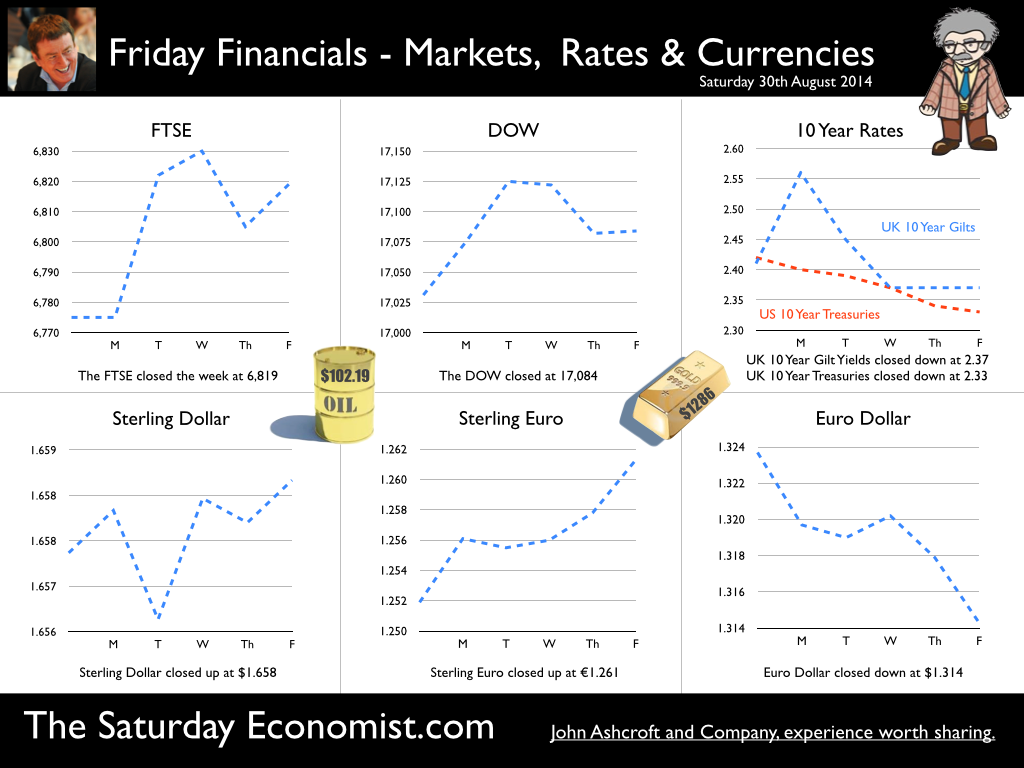

Give a man a fish and you feed him for a day Teach a man to fish - and you feed him for a lifetime! Yep - The old proverbs are great at summation but sometimes over looking the broader implications of the proposition. For the fisherman, thrusting a rod into hands is not enough. We have to preserve fish stocks, avoid pollution and ensure the piscators have a boat to reach the offshore shoals. A bit of international regulation helps, to guarantee the floating fish factories don’t suck away the livelihood of the locals. Yes, you can teach a man to fish but you leave him with nothing more than a stick in his hands and a soft line dangling into empty waters, unless broader policy issues are addressed. The great enemy of the truth is … What has this got to do with economics you may ask? We have to ensure the first principles of any proposition are covered in depth. JFK would say, “The great enemy of truth is very often not the lie - deliberate, contrived and dishonest but the myth - persistent, persuasive and unrealistic.” I feel the same way about QE, as I do about fishing. Allegedly stimulating growth and inflation, QE is a process in which central bankers buy debt from the debt management office underwritten by Treasury. In the UK HMT can then claim back the yield coupon eliminating the cost of debt issuance. It’s “money for nothing, gilts for free” a form of Dire Straits economics, which does little or nothing for growth or inflation. It is a combination of debt monetisation and financial repression. Ten year gilt yields at 2.3% are symptoms of the malaise, a combination of an over long stay on planet ZIRP with a toxic dose of QE, from time to time, in a misguided attempt to sustain life. QE is not the answer for Europe … In the UK, QE, intellectually discredited, came to an abrupt end in 2012. The Fed will terminate the US experiment in October this year. In Japan the nonsense persists. Kuroda, the Governor of the Bank of Japan continues with a QE programme worth $1.4tn (£923bn) despite the damage to the international gilt curve. This is the economy which introduced a sales tax in April, to stimulate inflation, ignoring the impact on demand and output. The impact on revenues muted in the process. In Europe, the torpor of the Euro economy continues, with news of rising employment and falling inflation. The Economist leads with “That Sinking Feeling Again” but what can Draghi do? Interest rates at the floor, Draghi can do no more, than talk down the Euro with a hint of QE to come. Why hold back? The ECB well understand, if there is nothing more powerful than idea whose time has come, there can be nothing more impotent or futile as an idea, for which the time has been and gone. So it is with QE, in part the problem of deflation lies elsewhere …. No Carnival in Brazil … In South America the bad news continues, a technical default in Argentina, major challenges in Venezuela and a down grade of growth forecasts in Brazil to just over 1% this year. An awful lot of coffee but no pick me up in Brazil as the world cup damaged output. Let them eat cacao but not watch football, the lesson from history. The latest data on world trade suggest that growth increased by 3.2% in the second quarter compared to 2.7% in Q1. The US recovery is assisting the process with news of a US GDP revision in the second quarter to growth of 2.5% compared to the earlier estimate of 2.4%. The world is recovering … So what of world prices? Deflation may be the spectre that haunts Europe but world price trends are partly to blame. World trade prices increased by just 0.4% in the second quarter after a fall of 1% in Q1. Oil, energy and commodity prices remain subdued. No rising prices as yet, so rates may be on hold for a bit longer … So what of base rates … Flip flops are becoming the footwear of choice for central bankers. Mark Carney, the unreliable boyfriend, started the fad, closely followed by Janet Yellen, fishing for answers in Wyoming last week. The consensus is for UK rates to rise by 25 basis points in February, as a rate rise before the end of the year is ruled out. So what happened to sterling this week? Sterling closed unchanged against the dollar at $1.658 from $1.657 but up against the Euro at 1.261 from 1.252. The Euro was down against the dollar at 1.314 (1.324). Oil Price Brent Crude closed down at $102.19 from 102.32. The average price in August last year was $111.28. Markets, rallied on the fishing report from Wyoming. The Dow closed up at 17,084 from 17,031 and the FTSE closed up at 6,819 from 6,775. UK Ten year gilt yields slipped to 2.37 from 2.41 and US Treasury yields closed at 2.33 from 2.34. Gold was slightly tarnished at $1,286 from 1,302. That’s all for this week. Join the mailing list for The Saturday Economist or please forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here *|MC:SHARE|*

0 Comments

Economics news – no Flowers by arrangement ... Treasury Enquiry ... The Treasury has ordered an independent investigation into events at the Co-op Bank including the circumstances surrounding the appointment and governance of Paul Flowers. The former Chairman of the Bank was arrested on Thursday night, days after he was filmed handing over money for cocaine and exotic substance. Mr Flowers issued a statement apologising for doing some “stupid things” claiming, it had been a difficult year. Unfortunately, for lots of loyal workers and stakeholders at the Co-op bank the difficult years will roll on for some time yet. The Treasury enquiry will be led by an independent person appointed by the PRA and the FCA which of course replaced the FSA (which allowed the Flowers appointment in the first place). How the process of “Regulatory Scrabble” moves forward. The enquiry should ask what system considered Bob Diamond so unacceptable as a career banker, yet allowed Flowers to flourish when clearly out of his depth both managerially and professionally. Answers on a PRA, FCA postcard please. Borrowing Back to the economics, more good news for the Chancellor this week as the borrowing figures fell to £8.0 billion from £8.5 billion in October. The underlying data is much stronger than top line figures suggest. Expenditure year to date is up by just 2% but revenues have increased by almost 8%. Income tax and VAT revenues are increasing by over 5% as the recovery gathers momentum. Total borrowing at £115 billion last year will fall towards £100 billion in the current year. CBI and the March of the Makers The CBI survey reported a strong rise in output in the manufacturing sector in the latest survey data released this week. Growth in the manufacturing sector was the strongest for 18 years. Both the size of order books and the pace of output were the highest recorded since 1995. In other news, the SMMT reported a 17% increase in car manufacturing for the month of October. Output for domestic sales increased by over 50%. Don’t get too excited, year to date output growth is up by just over 5%. So what does this all mean? We expect a strong rally in manufacturing output in the final quarter of the year around 2.5% continuing into 2014. Borrowing figures for the year will be much better than expected. The median forecast of the HM Treasury panel is now just £100 billion for the current financial year, falling below £90 billion next year. Growth up, unemployment down, inflation down, borrowing down, only the trade figures will continue to disappoint the coalition platform as the election looms. What happened to sterling? The pound closed up at £1.6215 from £1.6113. Against the Euro, Sterling closed at €1.1966 from €1.1940. The dollar moved up against the yen closing at ¥101.3 from ¥100.1 and closing at 1.3555 from 1.3494 against the Euro. Oil Price Brent Crude closed at $111.05 from $108.50. The average price in November last year was almost $110. We expect Brent Crude to average $110 in the month, with no material inflationary impact. Markets, US pushed higher - The Dow closed at 16,065 up from 15,962. The FTSE closed at 6,674 from 6,693. 7,000 FTSE still the call before Christmas. UK Ten year gilt yields closed at 2.79 from 2.75 US Treasury yields closed at 2.74 from 2.70. Yields will test the 3% level over the coming months. Gold closed at $1,244 from $1,288. The bulls may have it may just have to wait for now. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow and watch out for news of our Monthly Markets updates coming in the New Year. John Join the mailing list for The Saturday Economist or please forward to a colleague or friend. UK Economics news and analysis : no politics, no dogma, no polemics, just facts. © 2013 The Saturday Economist. John Ashcroft and Company, Dimensions of Strategy. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.  Andy Haldane warned this week : “Let’s be clear, we have intentionally blown the biggest government bond bubble in history” speaking before the Treasury Select Committee. Andy Haldane is the director of financial responsibility at the Bank of England. His views were quickly distanced by Old Lady of Threadneedle Street, as very much a “personal view”. OK bond markets may be the main risk to financial stability but best not to speak of it in public. Not to worry, the markets will get the message in the end. High bond prices and absurdly low yields are a by product of life on Planet ZIRP. With short rates at or near the zero interest rate policy level, undermining long term rates was considered to be the next great step. Who could possibly think that creating a financial climate with negative long term real rates, would encourage lending, in an uncertain business world. Well Ben Bernanke for one. There is no “Lonely Planet” Guide to life on Planet ZIRP as we pointed out in December 2008. Commenting on a paper by Bernanke - we said then - “OK it’s official, the effects of QE remain quantitively quite uncertain. Welcome to Planet ZIRP. We don’t have a hand book or fully understand the terrain. We cannot be sure QE is going to work at all. The process of quantative easing, the plan to helicopter money may work but as a fire fighting option, it may be like dropping water into a desert, such are the fissures in the financial system” We also said, “This is your captain speaking, Welcome on board flight QE 2009. I hope you have a nice flight, I am relatively new at this, haven’t actually flown before, we shall be flying by the seat of our pants but have every confidence, we will get somewhere, but not sure where, in the end.” QE was an experiment which is still five years late unproven. We warned then, Planet ZIRP, would be a desiccated sterile planet where a liquidity crisis is exacerbated and prolonged. Now, five years on, the US markets are beginning to fret about the end of the Bernanke flight, with fears of a crash landing in prospect. As Sam Fleming, warns in The Times today, “the Governor of the Bank of England, in 2009, described the process of reversing QE as completely straightforward. It is proving to be a nightmare. “ In the Saturday Economist we pointed out last week, The Bank of England has mopped up almost 75% of UK gilt purchases since QE began. There can be no reversal of QE in the UK. The gilts will be held to redemption. The real challenge - who will buy the gilts at negative real rates, now the Old Lady has to stay off the street. For earlier posts Google “Planet ZIRP - John Ashcroft” , or check out this post you had been warned! What happened to sterling? Further dollar weakness the story, this week as fears over QE3 increase. Sterling rallied to 1.5703 from 1.552 dollar basis and held at 1.1763 against the Euro. The Euro dollar closed at 1.3345 from 1.3216. Against the Yen, the dollar closed once again below the critical 100 level at 94.06 from 97.60. Oil Price Brent Crude closed at $105.93 from $104.56. In June last year Brent Crude averaged $95! The best for inflation may be over, oil prices will be up 10% this month compared to last year. Markets, The Dow closed at 15,070 from 15,248. The FTSE closed at 6,308 from 6,411. The easy calls have been made, time to stand aside whilst the markets consolidate and fret about QE. UK Ten year gilt yields held at 2.08 from 2.09 - US gilt yields closed down at 2.13 from 2.18. The great rotation - in a bit of a spin. As for gold, closed at $1,390 from $1,384. The excitement is over for now, this is a hung chart. Really pleased this week to be appointed as the Chief Economist at the Greater Manchester Chamber of Commerce. Looking forward to working with Clive Memmott, and the team in Manchester. John The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft.  From whom has the Bank of England been buying all the gilts? 1 Since QE began in the first quarter of 2009, the total value of gilts in issue has increased from £616 billion to £1.354 trillion [Data to 2012 Q4 The latest figures available from the Debt Management Office.] 2 The Debt management office has issued £738 billion of new gilts over the period to fund the government deficits, over half of which have been purchased by the Bank of England under the QE policy. 3 At the end of 2012, the Bank of England held gilts to the value of £397 billion. That’s almost £400 billion. The Bank of England has purchased almost £400 billion or 54% of the new gilts issued, according to the data. 4 Overseas holdings of gilts have doubled in the period, increasing from £203 billion to £420 billion, an increase of £217 billion. 5 UK holdings of gilts have increased from £400 billion to £937 billion, that is to say, UK holdings have increased in value by £523 billion. 6 The Bank of England has accounted for 76% of the UK purchases of gilts issued since the first quarter of 2009. 7 Insurance companies and pension funds have increased holdings of gilts from £228 billion to £348 billion. 8 Households have increased their holdings of gilts over the period from £13 billion to £31 billion. 9 In fact most, if not all, holders on gilts at the end of 2008, have increased the value of gilt holdings over the last four years. 10 There is some evidence of front running by some financial institutions as holdings increased ahead of the QE announcement in early 2009 but other than that holdings have increased across the board. Which poses the question, from whom has the Bank of England been purchasing all the gilts? It would appear to some the QE policy is more concerned with mopping up the gilts issued by the DMO, at beneficial rates, than it is with stimulating growth or avoiding deflation. If that is the case, then the Governor of the Bank of England has done a great job but hence the need to continue with QE despite the recovery in growth and inflation. Download the DMO Data Set Here. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed