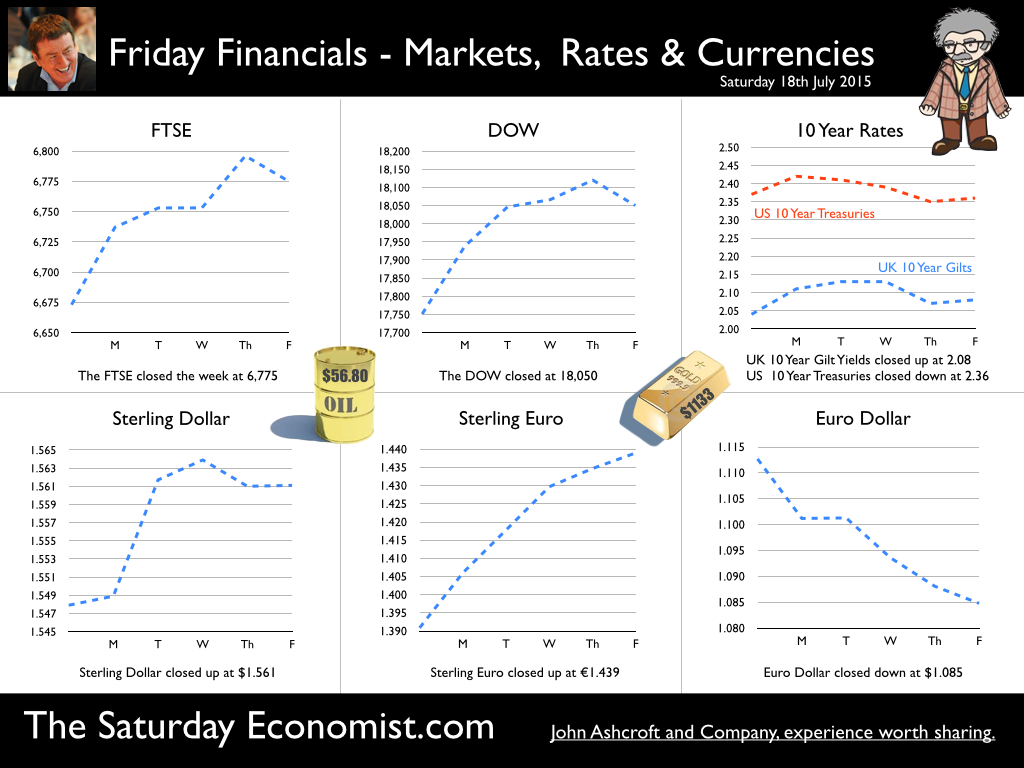

The Governor gave the clearest indication yet interest rates are likely to rise by the end of the year, in appearances in London and Lincoln, this week. On Tuesday, he was in front of the Treasury Select Committee and on Thursday he was in Lincoln, delivering his lecture “From Lincoln to Lothbury, a short study on Magna Carta and the Bank of England. “The time is getting closer of a rate rise” … “the decision as to when to start such a process of adjustment will likely come into sharper relief around the turn of this year”, the message. Magna Carta and the Bank of England … Inflation, public sector finances and bail out problems in Europe featured in the Lincoln speech. Challenges besetting King John in 1215, not King George in 2015. Wage inflation was then, heading for 20%. Money supply was surging. Government finances had taken a massive hit some years earlier. Richard I had managed to get himself trapped in Germany on his way back from the Holy Land. The king was held to ransom by the Germans demanding £66,000 in silver for the bail out. The equivalent of two to three times annual crown income was needed to secure an agreement. The strain on central government finances evident. King John narrowly avoided a VAT hike and currency devaluation. No IMF on the mediaeval landscape. No haircuts on offer despite onerous and punitive terms. Calls for a Lexit [Lionheart exit] unheeded. King John, years later, struggling for cash was obliged to sign the Magna Carta and the rest, as they say is history. Where was the MPC then when needed! bemoaned the Governor. David Miles …. It was clearly a week for signals. David Miles, one of the doves on the MPC reiterated the bank rise message … “We are now close to the time when it is appropriate to raise rates.” he said in a speech given at Resolution Foundation, in London. The dove is shedding his love for life on Planet ZIRP. David Miles will retire from the MPC in August. Six years and no decision on an interest rates rise, remarkable. Inflation … The latest figures for inflation confirmed the headline CPI rate fell back to zero in June. Energy food and commodity prices featured in the move. Service sector inflation was 2% and goods inflation was negative -2%. Expectations remain for inflation to increase by the end of the year as the oil price shock unwinds and earnings increase. The Governor will have to write another letter to the Chancellor but inflation is expected to return to target in 2016. Earnings … Pay is on the rise and how! Earnings increased to 3.2% in the three months to May despite the low level (0.4%) of public sector pay increases. Construction earnings increased by 5%. Private sector pay increased by 3.8%, with significant increases in professional services and the leisure sector. No wonder rates are set to rise. Unemployment data … The latest jobs data presented something of an anomaly this week. Vacancies fell, the claimant count fell but by less than 3,000, the slowest rate for three years. The headline LFS data suggested unemployment increased by 40,000 in the three months to May compared to the three months to April. The headline rate increased from 5.5% to 5.6%. So what does this mean? We can’t be sure yet. It looks like a blip against trend but the slow down in imports and manufacturing activity could also be significant. Let’s hope not. China growth … In other world news, the growth rate in China was confirmed at 7% in the second quarter. Another great benefit of a command economy. No need to worry about China. The Greek crisis abated … time to worry about Puerto Rico and the transmission shock of the imminent US rate rise. So when will rates rise? … In the US, Janet Yellen once again reaffirmed a commitment to raise rates this year .September remains the favourite for the first rate rise with a further rate rise quite possible before the end of the year. We continue to expect a UK rate rise within three to six months of the first Fed move. Last week we warned “Don’t rule out a UK rate rise before the end of the year.” The Governor confirmed the message this week. So what happened to Sterling this week? Sterling moved up against the Dollar to $1.561 from $1.548 and moved up against the Euro to €1.439 from €1.391. The Euro moved down against the Dollar to €1.0853 from 1.113. Rate calls in the US and UK pushed the synthetic lower. Oil Price Brent Crude closed at $56.80 from $58.66. The average price in July last year was $106.77. The deflationary push continues. A $75 - $80 recovery by Q4 remains the base case in our outlook forecast. The rise in US summer stocks may threaten price levels exacerbated by Iranian peace moves and aggressive Saudi oil pumps. Markets, rallied. The Dow closed down at 18,050 from 17,751 and the FTSE closed down at 6,775 from 6,673. Gilts - yields were mixed. UK Ten year gilt yields moved to 2.084 from 2.04 US Treasury yields moved to 2.36 from 2.37. Gold moved up to $1,133 ($1,159). Base rate rise news never great for the ancient relic. That’s all for this week. Don’t miss the Great Manchester Economics Conference in October. The Agenda is now on the web site. The Early Bird deal is now open. The FIRST one hundred tickets save over £50. Check out the web site Sign up and Save. The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed