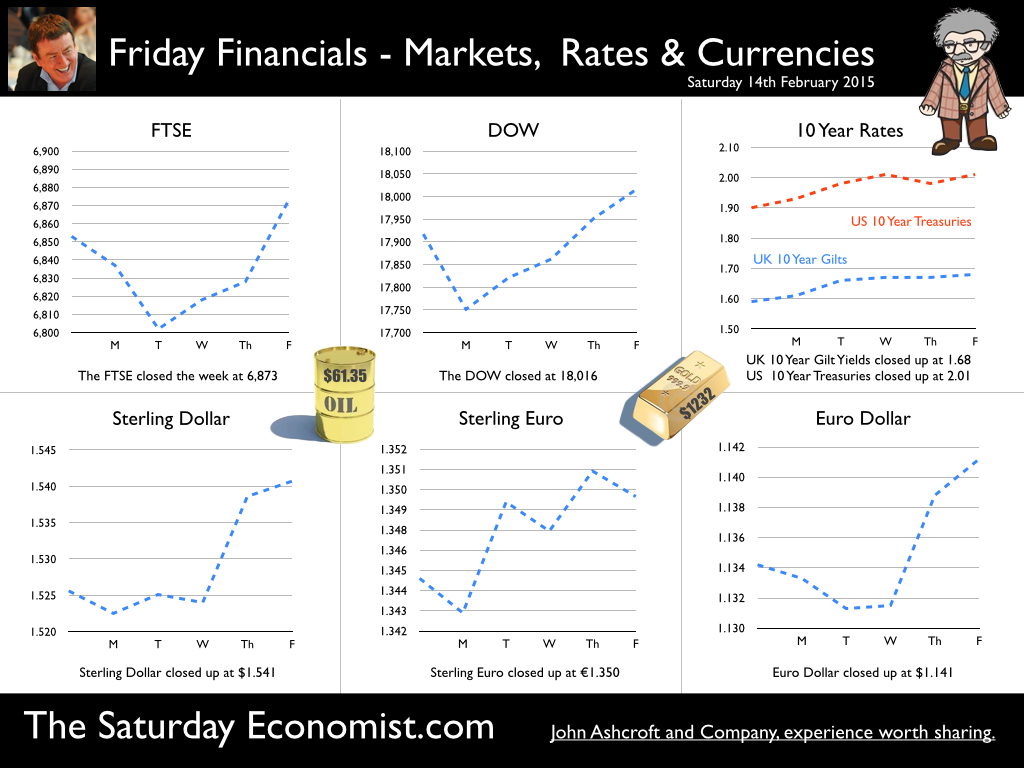

The Inflation Report headlines were “relatively straightforward" this week according to the Governor. Inflation is at its lowest level since the introduction of “Targeting” two decades ago. It will fall further, potentially turn negative in the Spring, before rising towards the end of the year. Inflation is then expected to return to the 2% target over a two year horizon. GDP growth is expected to be around 2.9% for this year and into next. Unemployment will continue to fall, the capacity gap will shrink and base rates are likely to remain on hold until the second quarter of 2016. World growth reflects a continuing recovery boosted by low oil, energy, food and commodity prices. Monetary policy around the world remains accommodating. [Euroland recently joined the QE club pushing rates to the floor in the process. The latest Eurostat data released this week confirms recovery in Germany and elsewhere. ] In the UK, unemployment continues to fall, earnings are rising and real earnings are enhanced by the fall in headline inflation. Households will benefit. Consumer spending will boost domestic demand along with an expected increase in investment. Should we worry about deflation … In his letter to the Chancellor, the Governor explained the drop in inflation was largely as a result of the falls in energy and food prices. Core inflation is around 1.3%. Inflation is muted as a result of a prolonged period of high unemployment, low earnings growth and remaining “slack” in the economy. However, the large, one-off falls in prices (oil) are likely to dissipate in around a year. Service sector inflation remains above target. Earnings are set to rise faster as the labour market tightens. Commodity prices are set to rally and [we] continue to believe the oil price will rally faster than markets expect. The implications for headline inflation will impact in the final quarter of 2015. So what of interest rates … The Governor reiterated the brief. The inflation target is symmetric. “We care as much about inflation below target as above”. The Bank believe monetary policy takes between eighteen months to two years to have peak impact. So with the effects of the large, one-off falls in prices likely to dissipate in around a year, “We will look through them”. In other words, base rates and QE will remain on hold, with no tendency to push rates lower or to extend QE as a result of the low headline inflation rate. The inflation forecast in the report shows inflation coming back to the target within two years and then rising a little further. The forecast assumes Bank Rate follows the path implied by market yields - gradual and limited increases over the forecast horizon beginning some time in Q2 2016. So are we heading for a NICE decade …? Is the period of non inflationary constant expansion returning? Growth in the UK over the next two years should continue, with inflation returning to target perhaps a little sooner than markets expect. The labour market is tightening, earnings are rising, private service sector growth is way ahead of trend rate. Oil prices will rebound, the recovery in US and Europe will continue and gather pace. The Fed is still expected to move in June this year. The MPC is unlikely to delay a UK rate response beyond the end of the year, if Yellen blinks first. A NICE decade - that’s a big call. We expect growth of around 3% this year and into next, with continued falls in unemployment and government borrowing. The trade figures will continue to disappoint. The current account deficit at 6% of GDP may become a real threat to growth. So what of base rates? We expect rates to rise towards the end of 2015, extension into 2016 too much of a stretch. Sterling markets appear to heed the call … So what happened to Sterling this week? Sterling closed up against the Dollar at $1.541 from $1.526 and moved up against the Euro to €1.350 from €1.345. The Euro closed up against the Dollar at €1.141 from 1.134. Oil Price Brent Crude closed up at $61.35 from $57.84. The average price in February last year was $108.90. Low oil prices are for Christmas not for life! Markets, rallied. The Dow closed at 18,016 from 17,917 and the FTSE closed up at 6,873 from 6,853. UK Ten year gilt yields moved up to 1.68 from 1.59. US Treasury yields moved up to 2.01 from 1.90. Gold closed unmoved at $1,232 ($1,232). That’s all for this week. Check out the Oil Market Update. Don’t miss the Great Manchester Business Conference in March, the Social Media Conference in July and the Economics Conference coming to Manchester in October. It’s a great line up for all events! John © 2015 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed