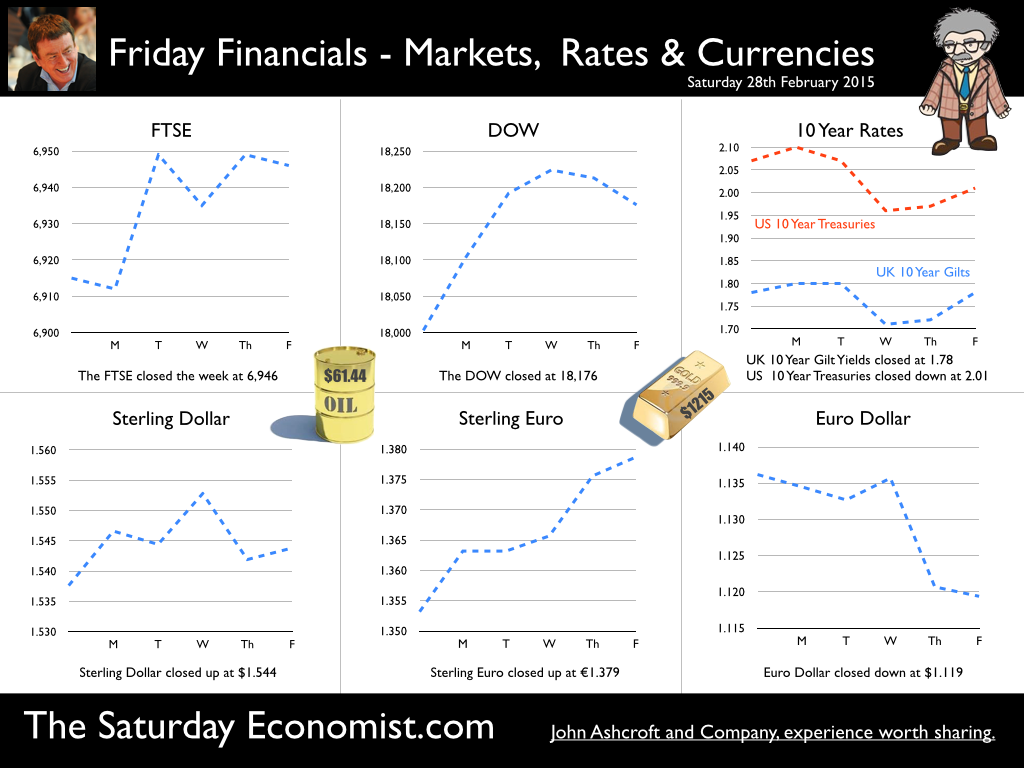

Latest UK GDP Data … The latest revisions to GDP released this week, were unchanged from prior estimates. Household spending increased by 2.1% in the year, government expenditure increased by 1.5%. Investment in the form of Gross Fixed Capital Formation increased by almost 7%. Export growth was modest at 0.4% as imports increased by 1.8%. The trade deficit continues to deteriorate as leisure and construction drive recovery. In output terms, the service sector contributed growth of 3%, private service sector growth increased by almost 4%, with strong growth in leisure, transport and business services. Manufacturing increased by 2.7%, construction increased by 7.3%. So what does this mean? The recovery continues. Our forecasts for this year are broadly unchanged. Updated Forecasts for 2015 … This week we update our forecasts for 2015 and 2016 reflected in the UK Economic Outlook March edition. The UK recovery continues. We expect growth of 2.9% in 2015 … slowing to 2.8% in 2016. The collapse in oil prices has significantly changed the world outlook for growth and inflation over 2015. Growth estimates for oil importers have been revised upwards and the fortunes of oil exporters have been revised down as a result. The inflation outlook is much more benign with fears of deflation continuing to overhang the recovery in Europe. In the US the recovery continues with growth of 3.1% expected in the year ahead. In the March update we forecast world growth of 2.9% in 2015, increasing to 3.1% in 2016. UK Inflation will average just 0.8% over the balance of the year. Unemployment will continue to fall, government borrowing will also fall. The service sector will lead the recovery as manufacturing and construction output also rise. We are forecasting a modest increase in manufacturing of around 2.5% with a 5.5% increase in construction activity as the strong housing market recovery continues. The trade figures will continue to disappoint, offset by a potential £4 billion oil dividend, as a result of the oil price collapse. The challenge to the current account following the drop in overseas investment income continues and will present a significant problem to the outlook for sterling over the medium term. For the moment, the Dollar and the Swiss Franc remain the traders favourites with the Euro under pressure as the QE placebo unwinds slowly across Euro land. Check out our UK Economic Outlook for 2015 and 2016. These are the benchmark forecasts against which we update the Chart of the Day and Quarterly Data Forecast Series. It’s a free download! Check out our Oil Market outlook which reflects the outlook for oil prices. As Mark Carney and more recently Janet Yellen have confirmed, the pricing issue is not a function of demand. It is the adjustment to new output particularly in the US. The Baker Hughes US Oil Rig Count dropped by almost 30% over the past six months. An indication of why we think prices will harden significantly by the end of the year. So when will rates rise? Markets expect UK rates to stay on hold into 2016. We think the Fed will move in June or early in Q3 this year. The UK will follow shortly thereafter. We have spent too long on Planet ZIRP. The yield curve is distorted. It really is time to move on and let markets, especially bond markets, clear. So what happened to Sterling this week? Sterling closed up against the Dollar at $1.544 from $1.538 and moved up against the Euro to €1.379 from €1.3553. The Dollar closed down against the Euro at €1.1379. €1.1360. Oil Price Brent Crude closed up at $61.44 from $60.48. The average price in February last year was $108.90. Markets, rallied. The Dow closed at 18,176 from 18,003 and the FTSE closed up at 6,946 from 6,915. UK Ten year gilt yields held at 1.78 unchanged. US Treasury yields moved down to 2.01 from 2.07. Gold closed up at $1,215 ($1,206). That’s all for this week. Don’t miss the Great Manchester Business Conference in next week, the Big Social Media Conference in July and The Saturday Economist Economics Conference coming to Manchester in October. It’s a great line up for all events! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed