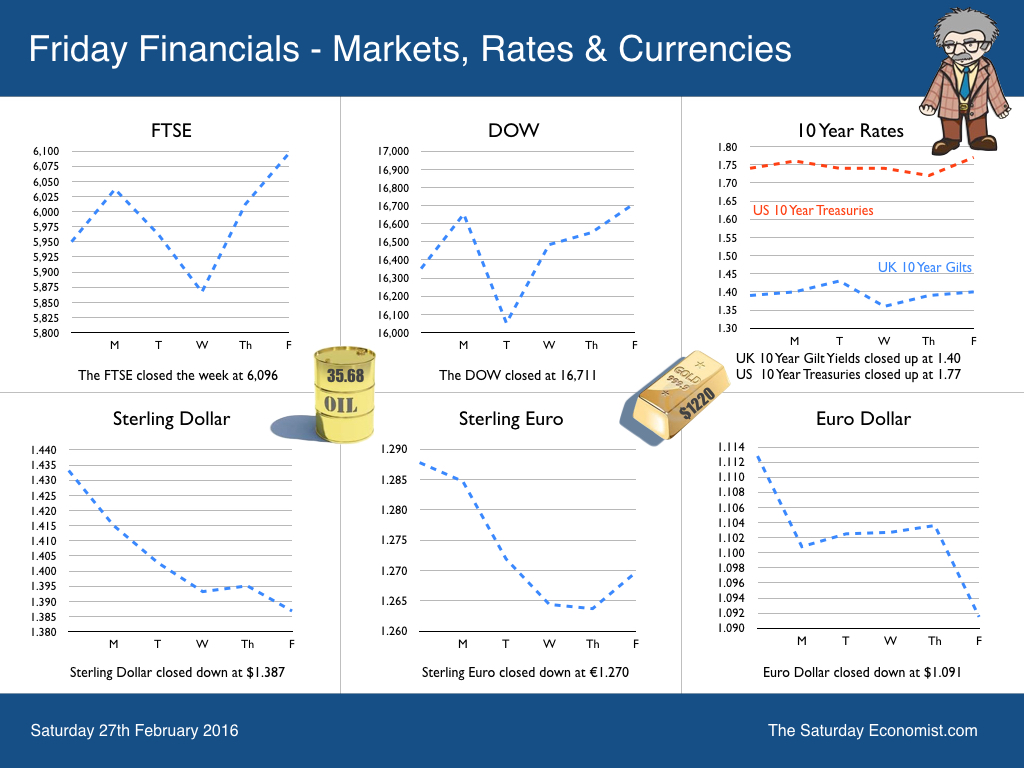

Sterling closed down against the dollar this week at $1.387 compared to a 2015 average of over $1.52. It’s a big move. Boris Johnson's call for Brexit allegedly to blame as The Mayor of London became Enemy of the State despite naming Crossrail, the Elizabeth line. The Brexit debate is warming up. Writing in the Telegraph Dr Gerald Lyons suggested the EU is like the Titanic. We need to jump off before it sinks. Gerard is economic adviser and now swim coach presumably to the Mayor of London. The Economist, on the other hand, headlined - leaving the EU would hurt Britain, and deal a terrible blow to the West. The G20 Finance Ministers meeting in Shanghai this week concluded Brexit would pose a risk to the world economy. It’s set to be a great four months of debate and sound bites. Can’t wait for the cant and rant to hot up. So what happened in the USA … So was Boris really to blame for the Sterling demise? Not really. The short term fundamentals are in favour of the dollar with the UK currency under pressure. The latest data from the Bureau of Economic Analysis confirmed US growth in the final quarter was slightly stronger than first thought. Growth for the full year of 2.4% in 2015 was unchanged but data suggest the US will get off to a stronger start in the first quarter 2016, than expected. Last week the Bureau of Labor Statistics reported, the US all items CPI index increased 1.4% in January before seasonal adjustment. This was up from 0.7% in December. US inflation is on the move, despite the strength of the Dollar, and the weakness of commodity and energy prices. The US Labor market is tightening. The Fed will be forced to act accordingly. Nothing has changed in the US to suggest the “Blue Dot” projections of steady rate rises through this year will not continue. Hence the strength of the Dollar and the high probability the Bank of England will be forced to make a move early in the current year in response. For the moment, Sterling looks over sold. We expect a near term rally to $1.42 in response ... Back in the UK … The ONS released the second estimate of GDP for the final quarter of last year and 2015. Growth was marginally better than expected in the last three months but not enough to warrant a revision for the year as a whole. UK growth in 2015 was 2.2% down from 2.8% prior year. The service sector continued to drive the recovery with growth in distribution, hotels and leisure up by 4.8% followed by transport, storage and comms up by 4.2%. Construction growth slowed to 3.4% compared to 7.5% prior year. Manufacturing output was down by -0.2% compared to almost 3% growth in 2014. So much for the march of the makers and on shoring for that matter. Is the economy rebalancing? Not really! Household spending and investment increased by 3% and 4.2% respectively in the year. The net trade position deteriorated further as export growth of 5% was offset by over 6% growth in imports. It’s a familiar story of service sector driving the recovery but with strong contributions from construction, investment and household spending. The trade deficit and current account deficit will continue to present a challenge to policy. The risk of negative capital flows, will put pressure on the Bank of England to hike rates. The kindness of strangers will have a price to pay in the end. So what of 2016 … The consensus for the UK economy is for growth of 2.2% in the current year. We are more optimistic and still expect growth of 2.5% based on our GDP output model. The full forecast will be released next week. Growth in the service sector will continue supported by strong household spending. Manufacturing output will recover slightly but construction growth will slow when compared the strong performance in the first half last year. So what of rates … US rate rises will continue into 2016. Negative rates will be reversed in Europe and Japan. The Bank of England will be forced to act this year, as growth continues, the labour market tightens, earnings increase and inflation trends return. So what happened to Sterling? Sterling closed down against the Dollar at $1.387 from $1.433 and down against the Euro at €1.270 from €1.288. The Euro moved down against the Dollar to €1.091 from €1.113. Oil Price Brent Crude closed at $35.68 from $32.99 The average price in February last year was $58.1. The deflationary impact continues with some strength. Markets, rallied - The Dow closed at 16,711 from 16,352. The FTSE closed at 6,096 from 5,950. Gilts - yields moved up but not much. UK Ten year gilt yields were at 1.40 from 1.39. US Treasury yields moved to 1.77 from 1.74. Gold closed at $1,220 ($1,231). Not much excitement for the old relic. That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline or download The Saturday Economist App! The easy way to keep in touch, we always keep you in the picture. John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed