|

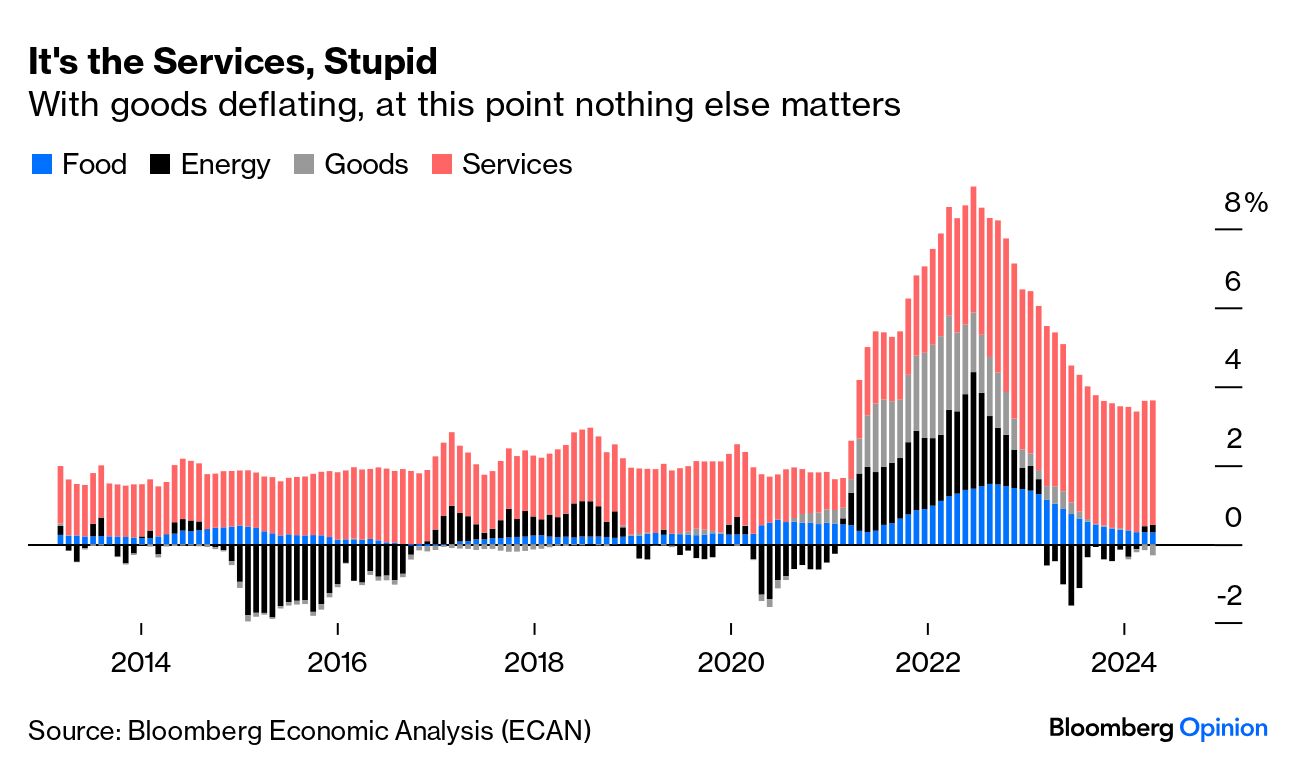

U.S Rate Cuts Could Come In September ... Traders appear increasingly confident, the U.S. Federal Reserve could start cutting interest rates as early as September, as inflation data cooled more than expected in April. Jerome Schneider, head of short-term portfolio management at PIMCO, said on Thursday, the latest U.S. inflation data confirmed to investors the potential for a near-term rate hike was now off the table. The next move will be down. John Authers, Points of Return, Bloomberg this week explained the market dilemma. "There was white smoke over the Bureau of Labor Statistics on Wednesday morning. The key measures of consumer price inflation for April confirmed expectations for a slight decline, and alleviated growing anxiety over a possible re acceleration. [Inflation CPI basis eased to 3.4% in April from 3.5% prior month.] The numbers could easily have been worse, and after a month in which prices had discounted growing risks of inflation, the direction of travel on markets made total sense. Bond yields should come down a little in these circumstances, while equities are reinforced. It is, however, reasonable to question whether these numbers were any kind of a turning point in the battle against inflation. To start, this "beautiful" chart generated by Bloomberg Economic Analysis breaks CPI into four major components; food, fuel, other goods, and other services. Two years ago there were major shocks to the prices of goods, food and energy, all of which have now dissipated. That's why inflation is much lower now. The problem is that services inflation remains stubbornly high, and accounts for substantially all of headline inflation at this point." "The Atlanta Fed's sticky price index, concentrates on goods and services whose prices take a while to change and seldom fall. This is inflation that's particularly difficult to reverse, and so any rise will make the central bank uncomfortable. It is coming down, but very slowly, and it remains above 4% level. Taken together these confirm that disinflation is still happening while there is no sign of an outright acceleration. So rate hikes look very unlikely. But cuts in the near term can also be ruled out as several key measures are sticky and remain too high." Markets expect the first U.S. rate cut in September, with two possible rate cuts before the end of the year. It remains to be seen if the Bank of England will move ahead of the Fed ...

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed