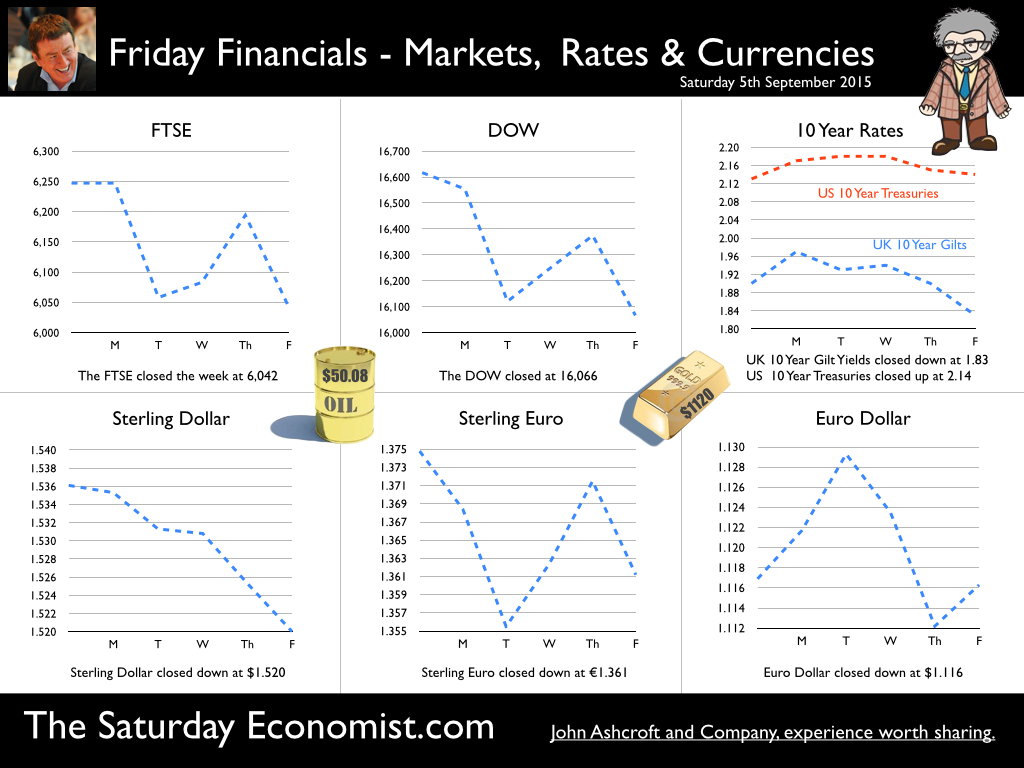

All eyes on the Fed this month as the decision on a US rate rise looms. September or December? Markets are undecided. The US jobs data released this week appeared at first sight inconclusive. The unemployment rate fell to 5.1% in August, the lowest since April 2008. The U rate is in line with the average between 2000 and 2007. A powerful argument to push rates higher. On the other hand the rate of job gain was just 173,000 in the month, slightly below market expectations. Upward revisions to data in June and July ensure the average over the past three months was 221,000. The data represents “a healthy employment growth rate, as the US economy steams ahead”. We expect the US economy to grow by over 2.7% this year. An economy steaming ahead with base rates on hold presents an unacceptable anomaly. At the G20 summit, leaders expressed concern about the proximity of a hike in US rates. adding to the warnings from the IMF. The final statement may accept the inevitable, a sort of “Get on with it, and be on your way” mentality. It is time to pull the trigger and leave Planet ZIRP. In contrast Mario Draghi reduced the forecasts for Euro growth this week and expressed a commitment to easy monetary policy and more QE - much to the delight of markets. Fears about China overdone … Fears about China still abound but for how long? At the G20 summit China assured leaders the Renminbi was not in pursuit of further competitive devaluation. Beijing would implement key reforms expressing absolute determination to sustain economic growth in the future. Nouriel Roubini, (Dr Doom) dismissed market panic over China as “excessive, unreasonable and irrational”. “China is not in free fall” he told world leaders in Lake Como this week. Growth may be around 6.5% this year at worst according to Dr Doom. Hardly a hard or soft landing as we have explained with our Chinese Whispers series. UK Car Sales … No soft landing was evident in the UK this week. The SMMT reported a near 10% increase in car sales in August. New car registrations increased 9.6% to 79,060, taking year-to-date growth to a healthy 6.7%. The new car market recorded its 42nd consecutive month of growth. For the year as whole we expect registrations of over 2.6 million. Output on the other hand will be just over 1.5 million. The deficit (trade in cars) compounding the structural balance of payments problem. Markit/CIPS UK Series PMI® A confused picture emerged from the Markit/CIPS series this week. UK construction sector picked up slightly in August, led by fastest rise in commercial work for five months. Manufacturing expansion remained subdued despite a strong performing consumer goods sector. The service sector increased at the weakest rate in over two years in August. The index slowed to just 55.6 from 57.4 in July, still well into growth territory. So what can we make of it all … We have just updated our GDP(O) forecast model for the UK economy. We still expect growth on 2.8% for the year, led by strong growth in the (private) service sector. The leisure sector, (distribution, hotels, restaurants) is expected to grow by over 4%. Business and Professional Services will increase by 3.5%. Service sector growth will be 3% in line with prior year levels. Construction is expected to rise by over 4.5% in the year. We expect further upward revision to the published Q2 data. Manufacturing is expected to increase by just 1.5% compared to growth of over 3% last year. The march of the makers disappointing. The upturn in consumer products, offset by the slow down in capital goods exports. The extent of the slow down, difficult to understand in view of the strength of domestic demand and the gradual recovery in Europe. Still worried about China? Don’t forget Linda Yeuh, ex Bloomberg, expert on China will feature at our Economics Conference in October. Author of China's Growth: The Making of an Economic Superpower, Linda will put concerns about growth into full context. David Smith will talk about his new book “Something will turn up”, Ian King Will be with us from Sky News. Andrew Sentance will update on his perspectives about “The New Normal”. It’s at the Radisson in Manchester on the 2nd October. A great line up. Don’t miss this chance to see some of the great UK economists and commentators, together in our fast paced “News Style” show. Book Now! So what happened to Sterling this week? Sterling moved down against the Dollar to $1.536 from $1.570 and moved down against the Euro to €1.375 from €1.381. The Euro moved down against the Dollar to €1.117 from 1.137. Oil Price Brent Crude closed at $50.08 from $50.43.19. The average price in September last year was $97.09. The deflationary push continues. A $75 - $80 recovery by Q4 remains the base case in our outlook forecast. Markets, slipped this week! The Dow closed at 16,066 from 16,617. The FTSE closed down 6,042 from 6,247. Gilts - UK yields fell. UK Ten year gilt yields fell to 1.83 from 1.90. US Treasury yields moved to 2.14 from 2.13. Gold moved down to $1,116 ($1,117). The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed