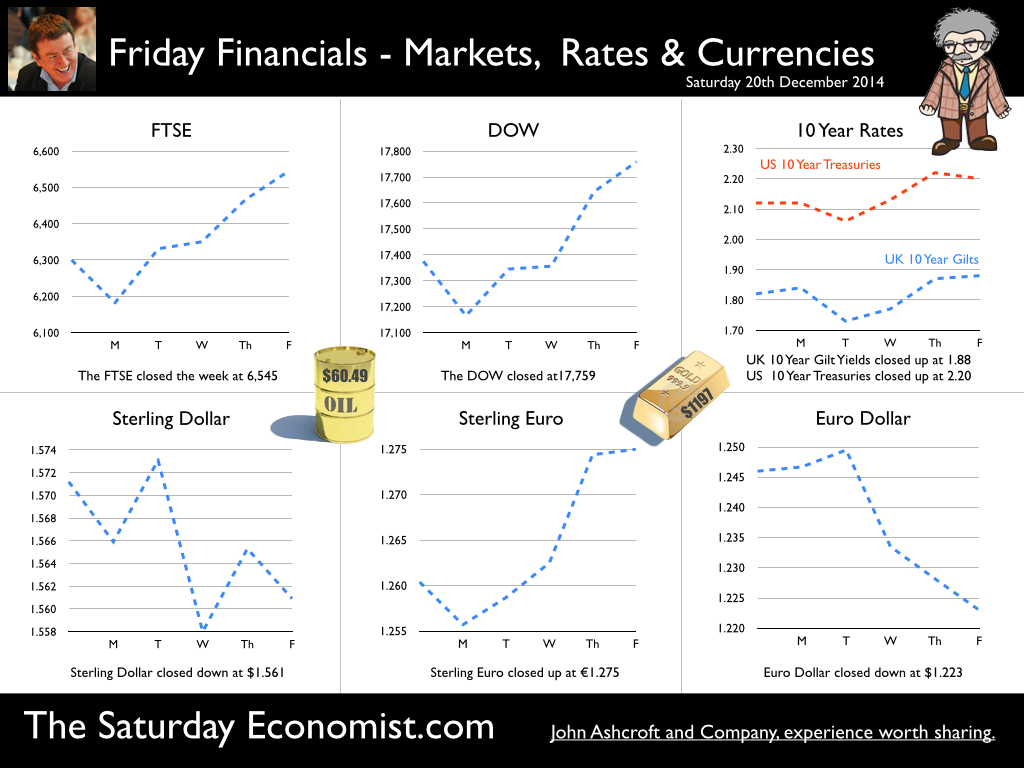

Merry Christmas and a Happy New Year … This will be the last Saturday Economist of 2014. We will take a short break over Christmas and be back in the New Year on the 4th January. My thanks to everyone for their support and re tweets this year. The prof and I wish you all a Merry Christmas and a Happy New Year to you and your families. Fifty years of economics … I love economics. Did I mention, this year marks the 50th year since I first picked up an economics text book? It was September 1964. I had been fast tracked to take A levels a year early. I was sixteen years of age. The text book was Lipsey, the concepts were complicated. We had to learn many of the ideas “parrot fashion”. Neither students or staff really understood some of the basic ideas. No surprise, so many ideas were invalidated in the years that followed. Keynes had modeled a closed economy with little or no home ownership. Consumer spending and the marginal propensity to consume were constrained by ration coupons and the lack of dollars to trade abroad. Home heating costs were minimised by raids on slag heaps, rather than rates of fossil fuel extraction in far off lands. Economics theory can lead to mis direction … Economics theory often leads to misdirection. An understanding of the real economy constrained by theory at odds with reality. The output gap, the meandering NAIRU, the Vertical Phillips curve, the J curve. I have never understood the IS/LM curve. How a trade deficit reflects a surplus of investment over savings, or is it the other way round? I never really understood. Or how Savings equals investment, (as long as we don’t borrow from abroad). Interest rate theory and inter temporal theories of consumption at odds with the spending constraints of highly indebted mortgaged households, as interest rates rise with a fiscal rather than a monetary dimension. The Saturday Economist … In our work we have explained why depreciation does not resolve the problem of the UK balance of payments deficit. Why low interest rates do not lead to a surge in investment and how inflation is (currently) always and everywhere an international phenomenon. The re balancing agenda a fools errand. The march of the makers rebuilding the workshop of the world, a quixotic call to action. We ask - what colour are the eyes of a Yeti? A better quest, to find solution, than the dimensions of the capacity gap or vagaries of the savings ratio. Productivity dilemma … much ado about nothing … Now we challenge the concern about productivity. It has a Shakespearean dimension. It is much ado about nothing! Does productivity really matter in a service sector economy? Not really! What does higher productivity actually mean? White vans drive faster, with a greater load in the back? Waiters serve more tables. Hotels push more beds into rooms. Cleaners clean faster. Security guards, guard more? Productivity per hour enhanced by films fast forward in Odeon cinemas everywhere. Bingo callers shout out two numbers at a time improving leisure productivity in the process. Productivity is important in manufacturing … Productivity is important in manufacturing, especially manufacturing with international exposure. It is one of the great KPIs. But in a service sector economy is it so critical? Not really. In a service sector economy, productivity is an output of, not an input to, growth. We measure productivity by dividing output by employment. A Cobb Douglas production function, as relevant and informative, as a recipe for nail soup. For those who suggest that the UK has a lower level of productivity compared to our European competitors? We simply ask, what exchange rate was used in the translation? Productivity will return to trend … The productivity dilemma will unwind as sustained growth returns. Productivity is a function of output divided by employment, not the other way round. Normalised rates of growth will return as growth continues. The good news about all this? Productivity is not a constraint to growth for the UK economy in the years ahead. We expect strong growth to continue at trend rate (2.7%) for the next two years at least! And the colour of the eyes of a Yeti? They are brown like the leaves in Autumn, even on Planet ZIRP. Better Borrowing Figures but still much to be done if OBR targets are to be met … The Chancellor will be smiling this week. Public Sector borrowing was £14.1 billion in November 2014, a decrease of £1.6 billion compared with November last year. Year to date, borrowing was down by £0.5 billion to £75.8 billion. Last month the OBR forecast the deficit would fall in the current financial year to £91.3 billion. There is still much to be done. Great emphasis is placed on January tax receipts but November’s revenues were heading in the right direction. November was a good month for the Chancellor, receipts were up by over 5% as expenditure was contained to just 1%. Income tax receipts increased by over 4% and VAT revenues were up by 3%. For the year as a whole, revenues still appear weak up by just 2%. However, last year’s figures included some £12 billion of dividends from the APF programme, down to just £8.7 billion this year. It will look pretty good for the Chancellor come May 2015. Retail Inflation CPI … Inflation CPI basis fell to 1.0% in November from 1.3% in October. Falls in transport costs (notably for motor fuels and air transport) were the main contributors to the slowdown in the rate of inflation between October and November. The Governor will not be writing a letter to explain why inflation is below target this month but it must have been a close run thing. Low oil prices will contribute to lower inflation in December and January but as always we caution on the high rate of service sector inflation. Service sector inflation in November was 2.4%. Goods inflation was negative at -0.2%. Smokers with kids in private school continue to pay much more with the cost of tobacco up almost 8% and education costs increasing by 10%. Producer Prices … The price of goods bought and sold by UK manufacturers continued to fall in November. This was due to falling prices for crude oil, petroleum and food products. The output price index for goods produced by UK manufacturers fell 0.1% in the year to November, compared with a fall of 0.5% last month. The overall price of materials and fuels bought by UK manufacturers fell 8.8% in the year to November, compared with a fall of 8.4% last month. Crude oil prices fell by 25% as total fuel costs fell by 5%. Food costs fell, along with the price of imported chemicals. As the oil price Brent Crude basis continues to unwind, the soft pressure on manufacturing prices is set to continue for some time yet. Here again we caution, the oil price fall is just for Christmas and not for life. Check out our Chart of the Day on the speculative bubble map! Prices will bounce back in 2015. Inflation is likely to be ahead of target by the final quarter next year. Retail Sales - Black Friday and falling prices produce retail boom in November … Retail Sales volumes increased by 6.4% in November. The value of sales increased by 4.3% compared with November 2013. Online sales values increased by 12.9% with online now accounting for 11.5% of all retail sales. Average store prices fell by 2.0% in November 2014 compared with November 2013. The largest contribution to the year-on-year fall once again came from petrol stations. Prices in food stores also fell decreasing by 1.0%. Retailers reported a bonanza from “Black Friday”. Price discounts boosted sales at department stores by 16% and household goods stores by 17% year-on-year. The volume of electrical household appliances sold increased at the highest annual rate since records began, up 32.0% on the year. Last year’s Black Friday fell during December. December 2014 volumes may be less exciting as a result. For the year as a whole we expect retail sales volumes to increase by 3.7% in 2014, slowing slightly to 3.5% next year. Earnings are set to increase next year but then so too are base rates. Claimant Count … Unemployment fell by 27,000 in November to 900,000 compared to 927,000 prior month. The rate of unemployment also fell to 2.7% from 2.8% last month. Compared to prior year, the number of people claiming benefits has fallen by 368,000. “If the trend persists into 2016, job centres will be closing in the Spring of 2017, there will be no one looking for work. Immigrants will be press ganged in Calais and dragged over the channel to meet the work quotas.” By Spring 2015, the claimant count will be at the same levels experienced in the first quarter of 2008. Earnings are rising and recruitment difficulties are increasing. The labour market, if not overheating, is certainly hotting up! Vacancies … Vacancies in November, increased to 690,000 the highest level since March 2008. At a level of 692,000, this was the peak of the cycle pre recession. The U:V (unemployment to vacancies) ratio fell to 1.30, a level last seen in June 2008. Earnings are rising … Earnings increased to 1.8% in October single month basis and to 1.6% on a three month average basis. Private sector pay increased by 2.2%. In business services and construction, the increase was near 3%. Unemployment LFS basis (October) … Unemployment LFS basis fell to 1.958 million in October, a rate of 6.0%. The number of people in employment increased to 30.8 million up from 30.2 million in the same period last year [0.6]. The number of employees has increased from 25.6 million to 26.0 million [0.4] and the number of self employed has increased from 4.3 to 4.5 million. Almost all the increase is explained by those working full time. So what can we make of it all? Vacancies are near an all time high compared to the pre recession period. The U:V ratio is within 10% of the pre recession peak and by Spring 2015, the claimant count will be at the same levels experienced in the first quarter of 2008. Earnings are rising and recruitment difficulties are increasing. The labour market is tightening at odds, the scenario at odds with base rates at 0.5%. Oil Prices - The speculative bubble map returns … In June 2008 as the oil price headed for $200 dollars per barrel Brent Crude basis, we called the price down. The black gold price move was an exact overlay of the Speculative bubble map. We cautioned and advised prices were heading lower. In 2014, the demand fundamentals are little changed, despite the slow down in world growth. The supply side dynamics from US shale have changed but not that much. The increase in output does not warrant the 50% fall in oil prices. A wider dimension is at work. Geo political guesswork about, sheiks versus shale, east versus west, the Putin Put, Sunni versus Shiite, all help volatility and the players in the market. The 2014 price move mirrors the 2008 price move [inverted] as our chart suggests. This time the bears have the ring but not for much longer. The Speculative bubble map has returned but sooner or later, so will the fundamentals. [The oil price collapse will mask the inflation threat to the economy in the short term. Weak oil prices are for Christmas but not for life. In the UK with service sector inflation at 2.4%, earnings increasing, inflation will be above target by the final quarter next year. Base rates will be on the rise by September 2015 at the latest.”] So what happened to sterling this week? Sterling closed down against the Dollar at $1.5610 ($1.571) but moved down against the Euro to 1.275 from 1.260. The Euro closed down against the dollar at €1.223 from (€1.246). Oil Price Brent Crude closed down at London close at $60.49 from $61.89. The average price in December last year was $110.76. Markets, rallied. The Dow closed at 17,759 from 17,375 and the FTSE closed at 6,545 from 6,300. So much for 7,000 in the Christmas stocking! Or even New Year? We shall see! UK Ten year gilt yields moved to 1.88 from 1.82. US Treasury yields increased to 2.20 from 2.120. Gold moved down to $1,197 from $1,223. That’s all for this week and for this year! Have a great break over the holiday! John © 2014 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed