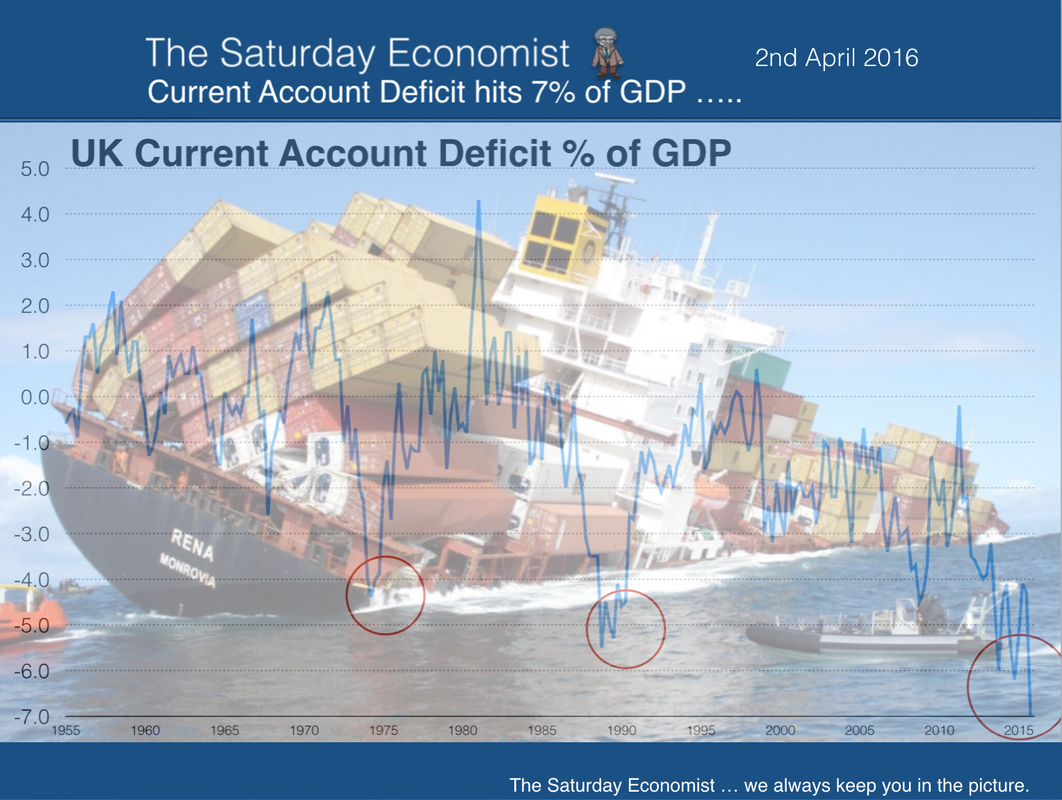

Great news from the ONS this week, the UK economy grew at a slightly faster rate than first thought. GDP growth was 2.3% for the year as a whole compared to the previous estimate of 2.2%. Not much of a change and rather inexplicable. Output growth was revised down to 2.2% from 2.3%. The mysteries of Welsh valley publications continue. We have revised our forecast growth for the current year to 2.5% using the latest published data. The Balance of Payments … So far so good. Then came news of the UK Balance of Payments and the Current Account Deficit. The current account deficit increased to 7% of GDP in the final quarter of last year. Always good to see the UK economy breaking records. This is the highest deficit on record in post war history. That’s not so good. At the end of the day, the balance of payments must balance. We are reliant on the “kindness of strangers” to fund the current account deficit - the message from the Governor in January. Deficits “with inky blots and rotten bonds sustained” - the message from Cabinet Office in the 1930s … The Current Account Deficit … The current account deficit includes the deficit, trade and goods … a deficit (goods) of £125.4 billion was offset by a surplus (services) of £88.7 billion. The net trade deficit in goods and services was £36.7 billion. The imbalance at around -2% of GDP is not really a cause for concern and is easily funded, or should be. The deterioration on the “primary income account" is more serious. Net investment income fell to minus £33.7 billion for the year as a whole and almost minus £13 billion in the final quarter. Earnings remitted from the UK are in excess of receipts from investments in foreign lands. Is this a real problem? That rather depends on whether this a cyclical challenge - a result of the strong growth in the UK compared to lower growth in Europe and elsewhere. In which case, there is no real cause for concern. The trend will reverse as foreign economies improve and overseas earnings increase accordingly. On the other hand we must consider if this a structural problem? A result of the long term reduction in UK overseas investment and the acquisition of UK domestic assets by international corporates? In which case there will be no cyclical relief as growth in Europe and the rest of the world accelerates. The current account deficit may continue to deteriorate. This may then lead to a serious credibility and funding problem. The “kindness of strangers" may not extend to the “madness of crowds”. The Twin Deficit Dilemma … The Current Account Deficit was £96 billion in 2015 (-5.2% of GDP). Government borrowing (the internal balance) was -£82 billion (-4.4% of GDP). The twin deficit dilemma represents a structural problem within the UK economy. The deficits should be as opposite sides on a see saw, one rising as the other falls. When both are down, the see saw is broken. We then spend more time on the slide … The strength of domestic demand is generating a trade deficit but earnings are not strong enough to generate the government revenues needed to offset public sector borrowing. The solution? Higher tax and higher interest rates the classic and inevitable solution to the Twin Deficit Dilemma but not just yet ... The Saturday Economist on Brexit … For the moment, the focus is on the referendum in June. We have now completed our presentation on the Brexit issue. We analyse the issues into the Business, Economic, Political and Social arguments. The latter largely confined to immigration, the political a matter of choice. Almost 100 slides are available on line with all the information needed to understand the key issues in this important vote. You can download the presentation here … Steel Crisis … So what of Port Talbot … last year China produced more steel than the UK produced over the last 45 years. Over the past two years, China produced more steel than the UK has produced since the introduction of the Bessemer converter in the late 19th Century. China has over 50% of the world steel market. The UK less than 1%. The game of Chinese Chequers, almost over. It’s Check Mate for UK steel … In the USA … In March the economy created 215,000 new jobs. Earnings increased by 2.3%. Household confidence and spending continues. New car sales were up by 3% in the month. Car registrations set for 18 million this year. We expect growth in the US of 2.4% in 2016, interest rates will continue to rise … So what of rates … Janet Yellen suggests rates may rise under caution, with a further two rises in interest rates before the end of the year. We expect UK rates to rise in the third quarter this year as inflation accelerates and commodity prices rally. The MPC will be obliged to follow the Fed at some stage … So what happened to Sterling? Sterling closed down against the Dollar at $1.422 from $1.480 and down against the Euro at €1.247 from €1.265. The Euro moved up against the Dollar to €1.140 from €1.116. Oil Price Brent Crude closed at $38.71 from $40.45 The average price in April last year was $59.52. Markets, held - The Dow closed at 17,720 from 17,515. The FTSE closed at 6,146 from 6,106. Gilts - yields moved down. UK Ten year gilt yields were down at 1.44 from 1.48. US Treasury yields moved down to 1.80 from 1.90. Gold closed at $1,217 ($1,265). The old relic is losing it’s shine. John That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline or download The Saturday Economist App! Our review of the Brexit facts and figures out now! Download Here! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed