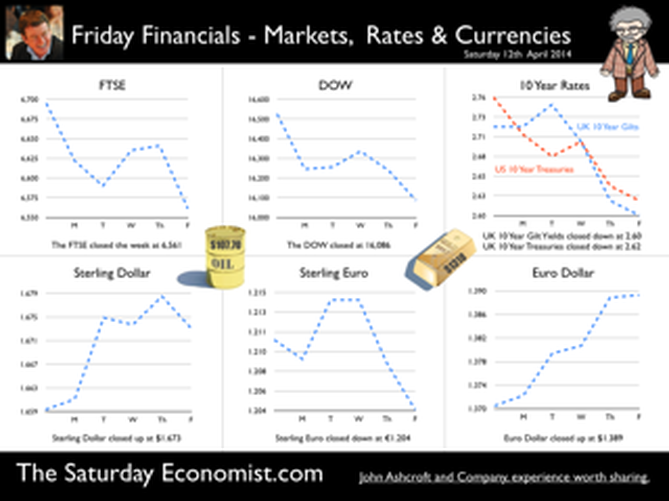

The Chancellor in Washington, lessons for the IMF ... George Osborne was in Washington this week, delivering a speech to the American Enterprise Institute or was it perhaps, a lecture to the IMF? The timing could not have been better. Olivier Blanchard, Chief Economist at the Fund had earlier revised up yet again, the forecasts for growth in the UK. Blanchard, a closet Keynesian and a critic of UK austerity policy, was forced to admit he had been wrong about the need for stimulus to restore growth in the UK economy. Osborne:“Pessimistic predictions that fiscal consolidation was incompatible with economic recovery have been proved comprehensively wrong. Cutting deficits and controlling spending has not choked off recovery but has instead laid the foundations for sustainable growth.” he said. Ouch. “In the UK not only has our growth rate been the fastest in the G7 over the last year, but it is now forecast by the IMF to be so again in 2014 – all despite warnings from some (including the IMF) that our determined pursuit of our economic plan made that impossible.” “Credible fiscal consolidation plans are not only a crucial foundation for effective monetary policy, they are a necessary precondition for sustainable economic recovery.” Hurray! Here we have a Chancellor at the top of his game, on track to be the most successful Chancellor in recent history. Growth up, inflation down, employment up, borrowing down, “building a ladder of opportunity” for people to climb the rungs to “higher incomes and full employment". It could not be better. Even the IMF can find little to worry about in the UK and the USA for that matter. What would the Black Cloud Gang have made of it all? All is well for the Chancellor. Just the trade figures alone will continue to disappoint and so it proved on Wednesday. Trade, Manufacturing and Construction Trade in Goods and Services Seasonally adjusted, the UK's deficit on trade in goods and services was estimated to have been £2.1 billion in February 2014, compared with a deficit of £2.2 billion in January 2014. The deficit appeared to fall in the month but such comparisons are meaningless. For the quarter as a whole, the deficit is likely to be £6.3 billion compared to £5.5 billion in the first quarter last year. For the quarter, the trade in goods deficit will be £27.5 billion compared to £26 billion last year. As we warned last week, the deficit in cars deteriorated by almost £500 million in the month. We expect the deterioration to continue throughout the year. The trade in goods and services deficit will continue to be an overall drain on growth. Manufacturing February Manufacturing figures for the month of February were more positive. Overall growth was up by 3.8% following growth of 3.2% in January. The strong growth in capital goods continued (3.4%) and there was a big pick up in consumer durables output at 5.4%. For the first quarter, growth may average 3.5%. We expect manufacturing growth of 3% to 3.5% for the year as a whole. Construction output The construction output data for the month was a little disappointing. Year on year growth slowed to 2.8% in the month, after the strong January growth of almost 6%. Bad weather and a shortage of bricks, may have held back output in the month. Closer analysis confirms housebuilding, both public and private, increased by 30% and 15% respectively. Industrial and commercial real estate continued to be a drag on the rate of overall new project growth in the sector. Nevertheless, we expect overall construction growth to be around 5% in the first quarter, maintaining a similar level of growth throughout the year. GDP Flash Estimate The strong growth in manufacturing and construction, suggests GDP growth in the first quarter 2014 will be just over 3%. This is in line with the preliminary estimate of GDP according to the NIESR tracker and confirms the strong result from the GM QES Manchester Index®. For the moment we still expect GDP growth to be around 2.9% for the year as a whole slowing to 2.8% in 2015. Access the latest Economic Outlook here. So what happened to sterling this week? The pound closed at $1.673 from $1.658 and at 1.204 from 1.21 against the Euro. The dollar closed at 1.389 from 1.3706 against the euro and at 107.70 from 103.26 against the Yen. Oil Price Brent Crude closed at $107.70 from $106.72. The average price in April last year was $101.2. The energy kicker to falling prices may well be over. Markets, the Dow closed down at 16,086 from 16,413 and the FTSE also closed down at 6,561 from 6,696. UK Ten year gilt yields closed at 2.60 (2.68) and US Treasury yields closed at 2.62 from 2.73. Gold moved higher to $1,318 from $1,302. All very mixed results. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed