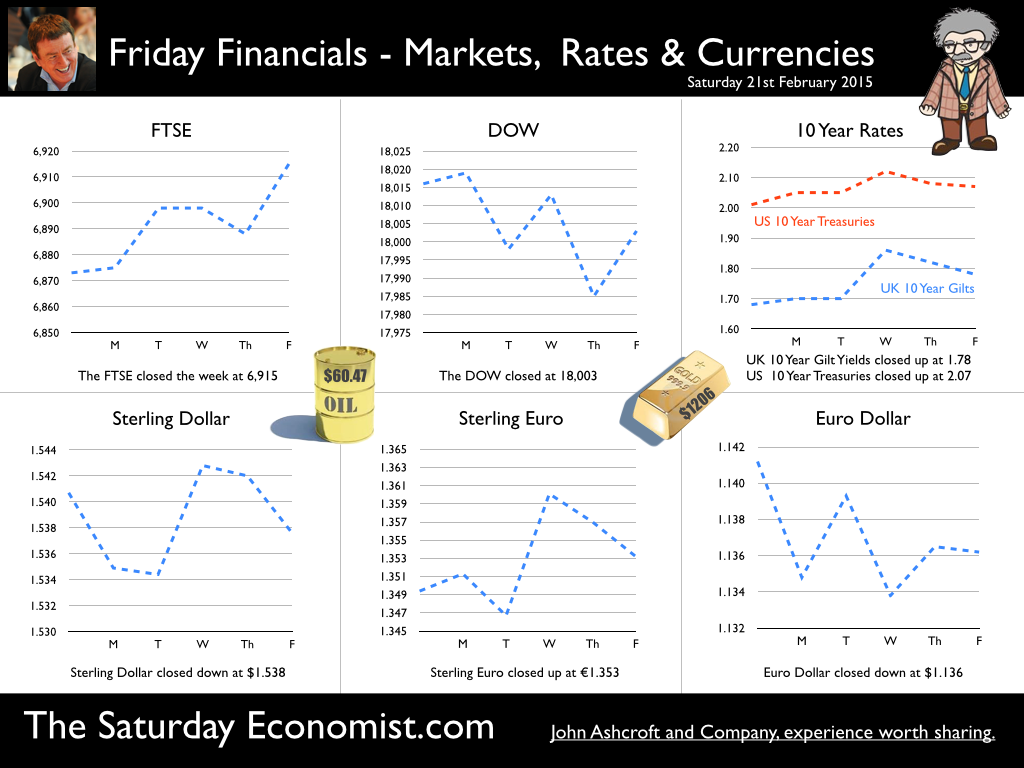

A great week for the Chancellor with good news on borrowing, retail sales, employment, earnings and inflation. With months to go to the election, the economy will be in great shape come polling day … Borrowing on track, Chancellor will meet OBR targets this year … In January 2015, Public Sector Borrowing was -£8.8 billion, an increased surplus of £2.3 billion compared with January 2014. In the financial year to date borrowing was £74.0 billion, a decrease of £6.0 billion compared with the same period in 2013/14. The Chancellor is back on track to hit the OBR target of £91.3 billion in the current financial year. It will make for a great pre election story, very convenient! Retail boom continues - volumes up 5.4% … Retail sales in January 2015 increased by 5.4% compared with January 2014. This is the 22nd consecutive month of year-on-year growth. The longest period of sustained growth since May 2008. Retail sales values increased by 2.3% compared with prior year. Internet sales increased by 12% year on year accounting for 11.6% of all retail activity in the month. All main store types, except petrol stations, showed increases in the amount spent year-on-year. Our forecasts for retail sales volumes have increased into 2015 as a result of the anticipated trends in inflation, employment and earnings. We now expect retail sales volumes to increase by at least 3.7% in the year with values increasing by 2.5%. Employment Trends - sign of overheating … Claimant Count Rate .. lower than 2007 The headline claimant count fell to 823,000 in January. This is good news for the economy but alarming for the overheating index. The average claimant count in the first quarter of 2008, immediately pre recession was 797,000. The average claimant count in 2007 was 863,000. The unemployment rate dropped to 2.5% in the month. The rate is lower than 2007 and marginally above the 2.4% recorded in the first quarter of 2008. The jobs market is tightening … the claimant count the measure. Vacancies … higher than pre recession The number of vacancies increased to 718,000 in January. The UV rate, the ratio of claimant count to vacancies dropped to just 1.15. Vacancy rates are higher than the pre recession average and indicate the growing pressures on recruitment and placement. Earnings … recovering quickly Earnings increased in the latest data to December. The single month earnings count jumped to 2.4% with strong growth of 2.7% in private sector earnings and 3.6% growth in business and financial services. Manufacturing earnings up 2.3% and construction pay up 3.5% also demonstrated strong growth. Employment Rate … highest since 2005 The employment rate was 73.2%. A level last seen in February 2005. It has never been higher, since comparable records began in 1971, LFS Unemployment … There were 1.86 million unemployed people. This was 486,000 fewer than for a year earlier. The unemployment rate was 5.7%, significantly lower than a year earlier (7.2%). Compared to pre recession peaks in the first quarter of 2008, the averages then were 1.6 million unemployed and a rate of 5.2%. We will reach those levels by the second quarter this year! So what can we make of it all … The labour market is simmering to the boil gently with early signs of over heating reflected in claimant count levels and the number of vacancies. Earnings are rising and real incomes will be boosted by the low headline inflation rate. Four hundred thousand left the unemployment register in the last twelve months. If current growth rates are maintained, job centres will be closing at the end of 2017, there will be no one left looking for work. Inflation falls - it’s all about oil and food. The consumer price index CPI basis was just 0.3% in January, according to data released by the Office for National Statistics (ONS). This is down from 0.5% in December. Food and soft drink prices were 2.5% lower. Transport prices were 2.8% lower. Should we worry about deflation? Not really. Service sector inflation increased in the month to 2.4% from 2.3% in December. Goods inflation on the other hand was negative -1.5%, driven lower by oil and food prices. Manufacturing Prices … The output price index for goods produced by UK manufacturers fell by 1.8% in the year to January 2015. Falling prices for crude oil, petroleum and food products were the main contributors to the reduction in prices. The overall price of materials and fuels bought by UK manufacturers fell 14.2% compared with a fall of 11.6% in the year to December. Crude oil prices fell by 50%, the largest annual fall seen for the crude oil index (data from 1997). Prospects for the year … Inflation is at its lowest level since the introduction of “Targeting” two decades ago. It will fall further, potentially turn negative in the Spring, before rising towards the end of the year. Inflation is then expected to return to the 2% target within eighteen months. The key barometer to watch in the short term is oil prices. Prices have rallied from a $46 dollar low in January, Brent Crude basis, to over $60 dollars spot last week! We expect prices to return to “normality” $80 plus by the end of the year. So what of base rates ... ? Service sector inflation is above target, earnings are increasing, oil, energy and commodity prices are set to increase. Inflation will return to the 2% target within eighteen months and possibly in the early part of 2016. Strong growth in the economy and a labour market showing early signs of overheating suggest base rates will have to rise before the end of the year, especially if oil prices rally as we now expect. The markets may expect a rate rise to be delayed into 2016. The MPC was unanimous in voting to keep rates on hold this month … but not for much longer. If the Fed moves in June, a UK move must follow soon … So what happened to Sterling this week? Sterling closed down against the Dollar at $1.538 from $1.541 and moved up against the Euro to €1.353 from €1.3505. The Dollar closed down against the Euro at €1.136. Oil Price Brent Crude closed down at $60.47 from $61.35. The average price in February last year was $108.90. Markets, rallied. The Dow closed at 18,003 from 18,016 and the FTSE closed up at 6,915 from 6,873. UK Ten year gilt yields moved up to 1.78 from 1.68. US Treasury yields moved up to 2.07 from 2.01. Gold closed down at $1,206 ($1,232). That’s all for this week. Don’t miss the Great Manchester Business Conference 6th March, the Social Media Conference in July and the Economics Conference coming to Manchester in October. It’s a great line up for all events! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed