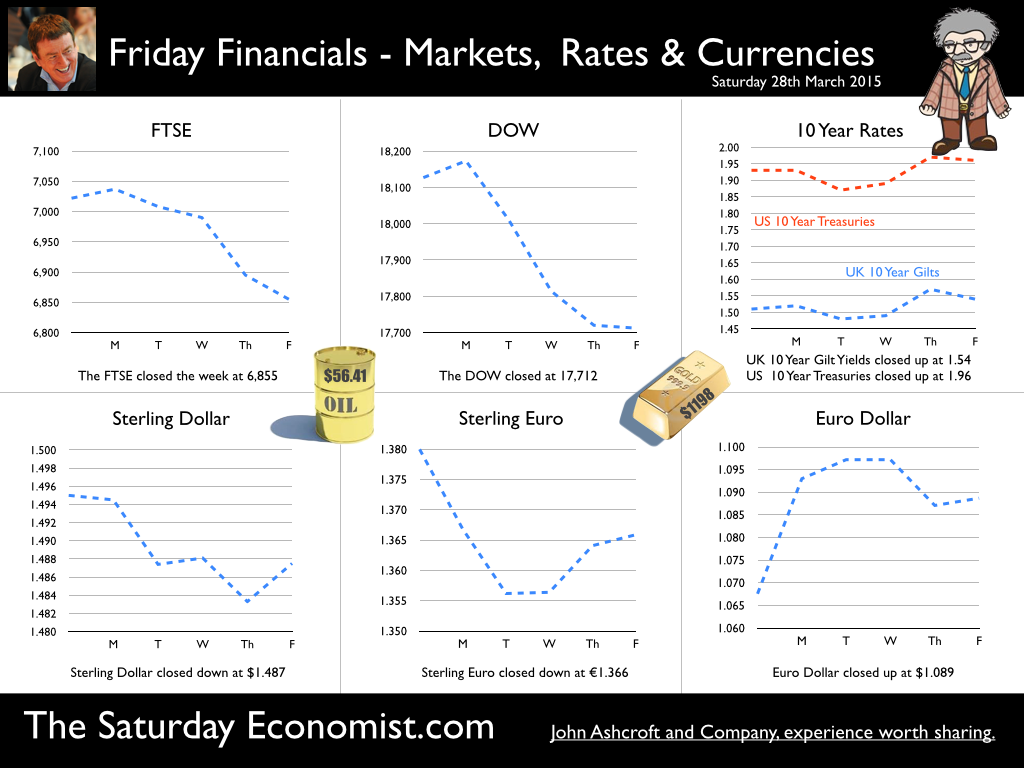

Retail Sales … strong growth continues … Retail sales volumes increased by 5.7% in February, following growth of 5.9% in January. This was the 23rd consecutive month of year-on-year growth and the longest period of sustained growth since May 2008. Online sales increased by 10% compared with February 2014, accounting for 11.6% of all retail sales in the month. Department store and household goods stores experienced strongest growth up 9%. Clothing stores also enjoyed buoyant growth up 6%. Car registrations in February were up by 12% compared to prior year. They are up by 8% over the first two months of the year. House sales continue to enjoy strong growth despite some obvious slow down in price escalation. Consumer confidence figures according to GfK are high in relation to the state of the economy and household finances. The tracker is actually higher than pre recession levels. The “Right time to buy” index is at the highest level since 2007. For the year as a whole we expect retail sales volumes to increase by over 4% compared to growth of 4% in 2014. Values are expected to increase by just over 2.5%. We expect car sales for the year to be up by over 5% at least. Housing transactions will continue at pace. Unemployment is falling, earnings are set to rise, strong retail sales growth and a buoyant consumer outlook, are incompatible with rates on hold at just 50 basis points. The next move in rates will be up. CPI Inflation … It was slightly surprising last week, when Andy Haldane, Chief Economist at the Bank of England suggested the next move in rates could well be down. Markets shuddered and Sterling took a hit. The cerebral banker had been swayed by imminent developments in domestic price inflation. And so it proved with the data released this week. Annual Inflation CPI basis fell to 0.0% in February compared to 0.3% in January according to the latest data from the Office for National Statistics (ONS). UK consumer price inflation hit the lowest point since the early 1960s. The greatest contributors to the inflationary slowdown were falling oil, motor fuels and food prices. Service sector inflation remained above target at 2.4% with the fall in goods inflation to -2.0%, pulling overall inflation below target. Education costs up by 10% were amongst the largest contributors to price rices. Smokers with kids at private school continue to take a hit. Producer Prices … Producer prices, fell by 1.8% in the month compared to a fall of 1.9% last month. Input costs fell by 13.5% compared to a reduction of 14% prior month. Crude oil prices, down over 40%, were the largest contributor to the reduction in costs. For the moment, inflation is always and everywhere an international phenomenon. Oil prices collapsed and world trade prices fell by 10% in the final quarter of the year, driven lower by oil price movements. Most analysts anticipate a brief bout of UK deflation in the coming months with inflation at -0.1% and -0.1% in March and April. For 2015 as a whole we expect inflation to average 0.4% over the first nine months of the year. By the end of the year, the inflation outlook will be radically different. Should we worry about deflation? Not really. We have growth, falling employment, rising earnings, with oil prices and commodity prices on the turn. The inflation outlook will look radically different by the final quarter of the year. Last week, we warned of the evident signs of overheating in the labour market. No more evident than in the claimant count data. By the time of the election, the number of vacancies will be higher than the actual claimant count. This is unprecedented. This week Mark Carney made it clear, the next move in UK base rates will be up. A sentiment subsequently reinforced by Ben Broadbent. The timing of the move, as yet unclear. So when will rates rise? Markets still believe the Fed will begin to increase rates later this year. Q3 now the favourite following the slight downward growth revisions for 2015. In the UK the forward OIS curve suggests markets expect rates to rise in the first or second quarters of 2016. The wait may not be so long … In the UK, we expect growth of 2.5% to 2.9% this year. The labour market is tightening, recruitment difficulties are increasing, wage rates and settlements are set to rise. The inflation outlook will be materially different towards the end of the year. Once the Fed makes a move, the MPC will surely follow within the current year …. It really is time to leave Planet ZIRP. So what happened to Sterling this week? Sterling closed down against the Dollar at $1.487 from $1.495 and moved down against the Euro to €1.366 from €1.3824. The Euro closed up against the Dollar at €1.089 from €1.0815. The push to parity postponed or perhaps aborted. Oil Price Brent Crude closed up at $56.41 from $55.32 US oil stocks are rising putting pressure on prices. The average price in March last year was $107.48. Markets, moved down. The Dow closed at 17,712 from 18,127 and the FTSE closed down at 6,855 from 7,022. UK Ten year gilt yields moved slightly to 1.54 from 1.52. US Treasury yields moved up to 1.96 from 1.93. Gold closed up at $1,198($1,182). That’s all for this week. Don’t miss The Big Social Media Conference in July and the Great Manchester Economics Conference in October. It’s a great line up for all events! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed