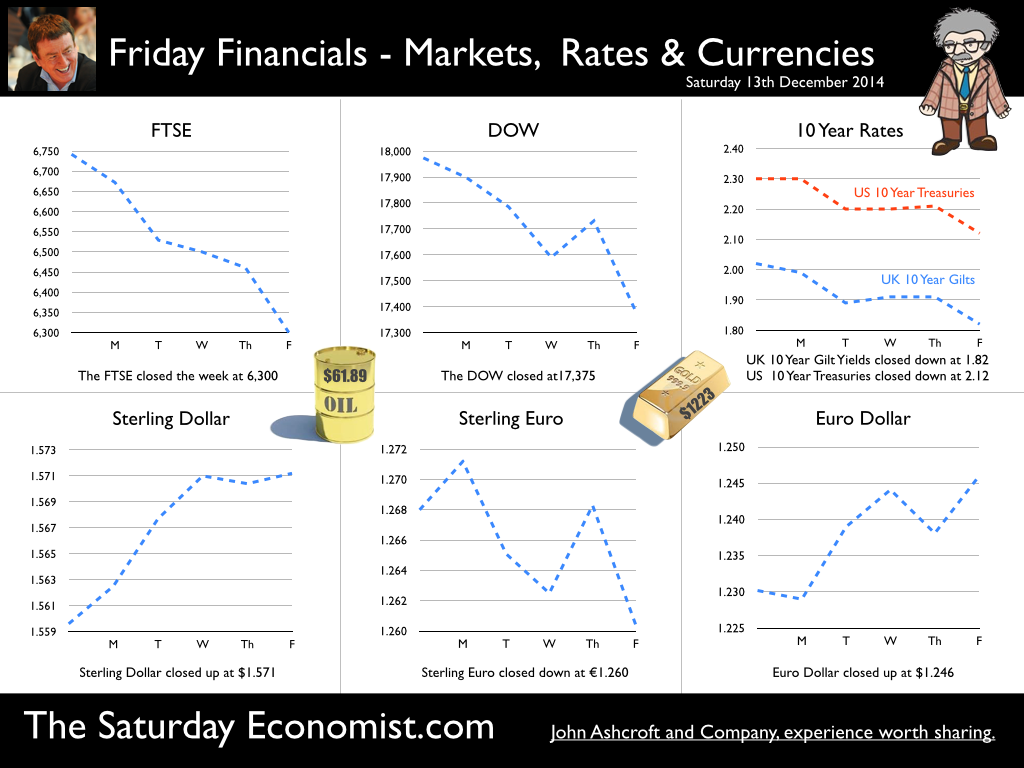

Troubled Oil on calm waters … more later The Manchester Index™ points to strong finish in 2014 … The latest data from the influential Greater Manchester Chamber of Commerce QES survey, points to a strong finish in the final quarter of the year. The Manchester Index™ improved from 32.0 in Q3 to 36.7 in the fourth quarter this year. A strong recovery in the outlook for export orders and deliveries in the manufacturing sector boosted confidence in both turnover and profits. This pushed the index to an all time high in the final reading of the year. We now think, the economy may improve by over 3% in the year as whole, with growth continuing into 2015 at around 2.7% to 2.8%. Manufacturing output increased by just 1.7% in October … Manufacturing output increased by just 1.7% in October following revised growth of just over 2.5% in the first nine months of the year. Should we be too disappointed? Not really. The average growth rate of manufacturing since 1948 has been just 1.5%! Hence the dwindling share of national output over the timescale. So much for the march of the makers rebuilding the workshop of the world and the so called rebalancing agenda. It was never ever going to happen … Capital goods output increased by 2.1% as the strong rally in consumer goods, up by 6.5% continued. Utilities, energy and extractives continue to disappoint. Overall production output increased by just 1.1%. We are revising our forecast for growth in the year from 3.7% to just 2.7% as a result of the revised ONS data. But this may yet, be revised again, as further ONS revisions are made. UK Trade improves in October … The latest UK trade figures released by the ONS this week, showed the trade deficit narrowed in October to £2.0 billion from £2.8 billion in September. A deficit of £9.6 billion on goods, was partly offset by an estimated surplus of £7.6 billion on services. Is that so good? Not really … The slight narrowing this month was driven by movements in “erratics”. Silver exports grew and fuel imports fell by £0.8 billion. For the year as a whole, we now expect the trade in goods deficit to increase to £120 billion from £112.5 billion last year. This is above our estimates earlier in the year but consistent with strong growth in the UK economy offset by the weakness of world trade particularly from a UK trade weighted perspective. The surplus in services will increased to over £85 billion from £79 billion last year. The overall trade in goods and services will be around £35.5 billion, up from £33.7 billion last year. The external deficit at less than 2% of GDP will not of itself present a threat to growth but will present a real threat to those who believe in the rebalancing rhetoric. Construction data disappoints … The conundrum that is construction data continued this month. Output in the sector year on year was apparently flat in October despite an 18% surge in housing output. Infrastructure fell by 11%. However we place little reliance on the accuracy of the monthly data for the time being. Oil Prices … closed at $62 dollars Brent Crude basis this week. The EIA have revised down world demand forecasts in 2015 but expectations of US shale output are expected to rise. Nigerian tankers are turning to Asia as the USA market closes. But the Saudis are unwilling to offer a free berth in Eastern ports to African competition. With OPEC no longer a swing producer, the EIA are forecasting $68 per barrel Brent Crude basis through 2015 and just $62.75 WTI. The tankers are slow to turn around leaving troubled oil on calm waters. [For UK trade, every 10% fall in price Brent Crude is worth about £1 billion to net trade in 2015.] So what happened to sterling this week? Sterling closed up against the dollar at $1.5710 ($1.560) but moved down against the Euro to 1.260 from 1.268. The Euro closed up against the dollar at €1.246 from (€1.230). Oil Price Brent Crude closed down at London close at $61.89 from $69.37. The average price in December last year was $110.76. Markets, fell. The Dow closed at 17,375 from 17,974 and the FTSE closed at 6,300 from 6,742. So much for 7,000 in the Christmas stocking! Or even New Year? Mining and Commodity majors feature in the UK market plus somewhere somehow there may be a few commodity puts and calls to unwind. UK Ten year gilt yields collapsed to 1.82 from 2.02. US Treasury yields fell to 2.12 from 2.30. Gold moved up to $1,223 from $1,192. That’s all for this week. Plans are in place for the Great Manchester Economics Conference in October next year. It’s a great line up. Tickets will be on sale in the New Year. Subscribe to The Saturday Economist for updates and news of early bird ticket deals in due course. Interested in Social Media? Profiled on LinkedIn? Check out our PhD in LinkedIn Guide. In the meantime, join the mailing list for The Saturday Economist or why not forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed