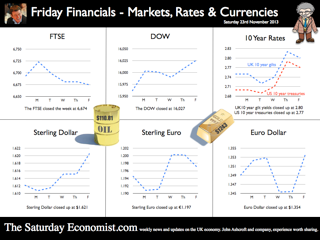

Economics news – no Flowers by arrangement ... Treasury Enquiry ... The Treasury has ordered an independent investigation into events at the Co-op Bank including the circumstances surrounding the appointment and governance of Paul Flowers. The former Chairman of the Bank was arrested on Thursday night, days after he was filmed handing over money for cocaine and exotic substance. Mr Flowers issued a statement apologising for doing some “stupid things” claiming, it had been a difficult year. Unfortunately, for lots of loyal workers and stakeholders at the Co-op bank the difficult years will roll on for some time yet. The Treasury enquiry will be led by an independent person appointed by the PRA and the FCA which of course replaced the FSA (which allowed the Flowers appointment in the first place). How the process of “Regulatory Scrabble” moves forward. The enquiry should ask what system considered Bob Diamond so unacceptable as a career banker, yet allowed Flowers to flourish when clearly out of his depth both managerially and professionally. Answers on a PRA, FCA postcard please. Borrowing Back to the economics, more good news for the Chancellor this week as the borrowing figures fell to £8.0 billion from £8.5 billion in October. The underlying data is much stronger than top line figures suggest. Expenditure year to date is up by just 2% but revenues have increased by almost 8%. Income tax and VAT revenues are increasing by over 5% as the recovery gathers momentum. Total borrowing at £115 billion last year will fall towards £100 billion in the current year. CBI and the March of the Makers The CBI survey reported a strong rise in output in the manufacturing sector in the latest survey data released this week. Growth in the manufacturing sector was the strongest for 18 years. Both the size of order books and the pace of output were the highest recorded since 1995. In other news, the SMMT reported a 17% increase in car manufacturing for the month of October. Output for domestic sales increased by over 50%. Don’t get too excited, year to date output growth is up by just over 5%. So what does this all mean? We expect a strong rally in manufacturing output in the final quarter of the year around 2.5% continuing into 2014. Borrowing figures for the year will be much better than expected. The median forecast of the HM Treasury panel is now just £100 billion for the current financial year, falling below £90 billion next year. Growth up, unemployment down, inflation down, borrowing down, only the trade figures will continue to disappoint the coalition platform as the election looms. What happened to sterling? The pound closed up at £1.6215 from £1.6113. Against the Euro, Sterling closed at €1.1966 from €1.1940. The dollar moved up against the yen closing at ¥101.3 from ¥100.1 and closing at 1.3555 from 1.3494 against the Euro. Oil Price Brent Crude closed at $111.05 from $108.50. The average price in November last year was almost $110. We expect Brent Crude to average $110 in the month, with no material inflationary impact. Markets, US pushed higher - The Dow closed at 16,065 up from 15,962. The FTSE closed at 6,674 from 6,693. 7,000 FTSE still the call before Christmas. UK Ten year gilt yields closed at 2.79 from 2.75 US Treasury yields closed at 2.74 from 2.70. Yields will test the 3% level over the coming months. Gold closed at $1,244 from $1,288. The bulls may have it may just have to wait for now. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow and watch out for news of our Monthly Markets updates coming in the New Year. John Join the mailing list for The Saturday Economist or please forward to a colleague or friend. UK Economics news and analysis : no politics, no dogma, no polemics, just facts. © 2013 The Saturday Economist. John Ashcroft and Company, Dimensions of Strategy. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed