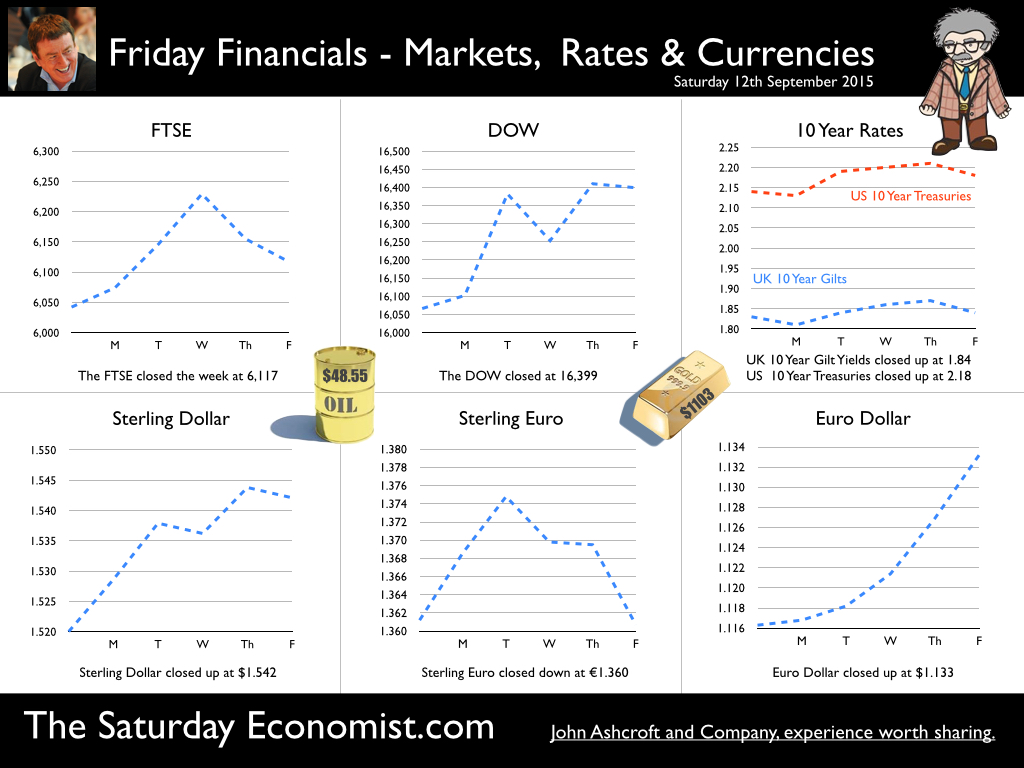

No surprises from Threadneedle Street this week - the MPC voted to keep rates on hold. The Bank will not move ahead of the FED. Ian McCafferty - the only member of the MPC to vote for a rate rise this month. In the US, with just a week to go, doubts remain about the timing of the FED rate rise. In yesterday’s Wall Street Journal poll, most private economists think the Fed will keep interest rates near zero at the next meeting but it’s a close call. 46% expect rates to rise. Not long to wait, to find out. Kristin Forbes caused some confusion in Cardiff later this week, suggesting UK rates may have to rise sooner than expected in order to fend off inflation. The comment by the MPC member taken slightly out of context. More a technical reference to the inadequacy of the exchange rate - inflation reaction function in the Bank of England model rather than “forward guidance” on the future path of monetary policy. Elsewhere in the world … Good news from Europe as the recovery gathers momentum. Euro Area GDP expanded by 1.5% in the second quarter following growth of 1.2% in Q1. Heading in the right direction, German GDP increased by 1.6% with growth in Spain up 3.1% and the Celtic Tiger, Ireland, growing by 6%. In China, growth in 2014 was downgraded slightly to 7.3% from 7.4%. A modest shift designed to demonstrate the accuracy of the economic data set, rather than a warning of slowdown. The authorities committed to a growth rate of 7% in the current year. Guidance was issued to domestic economics journalists and commentators locally to “promote the discourse on China’s bright economic future and the superiority of the China’s system” at every occasion. Chinese journalists who do not follow the party instructions can face sever punishment and arrest. Which makes you wonder what would have happened to Robert Peston during the banking crisis in 2008, had an alternative regime held sway at the time! Back in the UK … Latest data on construction, manufacturing and trade were released this week. Construction output fell in July by 0.7% year on year according to ONS data, following disappointing growth in Q2. The data is confusing. Walk around Manchester, the cranes are back evidence of strong growth in commercial and residential expansion. Strong appetite for investment from foreign funds is easing the funding process. The UK construction data is subject to revision. We expect construction output to increase by 4.5% this year slowing to 3.9% next. Manufacturing output fell in July by 0.5% compared to prior year. Consumer durables the only bright spot up by 3.6% as capital goods output fell by -0.7%. The march of the makers rebuilding the workshop of the world now a distant memory. We expect manufacturing growth of just 1.5% in the current year following 3% growth last year. The re balancing agenda takes a further hit in July. The trade deficit in goods increased to £11.1 billion in the month compared to £8.5 billion in June and £11.2 billion in July last year. For the year as a whole we expect the deficit to fall to around £117 billion compared to £121.2 billion last year. The slight improvement, a result of the oil price fall rather than any underlying improvement in trade conditions or the vagaries of sterling. Oil Prices … As for oil prices, the EIA project an average oil price Brent Crude Basis of $54.07 in 2014 and $58.57 in 2015 in the latest short term economic outlook. Crude oil production is forecast to fall through mid-2016 before growth resumes late in the year. Projected U.S. crude oil production will average 9.2 million b/d in 2015 and 8.8 million b/d in 2016. US shale taking the hit, delivering a small triumph of sorts for OPEC. The Great Manchester Economics Conference … Linda Yeuh, ex Bloomberg, expert on China will feature at our Economics Conference in October. Author of China's Growth: The Making of an Economic Superpower, Linda will put concerns about Chinese growth into full context. David Smith will talk about his new book “Something will turn up”, Ian King Will be with us from Sky News. Andrew Sentance will update on his perspectives about “The New Normal”. It’s at the Radisson in Manchester on the 2nd October. A great line up. Don’t miss this chance to see some of the great UK economists and commentators, together in Manchester in our fast paced “News Style” show. With just three weeks to go - Book Your Tickets NOW! So what happened to Sterling this week? Sterling moved up against the Dollar to $1.542 from $1.5360 and moved down against the Euro to €1.360 from €1.375. The Euro moved up against the Dollar to €1.133 from 1.117. Oil Price Brent Crude closed at $48.558 from $50.08. The average price in September last year was $97.09. The deflationary push continues. A $75 - $80 recovery by Q4 remains the base case in our outlook forecast but this appears unrealistic against the latest EIA short term forecasts. Markets, rallied this week! The Dow closed at 16,399 from 16,066. The FTSE closed up at 6,117 from 6,042. Gilts - UK yields steadied. UK Ten year gilt yields were at 1.84 from 1.83. US Treasury yields moved to 2.148 from 2.14. Gold moved down to $1,133 ($1,116). John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed