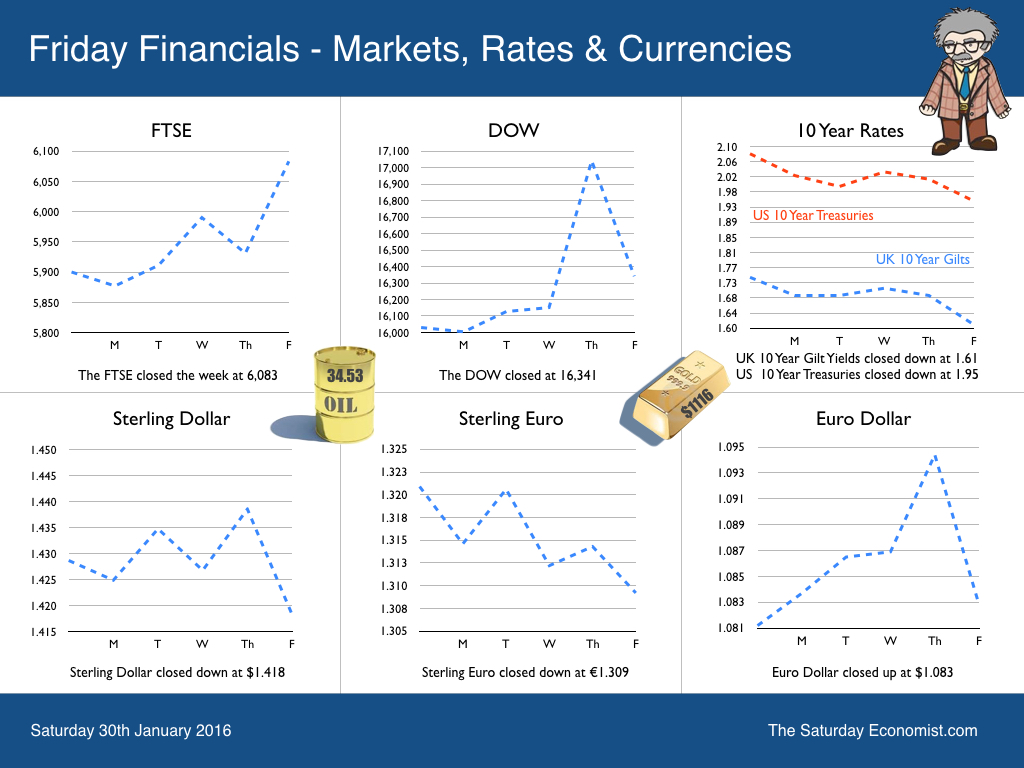

UK Growth slowed in the final quarter of the year according to the first estimate of GDP released this week. Output growth was just 1.9% in the quarter compared to a heady 2.8% in the final quarter last year. For the year as a whole growth was just 2.2% compared to 2.9% in 2014. Manufacturing output fell by 1% and construction growth slowed to 3.2% from 7.5%. The service sector remained the driver of growth, down from 2.5% from 3.5%. So what of 2016? 2.5% remains a plausible target for the moment. With growth in construction and service sector the major sectors of strength. Our full forecast update will be released next week … so watch out for that! What happened in the USA … Over in the US it was much the same story. Growth slowed in the final quarter to just 1.8% year on year compared to 2.4% for the year as a whole. Slowing consumption blamed by many but a fall in exports (goods) was largely to blame. The recovery is steady. Growth for the year is comparable to prior year levels at 2.4%. The doves accuse the Fed of jumping the gun with the December rate rise but don’t panic just yet. The kindness of strangers … This week the governor was in front of the Treasury Select Committee warning of the dangers of Brexit to the UK economy. Sterling weakness, the risk, with vulnerability and volatility the problem. Trade and capital account deficits leave the UK dependent on “foreign capital flows” - the “kindness of strangers" as he put it. Together the “Old Lady of Threadneedle Street” and the “Kindness of Strangers” account for over half of the £1.6 trillion gilts in issue. The Chancellor is set to miss his borrowing target for the current financial year, as slow growth, weak earnings and low inflation impact on the tax take. Gilt issues may have to be increased. The Old lady will be forced to cling to her handbag stuffed with bonds for the long term. This week the head of the Debt Management Office warned of the risk of a gilt strike as difficulties emerge in clearing the book on early issues this year. Foreign holdings at 25% are down from 30% six years ago. Should foreign investors loose their appetite for UK risk, pressure on Sterling will be compounded, forcing the Bank to make a move to defend the currency. In 1931, Sir Warren Fisher Permanent Secretary to the Treasury warned of deficits .. “with inky blots and rotten parchment bonds sustained”. Strange how history repeats itself … So what of markets … Last week we talked of the “GOBI desert on Planet ZIRP”. Was it the last Great Opportunity to Buy In to Western markets? Perhaps. Markets experienced a good rally last week allegedly on news of Japan experimentation with negative rates and an increase in Euroland inflation. It is a strange world on this Lonely Planet, the kindness of strangers and the madness of fools! So what do we expect of UK rates … Where do we go from here? We still expect the MPC to move within the first four months of the year, despite the weakness of growth in the final quarter. Markets are reversing, oil and commodity prices are set to rise. Fears for China are overblown, the sky is not falling down … it really is time to leave Planet ZIRP. So what happened to Sterling? Sterling moved down against the Dollar to $1.418 from $1.427 and moved down against the Euro to €1.309 from €1.321. The Euro moved up slightly against the Dollar to €1.083 from €1.080. Oil Price Brent Crude closed at $34.53 from $31.50. The average price in January last year was $47.76. The deflationary impact continues for the moment. Markets, rallied further - The Dow closed at 16,341 from 16,030. The FTSE closed at 6,083 from 5,900. Gilts - yields moved down. UK Ten year gilt yields were at 1.61 from 1.74. US Treasury yields moved to 1.95 from 2.08. Gold closed at $1,116 ($1,089). John That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline or download The Saturday Economist App! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed