|

Retail sales bounced back in January following a disappointing quarter at the end of 2023. Sales volumes were up by almost 1% in the month, year on year. Sales values increased by 4%.

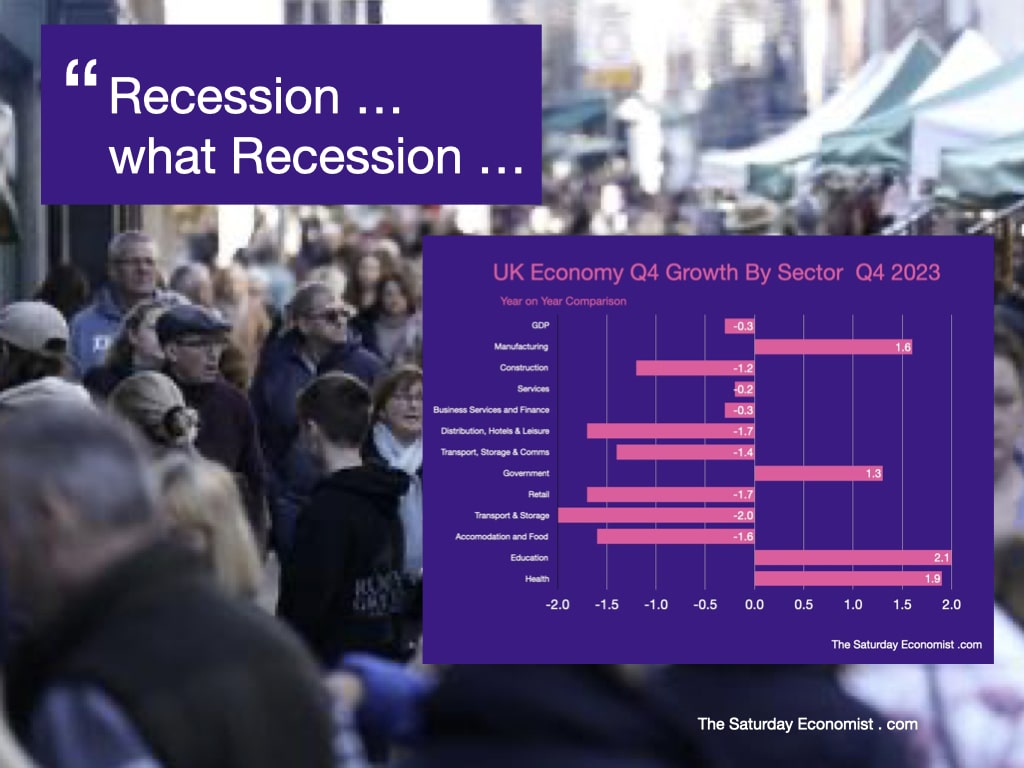

Consumers were spending big on alcohol (27%), music (34)%, computers (27%) and cosmetics (9%). Flowers, plant and seed sales were up by 18%, second hand goods sales increased by 29%. Biggest losers were chemists (-18%) and clothing retailers (-8%) . There is a pattern in there somewhere. Remember "Any explanation is better than none". Nietzsche. So what of the recession? Did you miss it? Markets, journalists and analysis were disturbed by the latest GDP date released on Thursday. The GDP monthly estimate for December 2023 revealed Real Gross Domestic Product (GDP) is estimated to have fallen by 0.3% in the three months to December 2023, compared with the three months to September 2023. According to the ONS, "On a quarterly basis, this gives two consecutive falls in GDP, with a fall of 0.3% in Quarter 4, following a fall of 0.1% in Quarter 3." For some, this constitutes a technical recession, defined as two consecutive falls in quarterly GDP. For purists (and those with pedantic disposition) this is not the case. The definition of recession requires two consecutive falls in quarterly GDP year on year, not quarter on quarter. This did not happen. The so called "technical recession" is in fact a "phantom recession." For the year as a whole, the UK economy is expected to have increased by 0.5% in 2023, compared to prior year. In the first half of the year, GDP increased by 0.6% in Q1 and Q2. Growth then slowed to 0.5% in the third quarter, then fell in the final quarter of the year by -0.3%. It was a strange quarter and a strange slow down. According to the latest employment data, the unemployment rate actually fell to 3.8% in December, the number unemployed fell to 1.3 million from 1.5 million in June. Data hardly consistent with a lurch into recession. Analyze the GDP fall by sector and the pattern becomes even more confusing. Strong growth was experienced in manufacturing and government spending, especially on health and education. Construction output slipped in the quarter, down by 1.2%. We still expect growth of 2.5% in the year as a whole, following a strong performance in the first half of the year and Q3. It is within the service sector down by -0.2% the damage occurred in the final quarter. Retail sales were down by 1.5%, this impacted on transport storage and communications, down by 1.4% overall (1.7% in retail and 2.0% in transport and storage.) In the leisure sector, distribution, hotels and leisure output fell by 1.7%, accommodation and food sales specifically fell by 1.6%. Maybe there is something of a structural change occurring in the sector as consumer spending is redirected. This month, Pryzm night club owner Rekom announced the closure of seventeen venues with the loss of 500 jobs. Students pre-drinking and not going out mid-week is to blame for nightclubs closing, the boss of the UK's biggest club chain has said. New data suggests close to 400 clubs permanently shut down between March 2020 and December 2023, according to the Night Time Industries Association (NTIA). Overall, the UK restaurant industry demonstrated resilience in the face of challenges including inflation, rising energy costs, food costs, staff turnover, recruitment difficulties and transport strike action. Yet ... According to the BDO Restaurant and Bars Report for 2023, over half of consumers cut back on discretionary spending to put the money towards energy bills. Of these people, 6 in 10 intended to achieve this by reducing how often they eat out (Barclaycard); 77% of UK hospitality firms reported a decrease in diners and drinkers at the end of last year. Outlets are responding by reducing opening hours and days to reduce energy costs. The British Beer and Pub Association reported over 500 pubs closed for good in 2023. In the Hotel sector, according to "Visit Britain" Hotel Occupancy rates were actually up in the final quarter from 76.3% to 77.0% thanks to a slight increase in the December performance. Overall, a disappointing performance in the leisure sector in the final quarter. The trade will be looking for a budget boost in the March statement on business rates, lower VAT and reform of the apprenticeship levy. The step up in the National Living Wage in April is unlikely to improve sentiment. The easing of price pressures on food and energy will help. The anticipated fall in base rates will undoubtedly assist. For the year as a whole, we still expect modest GDP growth of 0.7% in 2024 and over 1.3% in 2025. Inflation is expected to slow further, our base rate outlook is unchanged.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed