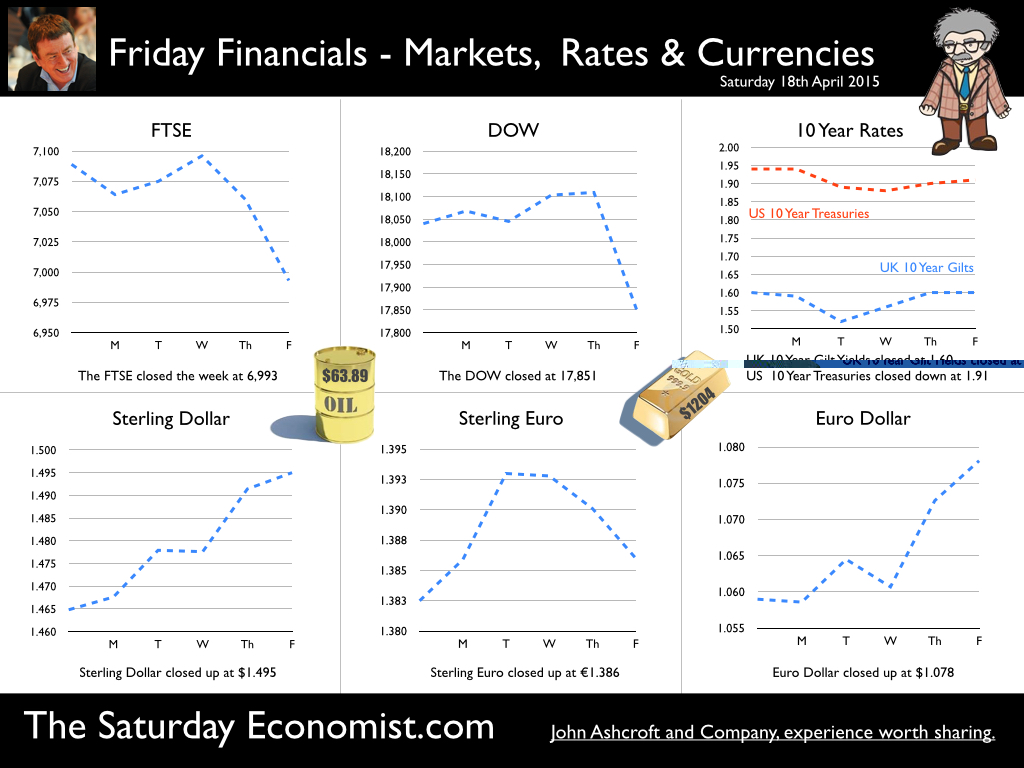

It was a tough start to the week. Breakfast TV, on Monday morning, to explain the UK productivity dilemma. It was a three minute slot, demanding over three hours of research on Sunday afternoon. Excellent! I thought I would share some of the main points in today's update ... So what’s the problem …? According to the latest data from the ONS, labour productivity last year was little changed from 2013. It was slightly lower than in 2007. Productivity is lower than the period prior to the economic downturn. In fact there has been an absence of productivity growth over the last seven years. The trend is unprecedented since the post-war period. If the lack of productivity growth continues, this raises concerns about the potential rate of growth of the UK economy in the years ahead. The UK economy will be unable to grow at trend rate (2.7%) because of constraints to productivity. It is said! But is that really the case? The UK economy is growing above trend rate. Jobs are being created at an unprecedented rate. Businesses are investing, profits are soaring. So what is the problem? Why has productivity been falling over the last fifty years …? For the research, we analysed the data, using estimates of labour productivity in thirty sectors back to 1948. Productivity has been falling over the last fifty years. To understand why it is important to understand the sectoral adjusted trend rate of productivity. So what does that mean exactly … Manufacturing delivers a higher rate of productivity than the service sector. Transport (wheels and wings) deliver a much higher rate of productivity growth than leisure (hotels and restaurants). As the UK becomes more of a service sector economy (and manufacturing falls as a share of output) the overall rate of productivity will fall. The growth of the service sector will mean the overall rate of productivity growth falls over time. Our estimate of the UK sectoral adjusted productivity rate of growth, is just 1.6% compared to an historical trend rate of 2.24%. Why has productivity not been increasing during the recovery …? Almost all of the job creation over the last year has been in the service sector. Particularly in leisure, hotels and restaurants. The productivity gain is near zero. In the manufacturing sector with a exposure to international markets, Productivity is important as a Key Performance Indicator (KPI). But it is not so important in the service sector. In the service sector, service is the KPI. Can waiters serve more tables? Housekeepers clean more rooms? Retailers cut staff without increasing queues at check out? Restaurants and coffee bars, are labour intensive. As chains expand, output improves but expansion does not offer great returns to scale, as would investment in plant and machinery. What really makes the difference to productivity? The level of output. More people spending money in pubs, restaurants, hotels and coffee shops. As demand grows, output increases, productivity improves. The UK economy is growing above trend rate but the level of output is still some 10% below the level which would have been achieved, had there been no setback in 2008. Does this explain the productivity dilemma? In part yes! The cyclically adjusted trend rate of productivity … Traditionally economists think of productivity as a driver of growth. Output as a function of labour, capital and productivity. It is called Total Factor Productivity in a Cobb Douglas framework. [It makes me smile. It is to prepare a Beef Stew beginning with the recipe for nail soup. The nail plays a role but much more is involved.] It is true, as we explain in the research, there is significant correlation between growth and productivity. But as in all correlations, we have to differentiate between cause and effect. We should think of productivity, not as a driver of growth but as a simple output of growth. An arithmetical calculation. A function of output divided by labour, delivering the productivity calculation. As output increases, productivity increases. As output falls, productivity falls. Productivity in the service sector … In the manufacturing sector with an exposure to international markets, productivity is important as a Key Performance Indicator (KPI). But is it so important in the service sector, where service is the KPI. Can waiters serve more tables? Housekeepers clean more rooms? Retailers cut staff without increasing queues at check out! The man in the van explains all. Our man in the van, is part of a national fleet delivery service. The next day delivery promise, demands a national fleet with a national team of drivers to keep the vehicles on the road. At the beginning of 2008, order books and the vans were full. Productivity was high. In 2008, the orders fell as did the loads in the back of the van. The productivity of our man in the van fell. It has not made a full recovery since. His productivity is improving but is not yet back to pre recession levels. The vans keep rolling, no matter how big the load in the back! We say, don’t worry too much about UK productivity. Understand the Saturday Economist concept of a sectoral and cyclically adjusted trend rate of growth of productivity. The man in the van helps to explain all. As the economy continues to grow, something will turn up. It will be UK productivity. For a copy of the PDF and the charts associated with this analysis - check out the page link, access and download the detail. So what of other news this week ... Inflation held at 0.0%. Service sector inflation increased at 2.5% and manufactured goods inflation fell by -2.1%. The employment data produced another set of strong results. Vacancies increased to 745,000 and the claimant rate fell 772,000. Next month there will be more vacancies than claimants. No wonder recruitment difficulties are increasing! Earnings are unlikely to remain at the sub 2% level for long! Over the last year, 600,000 more people are in work. The vast majority now in full time employment, in the service sector! So when will rates rise? With some evidence US inflation is edging up, markets still believe the Fed will begin to increase rates in Q3 this year. Once the Fed makes a move, the MPC will surely follow. We could be leaving Planet ZIRP before Christmas …. Buckle up! So what happened to Sterling this week? Sterling moved up against the Dollar to $1.4595 from $1.465 and moved up against the Euro to €1.386 from €1.382. The Euro rallied against the Dollar at €1.078 from €1.059. Oil Price Brent Crude closed up at $63.89 from $57.50. The average price in April last year was $107.76. The deflationary push continues for the moment. But watch out, our forecasts of a $75 - $80 oil price recovery, no longer so far fetched. Markets, could not hold the magic marks. The Dow closed at 17,851 from 18,040 and the FTSE closed just below 7,000 at 6,993 from 7,089. UK Ten year gilt yields held at 1.60. US Treasury yields moved down to 1.91 from 1.94. Gold closed steadied at $1,204 ($1,206). That’s all for this week. Don’t miss The Big Social Media Conference in July and The Great Manchester Economics Conference in October. It’s a great line up for all events! The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed