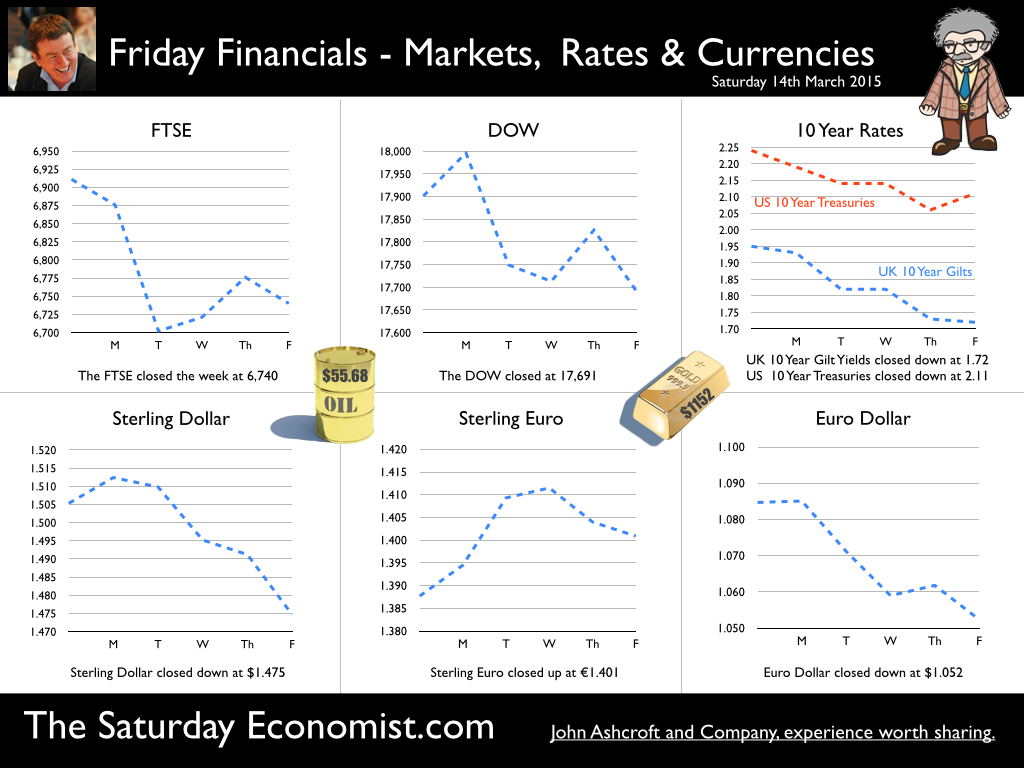

Euro QE - the placebo effect … Last week we suggested Euro QE was an idea whose time had come and gone. No need to worry, it has already been a great success, according to President Draghi. If indeed Dollar Parity is the Prize, Draghi should step up to the podium. The Euro closed at €1.05 against the Greenback, well on the way to parity. Bond yields are falling, stock markets are rallying. Hot money is moving into European equities on a growth - yield ticket with a guaranteed currency kicker over the medium term. The placebo effect is in full sway … in ways we could never have imagined at onset. US and UK monetary policy … In the US, the Fed determined to push forward with a rate rise later this year, despite the strength of the dollar. Mark Carney on the other hand suggested, strength of Sterling may be the reason the rate rise will be delayed into 2016. Confused … you should be. Mark Carney’s new broom is sweeping through the Bank of England, the Labours of Hercules as nothing. As the rivers Alpheus and Peneus washed through the Augean stables. It is as if the Thames is sweeping through Threadneedle Street, with the SFO in a mine sweeper. The MPC - out and about with clear thinking and straight talking. Mark Carney was out of office delivering a speech to the Sheffield Advanced Manufacturing Institute on inflation targeting - “Writing the path to target”. Ian McCafferty, avoided getting his feet wet. He was in Durham explaining the impact of oil prices on monetary policy. The hog cycle and cobweb theorem dragooned into the intellectual debate at Durham University. Excellent … explains all. So what happened in the UK this week? Construction output fell 3% in January … I am beginning to think, the construction data is produced by an algorithm with some kind of Bipolar or SADD (Seasonally Adjusted Deficiency) Disorder. One month up, one month down. In January the depressives ran the model. Output down -3% compared to prior year following an increase of 5% in December. In December, the optimists tweaked the buttons. Don’t worry too much about one months figures. We continue to forecast growth of over 5% in 2015 as the housing market will continue to drive activity. Manufacturing Output up by 1.9% in January… Manufacturing output increased by 1.9% in January compared to prior year. A slow start to 2015. Total production increased by just 1.3%. A large increase in mining and quarrying, offset by falls in utilities this month. Within the manufacturing sector, there was a surprise fall in capital goods, offset by strong growth in consumer durables. Textiles output fell by 10% with strong growth evident in transport equipment and food. ‘Wheels, wings and onion rings” the mantra for manufacturing growth in the years ahead. For the year as a whole we are still forecasting manufacturing growth of 2.5% following growth of 2.9% last year. A slow start in the first month, no need to worry just yet. Trade Deficit … On the face of it, the trade figures for January were heading in the right direction. The UK deficit - trade in goods and services was estimated to have been £0.6 billion compared with £2.1 billion in December 2014. This reflects a deficit of £8.4 billion on goods, partially offset by an estimated surplus of £7.8 billion on services. Good news but … The sharp narrowing of the deficit, reflects a fall of £2.5 billion in imports. Almost half of this fall (£1.2 billion) is attributed to oil imports. We estimate the impact of oil price movements to the trade deficit, will be worth some £4 billion to £5 billion in the full year. [The deficit in oil narrowed to £0.4 billion compared to £0.9 billion in January last year. Oil imports fell by £1.2 billion but exports fell by £0.8 billion.] On a regional basis, exports to the US were up but exports to Europe and China fell. Imports were down reflecting lower oil and commodity prices with a surprising fall in consumer goods and capital goods. Surprising given the strength of the recovery in the UK. So what does this mean for the full year? We forecast a deficit of around £120 billion this year. The gains in oil offsetting domestic demand growth effects. [The deficit in goods in 2014 was £120 billion up from £113 billion in 2013.] The overall deficit (goods and services) will be around £30 billion, down from the £32 billion in 2014. At less than 2% of GDP the deficit is not a challenge to growth. So when will rates rise? We still think the Fed will move in June or early in Q3 this year. The UK will follow shortly thereafter. We have spent too long on Planet ZIRP. The Euro QE is a placebo. A financial placebo which has already worked according to President Draghi. We will not see the full programme or it’s like again … So what happened to Sterling this week? Sterling closed down against the Dollar at $1.475 from $1.505 and moved up against the Euro to €1.401 from €1.387. The Euro closed down against the Dollar at €1.0520 from €1.1387, a huge move. The push to parity is on. Oil Price Brent Crude closed down at $55.68 from $60.55. US oil stocks are rising putting pressure on prices. The average price in March last year was $107.48. Markets, fell back on interest rate and currency fears. Hot money moves into Europe. The Dow closed at 17,691 from 17,901 and the FTSE closed down at 6,740 from 6,911. UK Ten year gilt yields moved down to 1.72 from 1.95. US Treasury yields moved down to 2.11 from 2.24. Gold closed down at $1,152 ($1,167). That’s all for this week. Don’t miss the Big Social Media Conference in July and the Great Manchester Economics Conference in October. It’s a great line up for all events! John © 2015 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed