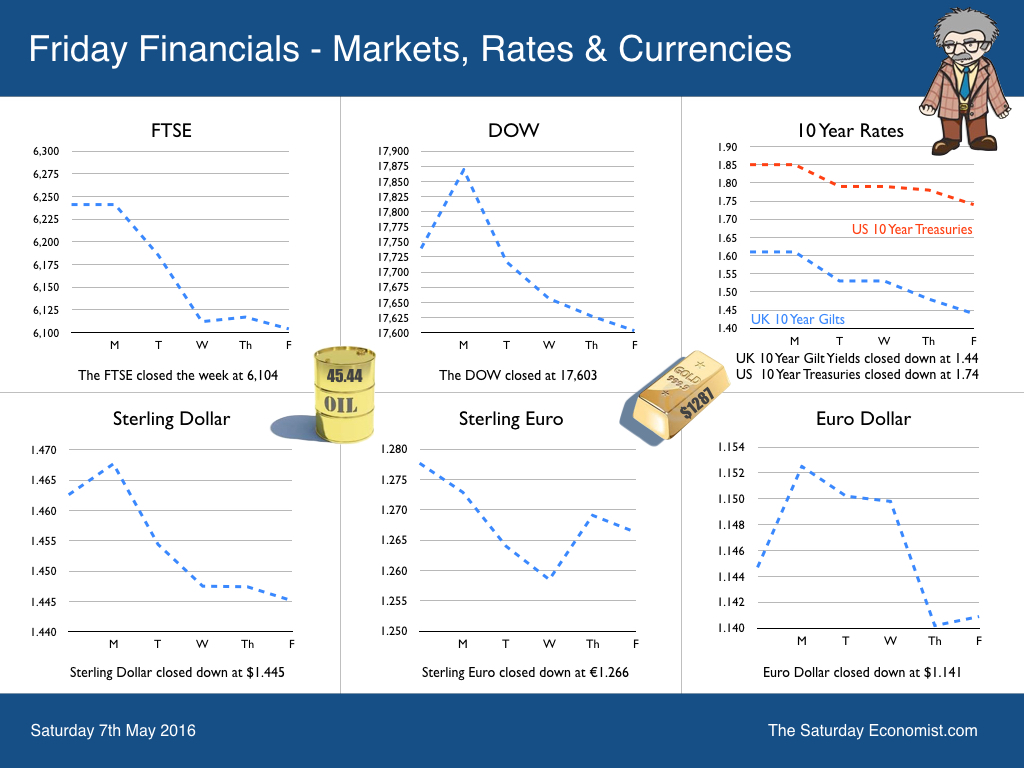

US jobs growth disappoints in April but wages edge higher … U.S. jobs growth in April was 160,000 compared to analysts expectations some 40,000 higher. Job gains in February and March were revised down. The unemployment rate held at 5%. For some, the news was disappointing, killing off any prospect or a rate rise in June. More, now expect the next hike to be in 2017. But is this really the case? The Fed will note with interest the earnings rise to 2.5% in the month. They will also note the 170,000 rise in private sector jobs and the increase in private sector wages to 3.2%. We still expect strong growth this year. US rates will rise at some stage. June may be a little juste! but “Fall remains the Call” for the next hike in rates. Back in the UK … Back in the UK it is the week of the Markit/CIPS PMI series. Prepare for setbacks. They are sentiment surveys after all. Construction output eased to the lowest level in almost three years, according to the survey data, as new business volumes slowed in April. The key index was down to 52.0 from 54.2 in March and a peak of 60 last year. Should we be too worried? Perhaps not. The index remains above the critical “no growth” level. Commercial building remained the strongest sector with a slight upturn in residential spending. Anecdotal evidence suggests projects may be on hold pending the out turn of the referendum in June. In manufacturing, the index fell to the lowest level since February 2013. At 49.2, the index was below the critical no growth level of 50, falling from 50.7 last month. Consumer and investment sectors were hit. The slow down in oil and gas investment impacted on output along with some hesitation ahead of the vote in June. In the service sector, growth appeared to be the lowest for three years. The Business Activity Index fell from from 53.7 in March to 52.3 in April. New business activity increased in the month. Here again, anecdotal evidence suggested the forthcoming EU referendum may have led to the delay in contract placement ahead of the critical June date. Talking with bankers, investors and project managers, there is little doubt some activities are on hold pending the referendum decision. This is not a widespread phenomenon. Either way, post vote, we should experience an upswing in the second half of the year, especially in business services and construction. The structural malaise in manufacturing may not benefit from the post “referendum” bounce. We still expect UK growth of 2.4% in the year, as the outlook in the second half will improve significantly. The Saturday Economist on Brexit … This week John Longworth ex Director General of the British Chambers of Commerce and Chairman of the Vote Leave campaign was our guest at a pro-manchester event on Wednesday. John is a powerful and fervent advocate of exit, wishing to free the UK from the yoke of European rules and regulation. Presenting over lunch, John then left for an evening presentation at Keeble College Oxford, before flying on to the Brookings Institute in Washington. A busy schedule to spread the message about the myths perpetrated by the “Remain” conspirators. According to John, June 24th will be declared “Independence Day” as the votes are counted and we set off on the great adventure. So what to make of it all? We remain on the fence as a neutral observer for now! To date, we have had almost 4,500 hits on our Brexit presentation published on line. We analyse the issues into the Business, Economics, Political and Social arguments. Almost 100 slides with all the information needed to understand the key issues in this important vote. Over the next few weeks we have a great series of events with debate from either side. Sir Richard Leese will be speaking at a pro-manchester event on the 26th May. AGMA has come out clearly in favour of “Remain”. So what will be the outcome on the day? The out turn on the 23rd June, still too early to call. Results of the Manchester poll will be released by the Chairman Tim Grogan at our Annual Dinner on Thursday. So what of rates? The Fed is still expected to increase rates this year, with one or two rate hikes remaining a possibility but not in June. In the UK, wage growth and headline inflation will provide the triggers to action with no rate rise expected ahead of the referendum in June. We still expect UK rates to be at least 0.75% by the end of the year, with two rate hikes to 1% a further possibility. Oil Brent Crude closed at $45 this week. The outlook for inflation will look remarkably different by the end of Q3 this year. So what happened to Sterling? Sterling closed down against the Dollar at $1.445 from $1.463 and down against the Euro at €1.266 from €1.278. The Euro moved down against the Dollar to 1.141 from €1.145. Oil Price Brent Crude closed at $45.44 from $47.94 The average price in May last year was $64.08. Markets, were mixed - The Dow closed up 17,603 from 17,739. The FTSE closed at 6,104 from 6,241. Gilts - yields moved down. UK Ten year gilt yields closed at 1.44 from 1.61. US Treasury yields moved to 1.74 from 1.85. Gold closed at $1,287 from $1,291. That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline and download The Saturday Economist App! Our review of the Brexit facts and figures out now! Download Here! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed