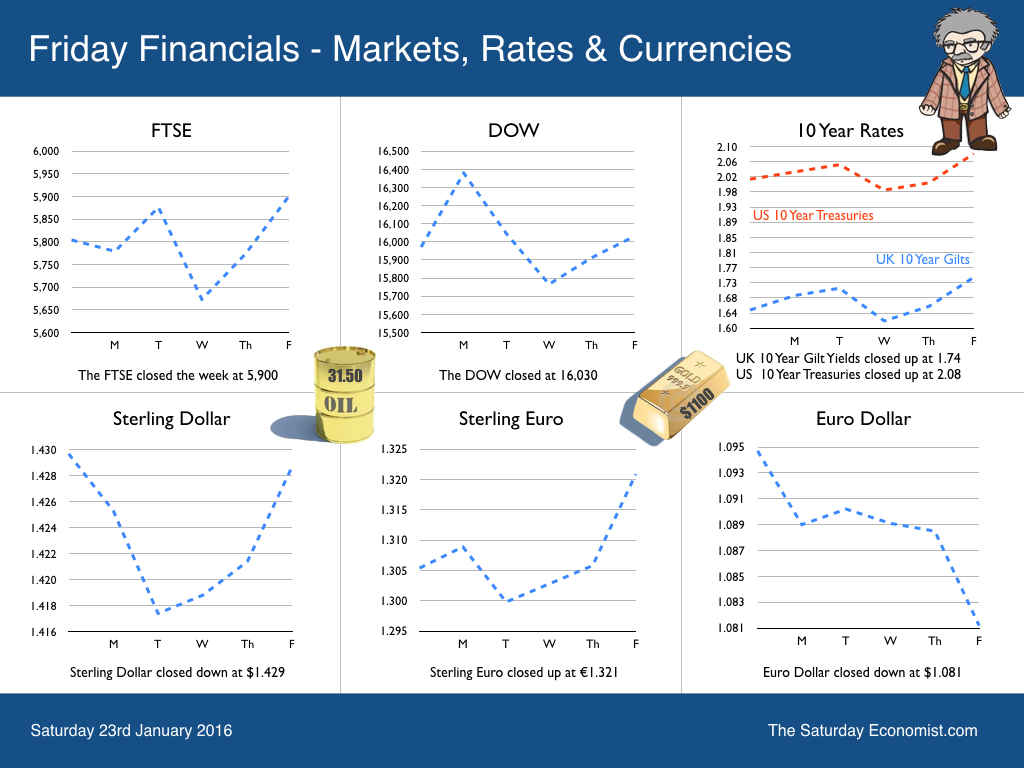

It was the week of #Davos2016. As the leaders met in the snow, the bears had their fun with the markets. Oil touched $27, the FTSE and the Dow closed below critical levels. Fears about China abundant, bulls wandered in and out of the “GOBI desert on Plant ZIRP”. Yep we think this was the last Great Opportunity to Buy In to Western markets. We are not so confident about the Eastern Shanghai Composite as we explain below. Should we worry about China? Not really. To understand what is happening in the East is to differentiate between the three issues of markets, currency and economy. Chinese growth increased by 6.9% in 2015 according to official data. The Shanghai Composite improved by 3.2% on the news. Good news on the economy bit for the markets, it’s a suckers rally. By the end of the week, the SCI closed below 3,000. Best avoided. The index is set to fall further, to clear the market around 2,000. It looks like a classic Speculative Bubble Map. [Google : Speculative Bubble Map to understand more] As for the economy, China is set to grow by over 6.5% in 2016 importing more oil and primary metals along the way. As for the Yuan, the currency is decoupling from the Dollar. The short technical position suggests dollar strength. The fundamentals of current account capital flows suggest inherent strength of the Renminbi along the way. The currency adjustment is not about trade, it’s about realignment in advance of the enhanced reserve currency status, particularly amongst the Asean trading block. For the geeks out there, the Triffin Paradox awaits as a further challenge to the Chinese authorities. Next week we will focus on “The importance of being Asean” in our weekly update. Just how important are the Asean economies to the world economy. We will explain all. Back in the UK … CPI Retail Inflation … The headline inflation rate CPI basis increased to 0.2% in December. No one seemed to notice that service sector inflation jumped to 2.9%. 2.9% is way ahead of the Bank of England target. The service sector rise was offset by weakness in goods inflation, predominantly food and oil falling by 2.1%. Producer Prices … Manufacturing prices fell by 1.2% in December. Is this significant? Yes. It is the slowest rate in the year. In August prices fell by 1.9%. The major contributions continue to be from food and oil. Inflation trends are turning as world commodity prices change tack Manufacturing costs fell by 10.8% in the month. Imported metals, commodities, oil and food the explanation. In August prices were falling by almost 15%. Prices are turning, inflation is returning. The MPC is looking the other way still operating in the misguided belief that interest rate rises take two years to impact on domestic inflation. No thought of the impact of Sterling and international commodity prices on the CPI index. Retail Sales … Retail Sales growth slowed in December to 2.6% as the value of sales fell by 1% in the month. It has been a good year for volume sales, in 2015, the volume of retail sales increased by 4.5%. Retailers were kept busy but margins were under pressure as the value of sales in the year increased by just 1.2%. On line pressures continued as internet sales increased by 8.2% accounting for almost 13% of all retail sales. Unemployment Figures … Strong growth in the jobs market continued into the close of year. The employment rate was 74.0%, the highest since comparable records began in 1971. There were 1.68 million unemployed 239,000 fewer than for a year earlier. The unemployment rate was 5.1%. We haven't seen such figures since before the great recession. Vacancies are increasing to record highs, the claimant count rate is falling to record lows. The data suggests a labour market which is overheating. Earnings fell to 2% from 2.4% in November. It’s just one month. We should not pay too much attention to what could well be an anomaly. So what of markets … The bears have had their fun as the shorts made their last play. The oil price closed above $30, the Dow and the FTSE closes above significant technical levels. The Shanghai composite closed below 3,000 despite the attempts of the PBOC and others to hold ground. The SCI is set to clear at 2,000, the donkey from Guizhou is easy meat for the bears. So what do we expect of UK rates … The Governor delivered a speech this week suggesting rates will stay on hold for some time to come. Martin Weale mandated this was not the time to raise rates based on the weakness of December earnings data. New dove in the MPC coop Dr (Gert) Gertjan Vlieghe made a speech at the LSE “I would like to see evidence that growth is not slowing further, and that a broad range of inflation indicators are on an upward trajectory from their current low levels” before voting for a rate rise! Where do we go from here? We still expect the MPC to move within the first four months of the year, despite the weakness of retail sales and earnings in December. Markets are reversing, oil and commodity prices are set to rise. Fears for China are overblown, the sky is not falling down … it really is time to leave Planet ZIRP. So what happened to Sterling? Sterling moved down against the Dollar to $1.427 from $1.429 but moved up against the Euro to €1.321 from €1.305. The Euro moved down against the Dollar to €1.080 from €1.095. Oil Price Brent Crude closed at $31.50 from $29.44. The average price in January last year was $47.76. The deflationary impact continues. Markets, rallied after mid week crisis - The Dow closed at 16,030 from 15,971. The FTSE closed at 5,900 from 5,804. Gilts - yields moved up. UK Ten year gilt yields were at 1.74 from 1.65. US Treasury yields moved to 2.08 from 2.01. Gold closed at $1,081 ($1,089). John That's all for this week. Off to see The Big Short later. Don't miss Our What the Papers Say, morning review! Follow @jkaonline or download The Saturday Economist App! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed