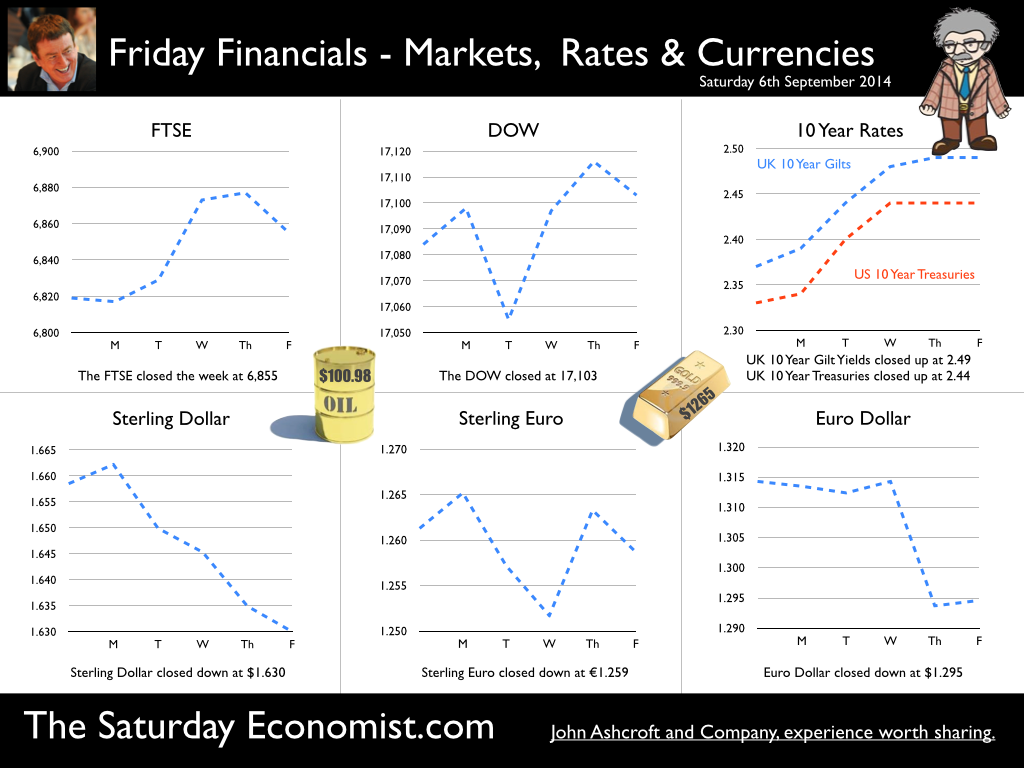

No surprise this week as MPC votes to hold rates … It’s that time of month again …The Bank of England’s Monetary Policy Committee voted to maintain Bank Rate at 0.5%. The Committee also voted to maintain the stock of purchased assets at £375 billion. The minutes of the meeting will be published on the 17 September. Can’t wait! The hawks views may have been subdued by the latest data on retail sales and earnings data but the economics news this week remains bullish about growth this year. Car Sales … Car sales in August were up by 9% in the month and just over 10% in the year to date. The UK is on track to sell 2.45 million cars this year. That’s higher than the pre crash levels recorded in 2007. Commercial vehicle sales were up almost 12% in August, increasing by 13% for the year to date. The car market remains a powerful indicator of consumer confidence and spending trends. August, with registrations of just 72,000, is no longer a big month for sales. September is the one to watch with over 400,000 new car sales recorded last year, 425,000 a hurdle number! UK Survey Data … The Markit/CIPS UK PMI® surveys for August were released this week. Chris Williamson, Chief Economist at Markit, claimed “An acceleration of growth in the services sector and an on-going construction boom offset a weakened performance in manufacturing in August. The three PMI surveys indicate that the economy grew at the fastest rate since last November, providing further ammunition for policymakers arguing for higher interest rates.” In the service sector, activity growth was the strongest for ten months. The headline Business Activity Index recorded 60.5 up from 59.1 in July, representing the sharpest monthly improvement in activity since October 2013. In the construction sector, output appears to have risen at the fastest pace for seven months. The key index recorded a level of 64.0 in the month, up from 62.4 in July. Residential construction posted the fastest growth in activity. News from the manufacturing sector disappointed slightly. The Manufacturing PMI index posted 52.5 in August, down from 54.8 in July. Albeit a 14 month low, the index is still in growth (above 50) territory. Domestic sales dominate, export demand is strong in North America, the Middle East and China but obvious problems in European order books persist. So what of the rest of the world? US jobs disappoint but Fed still on track to tighten … The US labour market added 142,000 new jobs in August, significantly below consensus expectations and well below the 225,000 average over the prior six months. The unemployment rate fell to 6.1%. Positive news on car sales and manufacturing output also hit the headlines … “The data doesn’t say the economy is slowing down but it does not suggest it is accelerating much either” according to Steven Blitz chief economist at ITG Investment Research. Nor we would add, is there much in the data to suggest the Fed will stray from the path of gently monetary tightening in the first half of 2015. In Europe … The ECB adopted further measures in an attempt to stimulate the slow recovery and low inflation in the Eurozone. Growth in Q2 increased by 0.7% compared with Q2 last year with some evidence of a slow down in Germany. Inflation fell to 0.3% and unemployment remained stubbornly high at 11.5%. The ECB lowered policy rates by 10 basis points, the refinancing rate moved down to 0.05%, the marginal lending facility fell to 0.3% and the deposit rate was pushed further into negative territory, dropping to -0.2%. No escape from Planet ZIRP in prospect! Despite the concerns about deflation, GDP is forecast to increase by 0.9% in 2014 and 1.6% in 2015. Low prices are an international phenomenon, not confined to Europe. Negative rates and QE are unlikely to provide the solution to low commodity prices. A slow for recovery for Europe is in prospect. Marooned on Planet ZIRP, digging up the runway will not improve the timetable for takeoff and escape. There is an old Iberian imprecation, “May the builders be in your home”. Far worse - the curse “May the academics be in your central bank”. So what of base rates … In the UK base rates were held at 50 basis points with no additions to the asset purchase programme. The chances of a rate rise before the end of the year are receding. Hot money is moving to February for the first rate hike but if the bad news from Europe continues, the hike may be post hustings after all. Is this at odds with the latest data? Of course. Demand conditions are strong, the labour market is tightening, recruitment challenges are increasing and skill shortages are ubiquitous. Pay and earnings remain subdued and international energy and commodity prices remain low. For the moment the inflation target remains within reach, easing the grip of the hawks on monetary policy. So what happened to sterling this week? Sterling fell against the dollar to $1.630 from $1.658 and down against the Euro at 1.259 from 1.261. The Euro was down against the dollar at 1.295 (1.314). Oil Price Brent Crude closed down at $100.98 from 102.19. The average price in September last year was $111.60. Markets, move up slightly. The Dow closed up at 17,103 from 17,084 and the FTSE closed up at 6,855 from 6,819. UK Ten year gilt yields move up to 2.49 from 2.37 and US Treasury yields closed at 2.44 from 2.33. Gold was slightly tarnished at $1,265 from $1,286. That’s all for this week but we would like to introduce the Bracken Bower Prize to our readers! John Introducing the Bracken Bower Prize The Financial Times and McKinsey & Company, organisers of the Business Book of the Year Award, want to encourage young authors to tackle emerging business themes. They hope to unearth new talent and encourage writers to research ideas that could fill future business books of the year. A prize of £15,000 will be given for the best book proposal. The Bracken Bower Prize is named after Brendan Bracken who was chairman of the FT from 1945 to 1958 and Marvin Bower, managing director of McKinsey from 1950 to 1967, who were instrumental in laying the foundations for the present day success of the two institutions. This prize honours their legacy but also opens a new chapter by encouraging young writers and researchers to identify and analyse the business trends of the future. The inaugural prize will be awarded to the best proposal for a book about the challenges and opportunities of growth. The main theme of the proposed work should be forward-looking. In the spirit of the Business Book of the Year, the proposed book should aim to provide a compelling and enjoyable insight into future trends in business, economics, finance or management. The judges will favour authors who write with knowledge, creativity, originality and style and whose proposed books promise to break new ground, or examine pressing business challenges in original ways. Only writers who are under 35 on November 11 2014 (the day the prize will be awarded) are eligible. They can be a published author, but the proposal itself must be original and must not have been previously submitted to a publisher. The proposal should be no longer than 5,000 words – an essay or an article that conveys the argument, scope and style of the proposed book – and must include a description of how the finished work would be structured, for example, a list of chapter headings and a short bullet-point description of each chapter. In addition entrants should submit a biography, emphasising why they are qualified to write a book on this topic. The best proposals will be published on FT.com. Full rules for The Bracken Bower prize are available here or here http://membership.ft.com/PR/brackenbower/ © 2014 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

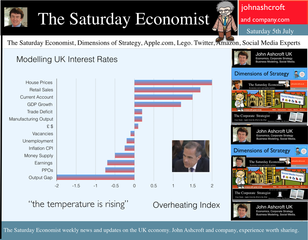

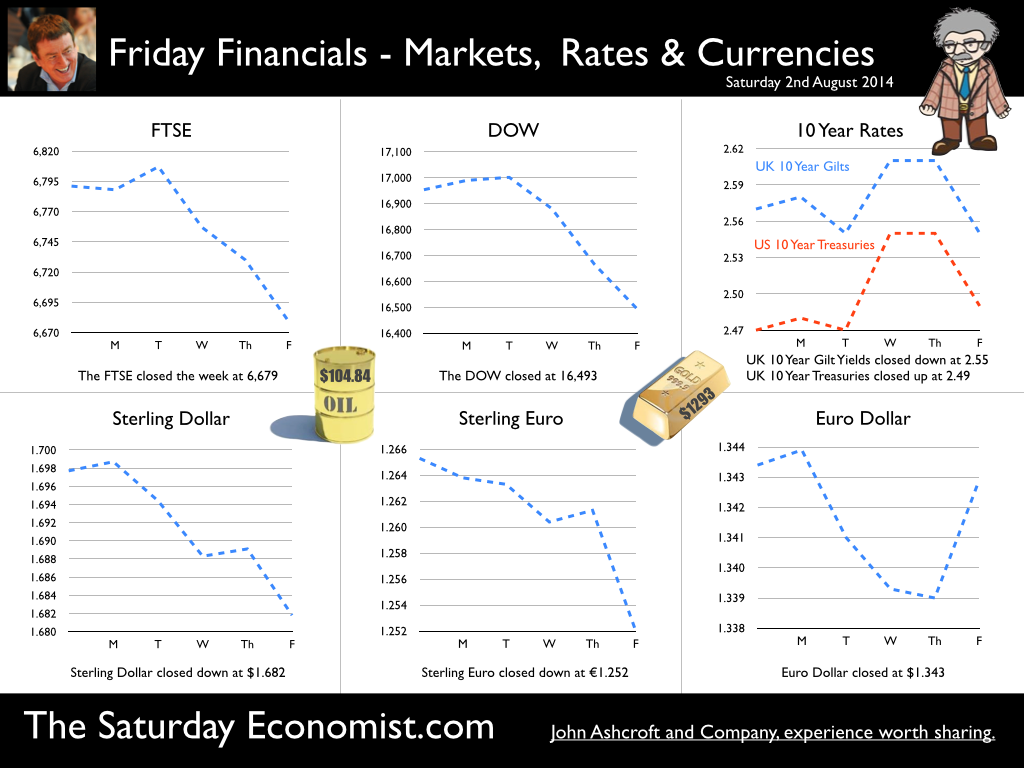

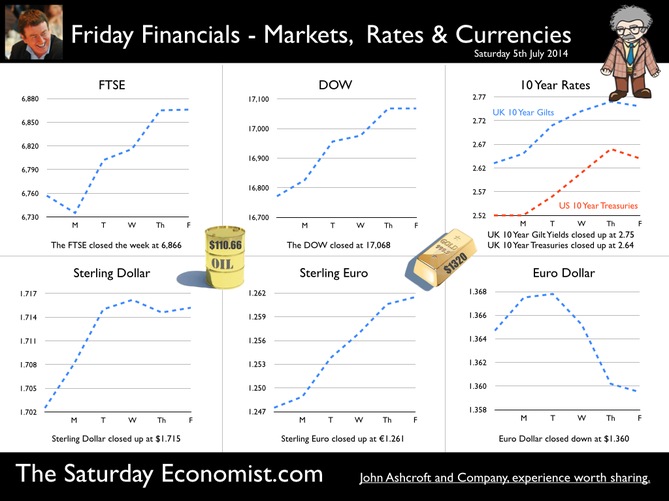

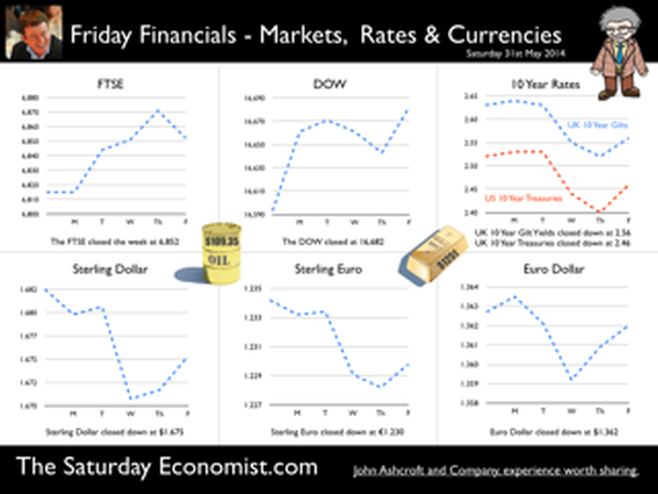

UK Interest Rates on hold ... No surprise this week as the MPC voted to keep rates on hold and to maintain the asset purchase facility at £375 billion. The decision to increase rates may becoming more finely balanced for some but the news from around the world, will disturb the hawks and give succour to the doves. The rate rise may well be held over into the new year, despite the continued strong performance of the domestic economy. The minutes of the MPC meeting, due later this month, may provide some insight into the overall views of the individual committee members. ECB and Rates ... problems in the East In Europe, rates were kept on hold as Draghi continues to consider QE. Action is needed but the futile process of debt monetisation will do little to offset the economies beset by weak levels of domestic demand. Complaints against the need for labour reform and excessive regulation will largely miss the point. Italy is slipping back into recession with forecasts for the current year downgraded once again to growth of just 0.2%. France will struggle to hit the 1% growth target this year and German export performance is slowing as economies are transfixed by the crisis in Ukraine. Trade sanctions and threat of war are damaging exports from Euro land to Eastern Europe and to Russia. The Euro trading block is now imperilled by it’s very “raison d’être” at inception. Growth in the Euro economies is expected to be just 1% this year with no prospect of a rate rise on the horizon until late 2015 / 2016 at the earliest. Production and Manufacturing ... In the UK, manufacturing data was surprisingly weak in the latest data for June but Euroland is not to blame. Output increased in the month by just 1.9% after strong growth of 3.6% in the first quarter and 4% in April and May. In the second quarter overall growth was up by 3.2%. The underlying data from the Markit/CIPS Manufacturing PMI® suggests strong growth continued into June and July which suggests the latest ONS data may be something of an aberration. [We are adjusting our forecast for the year to growth in manufacturing of 3.4% based on the latest data. Expectations for UK GDP growth are unchanged at 3% following revisions to our service sector forecast.] The Car Market … The SMMT reported strong car sales in July, with new registrations up by 6% in the month and 10% in the year to date. Output increased by 3.5% over the year. The car market is on track to sell 2.45 million units this year. That’s actually higher than the levels achieved in 2007. Assuming output hits the 1.55 million mark, the deficit (trade in cars) will increase to almost 900,000 units. Car manufacturing is benefitting from the recovery in consumer confidence and household spending but the trade deficit will increase as a result of the strength of domestic demand and limitations to domestic capacity. The UK cannot enjoy a period as the strongest growth economy in the Western world without a significant deterioration in the trade balance. Deficit trade in goods and services … And so it continued to prove with the latest trade data. The deficit trade in goods increased slightly in the month of June to £9.5 billion offset by a £7 billion surplus in services. For the second quarter, the deficit was £27.4 billion (trade in goods) and just under £7 billion overall, goods and services. The service sector surplus was £20.5 billion. For the year as a whole, we expect the goods deficit to be £112.3 billion offset by an £80 billion plus serve sector surplus. No threat to the recovery but we still have concerns about the current account deterioration and the drop in overseas investment income. In the first six months of the year, exports of goods have fallen by almost 8% in value and imports have fallen by 4.6%. World trade growth has been subdued in the first six months of the year yet UK domestic demand increased by 3%. Sterling appreciation against the dollar has lead to a translation impact on the trade balance rather than an elasticity effect. Construction and housing ... The latest adjustment for construction data confirms the recovery continues driven by a huge increase in new housing. Total output increased by 5.3% in June, up by 4.8% in Q2 2014 compared to Q2 last year. The total value of new work in the month increased by 5.8% with the volume of new housing increasing by 18% compared to June last year. House Prices ... The increase in housing supply is doing little to assuage the demand for house moves and house prices. Halifax and Nationwide reported prices up by 10% in July. Our transaction model is simple. Activity is a function of house prices and the real cost of borrowing. With mortgages fixed at 4%, the double digit capital appreciation is irresistible to the basic mechanics of a free market. The real cost of borrowing is negative 6%. Demand for housing will continue to out strip supply, despite the regulatory adjustments to the mortgage market. So what happened to sterling this week? Sterling closed down against the dollar at $1.6774 from $1.682 and unchanged against the Euro at 1.252. The Euro was largely unchanged against the dollar at 1.341. Oil Price Brent Crude closed up slightly at $105.02 from 104.84. The average price in August last year was $111.28. Markets, closed mixed. The Dow closed up 61 points at 16,554 from 16,493 and the FTSE closed down 112 points at 6,567 from 6,679. UK Ten year gilt yields were down at 2.46 from 2.557and US Treasury yields closed at 2.42 from 2.49. Gold was up at $1,305 from $1,293. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  A letter from America … This week the Professor is in America, reviewing the prospects for the US economy. Despite the pressure on the Bank of England to increase rates before the end of the year, the MPC will be reluctant to move ahead of the Fed and be the first to leave Planet ZIRP. So what are the prospects of a US rate rise any time soon? Two Fed policy hawks, Richard Fisher of the Dallas Fed and Charles Plosser of the Philadelphia Fed, made comments this week, suggesting they have seen enough evidence to support an interest rate rise earlier than expected. Currently, tapering is expected to continue, extinguishing the asset purchase programme in October. US rates are not expected to rise until Q1 or even Q2 next year. The Prof thinks the latest crop of economics data will take the pressure off the doves to move earlier. Growth in the USA … In the USA, real gross domestic product increased at an annual rate of 4.0 percent in the second quarter of 2014, according to the "advance" estimate released by the Bureau of Economic Analysis. 4% sounds quite exhilarating but …. According to our year on year comparison, US GDP Q2 increased by 2.4% in the second quarter compared to Q2 2013. This followed growth of 1.9% in the first quarter - both below trend rate. Our forecast of growth at 2.4% in 2014 is unchanged based on the latest data. The latest GDP estimates ensure there is no pressure on the Fed to accelerate the change in monetary policy. We expect tapering to continue into the Autumn, with a rate rise postponed into 2015. Jobs in the USA … Friday's employment and income reports pointed to steady U.S. job growth with the number of non farm payroll jobs increasing by 209,000. The unemployment rate ticked higher to 6.2% but this a refection of a widening labour pool rather than a slow down in the economy. Moderate expansion in payroll numbers, slightly below expectations, will ensure there is no short term pressure to increase rates anytime soon. Inflation in the USA … The US Consumer Price Index increased by 2.1 percent in the twelve months to June. The PCE (personal consumption expenditure) price index, the Fed's favoured measure of inflation, was up 1.6%. Average hourly earnings of private-sector workers were up 2.0% from a year earlier, unchanged from the range of the past few years. Growth, jobs, earnings and inflation are all demonstrating trends that are likely to keep the Federal Reserve on course to conclude the bond-purchase program in October but remain cautious about raising short-term interest rates before the end of the year. We would expect US rates to rise in the Spring of 2015. Despite any further increase in The Saturday Economist™ Overheating Index™, the MPC will be reluctant to increase rates this year and open the “Spread with the Fed”. So what of the UK? The latest manufacturing data from Markit/CIPS UK PMI® confirmed the strong output growth continued into July. Production and new orders both continued to rise at robust, above long-run average rates in the month. At 55.4, down from 57.2 in June, the headline index posted the lowest reading in one year but remained well above the survey average of 51.5. No need to worry about manufacturing output! Something to worry about … Ben Broadbent, Deputy Governor for monetary policy, Bank of England, made a speech in London this week. His theme - “The UK Current Account Deficit”. Last year the UK current account deficit was 4.5% of GDP. That’s the second-highest annual figure since the Second World War. So is the near record deficit a threat to growth? The Deputy Governor concludes the “significance [of the deficit] depends on the health of a country’s net foreign asset position and more fundamentally, on the trust in its institutions”. “…having a balanced net asset position seems to reduce the threat from a large current account deficit, as does a floating currency.” Now that is concerning. In the 80’s Chancellor Lawson argued the Balance of Payments “doesn’t matter”. It does and in the end it did! Interest rates had to rise dramatically to curtail domestic demand. In the current cycle, the deficit, trade in goods, is offset in part by the service sector surplus. At around 2% to 2.5% of GDP, the deficit is not a threat to growth. The collapse in overseas earnings on the other hand is a more serious concern. A current account deficit of 4.5% is unsustainable. A dismissive speech at Chatham House will not disguise the extent of the problem, rule or no rule. So what happened to sterling this week? Sterling closed down against the dollar at $1.682 from $1.698 and down against the Euro to 1.252 from (1.2653). The Euro was unchanged against the dollar at 1.343. Oil Price Brent Crude closed down at $104.84 from 108.30. The average price in August last year was $111.28. Markets, closed down. The Dow closed down 460 points at 16,493 from 16,953 and the FTSE was down 12 points at 6,679 from 6,791. UK Ten year gilt yields were down at 2.55 from 2.57 and US Treasury yields closed at 2.49 from 2.47. Gold was unchanged at $1,293 from $1,294. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  I made a trip to Liverpool this week. It was the Battle of the Economists, part of the International Festival of Business programme. Eight top economists were “in the ring” swapping punches. I “refereed” the morning event and hosted the Question Time session. It was a great event in the IFB calendar with lots of interesting perspectives on the world and UK economy. No blood spilled, nor egos bruised the outcome! To close the session, I asked the panel for views on when UK interest rates would begin to rise. Some argued for an immediate rate rise, most expected rates to rise in February next year and a few expected rates to rise in the November this year. As we said last week, “It is true there have been a lot of conflicting signals about when rates will rise! Following Mark Carney’s Mansion House speech, the odds in favour of a rate rise before the end of the year increased but then lengthened slightly, on the low inflation figures for May and the strength of sterling ”. “Don’t watch my lips - watch the data!” the new forward guidance from the Governor. This week, the data continued to suggest the rate rise would be sooner rather than later. House prices up almost 12% … House prices increased by almost 12% in the year to June according to Nationwide. In London prices increased by 26%. The price of a typical property in London, reached the £400,000 level with prices 30% above the 2007 highs. Should we be concerned? Of course but the rate of increase in house prices of itself, will not lead to an increase in interest rates necessarily. Sir Jon Cunliffe, Deputy Governor for Financial Stability at the Bank of England was in Liverpool this week. “The main risk we see arising from the housing market is the risk that house prices continue to grow strongly and faster than earnings. The concern is the increase in prices leads to higher and more concentrated household indebtedness.” The Bank is not worried about the rise in house prices per se. The FPC (Financial Policy Committee) is concerned about the risk to the banking sector from high household indebtedness exposed to the inevitable rate rise and potential collapse in asset prices. The introduction of measures on interest rate multiples and leverage, the confines of policy intervention for the moment. Car Sales up 10.6% year to date … The strength of the housing market demonstrates the strength of consumer confidence and spending. The economy is growing at 3% this year, retail sales were up by almost 4.5% in the first five months of the year, car sales were up by 6% in June and by 11% in the first six months. We are forecasting registrations will be over 2.4 million in 2014, higher than the pre recession levels recorded in 2007, placing additional pressure on the balance of payments in the process. Yet rates remain pegged at 0.5%! Does this continue to make sense? PMI Markit Purchasing Managers’ Index® Survey Data The influential PMI Markit surveys continue to demonstrate strong growth in the economy into June. In manufacturing, strong growth of output, new orders and jobs completed a robust second quarter. In construction, output growth continued at a four-month high and job creation continued at a record pace. In the service sector, the Business Activity Index, recorded 57.7 in June. The survey produced a record increase in employment with reports of higher wages pushing up operating costs. The Manchester Index™- nowcasting the UK economy The Manchester Index™, developed from the GM Chamber of Commerce Quarterly Economic Survey, slowed slightly from 35.1 in the first quarter to 33.6 in the second quarter, still well above pre recession levels. The data within the survey, confirms our projections for growth in the UK economy this year of 3%, moderating slightly to 2.8% in 2015. So when will rates rise ? The Saturday Economist Overheating Index revealed ... At the GM Chamber of Commerce Quarterly Economics Survey yesterday, we revealed the “overheating Index”. This is a summary of fourteen key indicators which form the basis of any decision to increase rates by the Monetary Policy Committee (MPC). The strength of consumer spending, reflected in house prices, retail sales and car sales would argue in favour of a rate rise earlier rather than later, as would the growth in the UK economy at 3% above trend rate. On the other hand, inflation, reflected in retail prices and manufacturing prices remain subdued. Despite the strength of the jobs market, earnings remain below trend levels. The decision, on when to increase rates, remains finely balanced for MPC members at this time. Our overheating index is broadly neutral but tipped slightly in favour of a rate rise now. By the final quarter of the year, assuming earnings and inflation rally from current levels, the decision will be much more clear cut. Based on data from the Overheating Index, we expect rates to rise before the end of the year. Clearly markets think so too ... So what happened to sterling this week? Sterling closed up again against the dollar at $1.715 from $1.702 and up against the Euro to 1.261 from (1.247). The Euro moved down against the dollar at 1.360 from 1.365. Oil Price Brent Crude closed down at $110.66 from $111.35. The average price in June last year was $102.92. Markets, US closed up on the strong jobs data. The Dow closed above the 17,000 level at 17,068 from 16,771 and the FTSE was also up at 6,866 from 6,757, the move above 7,000, too much for the moment. UK Ten year gilt yields were up at 2.75 from 2.63 and US Treasury yields closed at 2.64 from 2.63. Gold was up slightly at $1,320 from $1,316. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. The Manchester Index™ The influential Manchester Index™, is developed from the GM Chamber of Commerce Quarterly Economic Survey. It is a big survey which is comprehensive, authoritative and timely. Now we also have the Manchester Index™. The Manchester Index™ is an early indicator of trends in both the Manchester and the UK economy. Using the Manchester Index we are in a great position to “nowcast” the UK economy and get a pretty good steer on employment and investment in the process.  It may have taken some time but households across Britain have finally come to terms the with strength of the recovery. According to GfK, the UK Consumer Confidence Barometer increased to levels last seen in the early part of 2005. Rejoice - we are having a recovery - would have been the Conservative mantra under Prime Minister Thatcher. Confidence in the economic situation of the country, increased to the highest level EVER, since records released in 2004. The propensity to spend is back to levels of 2006, even though the financial situation of households index is still below pre recession numbers. No surprise, perhaps, but with interest rates at such low levels, there is no real uptick in the intentions to save - for the moment at least. Interest Rates set to rise … Maybe households are waiting for the rates to rise. According to Markit®, nearly one in four households expect a rate rise within the next six months … almost half expect rates to rise within the next twelve months. Chris Williamson, Chief Economist at Markit® said, “the recent upbeat news-flow on the economy, strong economic growth in the first quarter, record employment growth and surging house prices, means an increasing number of people think it inevitable that policymakers will be forced into an earlier rate hike than previously envisaged.” Quite right! In fact almost ten per cent, think rates are set to rise within the next three months! So much for forward guidance from the Bank of England. Charlie Bean and Baby Steps … Charlie Bean, the outgoing (as in departing) deputy governor of the Bank of England has suggested “The argument for gradual rises suggests rates should start to go up sooner. The rise could start with “baby steps to avoid making mistakes”. “There’s a case for moving gradually because we won’t be quite certain about the impact of tightening the Bank rate, given everything that has happened to the economy.” The sentiment was also echoed by MPC member Martin Weale, this week. "We can wait a bit longer. How long that 'bit longer' will be I'm not sure.” Ah yes, the merits of forward guidance and a clear steer on monetary policy. Governor Carney will have to whip the MPC troops into line if we are to avoid complete confusion on the direction of rates. The Bank would still have us believe rates will rise in the second quarter of next year. UK rates should rise in the Autumn … In our Greater Manchester Chamber of Commerce Economic Quarterly Outlook, to be released next week, we begin to caution, UK rates should be on the rise in the Autumn, if the present trends in household spending, retail sales and the housing market continue. From an international perspective, the MPC will be reluctant to act ahead of the Fed and the ECB. In the first quarter, US GDP recorded growth of just 2% year on year, postponing, perhaps, the inevitable rate rise. In Europe, fears of deflation may force the ECB to act, to ease, rather than tighten, monetary conditions still further in the June meeting. Japan ends fears of deflation … In Japan, fears of deflation have been assuaged by Abenomics. The solution to fears of falling prices - increase the rate of sales tax and push up prices! Japanese inflation increased by over 3% in April, half of which is explained by the hike in taxes! Fears may later emerge about the slow down in growth, such is the Ground Hog day experience of the lost decade but for the moment, rejoice - the deflationary spiral has been broken in the East! Good News for growth in the UK … Good news for growth in the UK continued this week according to today’s Financial Times. Drugs and prostitution will add £10 billion to the UK economy. Yes, the news that prostitution and drugs will be included in the calculation of the National Accounts from September onwards, adding a new dimension to the “Service Sector” offer. The change will add almost £10 billion to the National Accounts. Hookers will contribute £5.3 billion to “output” (GDP(O)) and drug addicts will add £4.4 billion to the calculation of expenditure (GDP(E). According to ONS research, in 2009, 60,879 prostitutes serviced 25 clients per week at an average spend of £67.19. Don’t you just love economics! If only "tricks" paying 19p could be persuaded to spend more … that would be a recovery! So what happened to sterling this week? The pound closed down against the dollar at $1.675 from $1.682 and down against the Euro at 1.230 (1.234). The dollar closed broadly unchanged at 1.362 from 1.363 against the euro and at 101.80 (101.97) against the Yen. Oil Price Brent Crude closed down at $109.35 from $110.52. The average price in May last year was $102.30. Markets, the Dow closed up at 16,682 from 16,593 and the FTSE moved up to 6,852 from 6,815. The markets are set to move higher. UK Ten year gilt yields closed at 2.56 (2.63) and US Treasury yields closed at 2.46 from 2.52. Gold moved down to $1,251 from $1,293. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Economics news – UK recovery continues at pace in January ... According to survey data this week, [Markit/CIPS UK PMI® January], the recovery in the UK economy continues at pace into the New Year. Manufacturing, construction and services all continued to demonstrate strong levels of activity. In the manufacturing sector, the strong rebound continued with improved domestic demand and rising export orders suggesting robust growth in the month. Construction survey data suggests the sector is experiencing the sharpest rise in construction output since August 2007. Housing activity is increasing at the sharpest rate for over ten years. Service activity remains elevated with a headline index rate at 58.3 during January, down slightly from 58.8 in December. Service sector output is still at a very high level, anything above 50 suggests growth. The latest monthly NIESR GDP tracker suggests the economy grew by over 3% in January. This week, NIESR also upgraded UK forecasts for growth this year to 2.5% with projections of unemployment falling, inflation tracking the 2% target level and government borrowing continuing to reduce. In fact on current plans, according to the leading think tank, the public sector finances will be in surplus in 2018-19. So much for fears of prolonged austerity to come. So growth up, inflation down, employment up and borrowing down. Just the trade performance is expected to deteriorate with the external current balance increasing from a deficit of £54 billion in 2013 to £78 billion by 2015. ONS Data on Trade ... ONS data this week for trade was a little surprising. The trade deficit in December improved significantly compared to our forecasts. Seasonally adjusted, the UK's deficit on trade in goods and services was estimated to have been £1.0 billion in December 2013, compared with a deficit of £3.6 billion in November 2013. There was a deficit of £7.7 billion on goods, partly offset by an estimated surplus of £6.7 billion on services. Some £2 billion of imports appear to have been lost in the analysis. If domestic demand was as strong as the data suggests, the fall in imports for the month is illogical. In any case, don’t get to excited about the rebalancing agenda - for the year as a whole, the deficit trade in goods was £108 billion. US Payroll data ... Over in the US, payroll data upset the markets as jobs growth proved disappointing for the second month running. US payrolls rose a seasonally adjusted 113,000 in January after gains of just 75,000 in December. The unemployment rate continued to move down, to 6.6% the lowest level since December 2008 and perilously close to the Fed forward guidance hurdle rate. It is thought the latest data is unlikely to change the Fed stance on progressive tapering through 2014. Janet Yellen, the new chair of the Federal Reserve Board, makes her first appearance before Congress next week. Emerging markets will shudder as the adjustment in the stance of QE and tapering continues. Rate rises could be on the US agenda by the end of the year. So what happened to sterling? Sterling closed at $1.6407 from $1.6433 and 1.2030 from 1.2184 against the euro. The dollar closing at 1.3635 from 1.3487 against the euro and 102.31 against the Yen. Oil Price Brent Crude closed at $109.57 from $106.40 The average price in February last year was almost $116. Markets, steadied - The Dow closed at 15,794 from 15,698 and the FTSE closed at 6,571 from 6,5210. UK Ten year gilt yields closed at 2.71 from 2.72 and US Treasury yields closed at 2.69 from 2.65. That’s all for this week. No Sunday Times and Croissants tomorrow or for the rest of this year for that matter. We are taking a break in this pre election year. John Join the mailing list for The Saturday Economist or why not forward to a colleague or friend? The list is growing as is our research and research team. Over ten thousand receive The Saturday Economist each and every week! © 2014 The Saturday Economist. John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.  Economics news – import drive and the march of the makers ... Import Drive ... “Sales of European cars drive trade gap wider” is the headline in the Times today as Britons “flocked” to buy cars built on the continent. The trade figures released this week, reveal the September deficit (trade in goods) increased to £9.8 billion from £9.6 billion last month. The trade deficit with the EU reached a record £6.0 billion as imports increased by £0.4 billion to £18.6 billion. “Half of the increase is attributed to cars”, according to the ONS, hence the slightly unbalanced headline from the Times. In reality, Britons have been flocking to the showrooms since the start of the year. Car sales are up by 10% this year. The deficit was offset as usual by a trade in services surplus of £6.5 billion. This is a familiar pattern which should come as no surprise to readers of The Saturday Economist. The trade deficit will deteriorate further especially if the UK continues to grow at a faster rate than major trading partners in the EU and USA. We are forecasting an overall trade deficit this year of £110 billion offset by a service sector surplus of almost £80 billion. The residual overall deficit easily financed. The September figures are confirmation of the trends within our well established trade model. Depreciation damages UK trade in goods performance. Imports do not react significantly to price changes. There will be no rebalancing of the economy. March of the makers picks up pace ... Did the march of the makers pick up the pace in September? Not really. According to the latest figures from the ONS. Manufacturing output increased in the month by just 0.8%. Output for the quarter was flat as signaled in the Markit/CIPS PMI® survey data last week. Nevertheless we still expect manufacturing growth of almost 2.5% in the final quarter of the year. Last year was such a dismal quarter, even the stumbling marchers will make progress. Watch out for the headlines heralding the rebalancing over the next few months and tie me to a chair. Other survey news ... The service sector continues to drive growth in the economy according to the Markit/CIPS UK Services PMI® for October. The headline Business Activity Index reached a level of 62.5 in October. “The UK service sector maintained its recent run of strong growth during October, with activity expanding at the fastest pace since May 1997 as levels of incoming new business rose at a survey record rate”. The construction rally also continues according to the Markit/CIPS UK Construction PMI® index. The sharp rebound in UK construction output continued in October. The lead index posted 59.4, up from 58.9 in September, above the 50.0 no-change threshold for the sixth consecutive month. So what does this all mean? The economy is recovering and growing at a much faster rate into the final quarter. The pick up in manufacturing output will add to the growth in services and construction. Higher growth, more jobs, lower borrowing, inflation falling, investment will pick up in the second half of next year, it’s all looking pretty good for the Chancellor. Just the trade figures will continue to disappoint. We now think base rates are now more likely to rise by around 50 basis points in 2015. Higher growth will result in unemployment hitting the 7% hurdle rate in the third quarter of 2015, several months after the election. What happened to sterling? The Euro rate cut weakened the hybrid and Sterling strengthened as a result. The pound closed at £1.6018 from £1.5912. Against the Euro, Sterling closed at €1.1982 from €1.1814. The dollar moved up against the yen closing at ¥99.1from ¥98.7 and closing at 1.3368 from 1.3484 against the Euro. Oil Price Brent Crude closed at $105.12 from $105.91. The average price in November last year was almost $110. We expect Brent Crude to average $110 in the month, with no material inflationary impact. Markets, pushed higher - The Dow closed at 15,762 up from 15,616. The FTSE closed at 6,708 from 6,721. The rally continues with a stronger Santa rally in prospect over the next five weeks. UK Ten year gilt yields closed at 2.77 from 2.66 US Treasury yields closed at 2.75 from 2.62. Yields will test the 3% level over the coming months. Gold closed at $1,284 from $1,312. The bulls may have it may just have to wait for now. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow and watch out for news of our Friday Financials Feature with Monthly Markets updates coming soon. John Join the mailing list for The Saturday Economist or please forward to a colleague or friend. UK Economics news and analysis : no politics, no dogma, no polemics, just facts. © 2013 The Saturday Economist. John Ashcroft and Company, Dimensions of Strategy. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.  Housing Market and Leisure Sector continue to lead recovery ... Nationwide House Prices House prices increased at a rate of almost 6% in October according to the Nationwide House Price Index. Access to finance, a result of FLS and H2B have improved the willingness of buyers to step into the market. The housing market is up, up and away as our October review of the UK Housing market confirms. Is there a boom in prospect? Robert Gardner, Nationwide's Chief Economist, points out that “while house price growth has picked up - prices remain 7% below their 2007 peak.” Houses are generally affordable - ‘typical mortgage servicing costs remain modest by historic standards thanks to the ultra-low level of interest rates. A typical mortgage payment for a first time buyer is currently equal to around 29% of take home pay, in line with the long term average.” Well it won’t take long for the price lag to be wiped out, even on the Nationwide index. The “real cost of borrowing” is negative - borrowing rates are lower than asset price rises. The essential conditions for market expansion. We expect transactions to increase above one million this year, still well below the peak of 2007. No boom in prospect but a healthy recovery is in train, the house market is up, up and away on a sustainable growth path. Service Sector Growth The service sector continues to provide the back bone of growth in the economy, with growth accelerating to over 2% for the year as a whole. The leisure sector is now the fastest growing sector of the UK economy. Distribution, hotels and leisure have expanded at a rate of 4% in the year. Check out our Service Sector Update for November. Six slides to explain just what is happening in the UK economy. Manufacturing Not the march of the makers, that’s for sure. The latest Markit/CIPS UK Manufacturing PMI® survey was released on Friday. The index slipped to 56.0 in October, down from a revised reading of 56.3 in September. “The UK manufacturing sector continued a strong third quarter performance into the final quarter of the year according to the summary”. Yet manufacturing growth in the third quarter was pretty flat. Nevertheless we still expect growth of over 2% in the final quarter of the year (in manufacturing). Last year was such a dismal quarter, even the stumbling marchers can make progress. So what does this all mean? The economy is recovering and growing at a much faster rate into the final quarter. We still think base rates are now more likely to rise by around 50 basis points in 2015 rather than 2016. We still say this, despite the decision by the Fed this week to hold rates and continue with QE. Growth in the US is weak, inflation is below target and the housing market is confusing analysts. We expect tapering will be back on the agenda in the New Year as we migrate to Planet Janet. What happened to sterling? It was all about the dollar this week. Sterling slipped against the dollar but moved up against the Euro. The pound closed at £1.5912 from £1.6166. Against the Euro, Sterling closed at €1.1814 from €1.1713. The dollar moved up against the yen closing at ¥98.7 from ¥97.4, closing at 1.3484 from 1.3803 against the Euro. Oil Price Brent Crude closed at $105.91 from $106.93. The average price in November last year was almost $110. We expect Brent Crude to average $110 - $115 in the month, with no material inflationary impact. Markets, pushed higher - The Dow closed at 15,616 up from 15,570. The FTSE closed at 6,7351 from 6,721. The rally continues. UK Ten year gilt yields closed at 2.66 from 2.63 US Treasury yields closed at 2.62 from 2.51. Gold closed at $1,312 from $1,352. The bulls may have it but are pegged and penned for the moment. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow and watch out for news of our Friday Financials Feature with Monthly Markets updates coming soon. Join the mailing list for The Saturday Economist or forward to a friend UK Economics news and analysis : no politics, no dogma, no polemics, just facts. John © 2013 The Saturday Economist, #TheSaturdayEconomist, by John Ashcroft and Company, Dimensions of Strategy and The Apple Case Study. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Economics news – Super September sees new car sales soar New Car Sales September new car registrations produced the highest monthly figure since March 2008 as sales totaled just over 400,000 units. Compared to last September sales were up by 12%. The UK car market is on track to sell 2.25 million units in the year up by 10% on 2012. Mike Hawes, Chief Executive of the SMMT said “Robust private demand has played a major role in this growth with customers attracted by exciting, increasingly fuel-efficient new models”. Private registrations have risen by 17% in the year, a measure of the strength of consumer demand. Markit/CIPS UK PMI® data The Markit/CIPS UK PMI® data series were released this week providing more good news on the strength of the economy. Manufacturing The UK manufacturing sector continued to expand at a marked pace in the month to round off its strongest quarterly performance since the opening quarter of 2011. At 56.7 in September, the seasonally adjusted Markit/CIPS Purchasing Manager’s Index® (PMI®) remained in expansion territory for the sixth successive month and was little-changed from August’s two-and-a-half year peak of 57.1. Service Sector The UK service sector continued to perform strongly in September to round off the best quarterly performance of the sector since Q2 1997. Activity and new business both rose at rates close to the August high. The Business Activity Index, recorded a level of 60.3, fractionally down on August’s near seven-year high of 60.5. Construction In the construction sector, the headline Markit/CIPS UK Construction Purchasing Managers’ Index® (PMI®) posted 58.9 in September, down only fractionally from a near six-year high of 59.1in August. The index was above the neutral 50.0 value for the fifth month running and signaled a sharp expansion of overall construction output. Housing construction activity increased at the fastest pace for almost a decade. So what does this all mean? The economy is recovering and growing at a much faster rate into the second half of the year. The service sector has maintained steady progress since 2009 growing at 1.6%. The manufacturing sector is recovering but the construction sector, particularly housing, is providing the significant boost to output. We think new housing, starts and completions, could grow by 30% this year boosting overall construction output by over 4% in the second half. This is the primary reason we have increased forecasts for 2013 to 1.5%. GDP growth is on track for 2.5% next year. Growth, inflation, jobs and even the borrowing figures are heading in the right direction. The trade figures alone will continue to disappoint. The UK cannot grow faster than major trade partners without exacerbating the external deficit. What happened to sterling? Sterling moved down against the dollar and against the Euro. The pound closed at £1.6012 from $1.6150. Against the Euro, Sterling closed at €1.1816 from €1.1935. The dollar moved down against the yen closing at ¥97.4 from ¥98.2.The dollar euro cross rate at 1.3556 was largely unchanged from 1.3530 Oil Price Brent Crude closed at $109.46 from $108.63. The average price in October last year was almost $112. We expect oil to average $112 in the current quarter, with no real inflationary impact. Markets, slipped - The Dow closed at 15,073 from 15,258. The FTSE closed at 6,454 from 6,512. The impasse on the US budget and government shut down appears to have damaged UK investment sentiment more than the US. UK Ten year gilt yields closed at 2.75 from 2.73, US Treasury yields closed at 2.64 from 2.63. Gold closed at $1,310 from $1,3361. The bulls have it or do they? Gold will trade sideways for some time yet. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow. Join the mailing list for The Saturday Economist or forward to a friend UK Economics news and analysis : no politics, no dogma, no polemics, just facts. John © 2013 The Saturday Economist, #TheSaturdayEconomist, by John Ashcroft and Company, The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed