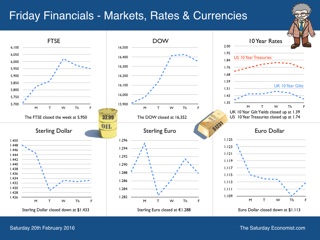

Worried about deflation, then consider a move to Caracas. The rate of inflation in Venezuela increased to 180% in 2015. Prices could double again and more by the end of this year as the currency is devalued and petrol prices hiked. Food prices are such, a cabbie in the capital, can allocate one day’s earnings to buy three chicken thighs according to the Wall Street Journal. A taxi tip won’t even buy a chicken toe In Caracas these days. Be careful what you wish for … UK Inflation … In the UK we don’t have to worry about deflation or inflation for that matter, at least for the moment. Inflation CPI basis increased to 0.3% in January. Goods inflation fell by 1.5% but service sector inflation remained above target at 2.3%. According to the Governor, we will have to wait the statutory two years for inflation to return to target. Ah yes, the mañana mantra of monetary policy. UK jobs data released this week suggest we may not have to wait that long … UK Jobs data … The claimant count fell to 760,000 in January as vacancies increased to 776,000. There are now more vacancies than claimants available for the job slots! Levels are lower (claimant count) and higher (vacancies) than pre recession. There were 31.4 million people in work, that’s 521,000 more than a year earlier. The employment rate is the highest since records began. The unemployment rate fell to 5.1% that’s lower than last year (5.7%) and lower than the highs of 2007 and 2008. (5.2%). The jobs market data is screaming for rates to rise as the labour market is flashing clear signals of overheating. Remember forward guidance and the 7% hurdle rate? Earnings ... Earnings remain something of an anomaly. Apparently, average weekly earnings in the final quarter of the year increased by 2% down from 3% in the third quarter. Why are earnings falling as the job market tightens and recruitment difficulties increase? It doesn’t make sense. Remember earlier in the year when vacancies where falling? That didn’t make sense either. Data revisions eliminated the slow down. Vacancy levels had actually increased. So it may well be with the earnings, expect some revision to the numbers. Then the MPC stance will have to change. Consumers are confident and continuing to spend … Retail Sales January … Retail sales in January increased by 5.2% in volume terms up by 2.3% in value. Internet sales increased by over 10% in the month accounting for 13% or all retail sales. Online sales for department stores increased by over 25%, such is the value of a strong multichannel proposition. The latest GfK consumer confidence data suggests households remain confident about the economy and consider it remains a good time to spend. So don’t worry too much about the prospects for the UK economy this year. Some of the spending filtered in to the Chancellor’s coffers in January … Public Sector Borrowing … Public sector borrowing was in surplus £11.2 billion, last month, that’s £1 billion more than last year. Year to date, borrowing fell by $10.6 billion compared to prior year, to a level of £66.5 billion. Latest projections suggest borrowing will be around £79.5 billion compared to £91.9 billion last year. The Chancellor will struggle to hit target but so what! Total debt fell to just under £1.6 trillion, approximately 80% of GDP. Half the debt held by the Old Lady of the Threadneedle Street and the “Kindness of Strangers” but for how much longer at yields sub 2%? So What of Rates … Sir Jon Cunliffe, Deputy Governor of the Bank of England, warned this week, the economic data did not suggest rates would remain on hold into 2017. The next move in UK rates will be up and sooner than markets expect. Mario Draghi has suggested the ECB may cut rates further into negative territory despite the steady recovery in growth. It would be a dangerous mistake. There is a growing backlash against negative rates amongst the public in Japan and bankers like Morgan Stanley, across the world. Journalists including Ambrose Evans Pritchard at the Telegraph, Oliver Kamm at the Guardian and Simon French in The Times today are openly critical of negative rates. This is no time to be experimenting with the world economy. It is time to call for a treaty of the Non Proliferation of Negative Interest Rates before too much damage is done. There were tentative moves towards a cap on OPEC production this week, the Iran intransigent for now. Sooner or later OPEC will make the move and oil prices (and inflation) will rally. Say No to NIRP on Planet ZIRP. It really is time to leave Planet ZIRP avoiding the lure of the NIRP Crevasse. If Yellen continues to tighten policy, the UK will surely follow, despite the market myopia. So what happened to Sterling? Sterling closed down against the Dollar at $1.433 from $1.448 but was unchanged against the Euro at €1.288. The Euro moved down against the Dollar to €1.113 from €1.124. Oil Price Brent Crude closed at $32.99 from $33.08 The average price in February last year was $58.1. The deflationary impact continues with some strength. Markets, rallied - The Dow closed at 16,352 from 15,910. The FTSE closed at 5,950 from 5,707. Gilts - yields moved up but not much. UK Ten year gilt yields were at 1.39 from 1.38. US Treasury yields moved to 1.74 from 1.71. Gold closed at $1,231 ($1,236). That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline or download The Saturday Economist App! The easy way to keep in touch, we always keep you in the picture. John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed