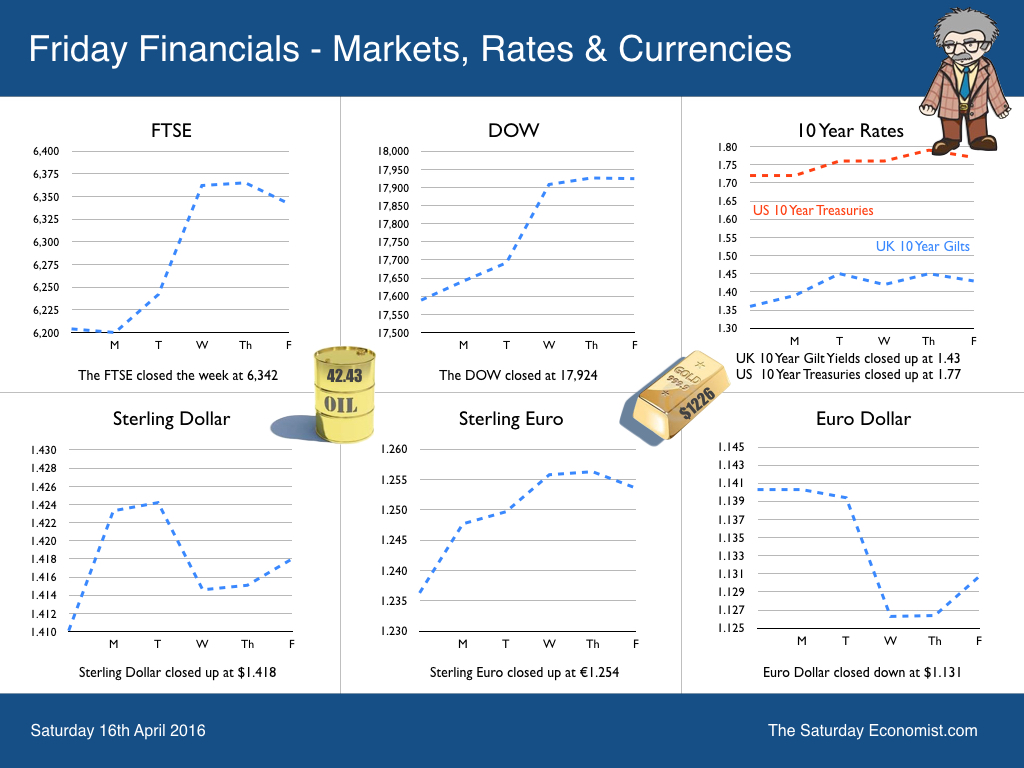

The Bank of England MPC held rates at 0.5% this week. No real surprise but the warnings of the referendum impact on UK growth this year were clear “There are some signs that uncertainty relating to the EU referendum has begun to weigh on certain areas of activity. Some decisions on capital expenditure and commercial property transactions are being postponed pending the outcome of the vote. This might lead to some softening in growth during the first half of 2016.” Softer growth? Perhaps but this is just a short term problem, assuming the “Remain” campaign wins the day in June. The official campaign has begun. The battle is on to win hearts and minds ahead of the EU referendum on 23 June.The tension will build in the weeks ahead … Inflation … This week, the ONS released the latest inflation figures. CPI inflation increased to 0.5% up from 0.3% last month. Service sector inflation increased to 2.8% offset by a 1.6% fall in goods inflation. Is this significant? Yes. We expect a big rise in service sector earnings this year, pushing service sector inflation still higher. As for goods inflation, commodity prices are turning in oil, hard metals and food. The evidence in the Producer Price Inflation charts is clear. Inflation is on the move. We expect inflation (CPI) to be rising towards the 2% target by the end of the year. There may yet be an escape from Planet ZIRP in 2016 … Negative rates … the lethal monetary policy injection … Trapped on Planet ZIRP, we are in danger of being dragged into the NIRP crevasse as central bankers continue to experiment with the world economy. Mis pricing capital in a capitalist system will create havoc in financial systems and so it is proving with negative rates. Japan’s negative interest rate experiment is floundering. Interest rate levels are having little effect on credit demand, the market function is declining. The policy is having no impact on household spending or investment activity according to the Wall Street Journal this week. Trading has withered in money markets, bond yields have fallen and the Yen has surged to 18 month highs against the dollar. “Every day is like being Alice in Wonderland”, said Tomohisa Fujiki head of interest rate strategy at BNP Paribas Securities. Deeper and deeper into the hole, negative rates and a rising Yen? It isn’t supposed to be like that. "Sometimes I have believed in as many as six impossible things before breakfast" said Alice. Carroll's character could have been talking about central bank monetary policy. In Germany, negative rates are fast becoming a lethal injection. In life insurance, the sector has historically offered high levels of guaranteed returns over very long periods to investors. To fund the outlay commitments of policies in place, insurers need investment returns of 5% plus. The search for Alpha difficult to achieve with EU bond yields sub 1%, as The Wall Street Journal explained this week. To meet the capital gap, high yielding assets are being sold to secure capital gains from older investments. In the short term this will boost liquidity and capital reserves. The search for yield then becomes a bigger problem have to be reinvested in an era of negative rates. With negative rates, the ECB is trying to stimulate inflation with an experimental unproven monetary policy which is damaging the financial system, failing to stimulate domestic demand and leading to unpredictable impacts on currency trading. It is a lethal cocktail. It is the wrong policy at the wrong time. The monetarist mantra “Inflation always and everywhere a monetary phenomenon” is out of time. For the moment, inflation is always and everywhere an international phenomenon, exacerbated by a commodity cycle driven lower by would be supply side adjustments in the energy sector. The commodity cycle is turning and will accelerate in due course. It is time to climb out of the NIRP crevasse and leave Planet ZIRP before more harm is done. The Saturday Economist on Brexit … We have had over 2,500 hits on our Brexit presentation published on line. We analyse the issues into the Business, Economics, Political and Social arguments. Almost 100 slides with all the information needed to understand the key issues in this important vote. Over the next few weeks we have a great series of events with debate from either side. Don’t miss the John Longworth event on the 4th May. So what of UK rates? The inflation data data will increase the odds for a rate rise this year. The IMF has been pessimistic about the outlook for UK, writing down the forecasts for GDP growth in the current year to just 1.9%. Why so gloomy when nothing much has changed? We still expect growth of 2.5% this year despite the latest disappointing data on manufacturing and construction. So what happened to Sterling? Sterling closed up against the Dollar at $1.418 from $1.410 and up against the Euro at €1.254 from €1.236. The Euro moved up against the Dollar at €1.143. Oil Price Brent Crude closed up at $42.43 from $41.83 The average price in April last year was $59.52. Markets, were positive - The Dow closed at 17,924 from 17,589. The FTSE closed at 6,342 from 6,204. Gilts - yields moved up. UK Ten year gilt yields closed at 1.43 from 1.36. US Treasury yields moved up to 1.77 from 1.72. Gold closed at $1,226 ($1,240). The old relic rebuffed this week. That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline or download The Saturday Economist App! Our review of the Brexit facts and figures out now! Download Here! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed