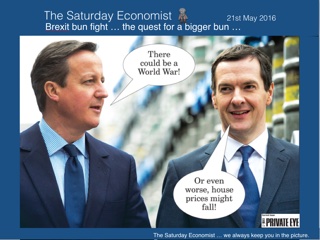

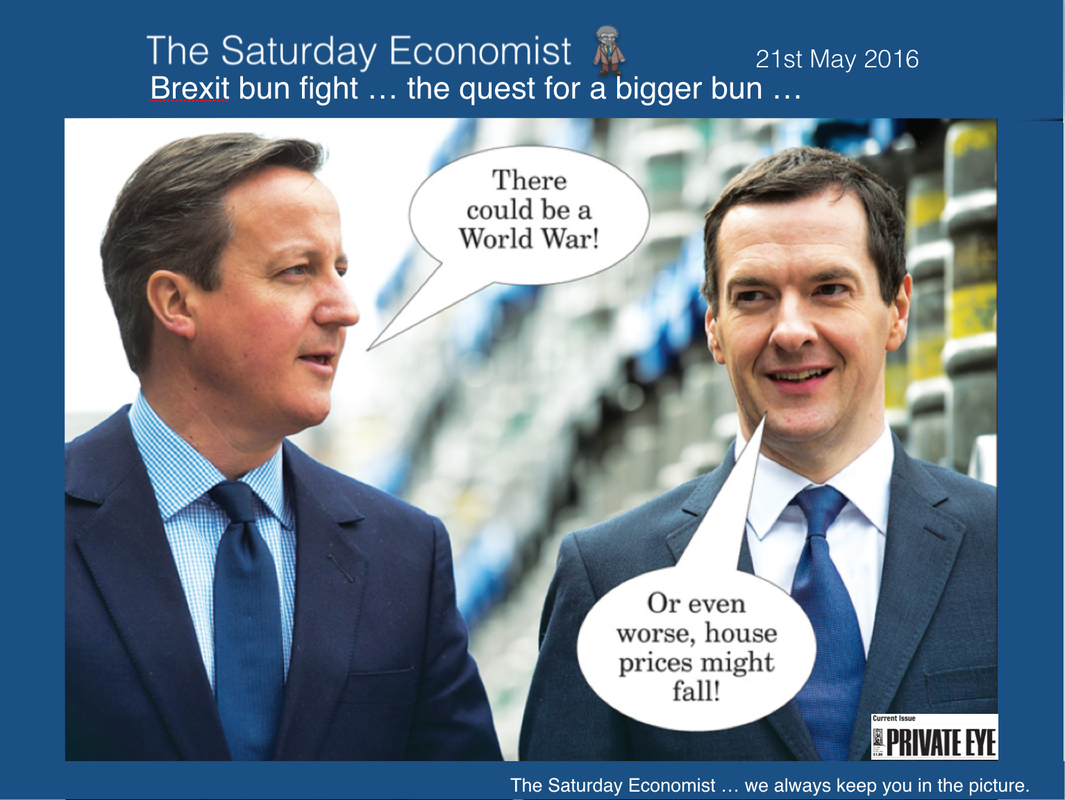

The Brexit debate is fast becoming a bunfight. The problem with bunfights it just leads to the quest for a bigger bun. Voters need facts, they are offered sound bites with high transmission potential. Michael Gove suggested this week 5.2 million people could come to the UK over the next ten years if we vote to “remain". George Osborne has suggested house prices will fall by 18%, if we vote to leave. Exit and the Prime Minister has warned the threat to peace could lead to nuclear war. Exit and Boris Johnson advises we will be able to buy bananas in bunches of more than three. Excellent. Leave and we will “renegotiate" say the leave camp. Leave and “we will make your lives a misery” warns Jean-Claude Juncker, President of the EU commission. Leave and we shed the yoke of Brussels bureaucracy. We will no longer subsidize Spanish bullfighting, hairdressers will be able to wear high heels and children of any age would be able to blow up balloons. Now that’s something worth fighting for, if only any it were true, Which way will the vote go? We can’t be sure. Just over four weeks to go to the referendum. Polls are confusing, suggesting voters are confused. “Brexit” The social .. political .. economic .. business arguments We have had 5,000 hits on our lengthy and objective Slideshare analysis. We advocate the debate is divided into the social, political, economic and business arguments. The social argument about immigration. The political argument who governs Britain. It’s about borders and sovereignty. Social and political, largely a political choice. The economics case places the Treasury, The OBR, NIESR, The Bank of England and The IMF in the remain camp. In the leave camp sit Patrick Minford, Roger Bootle, Gerard Lyons and Tim Congdon and others. Models abound. In fashion we say, there is a model for every cat walk, in economics we say, there is a model for every catfight. Voters have to make a choice based on dubious econometrics offering spurious accuracy. It’s a judgment call but many think “Leave” have already lost the economics argument. Oh yes, and I am one of them. As for the business case? There is no business case to leave. We know lower business confidence will lead to lower investment and lower foreign direct investment. Key contracts already have Brexit break clauses in place. Distribution sites in the UK will be subject to relocation in the Netherlands and elsewhere. Motors, aerospace and financial services will be particularly at risk. The Mini may well move to Munich! When meeting with business groups to discuss Brexit, the overwhelming consensus is to remain and get on with it. Businesses accept, we will have to trade with the EU subject to the same rules, regulations, product and packaging standards as everyone else. Better to remain, have a say and hold sway. There is no alternative to the “Blue Sky nearby”. Back in the UK … growth continues … Retail Sales … Retail sales volumes were up by over 4% in April and values increased by 1.2%. On line sales increased by 9.3%, now accounting for 13.4% of all retail sales. The high street “perfect storm” continues. Higher volume, lower margins with increased online penetration and the complication of multi channel retail with high delivery and return costs. Amazon announced a move into own label food this week! Only at Amazon could own label food margins be attractive. Jobs … A strong set of jobs figures were released from the ONS this week. There were 31.6 million people in work up by over 400,000 on prior year. The claimant count fell. the unemployment rate was 5.1%. Data is confirming labour market conditions are higher than pre recession in 2008. The unemployment rate is 2% lower than the first forward guidance offered by the Governor, on when rates would begin to rise. So what's missing? Earnings growth at 2% remains subdued overall but earnings increased by 8% in the construction sector. Earnings the missing link, for the moment, in the rate rise chain. Inflation … Inflation CPI basis slowed to 0.3% in April from 0.5% prior month. Goods inflation was unchanged at -1.6%. The major change is service sector inflation. Easter timing and travel costs were major factors in the move. The month on month change isn’t really significant. Manufacturing costs both input and output are signalling a major basing action with prices set to rise. Oil prices rallied to $50. Commodity prices are basing. Mining stocks are rallying. The inflation outlook will look very different in the second half of the year. So what of rates? Minutes from the Federal Reserve meeting suggest a June rate rise could still be on the agenda. Either way, markets expect at least two rate U.S rate rises this year. We still expect UK rates to be at least 0.75% by the end of the year, with two rate hikes to 1% a further possibility. UK GDP growth of over 2% (2.2% - 2.4%) the backdrop. So what happened to Sterling? Sterling closed up against the Dollar at $1.451 from $1.437 and up against the Euro at €1.294 from €1.271. The Euro moved down against the Dollar to 1.121 from €1.1301. Oil Price Brent Crude closed at $48.47 from $47.76 The average price in May last year was $64.08. Markets, were transfixed - The Dow closed at 17,527 from 17,604. The FTSE closed at 6,156 from 6,138. Gilts - yields moved up. UK Ten year gilt yields closed at 1.47 from 1.44. US Treasury yields moved to 1.86 from 1.73. Gold closed at $1,255 from $1,273. That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline and download The Saturday Economist App! Our review of the Brexit facts and figures out now! Download Here! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed