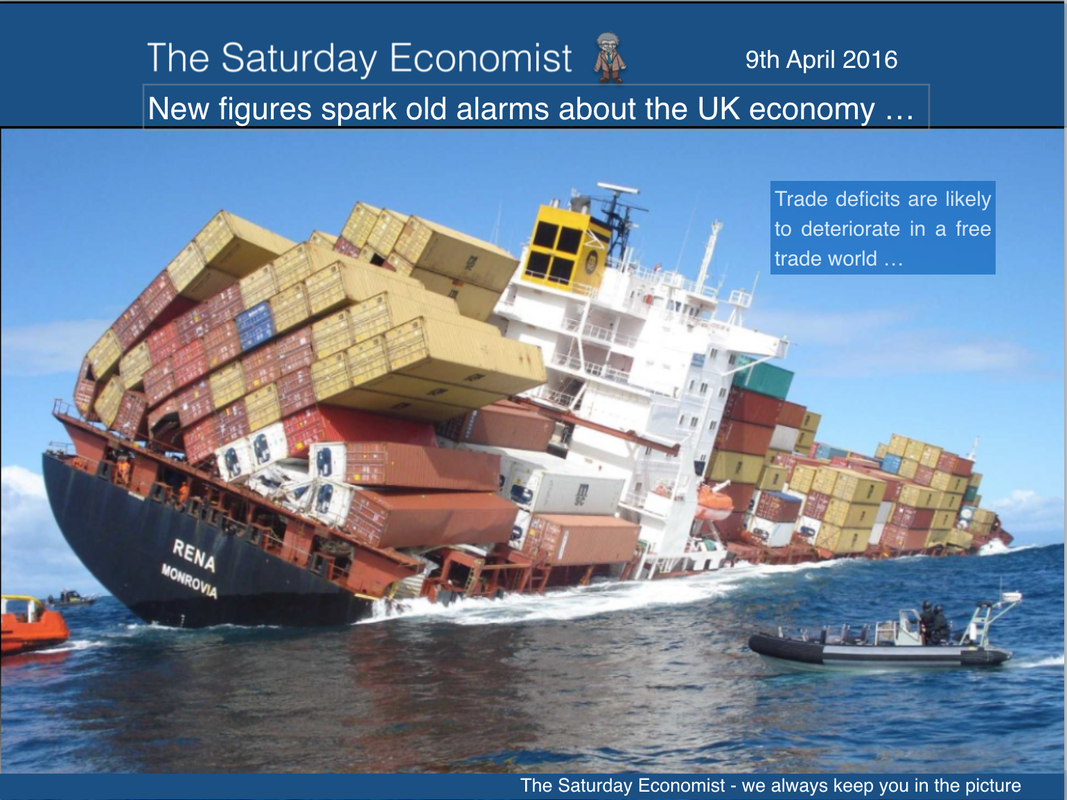

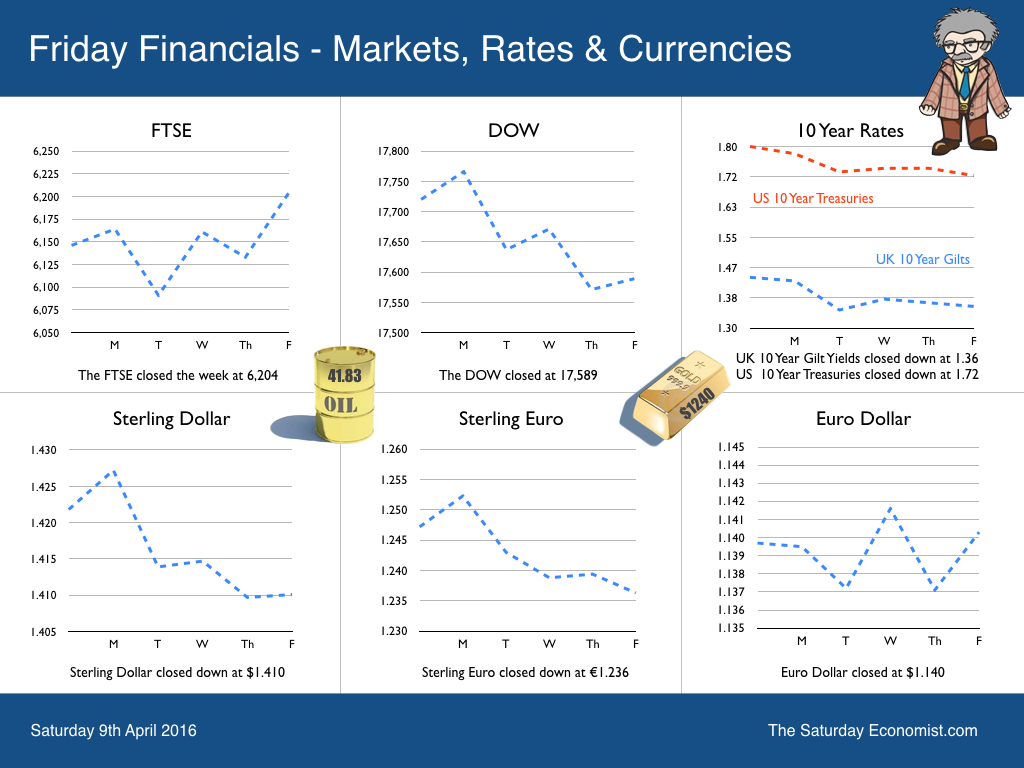

New figures spark alarm over UK recovery, the headline in the Times today. It is the week of ONS updates on trade and manufacturing output. Like a fire alarm test undertaken once a month, a regular ring, can first alarm, then insensitive the mind to the fundamental problems behind the noise on each and every subsequent occasion. So with the trade data and now manufacturing output, the new figures spark old alarms about the UK economy. Clearly there is no march of the makers rebuilding the workshop of the world. Soon there may be no steel, nor the anvils on which to forge a trade recovery. So what is going on ... Deficit Trade in Goods … There is a problem with the UK external deficit, made manifest by the record 7% current account deficit in the final quarter of 2015. To make matters worse, the trade deficit is set to deteriorate further this year. The trade deficit with the EU increased to £8.4 billion in February. We expect a trade deficit with the EU (trade in goods) of almost £100 billion this year. The overall UK trade deficit around the world will increase to over £133 billion this year from £125.4 billion in 2015. Free trade with the rest of the world? Be careful what you wish for. The trade deficit with China was £25 billion last year. It has doubled over the last ten years. Surplus Trade in Services … The deficit trade in goods will be offset by a potential £90 billion surplus trade in services. The problem is the service sector export performance is slowing, up by a mere billion in the year in comparison. The UK has a “revealed comparative advantage” in the service sector, particularly financial services. This "advantage" can improve the international trade performance. The service sector performance can be improved by a strategy which guarantees the role of London in Europe, challenges further regulation and resists the lure of a punitive tax and penalties regime providing easy revenue to the Exchequer. No time to kill the Golden Goose ... the UK is no longer laying billets of iron and steel. Manufacturing output slumps in February … Manufacturing output fell in February by 1.8% compared to prior year. We were not expecting much growth this year, just 1%. Nevertheless, the figures are disappointing. Capital goods output fell by over 3%, consumer goods fell by 1% approximately. Textiles, chemicals and metals were badly hit in the month. Big Pharma offered the strongest area of growth up by 5% in February. Car sales hit record in March … As if to add insult to injury, car sales hit a record 519,000 in March up by 5% in the month and year to date. We expect registrations on 2.6 million this year. Manufacturing will be around 1.6 million, generating a clear import “deficit” of one million units. The strength of household spending and domestic demand will exacerbate the trade deficit. Relative demand conditions dominate the balance of payments performance. So what of Sterling … Can fluctuations in currency assist the outlook? Not really. A fall in Sterling merely compounds the problem. It is no solution. We are import dependent for food, drink raw materials, semi manufactures and finished consumer goods. Imports are relatively inelastic with respect to price. A depreciation merely generates domestic inflation or damages margins in manufacturing, wholesale and retail. For those who would look to Sterling to solve the problems of the UK steel industry, consider the basic components of iron ore and high grade coke, are totally import dependent. The biggest set back to steel output since peak in 1971 was not the vagaries of sterling, nor the evils of the EU and Chinese imports. The coal strike in the early seventies, caused an immediate loss of output and market share for The British Steel Corporation. Another self inflicted wound from which there was no recovery. The Saturday Economist on Brexit … We have over 2000 hits on our Brexit presentation last week. It’s long I know. We analyse the issues into the Business, Economics, Political and Social arguments. Almost 100 slides are available on line with all the information needed to understand the key issues in this important vote. You can download the presentation here. Over the next few weeks we have a great series of events with debate from either side. Don’t miss the John Longworth event on the 4th May, nor The Saturday Economist Quarterly Economics Presentation on the 18th of May we will present the Brexit data then ... So what of rates … The Fed are cautious about the outlook for the world economy but still consider the UK. recovery to be sound. The decision on rates is unlikely to change this month. We still expect a further two increases in the US this year. The Bank of England will be relieved to follow in the third or fourth quarter this year. A current account deficit of 7% of GDP is incompatible with base rates at 0.5%. The alarm is ringing but no one is rushing for the exit as yet … So what happened to Sterling? Sterling closed down against the Dollar at $1.410 from $1.422 and down against the Euro at €1.236 from €1.247. The Euro held against the Dollar at €1.140. Oil Price Brent Crude closed up at $41.83 from $38.71 The average price in April last year was $59.52. Markets, were mixed - The Dow closed at 17,589 from 17,720. The FTSE closed at 6,204 from 6,146. Gilts - yields moved down. UK Ten year gilt yields were down at 1.36 from 1.44. US Treasury yields moved down to 1.72 from 1.80. Gold closed at $1,240 ($1,217). The old relic slightly buffed. That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline or download The Saturday Economist App! Our review of the Brexit facts and figures out now! Download Here! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed