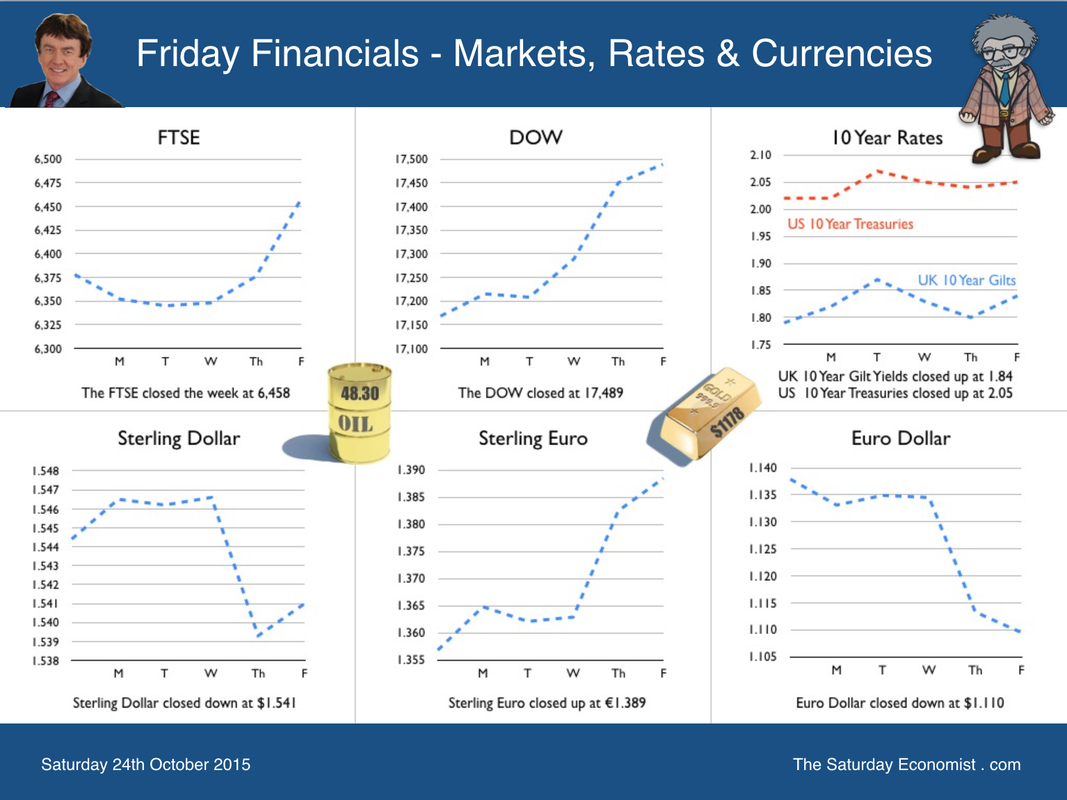

It isn’t every night you get to sleep next door to the President of China. This week President Mr Xi Jinping and Madame Peng Liyuan, were staying at the Lowry Hotel in Manchester, so close. Security intense. helicopters in the sky, dinghies in the river. The walkway bridge over the Irwell closed to passenger traffic and hi vis jackets ubiquitous. The red carpet was out and not just for an important wedding later today. The Silk Road to Wigan Pier has opened, the extension to the West complete. Orwell would have been thrilled. As indeed we should all be. The Chinese are coming, visas permitted and want to invest in the Northern Powerhouse. Chinese Foreign investment is measured in terms of ATM - Access to markets, ATT - Access to Technology and ATR - access to resource. For China the UK is important, not because of markets, technology or resource. Deals on nuclear energy and hi speed rail benefit both. The acquisition of trophy assets like Weetabix and Hamlets flatter. The UK has a revealed comparative advantage in financial services which China seeks to mirror and develop in the years ahead. London as a trading centre for the Renminbi, important for both countries, Britain’s engagement in the Asian Infrastructure Investment Bank, a real prize for the Chinese and for the UK. China is embracing Britain to provide a financial bridgehead in the West. “The UK is the leading offshore trading centre, outside of Hong Kong” President Xi told parliament this week. China seeks to internationalise the Yuan securing a place in the IMF SDR basket. It will one day replace the Dollar as the dominant currency but not just yet. The Bank of England was the first G7 central bank to sign a swap agreement with the Central Bank of China. The first Chinese sovereign bond, worth over $4 billion, was issued this week in London. It is a significant step. This is the start of the “Golden Era” between the UK and China. The Middle Kingdom is returning to the world stage with a policy of benign hegemony. Lest we forget, in 1820, China accounted for one third of world GDP with the largest population (37%) on the planet. Over one hundred years were then lost to foreign invasion, sequestration, famine and pestilence. In the West we have the audacity to lecture on human rights, conveniently forgetting 19th century Opium wars were fought to dump surplus drug stock from the East India Company, in the largest market on earth, in exchange for tea, silks and porcelain. Much cheaper than silver and much more addictive. The lost output worth $ Quadrillions. The potential for China remains huge. 1.3 billion population, with $3.5 trillion of international reserves - the second largest economy in the world. Yet in terms of GDP per capita, the country still struggles amongst the top eighty in the world, such is the challenge remaining, a guide to the growth potential. The new five year plan, out soon, may reveal a lower GDP target growth target of 6.5%. This is a moderate slowdown with little or no chance of a hard landing. Too often we look from the West with eyes conditioned by Stop Go policies stimulating cycles of Boom and Bust. It is a mistake. Lessons from history suggest the Middle Kingdom is returning to a rightful place on the world stage. The potential is awesome still. So what happened in the UK this week … Retail sales in September were up by 6.5% compared to prior year. Beer swilling, curry eating rugby hordes attending the world cup, may have boosted takings in the month. There is no doubt, a strong jobs market, with improving earnings is boosting consumer confidence and household spending. This is the year of the Lilies, with low interest, low inflation and an earnings surge. It won’t get much better than this. On line sales were up by 15%, retail values increased by 2.7%. Base rates at 50 basis points the anomaly against the strong retail sales performance. Time for the MPC to get ahead of the curve. Government Borrowing … Good news for The Chancellor this week as borrowing in September fell to £9.4 billion from £11.0 billion prior year. For the year to date borrowing was down by £7.5 billion as revenues increased by 4% and expenditure wass contained at or around 1%. For the year as a whole, the target is £69.5 billion from £90 billion last year. Our forecast would suggest £73 billion is the current marker but the overall reduction task remains feasible given the strength of income growth and domestic demand. It would be a great achievement pushing borrowing to around 3.5% of GDP. The spending round and the full tax credit programme may be more difficult to justify politically as the economy continues to recover well and the Treasury coffers benefit. So what happened to Sterling this week? Sterling moved down against the Dollar to $1.541 from $1.544 but moved up against the Euro to €1.389 from €1.357 The Euro moved down against the Dollar at €1.110 from€1.138. Oil Price Brent Crude closed at $48.30 from $50.33. The average price in October last year was $87.43. The deflationary push continues. Markets, up this week! The Dow closed at 17,489 from 17,168. The FTSE closed up at 6,458 from 6,378. Gilts - UK yields moved up. UK Ten year gilt yields were at 1.84 from 1.79. US Treasury yields moved to 2.05 from 2.02. Gold moved to $1,178 ($1,181). John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed