4,000 hits on our Brexit presentation published on line. We analyse the issues into the Business, Economics, Political and Social arguments. Almost 100 slides with all the information needed to understand the key issues in this important vote. It is difficult to identify the business case to leave the EU. In fashion it is said, there is a model for every catwalk. In economics we say, there is a model for every cat fight. So it proved with the release of new forecasts from the group of eight economists for the leave campaign this week. Over the next few weeks we have a great series of events with debate from either side. John Longworth is with us next week and Sir Richard Leese will be speaking later in the month. So what of rates? In the US, the Fed is still expected to increase rates this year, with one or two rate hikes remaining a possibility. In the UK, wage growth and headline inflation will provide the triggers to action in the second half of the year, with no rate rise expected ahead of the referendum in June. We still expect UK rates to be at least 0.75% by the end of the year, with two rate hikes to 1% a further possibility. Oil Brent Crude closed just below the $50 dollar mark this month. The outlook for inflation will look remarkably different by the end of Q3 this year. So what happened to Sterling? Sterling closed up against the Dollar at $1.463 from $1.440 and steady against the Euro at €1.278 from €1.280. The Euro moved up against the Dollar to 1.145 from €1.125. Oil Price Brent Crude closed up at $47.94 from $41.64 The average price in April last year was $59.52. Markets, were down - The Dow closed at 17,739 from 18,000. The FTSE closed at 6,241 from 6,294. Gilts - yields moved up. UK Ten year gilt yields closed at 1.61 from 1.60. US Treasury yields moved up to 1.85 from 1.87. Gold closed at $1,291 ($1,243). That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline and download The Saturday Economist App! Our review of the Brexit facts and figures out now! Download Here! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed