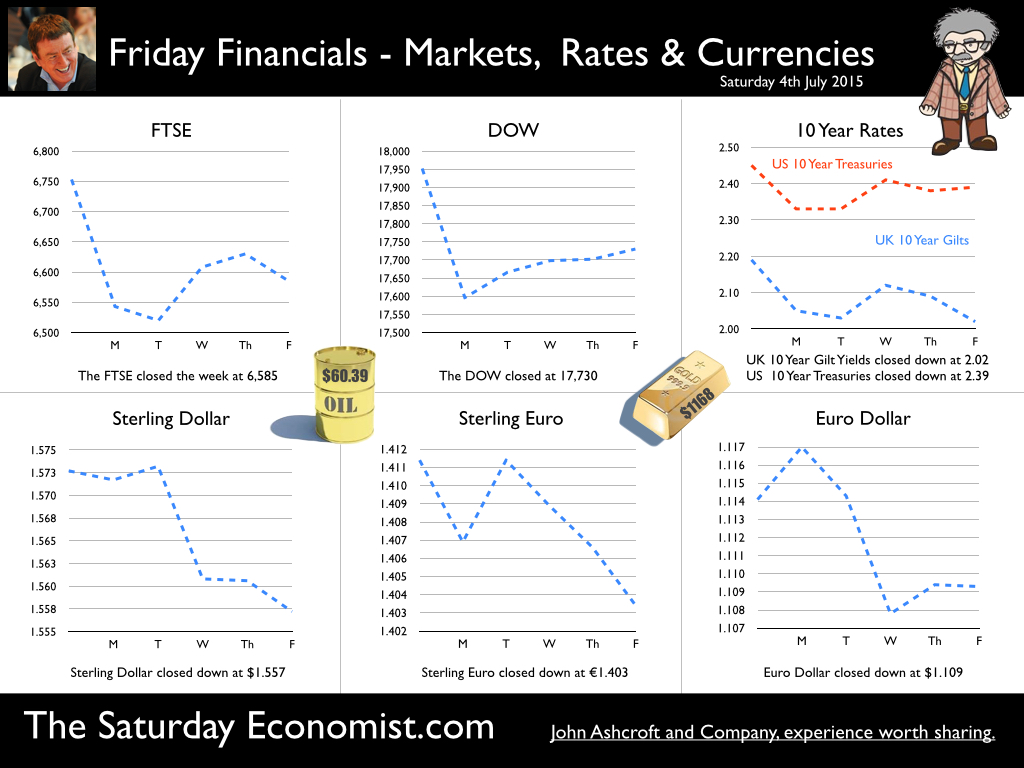

The ONS released the latest data on the UK economy this week. Growth in 2014 was revised up to 3%. Growth was also revised up to 2.9%, in the first quarter of this year, from the previous estimate of 2.4%. The collapse in construction output in the first quarter was revised to reveal growth of just over 4%. The SADD (Seasonal Adjustment Deficit Disorder) continues in the construction data set. The service sector continues to drive growth in the economy, with private service sector growth over 4%. Manufacturing output continues to languish with growth of 3% last year slowing to just 1.4% in the first three months. For the year as a whole, we expect UK GDP growth of just under 3% slowing only slightly into 2016. We have updated our UK Economic Outlook (July edition) to reflect the latest data release. The Bank of England having reduced the growth forecast from 2.9% to 2.5% in the latest inflation report, will have to revert to the February estimate as a result of the construction data revision. Will this change the outlook for interest rates amongst MPC members? - Inevitably. Household spending is driving the recovery with a 3.4% surge in spending evident in the first quarter. Investment trends continued with growth of 5% in the first quarter. We expect the economy to flourish in the second half, in this, the year of the Lilies. Low inflation, Low interest rates and an earnings surge are pushing spending and growth in the economy. The Treasury will benefit from higher tax receipts and lower unemployment in the short term. The trade deficit and current account deficit the only manifestations of malaise in a booming economy. So what of survey data? The latest survey data from the CBI was positive. Rain Newton-Smith, CBI Director of Economics, said: “Activity over the latest quarter as a whole has been good. We expect the economy to sustain a solid pace of growth over the remainder of the year as lower oil prices and inflation continue to boost real incomes and consumer spending.” Ah yes The Year of the LILIES! The Markit/CIPS UK PMI® data for June were released this week. Construction sector output growth rebounds to its fastest rate for four months in June the headline. Services growth was sustained at marked pace. Manufacturing was the odd one out. Growth slowed to a 26-month low. Don’t get too gloomy, the Index fell to 51.4 in June, down from a revised reading of 51.9 in May. The PMI remained above the neutral 50.0 mark. Still in growth territory but at a slow rate. There has been some concern about export performance in the sector despite the slow recovery now taking place in Europe. Our more detailed analysis of sixty sectors in manufacturing suggests a stronger performance for the year as a whole. But not much - just over 2% growth this year and next. Slightly below trend rate. Interesting Jaguar LandRover announced this week, outsourcing to Austria. Over the past five years, Jaguar Land Rover has doubled sales to more than 462,000 vehicles, doubled employment to more than 35,000 people and invested more than £10 billion in new product creation and capital expenditure. The company has invested heavily in its UK vehicle manufacturing facilities at Castle Bromwich, Halewood and Solihull to support the introduction of 10 all-new vehicles, including the Jaguar XE, Jaguar F-Type, Range Rover Evoque and Land Rover Discovery Sport. Nevertheless, growth and capacity absorption is pushing output into Europe ahead of new capacity coming on stream in Brazil and China. Overall - UK car registrations will be around 2.6 million this year, manufacturing output will struggle to hit the 1.6 million mark. The trade deficit in cars (and goods) will continue to haunt the rebalancing agenda. So when will rates rise? … In the US, September remains the favourite for the first rate rise with a further rate rise quite possible before the end of the year. In the UK, the latest growth revisions will ensure the hawks begin to flap their wings despite the low inflation outlook. We expect a UK rate rise within three to six months of the first Fed move. Don’t rule out a UK rate rise before the end of the year. So what happened to Sterling this week? Sterling moved down against the Dollar to $1.557 from $1.573 and moved down against the Euro to €1.403 from €1.411. The Euro moved down against the Dollar to €1.109 from 1.114. Oil Price Brent Crude closed at $60.39 from $63.23. The average price in July last year was $106.77. The deflationary push continues. A $75 - $80 recovery by Q4 remains the base case in our outlook forecast. Markets, were troubled. The Dow closed down at 17,730 from 17,952 and the FTSE closed down at 6,585 from 6,753. Gilts - yields fell. UK Ten year gilt yields moved to 2.02 from 2.19 US Treasury yields moved to 2.39 from 2.45. Gold moved up to $1,168 ($1,170). That’s all for this week. Don’t miss the Great Manchester Economics Conference in October. The Agenda is now up on the web site. The Early Bird deal is now open. The FIRST one hundred tickets save over £50. Check out the web site Sign up and Save. The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed