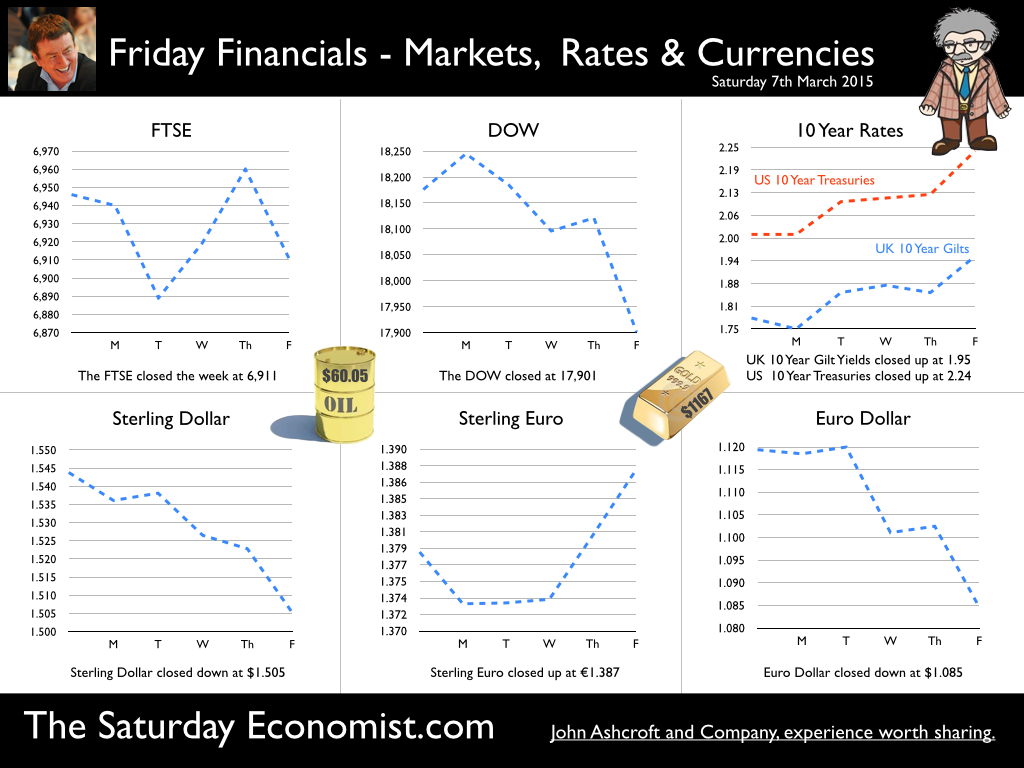

If there is nothing more powerful than an idea whose time has come - there can be nothing more impotent than an idea, whose time, has come and gone. So it must be with QE in Euroland. On Monday, the ECB begins the monthly purchase programme of €60 billion of Euro denominated public and private sector securities. The spend will continue until September 2016 or until such time as there is a recovery in the “sustained adjustment in the path of inflation”. QE in Europe, is not about growth. Forecasts for real GDP growth in Euroland are now expected to be 1.5% in 2015, 1.9% in 2016 and 2.1% in 2017 according to the ECB latest forecasts. Nor can it really be about liquidity. The annual growth rate of broad money M3 increased to 4.1% in January and narrow money M1 increased at an rate of 9% in the same month. Can it really be about deflation? HICP inflation in February was -0.3% slightly better than the -0.5% in January. Inflation is expected to remain very low or negative in the months ahead. The latest ECB projections forecast annual inflation at 0.0% in 2015, rising to 1.5% in 2016 and 1.8% in 2017. We know that oil, energy and commodity prices are pushing headline inflation rates lower. Oil at $60 per barrel Brent Crude basis remains some 50% lower than March last year. Perhaps then the QE bond buying programme should continue until “Oil prices bounce back to a reasonable level”. Whatever that is! Who will benefit from the bond buying programme? Almost half of the euro bonds are held outside the euro area. The average weighted price of bonds in the 2 to 30-year maturity is well above par. It’s exactly 124% according to Mario Draghi’s statement this week. So Euro bonds offer negative yields, with a negative price to redemption, in a currency vulnerable to the Dollar rally. The ECB will be the buyer of last resort in a desiccated Euro bond market. One of the many facets of life on Planet ZIRP, telling us it really is time to pack up and leave. Long oil and short Euro bonds must be the Golden Spread for 2015! America will lead the way … “Brisk jobs growth in the US puts Fed on notice” is the headline in today’s Wall Street Journal. US payrolls increased by 295,000 in February and the unemployment rate fell to 5.5%. The central bank could be on track to increase rates in June or certainly in Q3, pushing the dollar towards parity against the Euro. The UK will follow … News of growth in the UK economy continued this week. Car sales in February were up by 12% year on year providing three straight years of continuous expansion. The latest UK Markit/CIPS data revealed manufacturing rising to a seven month high, construction output rising at sharpest rate for four months and strong growth in the service sector maintained. New business, employment and order books are increasing across all sectors. Our forecasts for the UK and world economy were updated last month. We expect strong growth to continue around 3% in 2015 and 2016. The labour market is showing signs of overheating. The MPC voted to keep rates on hold this week. Six years of rates on hold - but for how much longer? So when will rates rise? We think the Fed will move in June or early in Q3 this year. The UK will follow shortly thereafter. We have spent too long on Planet ZIRP. The yield curve is distorted. It really is time to move on and let markets, especially bond markets, clear. The Euro QE is a placebo. A shadow of an idea whose time has come and gone. If indeed it should have had much time at all. So what happened to Sterling this week? Sterling closed down against the Dollar at $1.505 from $1.544 and moved down against the Euro to €1.387 from €1.379. The Dollar closed against the Euro at €1.085 from €1.1379, with some traders calling parity within months. Oil Price Brent Crude closed down at $60.05 from $61.44. The average price in March last year was $107.48. Markets, fell back on rate rise fears. The Dow closed at 17,901 from 18,176 and the FTSE closed down at 6,911 from 6,946. UK Ten year gilt yields moved up to 1.95 from 1.78. US Treasury yields moved down to 2.24 from 2.01. Gold closed down at $1,167 ($1,215). That’s all for this week. Don’t miss the Big Social Media Conference in July and the Great Manchester Economics Conference in October. It’s a great line up for all events! John © 2015 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed