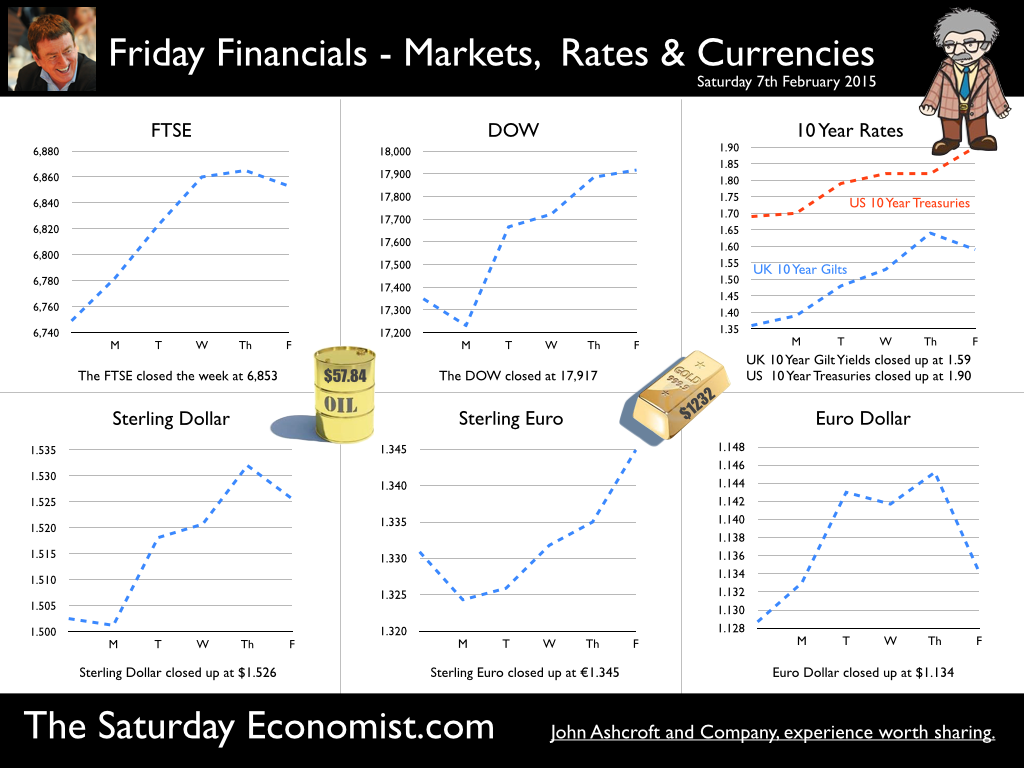

The Bank of England’s MPC voted to maintain Bank Rate at 0.5% this week. The Committee also voted to maintain the stock of purchased assets at £375 billion. No real surprise, low oil prices and the prospect of negative inflation were hardly likely to produce tough debates, about a rise in rates. Don’t be too complacent, oil prices jumped by 17% last week. The number of US oil rigs fell by 10% in January. The U.S. rig count dropped by 200 in the month according to the Baker Hughes data. The oil price collapse is not a function of demand. The world recovery continues, as does the demand for energy. For a few barrels more, around 2% of consumption, prices have fallen by 60%. Hence we cautioned, “Low oil prices are for Christmas, not for life”. The rebound to $100 dollar oil will come sooner than anyone expects. Then, the impact on inflation and interest rate policy will be significant! The hawks will squawk once again in the MPC aviary ... So what news of the economy this week … The PMI Markit data on manufacturing, construction and services for January produced a raft of strong headlines. “Construction output growth rebounds at the start of 2015”. “Manufacturing PMI edges higher at start of year”. Service sector sharp growth sustained”. In fact in every major sphere of activity within the economy, the strong growth continues into the new year according to the Markit/CIPS survey data. Private service sector growth increased by over 4% in the final quarter of 2014. Construction growth will continue to benefit from strong housing market growth. Even the march of the makers will pick up the pace. Consumer confidence is high, mortgage rates remain low, the economy is simmering gently. Watch out for “double, double, oil price trouble, Fire burn, and caldron bubble”. Fears may soon turn to overheating in the UK economy, despite the current qualms about growth in Europe … Car Sales … Car sales in January were up by 7% compared to last year, the strongest January since 2007. It was the 35th consecutive month of rises, reflecting the strength of the recovery in the UK. Remember there were almost 2.5 million new cars registered in the UK last year, the most in a calendar year since 2004. We expect a 5% increase in registrations this year, a reflection of the strength of the recovery increasing the deficit trade in goods in the process. Halifax House Prices … Halifax house price increased by 8.5% in January compared to prior year. The data slightly at odds with the 6.8% rise reported by Nationwide last month. Mortgage approvals increased in December and low rates continue to attract buyers into the market. For the year as a whole we expect house prices to increase by 5%. The real cost of borrowing will remain negative providing a boost to transaction activity over the period. Trade Data … The UK deficit on trade in goods and services was estimated to have been £2.9 billion in December 2014. A deficit of £10.2 billion on goods, was partly offset by an estimated surplus of £7.3 billion on services. For the year as a whole the trade in goods deficit was £120 billion compared to £113 billion in the prior year. The deficit is set to rise to £125 billion this year despite the mitigating impact of lower oil prices. The overall deficit, trade in goods and services was £35 billion in the year compared to £34 billion in 2013. What happened in the US? In the USA, the strong recovery continues. January payroll numbers increased by 257,000 jobs in the month as wages increased by 2.2% year-on-year. The US economy is expected to grow by 3% this year. The Fed is still expected to make the move on rates in June or early Q3. So what happened to Sterling this week? Sterling rose against the Dollar to $1.526 from $1.503 and against the Euro at €1.345 from €1.331. The Euro rallied slightly against the Dollar at €1.134. Oil Price Brent Crude closed up 17% at $57.85 from $49.60. The average price in February last year was $108.90. Markets, closed up. The Dow closed down at 17,917 from 17,349 and the FTSE closed up - to 6,853 from 6,749. 7,000 just a hop ahead of the Easter bunny! UK Ten year gilt yields moved up to 1.59 from 1.36. US Treasury yields rallied to 1.90 from 1.69. Gold closed at $1,232 ($1,272). That’s all for this week. It is looking good for the election run in. Just the borrowing figures to sort out! Check out our Oil Market Update. Don’t miss the Great Manchester Business Conference in March, the Social Media Conference in July and the Economics Conference coming to Manchester in October. It’s a great line up for all our events! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed