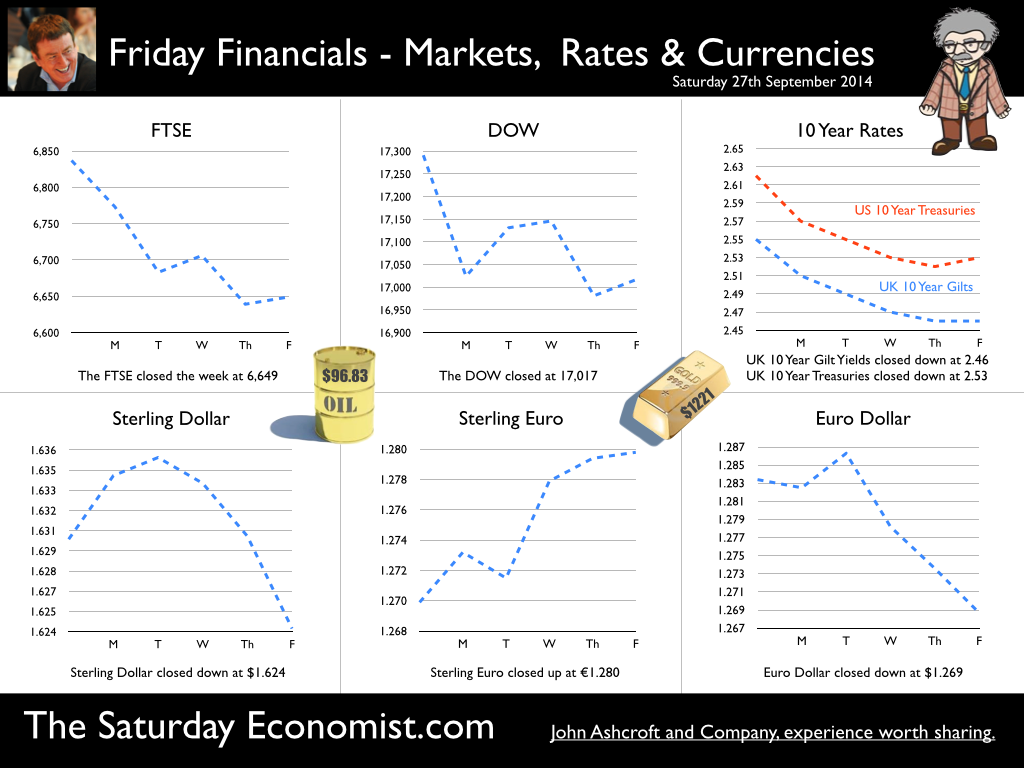

Brigitte Bardot, the "impossible dream of married men", will be 80 years of age tomorrow. Now a great grandmother, in a birthday interview for Paris Match, Ms Bardot claimed “I have loved a lot, passionately madly and not at all. Yet, I only keep one man in mind : the next one”. I feel much the same way about economic forecasts. I love a lot, passionately and madly, some not at all. I only keep one forecast in mind - the next one. Especially the next forecasts resulting from the GDP revisions out next Tuesday. The inclusion of drug dealing and prostitution for the first time, will no doubt, boost output and productivity in the UK economy. UK growth forecasts for the year will be revised as a result. The productivity dilemma resolved, understanding economic agents, burn a spliff, lie back and think of England as they contribute to economic growth. Forecast Revisions … Good news from Spain this week, as forecasts of growth have been revised up. The Finance Minister, Luis de Guindos has suggested growth this year will be 1.3% and 2% next. Still some way to go to full employment, the government now expects the unemployment rate to be 22.9% in 2015, down from prior forecasts of 23.3%. In the USA, growth in the second quarter has also been revised up! The annualised rate of growth revised higher to 4.6% from the previous 4.2%. The underlying growth rate (year on year) revised to 2.6% in the quarter. We now expect US growth of 2.5% for the year as a whole, following the slow start in the first quarter. The Manchester Index™, In the UK, the economy is on track for growth of 3.1% this year slowing to 2.8% next according to the latest data from GM Chamber of Commerce Quarterly Economic Survey and the influential Manchester Index™. The Manchester Index™ index moderated from 33.6 in Q2 to 32.0 in the third quarter largely as a result of the change in outlook for exports. The index remains above the pre recession average for the period 2005 - 2007. The outlook for home orders and deliveries improved slightly in both the service sector and the manufacturing sector. Exports, on the other demonstrated a significant fall in deliveries in both manufacturing and services. Service sector orders fell but the drop in export manufacturing orders was particularly marked. Overall confidence in turnover and profits was maintained and the prospects for employment and investment was particularly marked. Borrowing figures … Government borrowing figures were released this week. Public sector net borrowing was £11.6 billion in August, an increase of £0.7 billion compared with August 2013. For the year to date, total borrowing was £45.4 billion, an increase of £2.6 billion compared with the same period in 2013/14. Receipts in the month were boosted by Stamp duty up 24% and VAT receipts with a recovery in income tax payments, up by 2.4%. The cautionary note, expenditure £54 billion increased by 3.3%. The government is off track to meet the deficit targets this year. The good news, borrowing was revised down for 2013/14 to £99.3 billion. The reduction to £95 billion this year, less of a challenge as a result but there is still much to do with seven months to go before the end of the financial year if the targets are to be hit. So what of base rates … The Governor delivered a speech in Wales this week. “With many of the conditions for the economy to normalise now met, the point at which interest rates also begin to normalise is getting closer. In recent months the judgement about precisely when to raise Bank Rate has become more balanced. While there is always uncertainty about the future, you can expect interest rates to begin to increase. We have no pre-set course, however; the timing will depend on the data.” So what does this mean for UK rates? As we said last week, weak growth in Europe, monetary accommodation in the US, low inflation and earnings data in the UK, will push the increase in UK base rates into 2015. Despite the schism on the committee, the MPC will be reluctant to move ahead of the Fed. The timing will depend on the data. The inflation and pay data says “don’t move yet but February is the best bet”. So what happened to sterling this week? Sterling slipped against the dollar to $1.624 from $1.630 but up against the Euro at 1.280 from 1.270. The Euro closed against the dollar at 1.269 (1.270). Oil Price Brent Crude closed down at $96.83 from $98.08. The average price in September last year was $111.60. Markets, moved down. The Dow closed at 17,017 from 17,291 and the FTSE closed down at 6,649 from 6,837. UK Ten year gilt yields move up to 2.46 from 2.55 and US Treasury yields closed at 2.53 from 2.62. Gold moved sideways at $1,221 from $1,218. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

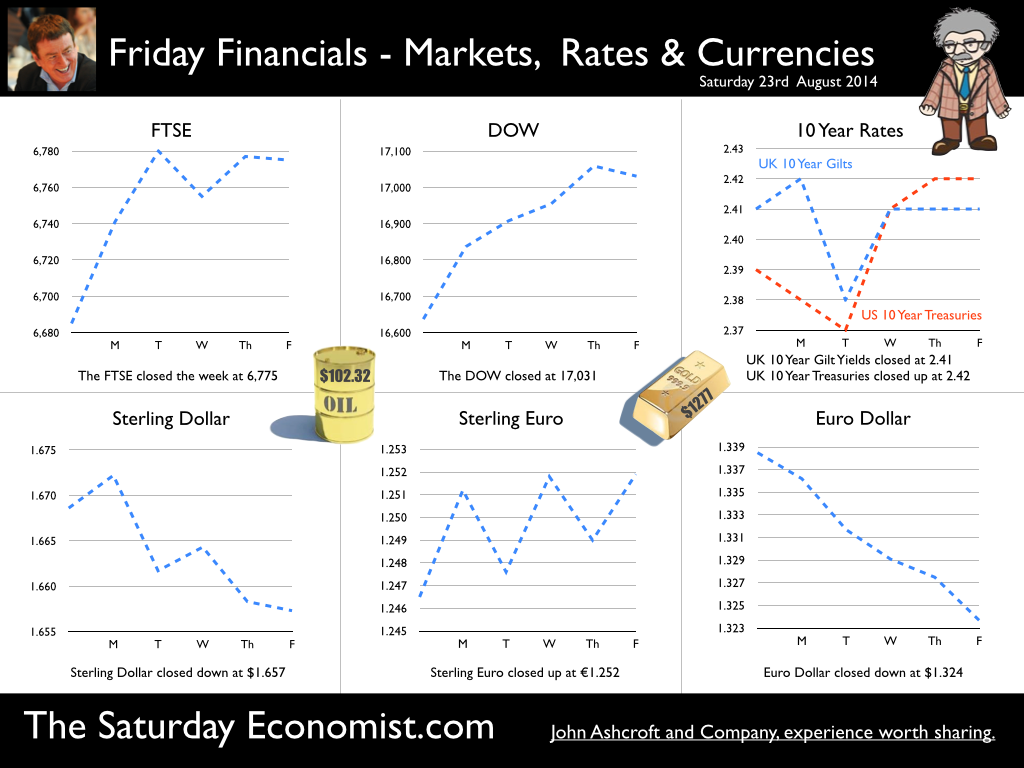

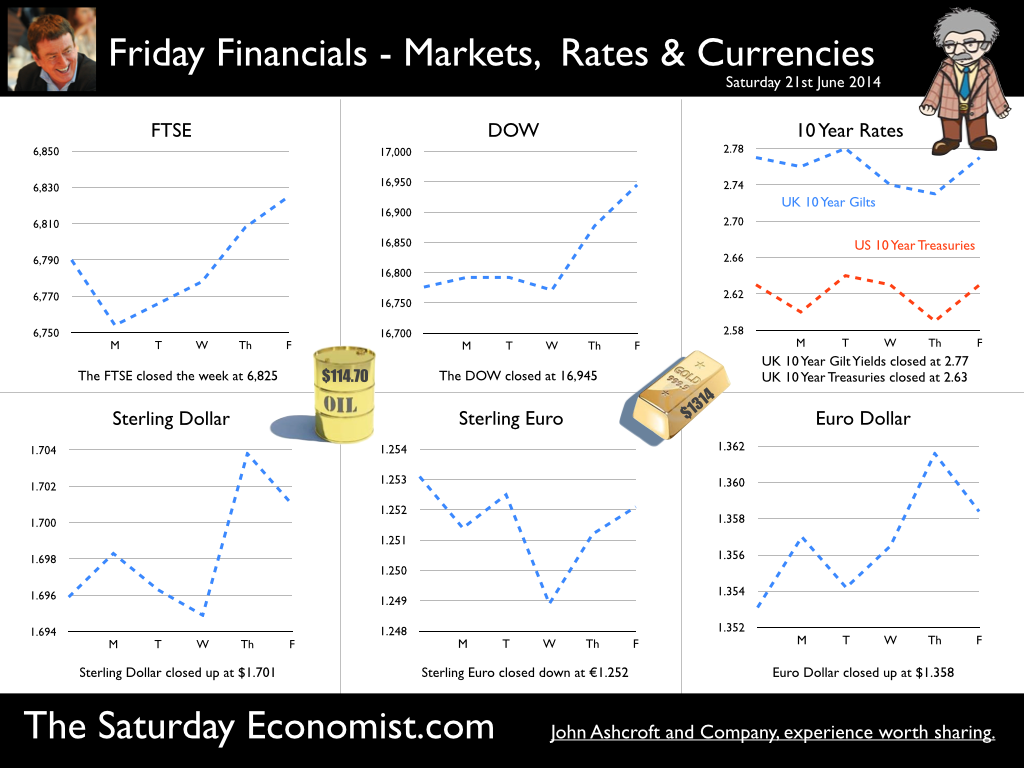

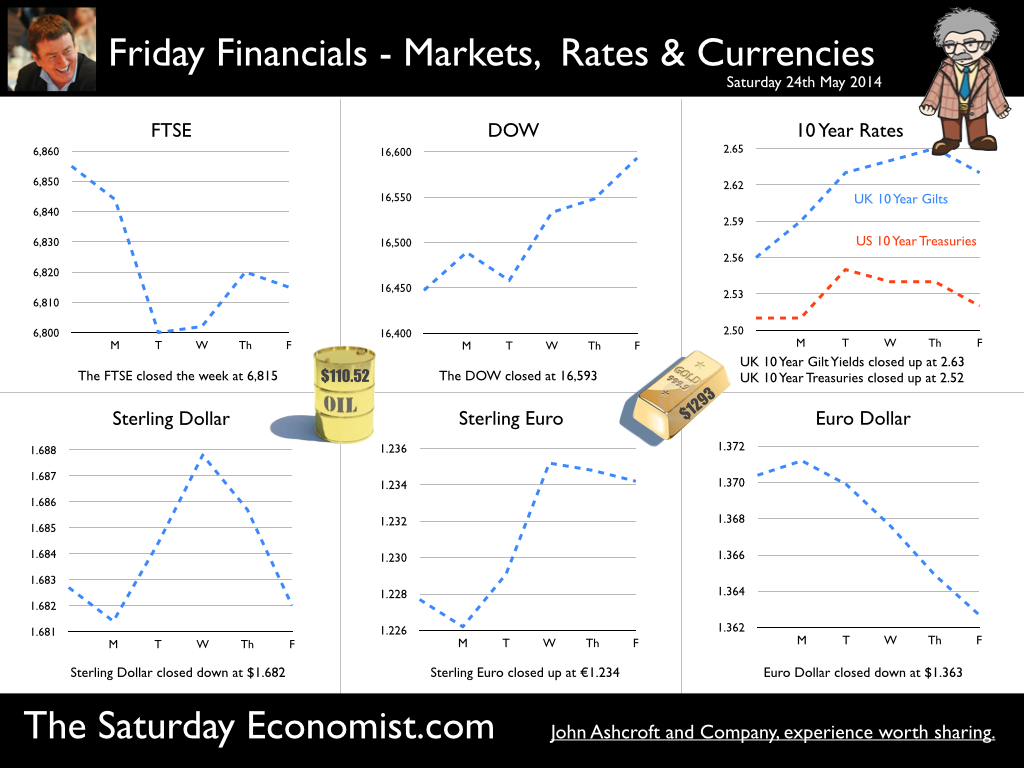

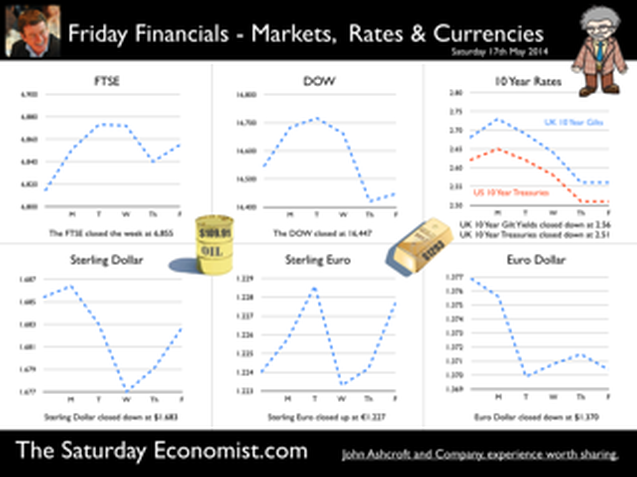

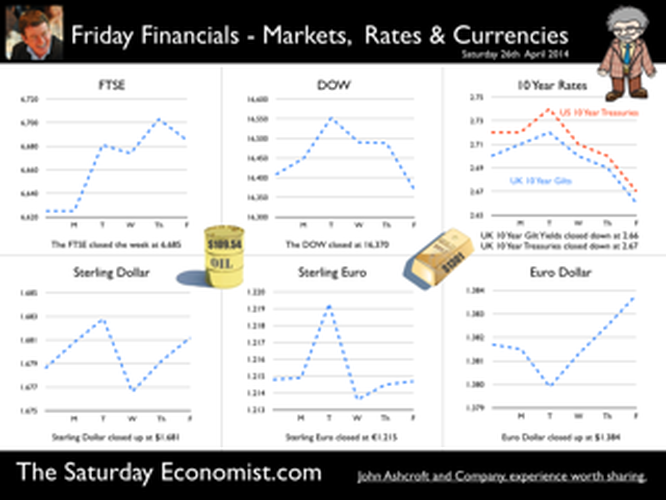

Jackson Hole, Wyoming. Skiing in Winter and Fly Fishing in Summer, there are several perks to the role of central banker. This week the bankers were in Jackson Hole, Wyoming, fishing for answers to the employment - inflation conundrum. The occasion - the Federal Reserve, Kansas City, Economic Symposium, Jackson Hole, Wyoming. Why Wyoming? You may well ask? In 1982 the conference moved to Jackson Hole (Kansas City district) to persuade Paul Volcker, then chairman of the Fed and an avid fly-fisherman, to attend. Flies and fish were the big lure for the head of the Fed - and so it began. The location, based some 2,000 miles from New York and 5,000 miles from London is not ideal. Communication - in the early days - not always ideal either. Want a copy of the New York Times? The local store stocked today’s and yesterday’s but if you wanted today’s copy, you had to come back tomorrow - delivery lagged a day behind. Monetary Policy and the Muddler Minnow* … This year the theme was Labor Market Dynamics and Monetary Policy. Mario Draghi reassured markets there would be no early rise in rates in Europe! Quelle Surprise! Janet Yellen delivered a lecture on structural, cyclical, secular and frictional unemployment before claiming the mantle of Truman’s two handed economist to explain the Fed’s stance on future monetary policy. On the one hand … “If progress in the labor market continues to be more rapid than anticipated or if inflation moves up more rapidly than anticipated, resulting in faster convergence toward our dual objectives, then increases in the federal funds rate target could come sooner than the Committee currently expects and could be more rapid thereafter.” On the other hand … “If economic performance turns out to be disappointing and progress toward our goals proceeds more slowly than we expect, then the future path of interest rates likely would be more accommodative than we currently anticipate.” Excellent. Yellen then left the room, thrust on a pair of waders, tied on a muddler minnow before making an excellent double spey cast into the River Snake. [*The muddler minnow is currently one of the most favoured trout flies amongst central bankers.] The MPC Minutes … muddying the waters … Back in the UK, the Bank of England released the minutes of the August MPC meeting. Two members of the committee, Martin Weale and Ian McCafferty voted for an increase in base rates by 25 basis points. The Carney consensus has cracked. Charm school is out for the Summer. Markets fell, Sterling rallied, on the prospect of an early rate rise. Inflation Update ... The day before, the ONS released the inflation figures for July. CPI fell to 1.6% from 1.9% prior month. Markets had rallied, Sterling fell, prospects of an imminent rate rise postponed. No one seemed to notice that service sector inflation was unchanged at 2.5%. The overall drop in the headline rate - attributable to goods inflation down to 0.8% from 1.4% in June. So why the drop in goods inflation? Manufacturing output prices were flat but input costs fell by over 7% in the month. Effects of sluggish world trade, weak commodity and energy prices were exacerbated by the translation impact of a stronger Sterling. Government Borrowing … Thursday and the ONS released figures on government borrowing for the month of July. Four months into the year and borrowing remains off track compared to last year and to plan. In the first four months, total borrowing was £37.0 billion compared to £35.2 billion in 2013. In July borrowing was down to £0.7 billion from £1.6 billion last year. An improvement but with an economy expanding by over 3% in the first half of the year, we would expect a big improvement in borrowing given the strength of the recovery. Government spending is not the problem, nor VAT receipts up by 5%. The problem is revenues from income and capital gains tax are actually down on prior year over the first four months of the fiscal year. In part this is a result of strong receipts in the first quarter last year which may level out in due course. Compared to two years ago, revenues are up 5%. Even so, for the year as a whole the Chancellor will still have some work to do if the OBR target is to be met. Retail Sales … Retail sales in July were up by 2.6% after growth of 4% in the first half of the year. A disappointment, perhaps. Internet sales were up by 11% accounting for 11% of all retail activity. It will take more than a few digital mannequins to reverse fortunes on the high street but it is a tad to soon to make the call about a slow down in overall activity. The house market remains strong in terms of prices and the Council of Mortgage Lenders reported a 15% increase in gross mortgage leading last month. So what of base rates … The MPC minutes suggested the rate rise could come earlier than expected but news on inflation and retail sales suggest the rates will be kept on hold until 2015. No rate rise in prospect in Europe but Janet Yellen has “nowcast” a muddler minnow into the thought stream. A rate rise in the USA on the cards for Q2 next year or even earlier? Possibly. In the UK - February or June would appear to be the call. So what happened to sterling this week? Sterling closed down against the dollar at $1.657 from $1.669 but up against the Euro at 1.252 from 1.246. The Euro was down against the dollar at 1.324 (1.246). Oil Price Brent Crude closed down at $102.32 from 102.96. The average price in August last year was $111.28. Markets, rallied on the fishing report from Wyoming. The Dow closed up at 17,031 from 16,637 and the FTSE closed up at 6,775 from 6,685. UK Ten year gilt yields were unchanged at 2.41 and US Treasury yields closed at 2.342 from 2.39. Gold was largely unchanged at $1,302. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Deficits with inky blots and rotten parchment bonds sustained - of Balance of Payments and Public Sector Finances. Earlier this month is his speech at the Mansion House, Mark Carney, Governor of the Bank of England, referenced the Sterling Crisis of 1931 and imbalances within the economy. “We need balance. One has only to look back to 1931 when Britain’s economic prospects were strained by a large budget deficit and a deteriorating balance of payments. In the ensuing crisis, the government of the day resigned, sterling was forced off the gold standard" [and the Governor of the day went back to Canada.] In 2014, despite significant internal and external deficits, neither the resignation of the government, nor the repatriation of the Governor of the Bank of England appears imminent. It is however, worth revisiting 1931 and recalling the worlds of Sir Warren Fisher, permanent secretary to the Treasury. In September of that year, Sir Warren Fisher, warned Cabinet, of the Balance of Payments Crisis and the National Budget problem - "Deficits with inky blots and rotten parchment bonds sustained". He could easily have been talking of the present day, QE and debt monetisation. Trade Deficit ... Fisher 1931: The seriousness of the financial difficulties which are engaging public attention is perhaps not fully realised. The root cause of the "run on Sterling" on the part of the foreign depositor is the fact of our living beyond our means as evidenced by our ordering from abroad more goods than we could pay for and therefore our owing to other countries more in dollars and francs than they owe to us in sterling.” Public Sector Finances … Fisher 1931: Closely associated with this fact in the foreign mind is the question of our national Budget. After the war a certain number of countries continued to have difficulties in balancing their budgets and instead of pulling in their belts, resorted to the expedient of meeting deficits by printing innumerable bank or currency notes. Whenever this was done, the national currency lost much or all of its value i.e. purchasing power, and with the corresponding rise in prices, hardship, even hunger, was widespread. Consequently, when any of these countries subsequently desired financial assistance from other countries before the citizens of the latter could be induced to lend, they insisted on the borrowing country balancing its budget. And no one was more emphatic than ourselves in preaching this doctrine. National Budget … Fisher 1931: A national Budget has thus come to be regarded as a touchstone of a country's financial stability second only in importance to its international balance of trade; and if, as the case at present with us, we are "down" on our balance of trade with other countries, foreigners to whom we owe money automatically turn a microscope on to our Budget. And if the Budget is not really balanced, but is merely dressed up to look as though it were, the distrust abroad of our soundness would be intensified. Any expectation that we might continue on a "rake's progress" would complete the destruction of international confidence and thus result in the final collapse of our greatest asset, i.e. our credit. Living beyond our means … Fisher 1931: The remedy is to reverse the process which has been responsible for the trouble, and this means that instead of living at a level which has entailed ordering abroad more goods than we can pay for, we must relate our orders to our capacity to pay. And unless we can produce and sell abroad more goods (including "services") than we have been doing, we shall be forced to cut down our orders abroad, and our and our standard of living must be reduced accordingly. Consequences ... If not the epitaph of us English of to-day will be written by historians to come in Shakespeare' words (Richard II , Act 2, Scene l ) "England, bound in with the triumphant sea, Whose rocky shore beats back the envious siege of watery Neptune, Is now bound in with shame, with inky blots and rotten parchment bonds. That England, that was won’t to conquer others, hath made a shameful conquest of itself". Lessons from History And so history is revisited. With inky blots and rotten bonds sustained. The latest data on the Public Sector Finances is hardly reassuring and the trade deficit will continue to present a problem for an economy growing faster than major trading partners. Note "By the Secretary, The attached memorandum by Sir Warren Fisher is circulated to the Cabinet by instructions from the Prime Minister. (Signed) M. P. A. HANKEY Secretary, Cabinet, Whitehall Gardens, SW1. September 14th, 1931. Footnote : Up to this time the pound sterling, has for international purposes been valued and accepted as the equivalent of a gold pound or of 4.00 dollars or 124 Francs. The Financial and Economic Position of the United Kingdom 1931. Memo to Cabinet from Sir Warren Fisher, Permanent Secretary to the Treasury September 1931. Deficits with Inky Blots and Rotten Parchment Bonds sustained. This article was originally published John Ashcroft.co.uk in July 2009. References : Fun with the National Archives : Cabinet Papers  The Manchester Index™ confirms the UK recovery is on track with growth continuing around 3% into the second quarter of the year. The index fell slightly to 33.6 from 35.1, still much higher than pre recession levels. The preliminary results from the GM Chamber of Commerce QES data were available this week. The survey suggests strong growth in manufacturing continues, with slightly more moderate growth in the service sector. The results are in line with our forecasts for the full year - available in the June Economic Outlook. The full results and presentation on the influential Chamber of Commerce QES survey for Q2 will be available on the 4th July. Don’t miss that! Public Sector Finances off track … The strong performance in the economy is slightly at odds with the Public Sector Finances for May, released this week. The UK economy is expanding by just over 3% in the first half of the year. We would expect an improvement in borrowing given the strength of the recovery. Two months into the year and borrowing is off track compared to last year and to plan. In the first two months of the year, total borrowing was up at £24.2 billion compared to £23.2 billion prior year. Strong VAT revenues contributed to a 9% growth in total receipts but expenditure increased by almost 6%, despite a fall in interest payments. Last year’s borrowing figure has been revised to £107.0 billion for the financial year. Good news for the Chancellor but revenues will have to improve and expenditure will have to be contained, if this year’s OBR forecast is to be met. Strong Retail sales in May … Strong retail sales are contributing to the VAT receipts. In May retail sales volumes were up 3.9% compared to last year. This is down on April’s staggering 6.5% growth but we still expect growth of 4.6% in the current quarter and 4.3% for the year as a whole. Internet sales were up by 15%, now accounting for 11.4% of all activity. The online disruption continues. Sales values were up by just 3.2%, contributing to deflation and retail concerns in the High Street. Inflation slows in May … And so it was with the inflation figures. Inflation CPI basis slowed to 1.5% in May, down from 1.8% in April. Service sector inflation was 2.2% and goods inflation held at 0.9%. Falls in transport service costs, notably air fares, provided the largest contribution to the decrease in the rate. Other large downward effects came from food, drinks and clothing. The fall came as something of a surprise, we still expect inflation to track near target (2%) for the year as a whole. Producer Prices no pressure on inflation … No pressure on inflation is evident in the producer price information, released this week. Output prices in May increased by just 0.5% as input costs fell by 5%. Import prices of fuel, oil, food, metals, chemicals, parts, equipment and materials the real story. It is a story of weak international growth in GDP and trade, with slow growth in commodity prices, assisted by the strength of sterling, closing the week above the critical $1.70 level. Monetary Policy and Minutes of the MPC ... So why is Sterling so strong? Statements from Governor Carney that rates may rise “sooner than markets expect" are contrasting with the “Business as Usual” stance from the Federal Reserve. The Fed reduced the forecast GDP 2014 outlook for the US economy to just 2.2% from 3% earlier. Tapering is set to continue but guidelines suggest interest rates will not rise until the second quarter of next year. In the UK, we expect rates to rise in the final quarter of the year. Inflation and earnings suggest that strong growth of itself will not precipitate the rise. The Sterling genie is removing the $1.70 stopper. Who speaks for Sterling? We asked in March last year as the pound headed to the $1.50 level. Sterling look set to test $1.74 in the months ahead unless rate fears are calmed. So what happened to sterling this week? The pound closed up against the dollar pushing through resistance at the $1.70 level. Sterling closed up at $1.7010 from $1.696, steady against the Euro at 1.252 (1.253). The Euro strengthened against the dollar at 1.358 from 1.353. Oil Price Brent Crude closed up at $114.70 from $113.07 on Middle East concerns. The average price in June last year was $102.92. The inflation impact cannot be ignored if the a-seasonal pattern persists. Markets, closed up. The Dow closed down at 16,945 from 16,776 and the FTSE was also up at 6,825 from 6,790. UK Ten year gilt yields held at 2.77 and US Treasury yields closed at 2.63 from 2.77 on interest rate trends. Gold moved higher on geo political fears at $1,314 from $1,274. That’s all for this week. Visit the revamped web site. Download our Quarterly Forecast. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. About the Manchester Index™ … The Greater Manchester economy correlates highly with trends in the national economy. The Manchester Index® is an early indicator of trends in both the Manchester and the UK economy. The index is derived from the GM Quarterly Economics Survey which forms part of the British Chambers of Commerce National Survey. Greater Manchester is the largest contributor to this important business survey. We poll 5000 businesses every quarter. As the principal national business survey and the first to be published in each quarter, the results are closely monitored by HM Treasury and the Bank of England Monetary Committee. The GM survey data has a high correlation with the national data. In other key indicators, the unemployment claimant count for example, has a high correlation (over 99%) with the national data set. Our business investment tracker utilises data from capacity and investment intentions to forecast investment in the UK economy. We lag capacity by four quarters and investment intentions by two quarters to model spending.  The first rate hike - it could happen sooner than markets expect … speaking at the Mansion House this week, Mark Carney gave a clear indication UK rates could be hiked this year. “It could happen sooner than markets expect”, the exact wording. A bit tough on the markets, they had placed great confidence in forward guidance. So much for the “unemployment trigger” or the “eighteen indicators” - “watch my lips”, the Governor’s new condition precedent. Last week we suggested - UK rates would have to rise sooner than forward guidance implied. We didn’t have long to wait. The Governor made the move. The markets now believe rates may rise in the final quarter of this year. October would be a fair bet. UK data continues to suggest rates should rise in the Autumn … Construction output increased by a revised 6.7% in the first quarter of the year and by 4.7% in April. We are forecasting growth of almost 6% this year and 5% in 2015. Our forecast for GDP growth is upgraded slightly to 3% from 2.9% this year, as a result of the revisions to the construction data. [Our forecast is unchanged for 2015 - 2.8%]. Manufacturing output increased by 4.4% in April following growth of 3.6% in the first quarter. A strong performance in capital goods output was supported by growth in consumer durables. The march of the makers is picking up the pace but output remains just over 7% below the peak level of 2008. We continue to forecast a recovery with growth of 4% this year. Jobs Data - another strong performance revealed this week. The claimant count fell by 27,000 to 1,086 thousand in May. The reduction over the last three months was 86,000. The average claimant count from 2005 to the middle of 2008 was 880,000. If current trends persist, the pre recession levels will be achieved by the end of the year and job centres will be closing by the end of 2017! The number of vacancies increased to 637,000. This is higher than the average pre recession levels of 634,000. The UV ratio fell to 1.7 from a peak of 3.8 in 2009. The average 2005 - 2008 was 1.4. 33 million are in work [DYDC], an increase of over one million over the last twelve months. Our estimate of spare capacity is 0.6%, compared to the estimates of 1% - 1.5% within the Bank of England. The margin is wafer thin. The “gap” will be exhausted by the final quarter of the year. The labour market is tightening. Rates should be set to rise towards the end of the year. So what happened to sterling this week? The pound closed up against the dollar following the comments from the Governor, encountering resistance at the $1.70 level. Sterling closed up at $1.696 from $1.679, up against the Euro at 1.253 (1.231). The Euro softened against the dollar at 1.353 from 1.364. Oil Price Brent Crude closed up at $113.07 from $108.48. The situation in Iraq and the Middle East pushed prices higher. The average price in June last year was $102.92. The inflation impact cannot be ignored if the a-seasonal pattern persists. Markets, closed down on fears of the rate hike in the UK and in the USA. The Dow closed down at 16,776 from 16,899 and the FTSE was also down 6,790 from 6,858. UK Ten year gilt yields rallied at 2.77 (2.63) and US Treasury yields closed at 2.77 from 2.55 on interest rate trends. Gold moved higher on geo political fears at $1,274 from $1,250. That’s all for this week. Visit the revamped web site. Download our quarterly forecast. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  It was one of those heavy weeks for economics releases. Inflation, retail sales, government borrowing plus the eagerly awaited second estimate of GDP. Add in ONS house price information and a heady cocktail of excited headlines was to be expected from the financial pages. Inflation data as expected … It began quietly enough with the inflation data. No surprises, CPI inflation edged up to 1.8% in April from 1.6% in the prior month. The large rise in service sector inflation to 2.8% from 2.3% was offset by a small decline in goods inflation, falling to 0.9% from 1.0%. The uptick was marginally reflected in producer prices, increasing to 0.6% from 0.5%. The more volatile input costs, fell at a slower rate -5.5%, from -6.3% prior month. Energy and oil prices, were again significant in the reduced input costs. Imported metals, chemicals, parts and equipment fell significantly assisted by the 10% appreciation of sterling against the dollar. For the year as a whole, we think inflation will hover close to the target for the best part of the year. The risk remains to the upside in the final quarter. A rise in international prices, and domestic demand, boosted by compression in the labour market is likely to push prices higher. No risk of deflation on the UK horizon, a real risk to the upside is developing. House Prices .. UK house prices increased, according to the ONS data, by 8% in the twelve months to March. “The house market may derail the recovery", the headline. “Carney believes that house prices are the biggest risk to the economy” the great caution. No matter, that house prices increased by over 9% in the prior month or that house prices outside London are increasing by just 4% on average. In the North West prices increased by just over 3%, in Scotland prices hardly increased at all. In London, house prices increased by 17%. Foreign cash buyers at the top end of the market may be confusing the overall trend. However, significant volume and price escalation in the mid tier market is also impacting on price averages. Governor Carney has made it clear interest rates will not rise to combat rising house prices. The remit to action lies with the Financial Policy Committee. Already, action has already been taken to modify the Funding for Lending Scheme away from mortgage lending. Discussions between the Bank and Treasury will continue to consider modifications to the “Help to Buy Scheme”. Implementation of the Mortgage Market Review will also curb lending into 2014. There is a structural problem in the housing market. Mark Carney, Governor of Threadneedle Street, points out that Canada has half the population of the UK but builds twice as many houses. No wonder there is a supply issue. But is the Bank of England prepared to help out? Not really. The Little Old Lady will not turn a sod, grab a hod nor build a single house this year. “We are not in the business of building houses” the Governor’s mantra. The Bank of England will not build a single house in this cycle but neither will it allow the housing market to derail the recovery, provoking a premature move in base rates. Retail Sales … Retail sales figures, on the other hand, suggest rates may have to rise much sooner than expected. Retail sales volumes increased by 6.8% in April compared to prior year. It was May 2004 when retail sales volumes increased at a similar rate. Base rates were 4.75% at the time rising to over 5% within eighteen months. Retail sales values increased by just over 6%. Online sales increased by 13%, accounting for 11% of total action. Consumer confidence is back to the pre recession levels, car sales are up by 8% this year and retail sales are soaring. From a UK perspective, rates should be on the move by the Autumn of this year. The MPC will be reluctant to move ahead of the Fed and the ECB. The international context suggests the rate rise may be delayed until the second quarter of 2015. Thereafter, for those who would argue the forward horizon has 2.5% cap, the retail sales figures and base rate history should provide a warning of surprises to come. GDP Second Estimate … No surprises in the second estimate of GDP release for Q1. No revisions. The UK economy grew by 3.1% boosted by an 8% surge in investment activity. Manufacturing and Construction increased by over 3% and 5% respectively. The economy is rebalancing … well a little bit! Our May Quarterly Economics Update on behalf of GM Chamber of Commerce is released next week. The outlook for the year remains broadly unchanged. We expect the UK economy to grow by around 3% this year and 2.8% in the following year. The surge in retail activity has been a surprise, as is the continued strength in employment. The outlook remains much the same. Growth up, inflation rising slightly, employment increasing and borrowing, despite the blip in April, set to fall. Just the trade figures will continue to disappoint as we have long pointed out. So what happened to sterling? The pound closed broadly unchanged against the dollar at $1.682 from $1.683 and up against the Euro at 1.234 (1.227). The dollar closed at 1.363 from 1.370 against the euro and at 101.97 (101.54) against the Yen. Oil Price Brent Crude closed up at $110.52 from $109.91. The average price in May last year was $102.3. Markets, the Dow closed up at 16,593 from 16,447 but the FTSE adjusted to 6,815 from 6,855. The markets are set to move, the push before the summer rush perhaps. UK Ten year gilt yields closed at 2.63 (2.56 and US Treasury yields closed at 2.52 from 2.51. Gold was unchanged at $1,293 from $1,293. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  The Bank of England Inflation Report - May - So when will rates rise? Q2 2015 still the best bet. The final whistle not for some time yet! The Bank of England Inflation Report was released this week. It was all so predictable. The Governor’s opening remarks explained, “The overall outlook for GDP growth and inflation in this report is little changed from February. The UK economy continues to perform strongly. Having increased by more than 3% in the past year, output is now close to regaining the pre-crisis level. 700,000 more people are in work than a year ago and inflation is below, but close to, the 2% target. And so it proved. The strong labour market performance continued into April. The claimant count rate fell by 25,000, to a rate of 3.3%. The wider LFS data (to March) also reflected the improvement with a fall in the overall rate to 6.8%. On current trends the job centres really will be closing in 2017! The MPC expectations are for growth to increase by 3.2% in the second quarter and by 3.4% for the year as a whole, with continued expansion in household spending. Spending will be supported by an increase in real wages as inflation remains close to target and earnings increase moderately, with a gradual improvement in productivity. The MPC obsession with spare capacity continues. “While there is a range of views on the Committee, the best collective judgement is the margin of spare capacity is around 1% to 1.5% of GDP.” Charlie Bean is not entirely convinced about the “fuzzy concept” of spare capacity. “There is a real danger of spurious precision and the pretence of knowledge in this area” said the Deputy Governor. Quite so. That and many others perhaps! Does spare capacity impact on inflation prospects? Not so much. International inflationary pressures are key to current price trends and for the moment remain subdued. “The global picture is consistent with muted external inflationary pressures which, coupled with sterling’s appreciation, will moderate CPI inflation in the near term” said the Governor. Inflation has fallen sharply since the Autumn and the outlook for inflation in the medium term remains benign. A benign inflation outlook which will avoid undue pressure, in the short term, to increase rates, despite the strong growth figures and the buoyant housing market. So what of rates? The strength of the recovery has moved the economy “closer to the point at which interest rates will have to rise”, the official statement. So when will rates rise? In February, the MPC were happy to attach some credence to the market view that rates would begin to rise in the second quarter of next year. If anything the view in May is slightly more “dovish” or certainly more obtuse. “Our guidance is giving businesses and households confidence that we won’t take risks with price stability, financial stability, or the incipient expansion. It will promote the recovery in business investment, productivity and real wages, that a sustained expansion demands.” Rates are still unlikely to move until the second quarter of next year, the implication. As we explained last week, the MPC will be reluctant to move ahead of the Fed and the ECB. Forward guidance then lapsed into sporting analogy as the governor explained : “Securing the recovery is like making it through the qualifying rounds of the World Cup. That is an achievement but not the ultimate goal. The real tournament is just beginning and the prize is a strong, sustained and balanced expansion.” Yes the the Governor is laying out his team formation for the tournament ahead . “A flat back four with growth, inflation, unemployment and borrowing all heading in the right direction. Two strikers up front, household spending, with support to come from business investment. Some confusion in mid field from the housing market but no mention of exports and rebalancing. So expect the odd own goal from the trade performance, errant on the wing, as we move into the final stages of the competition. The Governor, for now, is not “taking away the punchbowl as the match gets going”. Far from it, you may continue to consume alcohol on the terraces, well into the final stages. Base rates are not expected to rise anytime soon. Q2 next year still the best bet. The final whistle will not be blown for some time yet.” So what happened to sterling this week? The pound closed broadly unchanged against the dollar at $1.683 from $1.685 and up against the Euro at 1.227 (1.224). The dollar closed at 1.370 from 1.375 against the euro and at 101.54 (101.18) against the Yen. Oil Price Brent Crude closed up at $109.91 from $108.16. The average price in May last year was $102.3. Markets, the Dow closed down at 16,447 from 16,544 but the FTSE closed up at 6,855 from 6,821. The markets are set to move, the push before the summer rush. UK Ten year gilt yields closed at 2.56 (2.68) and US Treasury yields closed at 2.51 from 2.62. Gold moved up slightly $1,293 from $1,287. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Next week the ONS will release the first estimate of GDP for Q1 2014. Expectations are for growth in the UK to be between 3% and 3.3% for the first three months of the year. The UK will be the fastest growing country in the developed world. A soggy start to the year may have damaged hopes in Washington to a claim on the title. Our own forecasts, realised last month, are at the bottom end of the range at just 3%. The Chancellor is creating a great platform in the run up to the election. Growth up, inflation down, employment up, borrowing down. Just the trade figures will continue to disappoint. The Osborne model for “austerity in recovery” may provide the textbook examples for the revisionist theory in the years to come. Four out of five rabbits ain’t so bad! The good news continued this week … Car Manufacturing According to the SMMT, car manufacturing picked up the pace in March as home and export markets improved significantly. UK car production rose 12% in the month to 142,158 units, bringing year to date growth to 2.9%. Good news for the UK’s volume manufacturers as European demand for cars strengthens. Not so good for the balance of payments. The growth in output will do little to offset the strength in domestic sales. New car registrations increased by 14% in the first three months of the year. Government Borrowing Better news on borrowing. Public sector borrowing totalled £107.7bn in the financial year. The out turn is £7.5bn lower than the £115.1bn borrowed in the prior year. Receipts were up by 4% with expenditure increasing by just 1%. The trend is heading in the right direction. The OBR expect borrowing to fall to £95 billion over the next twelve months and £75 billion in the following year. At the end of March 2014, public sector debt excluding temporary effects of financial interventions was £1,268.7 billion, equivalent to 75.8% of gross domestic product. Net debt has doubled since the end of the 2008/9 financial year. Retail Sales Even better news. Retail sales in March increased by 4.2% in volume and by 3.9% in value terms. Average prices of goods sold in March 2014 showed deflation of 0.5%. Fuel once again provided the greatest contribution to the fall in prices. The figures are consistent with the latest CPI data. But as we warned last week, oil prices Brent Crude Basis are now tracking ahead of last years levels for April and May. The deflationary shock may well be over. Domestic earnings are rising and world commodity prices are turning as the world and European recovery particularly, gathers momentum. Online sales were strong once again. The amount spent online increased by 7.1% in March 2014 compared with March last year. On line sales now account for almost 11% of total sales with a marked growth in food sales on line, increasing by almost 14%. Corporate Strategy Series Watch out for our Amazon case study coming soon. Over the Easter holidays, we released the second in our international corporate strategy series. The LEGO case study, follows on from the Apple Case Study originally developed for the Business School in Manchester. The third in the trilogy, Amazon will be released next month. Amazon is a great case study in how to grow (or how not to grow) an online business. Amazon with losses in 2000 of $1.4 billion on sales of $2.8 billion is probably the greatest example yet of a turnaround from burn rate to earn rate. How long can the Amazon model continue to grow? Is there much point in delivering salads in Seattle as part of the Amazon Fresh programme? Watch out for news of the release date.] So what happened to sterling this week? The pound closed up against the dollar at $1.681 from $1.679 and unchanged at 1.215 against the Euro. The dollar closed at 1.382 from 1.382 against the euro and at 102.15 (102.42) against the Yen. Oil Price Brent Crude closed at $109.54 from $109.76. The average price in April last year was $101.2. Markets, the Dow closed down slightly at 16,370 from 16,408 and the FTSE also closed up at 6,685 from 6,625. The markets will have to rally soon, if we are to sell in May and go away! UK Ten year gilt yields closed at 2.66 (2.70) and US Treasury yields closed at 2.67 from 2.72. Gold moved up to $1,301 from $1,293. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Good news in the car market but the higher level of sales will drive the trade deficit higher - no rebalancing on the road ahead. Download the file here. The new 14 plates have been great for the car market. Registrations in March were 465,000, up by 18% on March last year. UK car registration increased by 15% in the first three months of 2014. We forecast total sales of almost 2.5 million this year, returning to levels of sales, last seen in 2004 and 2005. Production is forecast to increase to 1.6 million units following the increase to 1.5 million last year. A further increase to 1.7 million units, then 1.8 million units is expected by 2016. Good news? Of course. But the majority of production is exported. Export sales may hit 1.3 million units in 2014, rising to 1.5 million by 2016. As a result, imports will have to increase to 2.2 million units in 2014, rising to 2.4 million units by 2016. The trade deficit (unit sales) will increase to 0.8 million units, to the levels least seen pre recession. The surge in car sales is a welcome demonstration of UK demand. As Mike Hawes, SMMT Chief Executive explains. “Given the past six years of subdued economic performance across the UK, there is still a substantial margin of pent-up demand that is contributing to a strong new and used car market.” The pent up demand is to be unleashed. Remember we have over 31 million cars on the road in the UK of which over one third are over nine years old. Easy finance deals and advanced technologies make new cars cheaper to buy and to run. There has never been a better time to buy a new car. Let’s hope they don’t all rush at once. That would create a traffic jam at the docks. That’s another reason why we say the trade figures will continue to disappoint, and threaten the recovery, especially if the collapse in investment income continues. Download the short report here.  UK rates on hold … No surprise this week - the MPC voted to keep rates on hold and maintain the size of the asset purchase programme at £375 billion. It will be some months yet before rates begin to rise. Our current assumption is that rates will begin to rise in the second quarter of 2015. 40% of respondents in the latest Bank of England/GfK Inflation survey expect rates to rise over the next twelve months. No worries for the future apparently. Once on the rise, over 70% expect rates to be less than 3% in five years time. So much for the madness of crowds. Clearly the general public have a much better grasp of the latest simulations of the “equilibrium real interest rate associated with a neutral monetary policy over the medium term” than is generally assumed. They must have been listening to the speech by David Miles last month. Asked about the current rate of inflation, the median answer was 3.5% down from 4.4% in November. Excellent. So much for the madness and the wisdom of crowds. US Payroll data up … In the USA, better than expected payroll data guarantees the Federal Reserve will continue to taper, with a further reduction this month to $55 billion. Employers added 175,000 more jobs in February. Movement in US futures suggest the markets attach a "higher probability to a US rate rise in the middle of 2015". Fed officials have said they are “comfortable with market expectations of future rate rises”. We think US rate rises could be on the agenda by the end of 2014 or early 2015. The implications for UK rate rises should be evident. Our mantra - watch the USA and add six months - may be a little more compressed in this cycle. UK survey data … This week the February Markit/CIPS UK PMI® surveys were released. The strong upswing in the UK manufacturing sector continued in February. Output and new business continued to rise at above-trend rates. The leading index at 56.9 was up from a revised reading of 56.6 in January. In construction, the pace of expansion continued to rise sharply. The leading index scored 62.6 in February, down from a 77-month high of 64.6 in January. Still a very strong performance. In the service sector, output continues to expand strongly in the month. The headline Business Activity Index recorded 58.2 during February, little changed on January’s 58.3 and indicative of a sharp rise in activity on a monthly basis. Overall, output in construction, manufacturing and services suggest the economy continues to recover across the board at a very strong rate. The latest NIESR GDP tracker suggest growth increased by 3.5% in January. The Bank of England expects growth of over 3.5% in the first quarter. For the year as a whole, the consensus forecast is for growth of 2.7% this year. We await the details of the latest GM Chamber of Commerce survey before raising our estimates of growth this year. The GDP(O) model is signalling growth of 3% for the year as a whole. The survey data is a little more tempered, I suspect. In the UK and the USA, growth is accelerating and the job market is “tightening”. The pay round will become more difficult by the end of the year. Earnings are set to increase significantly as critical unemployment levels are breached by early 2015. Household incomes are set to improve and the recovery in spending will continue. There will be no “rebalancing”, whatever that really means. Growth up, unemployment down, inflation down and borrowing heading in the right direction. Just the trade figures will continue to disappoint. If growth hits 3% this year, disappointment could turn to shock and alarm. Then all forward rate bets will be off. So what happened to sterling? The pound closed at $1.672 from $1.675 and at 1.205 from 1.213 against the Euro. The dollar closed at 1.387 from 1.381 against the euro and 103.3 from 101.7 against the Yen. Oil Price Brent Crude closed at $108.86 from $109.02. The average price in February last year was almost $116 falling to $108 in March. Markets, moved slightly - The Dow closed at 16,458 from 16,367 and the FTSE slipped closing at 6,712 from 6,809. UK Ten year gilt yields closed at 2.81 from 2.72 and US Treasury yields closed at 2.80 from 2.67. Gold lovers worship alone with a close at $1,338. That’s all for this week. No Sunday Times and Croissants tomorrow or for the rest of this year for that matter. We are taking a break in this pre election year. Join the mailing list for The Saturday Economist or forward to a friend. The list is growing as is our research team. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed