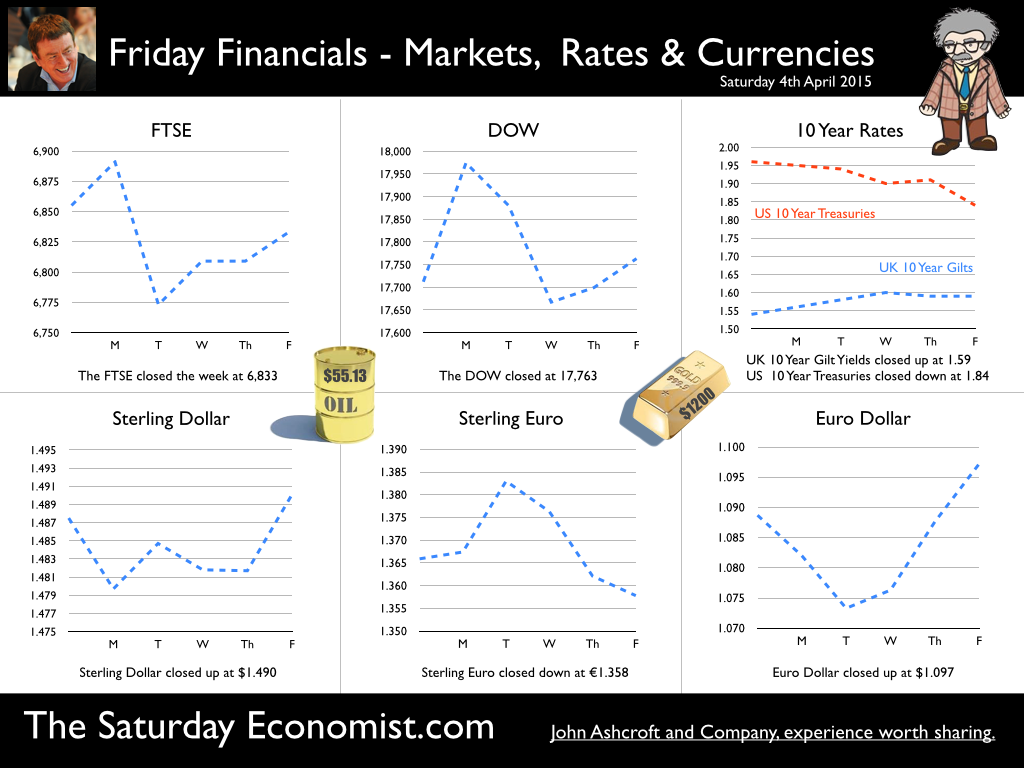

Strong growth revisions suggest rates will have to rise this year … This week, the ONS released the latest data on the Quarterly National Accounts. It was heady stuff. Growth in the final quarter of 2014 was revised to 3% and growth for the whole of 2014 was revised up to 2.8%. There may well be further revisions to come over the next six months, pushing the growth rate for the year as a whole to 3%. Is this important? Well yes. It marks a period of above trend growth. “Periods above trend, come to an end”, usually marked by a switch in monetary policy. 50 basis points and 3% growth do not make for a stable expansion. For the moment, inflation (or lack of it) is always and everywhere an international phenomenon. Markets may believe UK rates will be on hold into 2016. With headline inflation at 0.0%, talk of a rate rise may appear to be premature but last week Mark Carney made it clear, the next move in UK base rates will be up. No forward guidance as to when exactly! Service sector inflation and growth is above target and trend rate … In the UK, service sector inflation is above target rate. The jobs market is tightening (more vacancies than claimants by the time of the election). Wage rates and earnings are set to rise by the end of the year. In the UK service sector growth is above trend rate. Private service sector growth in leisure, distribution and business services increased by almost 4%. Service sector growth continues to drive recovery. Overall service sector growth was 3%. Manufacturing output increased by 2.9% and construction increased by a massive 7.4%. Domestic demand increased by 3.3% over the past year. Household spending increased by 2.5% and investment increased by an impressive 7.8%. Imports increased at a much faster rate than exports. The imbalance - a simple function of relative demand in domestic and export markets. So what of 2015 ... ? Next month we produce our Quarterly Economic Outlook Q2 following release of the ONS preliminary estimates for the first quarter. For the moment we have updated the Q1 forecasts with an April update. Really not much has changed. We think the growth rate and direction of the UK economy will continue from the pattern established in 2014. We forecast growth up 2.9% to 3%, with a strong performance in the service sector (3.1%), construction (5.5%) and manufacturing (2.5%). Household spending will increase by 2.6%. Investment growth with slow to 5.5%. Domestic demand growth will slow to 2.6%. Exports will increase by 2.6% as the European recovery continues. But once again imports will increase at a faster rate (2.9%) than imports. Concerns about 2015 ... ? There have been some concerns about growth in the first quarter following the latest data on manufacturing and construction. Manufacturing growth increased by just 2% in January. Construction growth, up by just 3% cast doubt about the recovery in the housing market. The construction data, beset as it is by some SAD (Seasonal adjustment deficiency ) disorder), will be revised up in future releases. The strong growth in service sector continued in January. Service sector growth increased by 3.2% with growth in leisure, distribution and business services up by 4.2%. The latest PMI Markit survey data, continues to suggest strong growth in the March data. We remain confident about the growth forecast notwithstanding the election uncertainty, pre and post the ballot date. Election jitters will freak markets. Financial markets will react badly to the prospect of a Labour SNP coalition. The twin deficit dilemma would be manifest. An external current account deficit and an internal borrowing requirement of around 5% of GDP do not for stable markets make. Rates may have to rise to defend a currency under threat from international speculators putting pressure on the pound in your pocket! So when will rates rise ... ? Markets still believe the Fed will begin to increase rates later this year. Q3 now the favourite following the slight downward growth revisions for 2015 and the sluggish jobs growth data in March released this week. In the UK the forward OIS curve suggests markets still expect rates to rise in the first or second quarters of 2016. The wait may not be so long … especially if markets take fright. In the UK, we expect growth of around 3% this year. The labour market is tightening, recruitment difficulties are increasing, wage rates and settlements are set to rise. The inflation outlook will be materially different towards the end of the year. We say again, once the Fed makes a move, the MPC will surely follow within the current year …. It really is time to leave Planet ZIRP. Business should begin to book their flights and plan accordingly … So what happened to Sterling this week? Sterling rallied against the Dollar up $1.490 from $1.487 and moved down against the Euro to €1.358 from €1.3660. It was all about the Euro this week. The Euro closed up against the Dollar at €1.097 from €1.089. The push to parity postponed or probably abandoned Oil Price Brent Crude closed down at $55.13 from $56.41. News from Iran pushed prices lower. The average price in April last year was $107.76. The deflationary push continues. Markets, settled. The Dow closed at 17,763 from 17,712 and the FTSE closed down at 6,833 from 6,855. UK Ten year gilt yields moved up to 1.59 from 1.54. US Treasury yields moved up to 1.84 from 1.96. Gold closed up at $1,200 ($1,198). That’s all for this week. Don’t miss The Big Social Media Conference in July and the Great Manchester Economics Conference in October. It’s a great line up for all events! The Saturday Economist, now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed