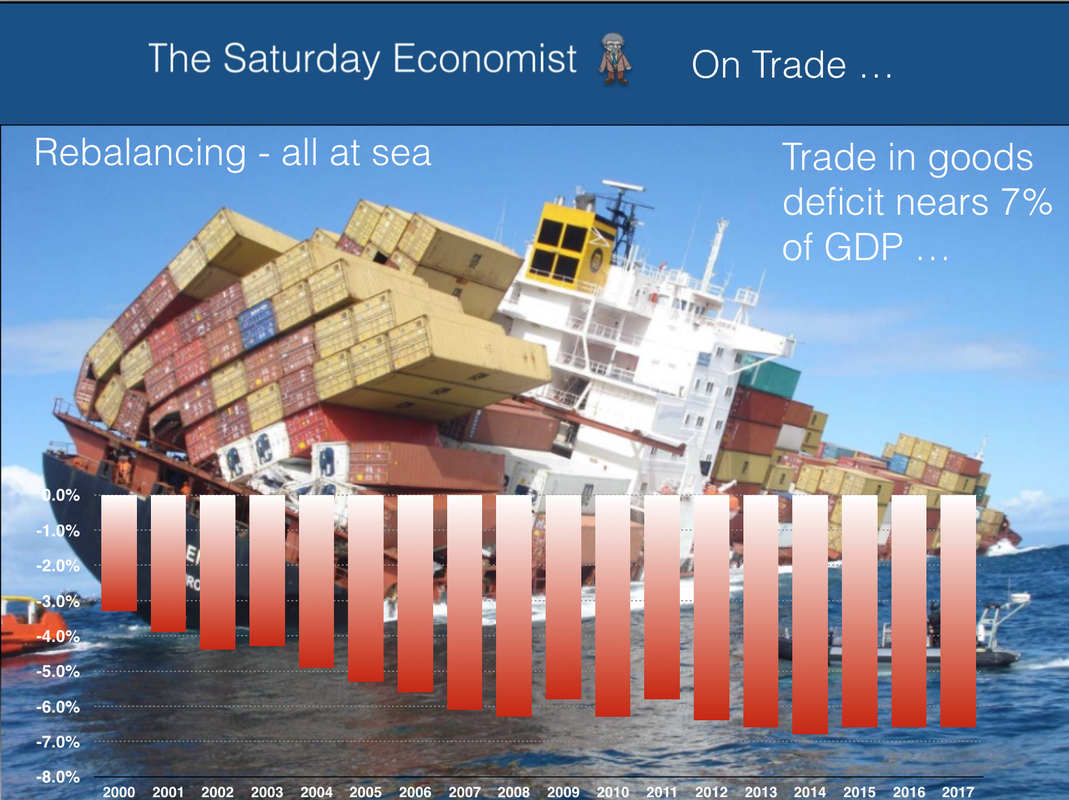

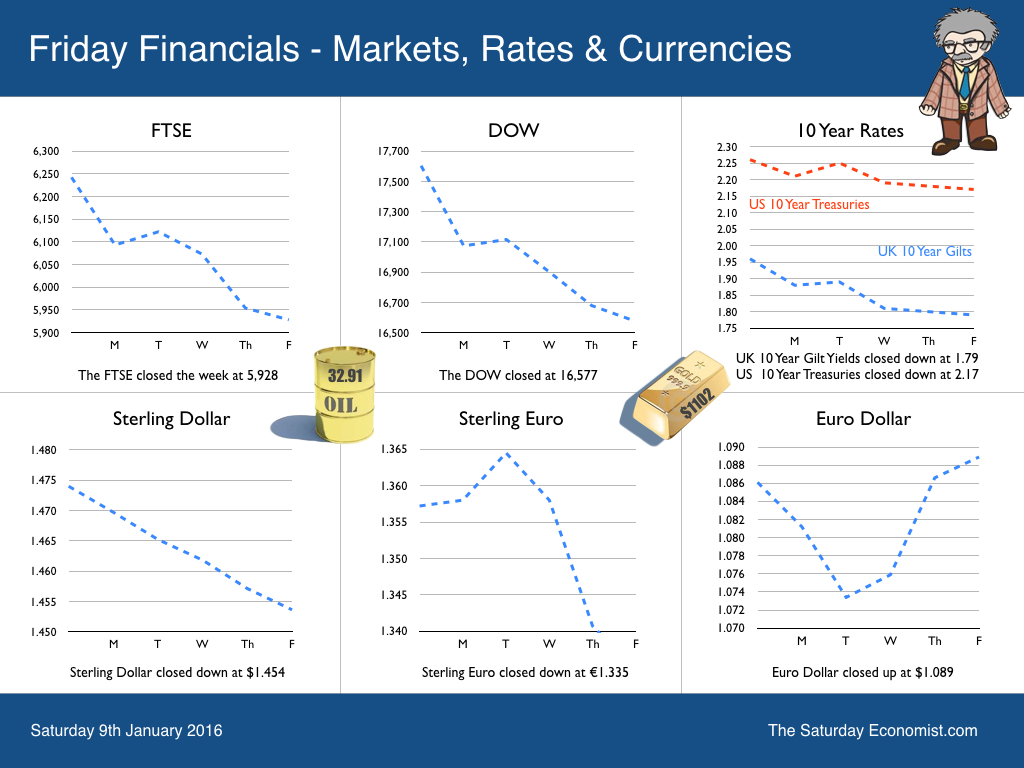

A Man in Qi Worrying about the Falling Sky … 3,000 years in a small kingdom called Qi, there was a man who always worried about everything around him. He was ridiculed in his village, because he always made a fuss about everything. He was restless day and night, fearing that someday the sky would fall and the earth would sink. He constantly worried about where to hide. He could neither eat nor sleep. Then a kind hearted man came to explain to him, the sky had its own track to go around, like the Moon and stars. It would never fall down. Even if it fell, it was so huge that no one could stop it. So there was no use worrying about it and doing harm to his health. Hearing that, the man finally felt relieved and went away. He built up his savings over may years and invested everything in the Chinese Stock Market. Hence the expression "杞人忧天 Qi Ren You Tian” "A man in Qi worrying about the falling sky should never invest time and money day trading”. China Market wobbles … Warren Buffett was a strategic long term investor. “I never attempt to make money on the stock market, he would say. I buy on the assumption they could close the market the next day.” And so it was … in China this week, they did. The Shanghai Stock Exchange's circuit breakers were triggered twice on Thursday. The day ended after just 29 minutes. Calling time on trading and the circuit breakers in the process. Slowly the Chinese authorities are coming to terms with capitalism and free market capital flows. Let the markets run should be the mantra within appropriate guidelines of course. Technically the Shanghai Composite is hung with downside potential evident. The authorities are endeavoring to manufacture a floor around the 3,200 level. Too many private investors were encouraged to enter in and have yet to pay the price. The reverberations of the New Year crash, swept around the world with the Dow and the FTSE closing below strategic 17,000 and 6,000 levels. So what hope for 2016? Better hope for the Yuan …. The People's Bank of China published rate guidance for the yuan for the first time in nine trading days having allowed the currency's biggest fall in five months. Don’t worry about the Renminbi. Rate manipulation is not about a weak economy securing export growth. With a trade surplus of $600 billion and a current account balance new $350 billion, there is no need to panic just yet. A larger game is in process. The daily midpoint rate for the yuan was set at 6.5636 per dollar. Slowly the PBOC is decoupling the Yuan from the Dollar and reducing dollar denominated reserves in the process. Admission into the IMF SDR basket at the end of the year and the creation of the Asian Infrastructure Investment Bank are steps in the strengthening of Yuan world reserve currency status. With international trade flows dominated by the dollar, The PBOC is developing an alternative trade and asset denomination currency for emerging markets and the Asian trading block. Current dollar strength is a result of short rate changes. Strength, slightly at odds with the $450 billion annual current account deficit for Uncle Sam. The Chinese don’t want to be caught out, as was the Bank of France in the 1920s, with huge holdings on end of empire currency. The French were left with overvalued holdings of Sterling which couldn’t be moved at book values. The Chinese authorities will not make the same mistake with the Greenback in the 2020s. So what of US rates … US rates seem set to move higher in the New Year as jobs increased by 292,000 in December. Markets expect a further rate rise in the Spring which will put greater pressure on the MPC to follow suite. UK trade data won’t help … The latest trade figures for November were released this week. Not much in one month’s data. For the year as a whole, we expect the deficit trade in goods to be £124.3 billion in 2015 flattered by a £3 billion oil price swing. At just under 7% of GDP, the service sector surplus of £90 billion will be a welcome offset to reduce the overall goods and services shortfall to around 2%. The vagaries of sterling have little impact on the trade balance as we have long explained. Now the IMF is slowly coming to terms with the reality. Almost half of UK imports and exports are in areas of food, materials, oil and semi manufactures. Areas which are basic to growth and inelastic with respect to price. Imported components form a significant part of exports. UK exports of manufactures and semi manufactures increased by 3% in 2015. The weakness of exports to the EU largely explained by low oil prices. Into 2016, the trade in goods deficit will continue to deteriorate as our disaggregated model explains. So what do we expect of UK rates … We still expect the MPC to move within the first four months of the year. The strength of domestic demand and the continuing current account deficit will provoke a cautionary move, despite inflation weakness in the first half of the year. So what happened to Sterling this week ...? Sterling moved down against the Dollar to $1.454 from $1.475 and moved down against the Euro to €1.335 from €1.3573. The Euro moved up against the Dollar to €1.089 from €1.086. Oil Price Brent Crude closed at $32.91. The average price in January last year was $47.76. Markets, closed below critical levels on China market fears - The Dow closed at 16,577 from 17,650. The FTSE closed at 5,928 from 6,250. Gilts - yields moved down. UK Ten year gilt yields were at 1.796 from 1.961. US Treasury yields moved to 2.17 from 2.226. Gold moved to $1,102 ($1,089). John That's all for this week. Don't miss Our What the Papers Say, morning review every day! Follow @jkaonline or download The Saturday Economist App! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed