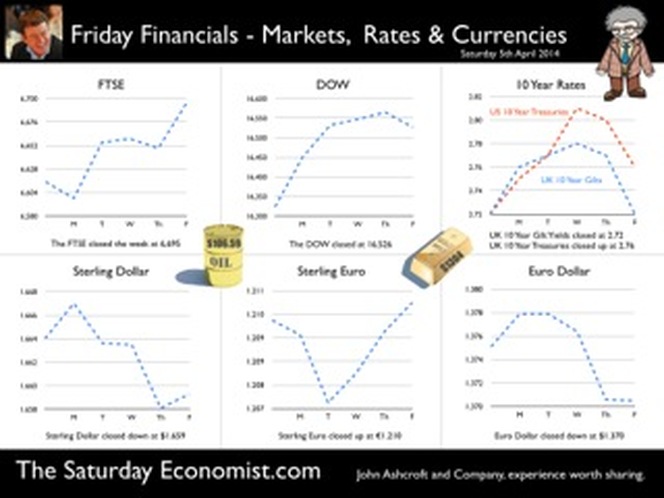

Car sales soar but so will the trade deficit … Good news of the recovery. Car registrations rose to 465,000 in March, an increase of 18% on last year. The new 2014 plates have been great for the car market. More new cars were registered last month, than at any time in the last ten years according to the Society of Motor Manufacturers and Traders. As Mike Hawes, SMMT Chief Executive explains. “Given the past six years of subdued economic performance across the UK, there is still a substantial margin of pent-up demand, contributing to a strong new and used car market.” Easy finance deals and advanced technologies make new cars cheaper to buy and to run. There has never been a better time to buy a new car. The pent up demand is to be unleashed. Bear in mind, we have over 31 million cars on the road in the UK, of which over one third are over nine years old. Let’s hope the owners don’t all appear in the showroom at once.That would create a traffic jam at the docks. The car market demonstrates clearly the problems with the march of the makers, the rebalancing agenda and the inability of sterling depreciation to remedy the trade balance. We expect car sales to increase to around 2.5 million units in 2014 returning to levels last seen in 2004 and 2005. Production is forecast to increase to 1.6 million units following the increase to 1.5 million last year. A further increase to 1.7 million units, then 1.8 million units is expected by 2016. Good news for manufacturing? Of course. But the majority of production is exported. Export sales may hit 1.3 million units in 2014, rising to 1.5 million by 2016. As a result, imports will have to increase to 2.2 million units in 2014, rising to 2.4 million units by 2016 to satisfy domestic demand. The trade deficit (unit sales) will increase to 0.8 or 0.9 million units. An increase to levels least seen pre recession. The recovery in the UK economy will exacerbate the trade deficit in cars just as it will in many other commodities. Relative rates of economic growth here and particularly in Europe primarily determine the demand for imports and exports. Demand is relatively inelastic with regard to price, particularly with exports. Manufacturers price to market or products form part of international syndication. Sterling has a minor role to play in determining the direction of trade in the international car market. Supply, is output constrained and cannot respond to domestic market growth. In fact 80% of car production is exported and 90% of domestic demand is satisfied by imports. We have warned previously, the UK cannot grow faster than trade partners in Europe or North America without a deterioration in the trade account. The car market is a simple arithmetic of the dilemma. Download the short report Car Market - Driving recovery or driving the deficit to access the underlying data. PMI Markit Surveys This is the week of the PMI Markit survey data with information on the March updates. The recovery continues in services, construction and manufacturing. The manufacturing upturn remains solid, service sector activity remains strong and construction firms report brightest outlook for business activity since January 2007. We have upgraded our forecast for UK growth this year to 2.9% based on the strength of the Manchester Index® and latest GM Chamber of Commerce QES survey data. House Prices, Nationwide reports house prices increasing by 9.5% across the UK, increasing by 18% in London. Prices remain slightly below the peak levels of 2007 except in the capital, were levels are now some 20% above peak. Should we worry about the boom in prices? Perhaps but not just yet. Activity levels are still subdued relative to the pre recession peaks but the recovery in prices will be of concern to policy makers as will the developing trade deficit. In our economics presentations we begin to touch on concerns about the recovery. Deflation is not one of them, house prices may be. The current account deficit certainly is. Especially if the trends in investment income from overseas are maintained. Then we shall see just what will happen to sterling. So what happened to sterling this week? The pound closed at $1.659 from $1.664 and at 1.21 unchanged against the Euro. The dollar closed at 1.370 from 1.375 against the euro and at 103.26 from 102.82against the Yen. Oil Price Brent Crude closed at $106.72 from $108.01. The average price in March last year was $108. Markets, the Dow closed up at 16,526 from 16,323 and the FTSE closed at 6,6956 from 6,615. UK Ten year gilt yields closed at 2.72 (2.72) and US Treasury yields closed at 2.76 from 2.72. Gold moved higher to $1,304 from $1,293. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

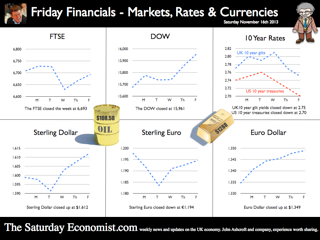

Good news in the car market but the higher level of sales will drive the trade deficit higher - no rebalancing on the road ahead. Download the file here. The new 14 plates have been great for the car market. Registrations in March were 465,000, up by 18% on March last year. UK car registration increased by 15% in the first three months of 2014. We forecast total sales of almost 2.5 million this year, returning to levels of sales, last seen in 2004 and 2005. Production is forecast to increase to 1.6 million units following the increase to 1.5 million last year. A further increase to 1.7 million units, then 1.8 million units is expected by 2016. Good news? Of course. But the majority of production is exported. Export sales may hit 1.3 million units in 2014, rising to 1.5 million by 2016. As a result, imports will have to increase to 2.2 million units in 2014, rising to 2.4 million units by 2016. The trade deficit (unit sales) will increase to 0.8 million units, to the levels least seen pre recession. The surge in car sales is a welcome demonstration of UK demand. As Mike Hawes, SMMT Chief Executive explains. “Given the past six years of subdued economic performance across the UK, there is still a substantial margin of pent-up demand that is contributing to a strong new and used car market.” The pent up demand is to be unleashed. Remember we have over 31 million cars on the road in the UK of which over one third are over nine years old. Easy finance deals and advanced technologies make new cars cheaper to buy and to run. There has never been a better time to buy a new car. Let’s hope they don’t all rush at once. That would create a traffic jam at the docks. That’s another reason why we say the trade figures will continue to disappoint, and threaten the recovery, especially if the collapse in investment income continues. Download the short report here.  The release of the second estimate of GDP in the 3rd quarter brought few surprises. Growth was confirmed at 1.7% year on year following growth of 1.4% in the second quarter. Service sector output continues to drive the recovery with particularly strong growth in the leisure sector. Construction output increased by 4% with manufacturing growth relatively flat in the latest three month period. In current value spending terms the economy grew by 3.8% as incomes of employees and businesses continued to show strong growth. Expenditure within the economy was driven by household spending up by 2.4% in real terms plus a build up in inventories. Government spending was up by just 1.1%, investment fell slightly and the trade figures continue to disappoint. Exports fell and imports increased as UK domestic demand exceeded the rate of growth in Europe and the USA. So what does this all mean? We expect strong growth to continue into the final quarter with overall growth around 2.4% bringing the year on year growth rate to 1.3%. We still think the economy is on track for growth of around 2.4% in 2014. Check out our latest publication “Modeling GDP(O)”. We release the forecasts of the ten key sectors and sub sectors in the UK economy over the next two years. Should we too worried by the lack of investment? Not really. At this stage in the cycle we would expect investment to be weak. Plant and machinery accounts for just 20%, of total investment. Spending on commercial real estate will continue to be subdued for some time yet as the overhang continues. We expect strong growth in productive capacity in the final quarter of the year and into next year. The four year capital stock model is down by just 15% from the peaks of 2008. No need to worry about “lost output” for the years ahead, trend rate of growth can be recovered and maintained. Investment will receive a significant boost in the final three months of the year and into next. Our UK investment model will be released next week. Prospects for the UK look good, but without a strong recovery in Europe and sustained growth in the USA, the trade figures will continue to be a net drain on overall performance. This should be no surprise to regular readers! The trade deficit in goods will increase largely (but not entirely) offset by a strong performance in service sector exports. Is this the wrong kind of growth? The UK economy has been dependent on domestic consumption since our records began. Growth based on investment and exports a policy dreamboat. There will be no rebalancing of the economy just more of the same to come. Bank moves on mortage lending Which is perhaps why the Bank of England modified the terms of FLS away from mortgage lending towards business loans. The old lady is no fan of the help to buy votes scheme. The Governor has made it clear the Bank of England will move to prevent another housing boom. The policy response includes several options this time around including post code selective spread and capital provisions to curb excessive movements in house prices if necessary. What happened to sterling? The pound closed up at £1.6360 from £1.6215. Against the Euro, Sterling closed at €1.2045 from €1.1966. The dollar moved down up the yen closing at ¥102.4 from ¥101.3 and closing at 1.3582 from 1.3555 against the Euro. Sterling is on a rally which has led to a break out above £1.60, pushing through resistance at €1.20 euro basis. Oil Price Brent Crude closed at $109.65 from $111.05. The average price in November last year was almost $110. The average price just $106 this year. Markets, US pushed higher - The Dow closed at 16,086 up from 16,065. The FTSE closed at 6,650 from 6,674. 7,000 FTSE still the call before Christmas. UK Ten year gilt yields closed at 2.78 from 2.79 US Treasury yields closed at 2.75 from 2.74. Yields will test the 3% level over the coming months but this may await the New Year. Gold closed at $1,252 from $1,244. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow and watch out for news of our Monthly Markets updates coming in the New Year. Join the mailing list for The Saturday Economist or forward to a friend UK Economics news and analysis : no politics, no dogma, no polemics, just facts. John © 2013 The Saturday Economist, #TheSaturdayEconomist, by John Ashcroft and Company, Dimensions of Strategy and The Apple Case Study. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Economics news – you don’t have to be an optimist to see the glass is half full .. Yes it's the Inflation Report “You don’t have to be an optimist to see the glass is half full”, the opening remarks from Governor Carney’s Inflation Report presentation this week. The Governor went on to say, “the glass is half full and it will be filled”. A clear reference the recovery will be allowed to gain momentum before the Bank of England and the MPC will intervene “to take away the punch bowl” and begin the rise in base rates. The MPC are sticking with forward guidance. Rate rises will not even be considered until the level of unemployment hits 7% or even lower. [Subject to caveats on inflation expectations and market stability]. When will this be? In August the Bank assumed this would be in 2016 at the earliest. On Wednesday, the Governor admitted there was a 40% chance this could be by the end of 2014 with a 60% chance it would be by the end of 2015. Such has been the strength of the economics data over the last three months. Our own models assume the knock out unemployment rate will be hit by the third quarter of 2015. Thereafter rates may rise by around 50 basis points in short time. For the moment, the MPC are on a learning journey. The path of productivity, earnings, job creation and unemployment so unclear, we are all embarking on a “learning journey” suggested the governor. The £5m recently spent on the Bank of England model, of little value in the new world it would appear. Charlie Bean appeared most discomfited by the trip. Economics from Cambridge, a PhD from MIT and teaching at Stanford and LSE in the knowledge pack. One could be forgiven the reluctance to take the Mark Carney refresher course. But then why not? Having seriously failed to understand the impact of low rates on investment and depreciation on the trade balance, it is time to denounce the omniscient stance of the Oxbridge collective. Yes send them back to school. Martin Weale was indeed sent back to school this week. The MPC member was delivering a speech on the role of monetary policy and forward guidance to A-level students in London. “To cut a long story short, our job is to ensure that people buy coats when they need them”. Excellent. I am sure that cleared things up. Martin once worked in a shop apparently. Yes the black cloud gang disbanded, it’s back to school for all. Fill up your glasses, the punch bowl is on the table, the Carney Credit card is behind the bar. Inflation Good news for the Governor, inflation fell in October CPI to 2.2% from 2.7% in the prior month. Education hikes last year fell out of the index as we expected but the fall in transport costs pushed the index even lower. 2.4% CPI inflation was our call and still seems to be a reasonable target by the end of the year. Manufacturing prices suggest there is little cost pressure in the economy but retail energy prices are moving significantly higher. Retail Sales Retail sales figures in October were slightly disappointing, an increase of 1.8% in volume and 2.5% in value, slightly down on the averages in Q3. The demise of Barratts Shoes and Blockbuster a reminder, conditions remain tough on the high street as household real incomes remain under pressure. Internationally Janet Yellen, the new head at the Fed is still worried about the strength of the US recovery. Tapering may be postponed still later into the New Year. Growth in France and Japan in the third quarter a further warning the world recovery still requires accommodation. QE tapering US style is not the answer. Buying treasuries and Mortgage Backed Securities to support asset prices makes no sense. Blend a NASDAQ tracker fund into the purchase mix would follow the logic and demonstrate the folly. What happened to sterling? Sterling closed at £1.6113 from £1.6018. Against the Euro, Sterling closed at €1.1940 from €1.1982. The dollar moved up against the yen closing at ¥100.1 from ¥99.1 and closing at 1.3494 from 1.3368 against the Euro. Oil Price Brent Crude closed at $108.50 from $105.12. The average price in November last year was almost $110. We expect Brent Crude to average $110 in the month, with no material inflationary impact. Markets, pushed higher - The Dow closed at 15,962 up from 15,762. The FTSE closed at 6,693 from 6,708. UK Ten year gilt yields closed at 2.75 from 2.77 US Treasury yields closed at 2.70 from 2.75. Yields will test the 3% level over the coming months. Gold closed at $1,288 from $1,284. The bulls may have it may just have to wait for now. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow and watch out for news of our Friday Financials Feature with Monthly Markets updates coming soon. John Join the mailing list for The Saturday Economist or please forward to a colleague or friend. UK Economics news and analysis : no politics, no dogma, no polemics, just facts. © 2013 The Saturday Economist. John Ashcroft and Company, Dimensions of Strategy. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.  Economics news – import drive and the march of the makers ... Import Drive ... “Sales of European cars drive trade gap wider” is the headline in the Times today as Britons “flocked” to buy cars built on the continent. The trade figures released this week, reveal the September deficit (trade in goods) increased to £9.8 billion from £9.6 billion last month. The trade deficit with the EU reached a record £6.0 billion as imports increased by £0.4 billion to £18.6 billion. “Half of the increase is attributed to cars”, according to the ONS, hence the slightly unbalanced headline from the Times. In reality, Britons have been flocking to the showrooms since the start of the year. Car sales are up by 10% this year. The deficit was offset as usual by a trade in services surplus of £6.5 billion. This is a familiar pattern which should come as no surprise to readers of The Saturday Economist. The trade deficit will deteriorate further especially if the UK continues to grow at a faster rate than major trading partners in the EU and USA. We are forecasting an overall trade deficit this year of £110 billion offset by a service sector surplus of almost £80 billion. The residual overall deficit easily financed. The September figures are confirmation of the trends within our well established trade model. Depreciation damages UK trade in goods performance. Imports do not react significantly to price changes. There will be no rebalancing of the economy. March of the makers picks up pace ... Did the march of the makers pick up the pace in September? Not really. According to the latest figures from the ONS. Manufacturing output increased in the month by just 0.8%. Output for the quarter was flat as signaled in the Markit/CIPS PMI® survey data last week. Nevertheless we still expect manufacturing growth of almost 2.5% in the final quarter of the year. Last year was such a dismal quarter, even the stumbling marchers will make progress. Watch out for the headlines heralding the rebalancing over the next few months and tie me to a chair. Other survey news ... The service sector continues to drive growth in the economy according to the Markit/CIPS UK Services PMI® for October. The headline Business Activity Index reached a level of 62.5 in October. “The UK service sector maintained its recent run of strong growth during October, with activity expanding at the fastest pace since May 1997 as levels of incoming new business rose at a survey record rate”. The construction rally also continues according to the Markit/CIPS UK Construction PMI® index. The sharp rebound in UK construction output continued in October. The lead index posted 59.4, up from 58.9 in September, above the 50.0 no-change threshold for the sixth consecutive month. So what does this all mean? The economy is recovering and growing at a much faster rate into the final quarter. The pick up in manufacturing output will add to the growth in services and construction. Higher growth, more jobs, lower borrowing, inflation falling, investment will pick up in the second half of next year, it’s all looking pretty good for the Chancellor. Just the trade figures will continue to disappoint. We now think base rates are now more likely to rise by around 50 basis points in 2015. Higher growth will result in unemployment hitting the 7% hurdle rate in the third quarter of 2015, several months after the election. What happened to sterling? The Euro rate cut weakened the hybrid and Sterling strengthened as a result. The pound closed at £1.6018 from £1.5912. Against the Euro, Sterling closed at €1.1982 from €1.1814. The dollar moved up against the yen closing at ¥99.1from ¥98.7 and closing at 1.3368 from 1.3484 against the Euro. Oil Price Brent Crude closed at $105.12 from $105.91. The average price in November last year was almost $110. We expect Brent Crude to average $110 in the month, with no material inflationary impact. Markets, pushed higher - The Dow closed at 15,762 up from 15,616. The FTSE closed at 6,708 from 6,721. The rally continues with a stronger Santa rally in prospect over the next five weeks. UK Ten year gilt yields closed at 2.77 from 2.66 US Treasury yields closed at 2.75 from 2.62. Yields will test the 3% level over the coming months. Gold closed at $1,284 from $1,312. The bulls may have it may just have to wait for now. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow and watch out for news of our Friday Financials Feature with Monthly Markets updates coming soon. John Join the mailing list for The Saturday Economist or please forward to a colleague or friend. UK Economics news and analysis : no politics, no dogma, no polemics, just facts. © 2013 The Saturday Economist. John Ashcroft and Company, Dimensions of Strategy. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.  Good news for the economy continued this week. A fall in the rate of unemployment AND an increase in output and orders for the construction industry. Who would believe it was just a few months ago headlines were devoted to the risk of a triple dip recession? The year is becoming a tale of two halves with a significant pick up in activity and sentiment into the third quarter. Get ready, we are leaving Planet ZIRP. Speed bumps in the housing market It is a strange recovery with strange roles in evidence. The Bank of England is hoping to keep base rates on hold for three years. The RICS warned this week of the need to maintain a stable and sustainable path for house prices. “We suggest setting an annual growth rate threshold in a national index, which if exceeded, triggers tighter macro prudential policy” said Josh Miller Senior Economist in the RICS report. The RICS is advocating “speed bumps” to limit the rate of price increases. The Bank of England (in the form of the FPC) should intervene to regulate mortgage allocations of LTV ratios across the UK if prices moved over 5%. That sort of thing. “Taking away the punch bowl as the party gets started” is the traditional role of the central banker. Now some of the heavy drinkers are suggesting, we dilute the hooch. How strange. Most commentators have reacted badly to the suggestion. Why 5%? Is there a regional variation? Is it the same for maisonettes and mansions? Should the government confiscate revenues where prices exceed the guidelines? Are the RICS advocating a prices and incomes board, monitored by the RICS perhaps? Graeme Leach at the IOD has suggested it is a “statist solution to a state created problem”. Calm down Graeme, it was just for fun and not to be taken too seriously. The FPC is to meet this week. Top of the agenda will be the need to limit loan to value ratios. The government “homes for heroes” scheme, (the scheme in which the tax payer underwrites high loan values for house buyers) will be on the agenda no doubt. Unemployment The unemployment rate ticked down in July to 7.7% in July. The claimant count fell to 4.2% in August. The number of claimants - down by 32,000 to 1.4 million. Further indicators the recovery is on track, towards trend rate of growth, into the final quarter. What does this mean for forward guidance? The models still suggest it will be the end of 2015 at least before the 7% threshold will be reached. That is the rate at which the MPC will begin to think about base rate rises, (speed bumps and knock out drops aside). The caveat about earnings continues. The recovery cannot be sustained without a change in household fortunes, either lower inflation or higher earnings growth is required. Plus, the UK cannot grow at a faster rate then Europe for too long, without the trade deficit coming under severe pressure. The trade deficit, of itself, “a speed bump or pothole”, where growth is concerned. Construction Good news on construction. Output increased in July by 2% compared to July last year. Orders for new work, especially in the housing market, were up by 33% compared to the same time last year. This is an important change indicator for the sector. Overall the growth in services continues. The recovery in manufacturing and construction will look much stronger into the final quarter of the year. The UK recovery is on track. It is just over eighteen months to the election. Buckle up, we are leaving Planet ZIRP. Gilts are already in low orbit. What happened to sterling? Sterling responded to the economics news, moving up against the dollar and also against the Euro. The pound closed at $1.5871 from $1.5627 and at €1.1940 from €1.1860 against the euro. The dollar moved up against the yen closing at ¥99.4 from ¥99.0 Oil Price Brent Crude closed at $111 from $114. The average price in September last year was almost $113. We expect oil to average $112 in the current quarter, with no real inflationary impact. Markets, rallied - The Dow closed up at 15,376 from 14,923. The FTSE closed up at 6,584 from 6,547. The Fed statement this month will mark the larger DOW move. Still a good time to move in? The FTSE will clear 7000 within ten weeks and the DOW will press 16,000. UK Ten year gilt yields closed at 2.94 from 2.95, US Treasury yields closed at 2.89 from 2.93. Long rates are decoupling from shorts, returning to fair value. They are just a bit reluctant to leave! Gold closed at $1,312 from $1,388. The bulls have it or do they? Some still worry about tapering. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow. Join the mailing list for The Saturday Economist or forward to a friend UK Economics news and analysis : no politics, no dogma, no polemics, just facts. John © 2013 The Saturday Economist. John Ashcroft and Company, Dimensions of Strategy . The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Base rates on hold this week as the MPC voted to hold rates at 0.5% and withstand any further pressure to increase QE above the £375 billion level. Speculation continues that rates will remain on hold into 2016 but can we really be so sure that UK base rates will remain at such low levels for a further three year period? In the USA Bernanke has opted for a QE infinite policy, injecting $85 billion monthly into the US economy until unemployment falls below 6.5% or inflation ticks higher above the 2.5% level. So much for forward guidance, it just gives the markets more things to fret about. In Europe the ECB held rates this week, forecasting negative GDP growth this year of -0.6%. Croatia with slowing growth and rising unemployment meets the convergence criteria apparently and will join the ranks of the soaring unemployed in Europe. It really is a difficult international back drop, against which to set rates in the domestic economy. The latest signals are that rates will rise sooner rather than later in the UK as a raft of data suggests the recovery in the second quarter could continue at trend rate of over 2%. Car sales in April and May have increased by almost 10% compared to 2012 and latest data from the British Retail Consortium suggests retail sales in May increased by almost 2% like for like. More convincingly, the latest survey data from Markit/CIPS PMI® surveys suggest the worst may be over in the construction sector. The short lived fillip to output from the outgoing labour administration has now worked it’s way in and out of the system. The latest boost to new home construction from the Treasury Homes for Heroes campaign may be having some effect. The construction index moved into positive territory led by residential building activity. The UK manufacturing sector continued its positive start to the second quarter of 2013. After returning to growth in April, May saw operating conditions improve at the fastest pace in over a year, with growth of production and new orders both improving. At 51.3 in May, up from 50.2 in April, the seasonally adjusted Markit/CIPS Purchasing Manager’s Index® (PMI®) posted its highest reading since March 2012 and remained above the neutral 50.0 mark for the second straight month. But it was in the service sector, the most positive signals to growth were found. The headline seasonally adjusted Business Activity Index hit 54.9, up from April’s 52.9, the index signaled a strong rate of growth, the largest since March 2012. New business activity increased at the fastest rate for three years. It has been a great couple of weeks for the Chancellor, with inflation falling, the deficit dropping and growth confirmed in the first quarter. Even the trade figures improved in April according to latest data this week. Alas, the improvement in trade for the wrong reasons, imports fell as exports remained flat. No signs of a booming economy in the second quarter but survey data suggests the recovery is continuing at a respectable pace. The UK economy should experience growth well above 1.0% this year, despite the problems in Europe. No pressure for rate rises in the short term. What happened to sterling? It’s all about dollar weakness this week. Sterling rallied to 1.552 from 1.5198 against the dollar and to 1.1763 from 1.1687 against the Euro. The Euro dollar closed at 1.3216 from 1.2996 and against the Yen, the dollar closed below the critical 100 level at 97.6. Why? US jobs data suggests more QE is guaranteed in the short term. Oil Price Brent Crude closed at $104.56 from $100.39. In June last year Brent Crude averaged $95! The best for inflation may be over, oil prices will be up 10% this month compared to last year. Markets, settlement week. The Dow closed at 15,248 from 15,115. The FTSE closed at 6,411 from 6,583. The easy calls have been made for the moment. Nervous money should move to the sidelines before the Autumn moves. UK Ten year gilt yields increased to 2.09 from 2.03 - US gilt yields closed up at 2.18 from 2.13. The great rotation continues albeit at a subdued rate. As for gold, closed at $1,384 from $1,387. The excitement is over for now, this is a hung chart. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow. Join the mailing list for The Saturday Economist or forward to a friend UK Economics news and analysis : no politics, no dogma, no polemics, just facts. John The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Economics news – Inflation Report, a welcome change in outlook Inflation Report Wednesday, May Inflation Report, last in the series (of 82) for Sir Mervyn King as Governor. “There is a welcome change in the economic outlook". Projections are for growth to be a little stronger and inflation a little weaker than expected three months ago. "A recovery is in sight”. Excellent. The Governor is upbeat. The forecast is for growth - slightly above 1% for the year as a whole, with a gradual recovery thereafter. Base rates are likely to remain on hold until 2016, inflation will moderate from the current 2.8% level but is likely to remain above target by the end of the year. This all fits nicely with The Saturday Economist outlook outlined earlier in February this year! No black clouds, no stormy water, no difficult charts to navigate, the economy is headed for a safe harbour that even a Canadian novice could pilot apparently. The King has had his day, "now it is over to the next generation to have theirs", he added, before leaving the room with an obvious smile on his face. Concerns about Europe Well there are a still a few concerns about Europe! “The main downside risk to the recovery continues to stem from overseas, especially in the euro area”. So it proved with the Eurostat updates on the Euro economy mid week. Not doing quite so well, the flash estimate for the first quarter of 2013 suggested Euroland GDP fell by 1% compared to the first quarter of 2012. It is not looking too good, the pigs are breeding and heading north. The French economy slipped back into recession with a fall of 0.4% following a similar fall in the prior quarter. Even the Germans, took a knock, with output down by 0.3% in the first three months. NIESR predicts negative GDP out turn for the Euro in the year, which fits nicely with the IMF three speed world recovery outlined recently by Christine Lagarde. Hopefully the UK is moving away for European trends and joining the Anglo Saxon growth alliance, as the US recovery gathers pace. Employment UK Not quite so fast as hoped, perhaps, the employment stats released on Wednesday were a little disappointing. The claimant count continued to fall into April, down by 8,000 to 1.52 million and a rate of 4.5%. The number of vacancies also increased slightly but on the wider LFS count, the number in employment actually fell slightly in the three months to March. That’s the great thing about the employment stats, sixty pages with something therein for politicians of any hue. For two handed economists, the data is at times indecipherable, the earnings data, incomprehensible, flat at best. Confused? Check out The Saturday Economist web site, probably the best economics site in the UK. What happened to sterling? Once again, it’s all about the dollar, pushing to 103.1 from 101.5 against the yen and to 1.2838 (1.2992) against the Euro. Sterling also fell to 1.5168 from 1.5356, down slightly against the euro at 1.1811 from 1.1825. Oil Price Brent Crude closed at $104.64 from $103.91. No impact on inflation at this level. Markets, once again the beneficiaries of US hopes. The Dow closed at 15,354 from 15,118 and the FTSE closed at 6,723 from 6,625. Time to sell in May and go away perhaps our US readers cautioned otherwise last week. UK Ten year gilt yields held at 1.90 but US gilt yields closed up 1.95 from 1.90. As for gold, gold closed down at $1,361 from $1,447. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow. The Saturday Economist.com is mobile friendly, no need for a special app any more! Join the mailing list for The Saturday Economist or forward to a friend to let them share the fun! Don't forget to check out the new web site The Saturday Economist.com. John The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft The Saturday Economist. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed