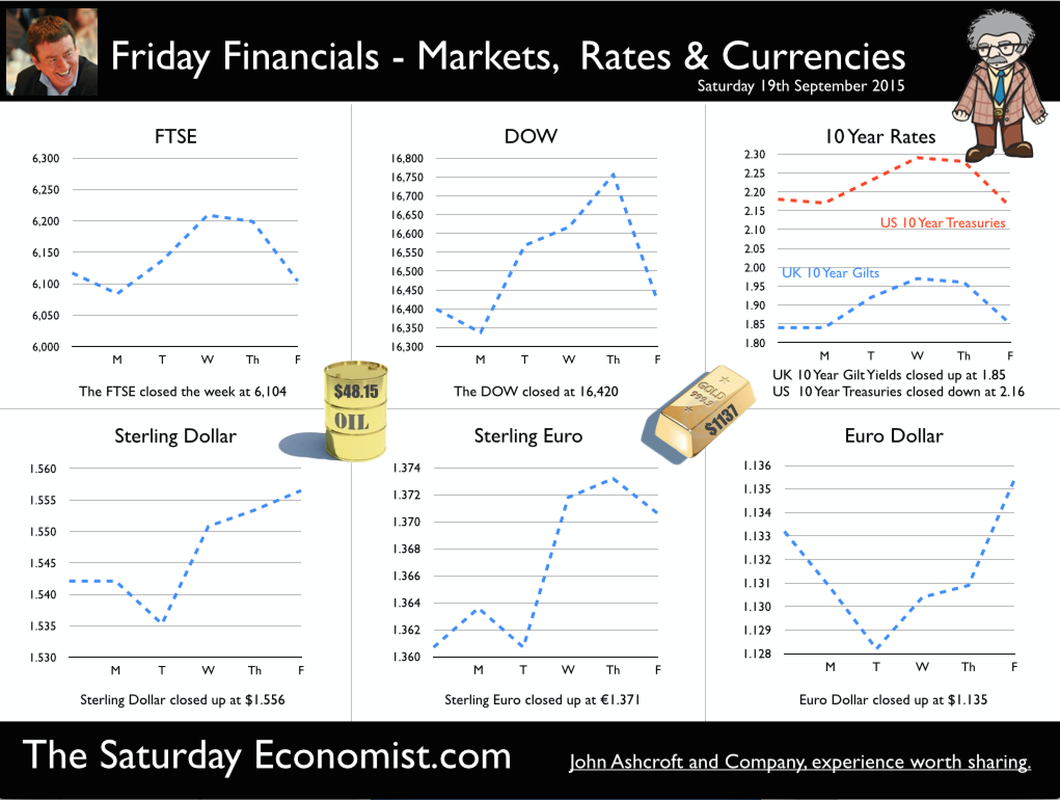

The Fed Funds rate remained unchanged this week. A low inflation outlook together with heightened concerns over international developments in China and emerging markets featured. Of the ten members of the FOMC, only one was in favour of a rate hike at the Thursday meeting. Current policy rate projections indicate a 25 basis point rate hike before year-end, followed by a total of 100 basis point increase until the end of 2016. The long-run projection of the Federal Funds rate was lowered to 3.5%. Forecasts for inflation, unemployment and GDP growth in 2016 and 2017 were reduced slightly. Our base case is now for a rate increase at the December 2015 meeting, as the US economy and labour market continue to improve. The outlook for oil and commodity prices remains subdued with concerns about growth in China manifest. A postponement of the rate rise into 2016 remains a strong possibility, with obvious implications for any UK rate rise in the short term. Inflation UK … In the UK, inflation in August fell to zero with goods inflation falling by -2% and service sector inflation slowing to 2.3%. Manufacturing prices continued to fall with output prices dropping by 1.8% in the period to August as input costs fell by 13.8%. Oil prices down by 48% the main story on costs, with a significant contribution from imported metals (-17.1%) and chemicals (-5.6%) also featuring. Oil Prices … The outlook for oil prices is so important but remains unclear. Goldman's $20 dollar call looks as well timed as the $200 front desk call in 2008. The OPEC outlook projects a $60 dollar price into the future, a statement designed to put further pressure on US oil production, perhaps. A good time to recall Herbert Stein’s Law. Herbert Stein (1916 – 1999) was a senior fellow at the American Enterprise Institute and was on the board of contributors to the The Wall Street Journal. He was chairman of the Council of Economic Advisers under Richard Nixon and Gerald Ford. "Herbert Stein's Law," states "If something cannot go on forever, it will stop”. So it must be with oil sub $50 and OPEC pumping away future revenues below the optimal revenue curve. Retail Sales August … Retail sales in August slowed slightly to 3.7% compared to 4.1% in July. The value of retail sales increased by just 0.2%. Household goods enjoyed a near 5% increase buoyed by the strength of the housing market. Online sales increased by 7.2% in the month, the lowest increase in almost three years. The proportion of sales on line in the month was just over 12%. Average Earnings … Clearly average earnings are assisting the retail boom. In July, earnings increased by 3.7% with private sector earnings growth of 4.4%. Finance and Business services increased by 5% with retail and leisure earnings increasing by almost 6%. In the construction sector, earnings increased by 4% in the three month period to July. Real earnings adjusted for CPI inflation, are now higher than pre recession levels. This really is the year of the LILIES with Low Inflation, Low Interest and an Earnings Surge. For the consumer - 2015 is as good as it gets in this recovery cycle. Unemployment … The jobs data revealed this month confirmed an unemployment rate of 5.5%. The number of people in work increased by over 400,000 compared to a year earlier. The claimant count fell slightly, with a rate of unemployment steady at 2.3%. The rate of pick up in jobs is slowing. This is consistent with an acceleration in wage rates, earnings (and productivity). At 2.3% the claimant count rate is lower than at any time in 2008 before the crash. The LFS rate compares to a cyclical low of 5.2% in 2007 and 2008. The rate of LFS structural unemployment may have increased over the past seven years, suggesting the margin of spare capacity has already evaporated. It really is time for base rates to rise in the UK and the US for that matter. The current weakness of oil and commodity prices may be maintained but the deflation impact will shortly unwind on a year on year basis. The average price in January was $48 per barrel Brent Crude basis. Petroleum inflation is set to rise modestly in 2016, even if low prices persist. On the other hand, prices may react to the upside with dramatic increase. An OPEC “volte face” would push prices back to $80 - $100. The UK trade balance would deteriorate. Sterling may come under pressure. Imported inflation would rise as domestic wage costs accelerate. Soon we would learn, the disappearance of inflation is more akin to the receding of the tide from the beach ahead of the Tsunami waves shortly to hit. The Great Manchester Economics Conference … Just TWO weeks to go to the Great Manchester Economics Conference on the 2nd October. A great line up. Don’t miss this chance to see some of the great UK economists and commentators, together in Manchester in our fast paced “News Style” show. If you enjoy the Saturday Economist - Book Your Tickets NOW! So what happened to Sterling this week? Sterling moved up against the Dollar to $1.556 from $1.5542 and moved up against the Euro to €1.371 from €1.360. The Euro moved up against the Dollar to €1.135 from 1.133. Oil Price Brent Crude closed at $48.15 from $48.558. The average price in September last year was $97.09. The deflationary push continues. A $75 - $80 recovery by Q4 remains the base case in our outlook forecast. This appears unrealistic against the EIA STEO backdrop and OPEC stance on output. Markets, mixed this week! The Dow closed at 16,420 from 16,399. The FTSE closed up at 6,104 from 6,117. Gilts - UK yields steadied. UK Ten year gilt yields were at 1.85 from 1.84. US Treasury yields moved to 2.16 from 2.14. Gold moved down to $1,137 ($1,133). John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed