|

Tectonic Plates Have Shifted ...

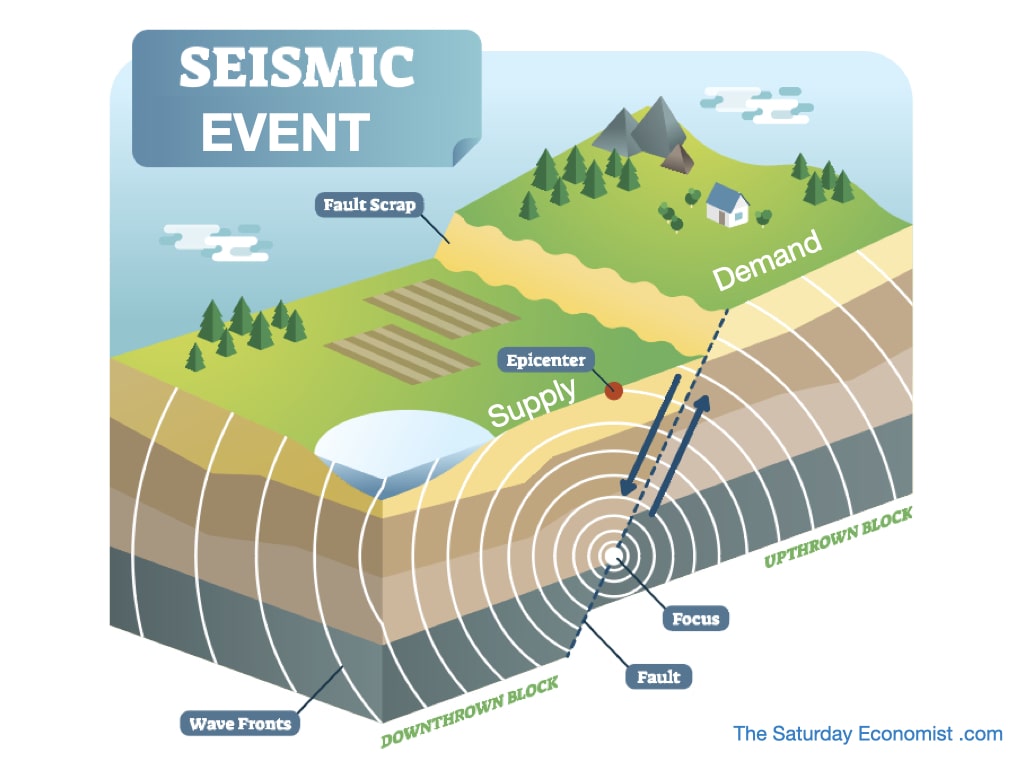

Two early morning sessions this week. It was our Quarterly economics update with Protiviti and Robert Half on Thursday. On Friday, we were presenting at the ICAEW Virtual Economic Summit. The challenge, how best to explain the vagaries of recovery with concerns about supply shortages, recruitment difficulties and energy cost spikes. Questions about possible stagflation were in the "virtual" room. Concerns were expressed about growth and recovery prospects. The situation was complicated by the jobs survey data, this week. Unemployment fell to 1.5 million. Vacancies increased to 1.1 million. The unemployment rate fell to 4.5%. The earnings rate slowed to 7.2%. The furlough scheme closed at the end of September. The expectation is most of the estimated one million on furlough, will be absorbed back into work or into the workforce more generally. The IFS worst case scenario is that approximately 300,000 may form part of a frictional adjustment in unemployment to be absorbed over the next six months. On Thursday, the latest estimates of growth were released for the UK economy. In the second quarter, growth is estimated to have risen by over 24%. It is now clear growth in the third quarter will be 7% year on year. Assuming growth slows to around 5% in the final quarter, the year on year performance will be over 8%. Accommodation and Food expanded over 25% year on year in Q3. Transport and storage is growing at over 10%. Construction output will average over 10% in the period. The trend rate of growth for the UK economy we model at 2%. A fourfold increase in the growth rate, with a tight labour market, supported by the furlough scheme, is leading to labour and supply constraints not just in the UK but around the world. There are four critical phenomenon ... 1 The Covid pandemic was a seismic event creating a shock to output in the UK and world economy in 2020. 2 The strong recovery has revealed a tectonic shift in supply and demand plates in the world in 2021. Supply streams are struggling to get back on line and into line with the dramatic demand surge. 3 Energy costs and commodity costs are spiking as demand returns to a world economy growing at 6% p.a. 4 Lock down and WFH has generated for many a fundamental reassessment of work life balance. Quality of life issues abound. 4.5 million quit their jobs in the USA in August. Recruitment difficulties are endemic as jobs growth pressures increase. So what of inflation? CPI inflation is expected to peak at around 4% before easing back from the second quarter next year. Inflation is always and everywhere a transitory phenomenon. No real expectation of an early rate rise. The shift in tectonic plates will continue to "shake" the world economy. No need to hide under the furniture, a chance to recognise strong growth and the challenges and opportunities that presents ... All At Sea ... Much talk of supply side constraints at the ICAEW event last week. No surprise really. World trade increased by 22% in the second quarter. Growth is expected to be 15% for the year as a whole. Trade fell by 14% in Q2 last year. Container capacity was cut by 10% as a result. Shipping pressures are evident. Supply networks are all at sea. Freight costs have surged. China to the West coast peaked at over $20,000 dollars in September. Prices have eased back to $15,000 dollars since then but still well above the $5,000 average at the start of the year. Lead times are increasing. The gap between order and delivery for "chips with everything" increased to a record 22 weeks in September from 12 weeks in January. Lead times for container shipments have increased from 60 days to 70 days. Congestion at port is increasing. In Los Angeles, 29 ships are in port with 38 waiting to dock. In HK Shenzen, 39 are in port with 67 out at sea. In Shanghai, 86 are in port with 61 at anchor. This week Maersk redirected container ships away for Folkestone to avoid excessive delays ... Once in port, containers are piling up on the docks. A shortage of HGV drivers is creating problems to clear the decks. In the US President Biden is urging the ports to work 24/7 to clear the backlog. In the U.K. the government is increasing visa allocations for elves and sleigh drivers to ensure Christmas is delivered on time. Strange to think I had a couple of weeks off in August. It all seemed so predictable and straightforward. Not a Black Swan in Sight ... A reminder, when all the plates are spinning nicely, it's either the end of the act or an illusion ...

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed