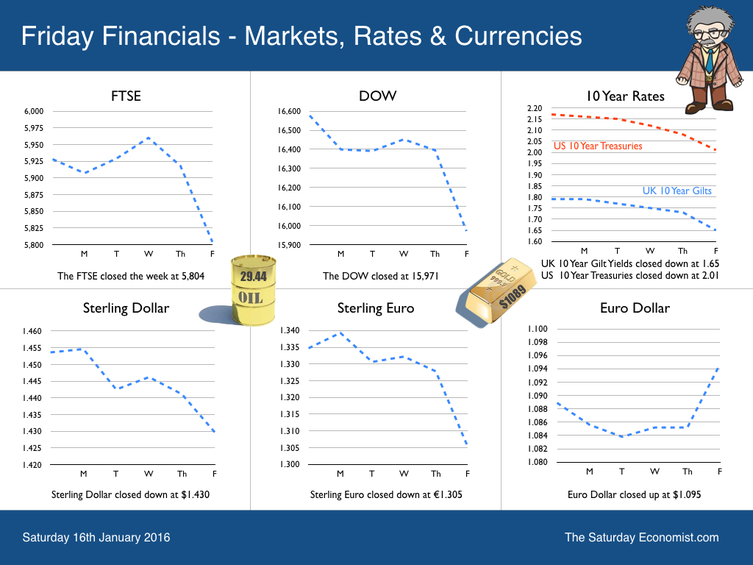

In ancient times, there were no donkeys in Guizhou, a province in southwest China. One day, a local man brought home a donkey. Since he did not know what to do with the animal, he decided to let it roam and graze in some nearby woods. The donkey, with long legs, large ears, black hair and big eyes, terrified the local tiger. Never having seen one before, the tiger thought the donkey to be a strange divine animal sent by a god. The tiger hid in thick bushes and dared to look only occasionally at the new arrival. Out of curiosity, the tiger decided after a few days, to move a bit closer to get a better look at the donkey. The donkey let out a terrifying bray, which made the tiger flee to safety. Eventually, the tiger became used to the donkey's loud noise and began to take move closer and closer. After some time, the tiger decided the donkey did not look as fearsome as first thought. Strange how we adapt to new things. The tiger became bolder and bolder with each passing day. One day, the tiger moved really close, just a few yards away. He made a careful study of the donkey but still did not dare make a move. To find out what the donkey might do if attacked, the tiger decided to test the donkey. As the tiger grew nearer, the donkey kicked out with his rear legs but missed the agile attacker. “So that is all you’ve got”, thought the tiger. “I have nothing to fear”. He then leapt onto the donkey, killed the strange beast and devoured the most delicious dinner the big cat had ever had. The moral of this fable is that although the donkey is big, has a scary hee-haw and looks formidable if you haven’t seen one before, it can trick and mislead even a tiger but just for a short time. So what can we learn from this tale ... Donkeys like markets should be allowed to run … The Shanghai Composite Index … The Shanghai Composite Index fell 107 points (3.6%) to 2,900 on Friday from 3,008 the previous day. The index has lost over 436 points (13%) over the last 12 months.. So what does this really tell us about the prospects for the Chinese economy? Not much really. The SCI reached an all time high over 6,000 in October 2007. The collapse to below 1,700 soon followed in 2008. The bull market rally to over 5,000 in June last year looks more and more like a speculative bubble map. The current close to below 3,000 will not be enough. Technically, the market may fall to 2,000 with a prospect for overshoot. Like it or not, markets must clear in the end. Just as with the tiger and the Donkey from Guizhou, bears will realise for the authorities, circuit breakers and “national teams” are all they have got. It is not enough. Rolls Royce and the unacceptable face of communism … Rolls Royce sales in China, fell by over 50% last year. The Big Roller became the unacceptable face of communism. Slowing Chinese economic growth, stock market falls, a crackdown on corruption and investigations into wealth accumulation led to a cut back on conspicuous consumption ... back in the UK ... UK Manufacturing … In the UK, Manufacturing output fell by -1.2% in November compared to prior year. Consumer durables fell by 3%, capital goods fell by 2.7%. Basic Metals, computer and electrical output fell by over 4%. Machinery and equipment output fell by 14%. Chemicals (3.4%) and big pharmaceuticals showed growth, along with transport up over 6%. It was not enough. UK Construction … Further bad news followed on Friday as the ONS released the latest dodgy data on construction. Compared with November 2014, output in the construction industry fell by 1.1%. All new work increased by 1.3% but there was a fall of 5.1% in repair and maintenance. The main upwards contribution to new work came from infrastructure which increased by 11.7%. There is considerable doubt about the quality of the construction data. Nevertheless most forecasters have down graded their forecasts for UK growth last year to 2.3% with a similar performance expected this year and next. We await the first estimate for Q4 before revising our forecasts for the current year currently at 2.5%. So what of markets … The bears have it as the Dow and FTSE closed lower this week on the oil price close below $30 and fears from China. The man from Qi is still worried about the falling sky. Further correction is possible in the short term but the markets will look much healthier by Easter surely. As for the oil price? Well all bets are off … So what do we expect of UK rates … The MPC voted this week to keep rates on hold and to reinvest the £8.4 billion of cash flows associated with the redemption of the January 2016 gilts. Ian McCafferty was the sole hawk voting for a 25 bps rate rise. Where do we go from here? Despite the short term market turmoil, e still expect the MPC to move within the first four months of the year, … So what happened to Sterling? Sterling moved down against the Dollar to $1.430 from $1.454 and moved down against the Euro to €1.305 from €1.335. The Euro moved up against the Dollar to €1.095 from €1.095. Oil Price Brent Crude closed at $29.44. The average price in January last year was $47.76. The deflationary impact will continue. Markets, closed below critical levels on China market fears - The Dow closed at 15,971 from 16,577. The FTSE closed at 5,804 from 5,928. Gilts - yields moved down. UK Ten year gilt yields were at 1.65 from 1.80. US Treasury yields moved to 2.01 from 2.17. Gold closed at $1,089 ($1,102). That's all for this week. Don't miss Our What the Papers Say, morning review every day! Follow @jkaonline or download The Saturday Economist App! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here .

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed