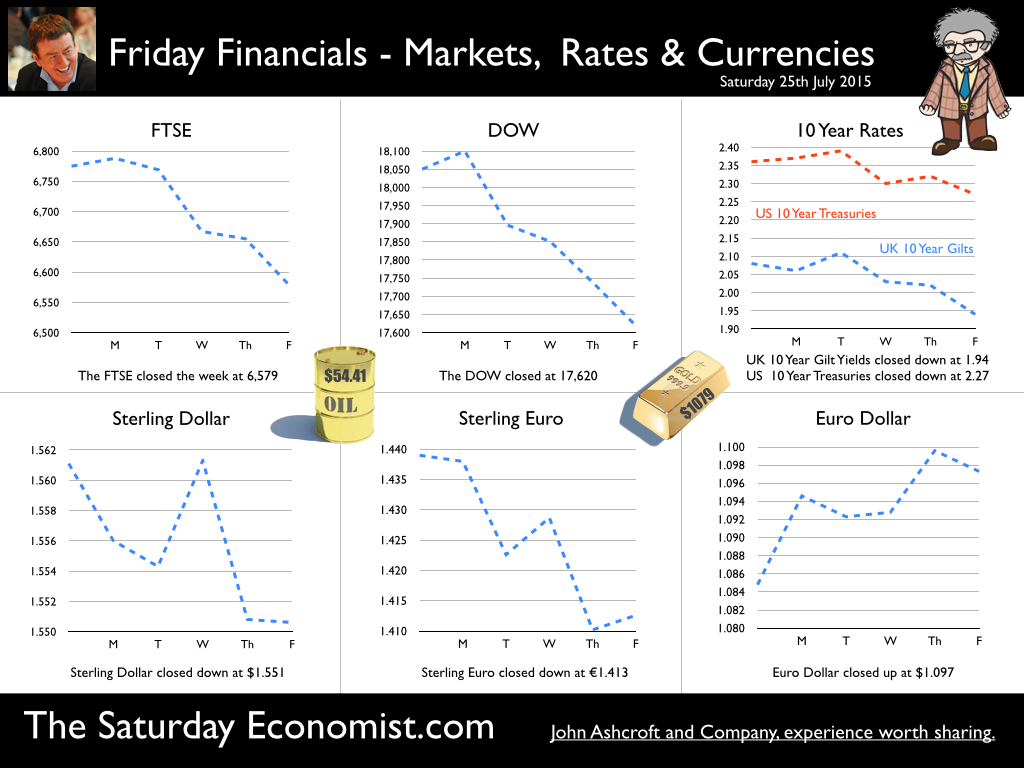

MPC Minutes ... The minutes of the MPC meeting in July were released this week. The decision to keep rates at current levels was unanimous. However, “for a number of members, the balance of risks to medium term inflation was becoming more skewed to the upside.” “For those members, the decision between holding Bank Rate at its current level versus a small increase was becoming more finely balanced.” Is this significant? Yes - it now looks as if Ian McCafferty and Martin Weale have been joined by David Miles in the more hawkish camp. Recent statements from David Miles and the Governor suggest rates could be on the rise by the end of the year. Retail Sales … And why not? June retail sales confirmed the strong growth in consumer spending continues. Sales volumes increased by 4% compared to June last year. Online sales increased by 11.4% accounting for over 12% of all retail activity. Food sales increased by almost 2%. The big beneficiaries - department stores and household goods stores, with sales volumes up by 7%. Is that so good for retailers? More volume means more activity but for lower value. Overall values increased by less than 1%. Oh how the high street would love inflation … boosting margins and the cash take in the process. The pressure continues on conventional retail. Government Borrowing … No pressure on the Treasury as the cash take continues to reduce borrowing. Government borrowing fell in June to £9.4 billion compared to £10.2 billion last year. In the first three months of the fiscal year, total borrowing was just £25.1 billion compared to £31.2 billion last year. That’s a 20% reduction. Higher VAT receipts and Tax charges boosted revenues by over 5%. Current spending actually fell underpinned by cash controls and lower borrowing costs. The average debt coupon in the month was just 3.5% on total debt of £1.5 trillion. The Chancellor is on track to hit the £75 billion target for current year borrowing set by the OBR in March. The July target of just under £70 billion may be more of a challenge. Commodity Prices … Commodity prices took a hit this week as gold came under pressure and copper hit a six year low. Weak PMI manufacturing data out of China cast further doubt on the 7% growth figures. Weaker commodity and energy prices will impact on growth in Australia, Canada, Russia and Brazil if the trend continues. Oil Brent Crude closed at $54.41 casting doubt on further strong price recovery for the rest of the year. So when will rates rise? … The US looks set to move in September and we expect the UK to follow before the end of the year or early next. The minutes of the July MPC meeting confirm the direction of travel. So what happened to Sterling this week? Sterling moved down against the Dollar to $1.5511 from $1.561 and moved down against the Euro to €1.413 from €1.439. The Euro moved up against the Dollar to €1.097 from 1.085. Oil Price Brent Crude closed at $54.41 from $56.80. The average price in July last year was $106.77. The deflationary push continues. A $75 - $80 recovery by Q4 remains the base case in our outlook forecast. Markets, slumped. The Dow closed down at 17,620 from 18,050 and the FTSE closed down at 6,579 from 6,775. Gilts yields - softened. UK Ten year gilt yields fell to 1.94 from 2.08. US Treasury yields moved to 2.27 from 2.367. Gold moved down to $1,079 ($1,133). That’s all for this week. Don’t miss the Great Manchester Economics Conference in October. The Agenda is now on the web site. The Early Bird deal is now open. The FIRST one hundred tickets save over £50. Check out the web site Sign up and Save. The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed