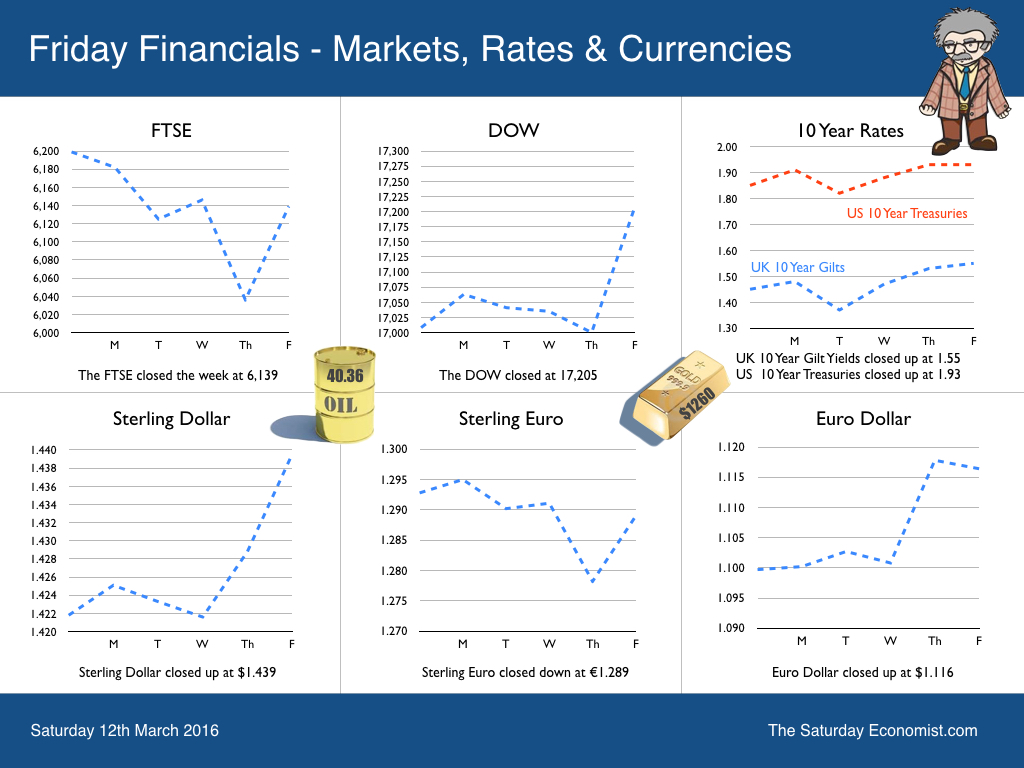

Chancellor faces tough budget week … It was a tough week for the Chancellor in the run up to the budget. This is the week of ONS updates on manufacturing,trade and construction. Manufacturing was flat in the first month of the year, construction was hit by the lack of public sector projects and the trade deficit with the EU hit record levels. The Chancellor will miss his borrowing target in the current financial year as the OBR will reveal next week. A great start! Should we worry about our 2.6% growth projection this year? A bit. We don’t expect much from manufacturing or construction, dependent on service sector and leisure sector output as we are. Household spending and investment will support domestic demand. The consensus is for lower growth of 2.2% this year. We expect sluggish growth in the first quarter but don’t write off the higher target just yet. Brexit … Boris Johnson appeared in Dartford this week, warning of “Brexit” fear mongers and the Gloomadon [Popper] Doppers. Reassuring the people of Britain, we have nothing to fear but fear itself. Boris takes his lines from Franking D Roosevelt in his 1933 inauguration speech. Churlish to point out US unemployment then averaged 20% over the next six years. Further reassurance was offered. No need to worry about tariffs. The people of France love the dense, glutinous chocolate cake we export from Walthamstow apparently. No need to worry about The Free Trade Area. The UK will have a deal like Canada. OK it may take seven to ten years to get the deal but what fun (and uncertainty) we will have along the way. Especially if Boris is leading the negotiations. What hope for simultaneous translation ... add another two years to the timetable for that! No need to worry about onerous regulation from Brussels. The people of Britain will “cast off their chains and be free”. Free to let our children “blow up balloons” and build “tall lorries” which won’t be allowed to drive in Europe but will be able to crash into bridges around the UK. Excellent! Gunboats down the Rhine, tall ships along the Seine, we will let them eat Essex cake and Welsh lamb, tax free. Civis Britannicus Sum. The Brexit is a vital issue for the UK economy. The voting public deserve an intelligent debate. Not a series of sound bites and photo ops in a cold depot in Dartford with a strange blend of Franglais to spell out the message. Don't miss The Saturday Economist on Brexit - Out Soon. Draghi Magic Fails to Convince … In Europe the ECB voted to reduce rates to zero and extend the QE programme. The interest rate on the main refinancing operations of the Euro system was reduced by 5 basis points to 0.00% and the rate on the marginal lending facility was reduced by 5 basis points to 0.25%. The rate on the deposit facility was lowered by 10 basis points to -0.40%. Monthly purchases under the asset purchase programme were expanded from €60 billion to €80 billion, intended to run until the end of March 2017. The ECB expects the key ECB interest rates to remain at present or lower levels for an extended period of time and "well past the horizon of our net asset purchases". The key objective remains the 2% inflation target.. Draghi is peddling old medicines for the wrong ailment. Inflation is always an everywhere an international phenomenon at present. Monetary policy will have little impact with energy and commodity prices on the floor. The good news? The IEA have suggested the oil price has bottomed out. Commodity prices are on the move. The ECB may get back to the inflation target sooner than is believed. A good thing too. The ECB is in danger of dragging Europe deeper into the NIRP crevasse on Planet ZIRP. So what of growth in Europe … According to the ECB economists, growth for the current year is expected to be 1.4% rising to 1.7% next year. The EU28 grew at a rate of 1.8% in 2015. In Spain, the economy grew by 3.5% in the final quarter. In Ireland the Celtic tiger grew by 7.8% last year. A strange time to experiment with lax monetary policy. We know the problems of a one size fits all monetary policy all too well. Oil prices and markets … Markets are bullish. Oil prices Brent Crude closed at over $40 Brent Crude basis, Sterling bounced back to $1.439 and the FTSE closed above 6,000. In the US the Dow closed once again above the sensitive 17,000 level. US Treasury yields rallied, copper, iron ore are on the rise. So what of rates … Our view remains. US rate rises will continue into 2016. Negative rates will be reversed in Europe and Japan. The Bank of England will be forced to act this year, as growth continues, the labour market tightens, earnings increase and inflation trends return. We expect UK rates to rise in the second or third quarter this year as inflation accelerates in the third quarter 2016 … I had a long exchange on Twitter last week with Danny Blanchflower. Mary and I were returning from London and a visit to the ENO. Danny fundamentally disagrees with our outlook and thinks the next move for UK rates will be down. A fair debate! I only wish I had a “Magic Flute” and all would dance to my tune … So what happened to Sterling? Sterling closed up against the Dollar at $1.439 from $1.422 and down against the Euro at €1.289 from €1.293. The Euro moved up against the Dollar to €1.116 from €1.100. Oil Price Brent Crude closed at $40.36 from $38.55 The average price in March last year was $59.58. The deflationary impact continues but will begin to unwind in the third quarter this year. Markets, rallied - The Dow closed at 17,205 from 17,008. The FTSE closed at 6,139 from 6,199. Gilts - yields moved up and down. UK Ten year gilt yields were down at 1.439 from 1.450. US Treasury yields moved up to 1.95 from 1.85. Gold closed at $1,260 ($1,268). A little flutter from the old relic settles back. That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline or download The Saturday Economist App! Our review of the Brexit facts and figures out soon! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed