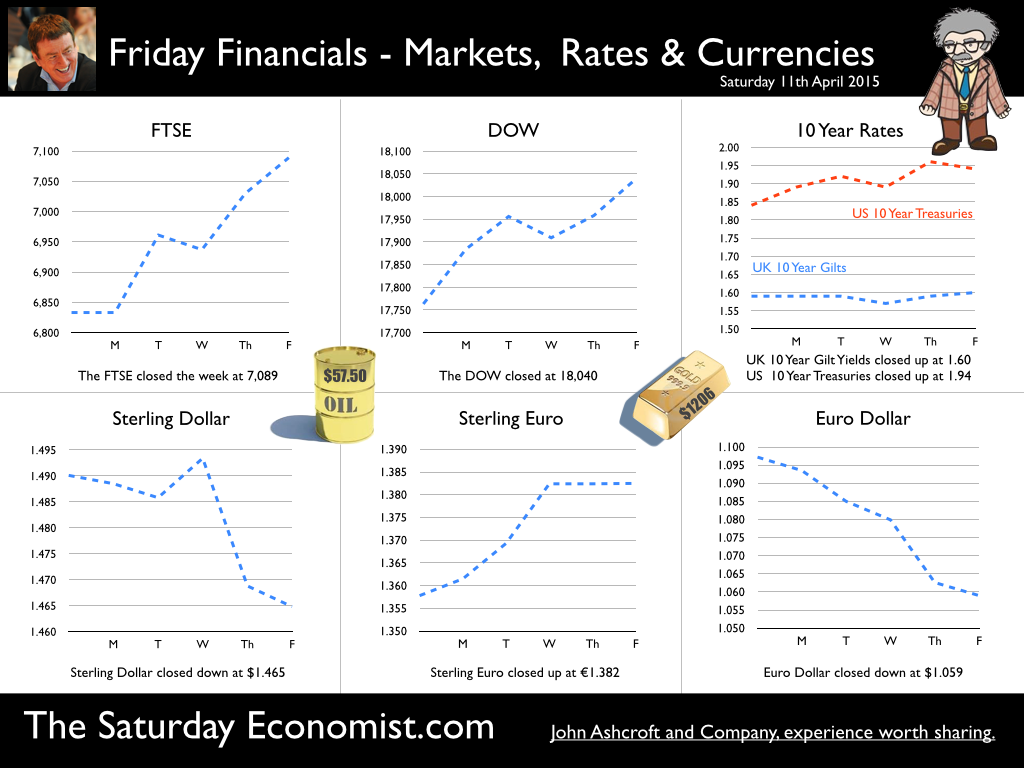

Manufacturing and construction data suggest slower growth in Q1 … This week the ONS released the latest data on trade, construction and manufacturing for the month of February. For a Chancellor of the Exchequer just weeks away from election, it was not great news … The trade deficit increased, the march of the makers slowed to a stroll and construction workers walked backwards. The data must have created some doubt in Downing Street about the platform for the polls. The first estimate of GDP for the first quarter will be released on the 28th of April. Days from the deafening roar of the electorate, strategists will be reminded of the dodgy trade data costing Harold Wilson the election in 1970. It’s the economy stupid and it ain’t going as well as we thought! Or is it? So how bad can it be …? The week had started well enough. The Markit/CIPS PMI® data for March suggested growth in the service sector accelerated in March. The index rose to 58.9 from 56.7 in February, a marked pace of expansion - the fastest since August 2014. For the first quarter, growth was estimated to be faster than the 3.4% rate achieved in the final quarter of last year. It was all going so well … Then came the trade data … The trade data dashed hopes of the rebalancing agenda. The deficit increased in February from prior month. The UK deficit on trade in goods and services increased to £2.9 billion in February 2015, from £1.5 billion in January. A deficit of £10.3 billion on goods, was partially offset by an estimated surplus of £7.5 billion on services. The widening of the trade deficit between January and February 2015 mainly reflected a fall in exports of goods to the United States. Imports, on the other had, were exactly in line with our forecasts. Whilst some commentators suggested the deficit was a signal of lower UK growth, the reality is quite the reverse. Strong import growth is a reflection of strong growth in domestic demand plus the February export setback is more anomaly than trend. We expect the deficit trade in good to be between £123 billion for the current year with an overall goods and services deficit of around £35 billion. Nothing changes over much with the February release. Then came the manufacturing data … ONS data suggested output in the manufacturing sector slowed to 1.1% in February. Growth for January was revised down to 1.7%. We had expected growth of 2.5% in the first quarter but now 1.5% looks to be a better bet. The good news, there were increases in nine manufacturing sub-sectors compared with a year ago. The largest contribution from the manufacture of cars and transport, up by 6.1%. The overall fall in the rate of growth is difficult to explain and data may well be revised in the months ahead. Then came the construction data … According to the ONS, output in construction fell by 1.3% in February and by 3% in January. Output will probably fall by around 1.5% for the full quarter, if the latest data are to be believed. We had expected much stronger growth. [Construction output increased by 7.5% in 2014 with growth slowing to 4.5% in the final quarter]. We still expect construction output to increase by 5% for the year as a whole but we shall see … So what of growth Q1 … Following the latest data, we now expect growth of 2.5% in the first quarter down from an earlier 3% estimate. NIESR estimate growth in the first quarter will be around 2.6% year on year. Although slower than the 3% recorded in the final quarter last year, it is respectable, given trends in Europe and the USA. Next month we will update our Quarterly Economic Outlook … don’t miss that! So when will rates rise? Markets still believe the Fed will begin to increase rates later this year. Minutes from the Fed meeting haven’t changed expectations over much. Q3 now the firm favourite following the slight downward growth revisions for 2015 and sluggish jobs growth data in March released last week. In the UK the forward OIS curve suggests markets still expect rates to rise in the first or second quarters of 2016. The wait may not be so long … especially if markets take fright. In the UK, we still expect growth of around 3% this year. The labour market is tightening, recruitment difficulties are increasing, wage rates and settlements are set to rise. The inflation outlook will be materially different towards the end of the year. Once the Fed makes a move, the MPC will surely follow within the year …. So what happened to Sterling this week? Sterling slipped against the Dollar down to $1.465 from $1.490 but moved up against the Euro to €1.382 from €1.358. It was all about the Euro this week, heading in the wrong direction. The Euro closed down against the Dollar at €1.059 from €1.097. The push to parity resumed. Oil Price Brent Crude closed up at $57.50 from $55.13, despite the Gatwick find. The average price in April last year was $107.76. The deflationary push continues. Markets, moved above the Magic Marks. The Dow closed up 18,040 from 17,763 and the FTSE closed above 7000 at 7089 from 6,833. UK Ten year gilt yields also moved up - to 1.60 from 1.59. US Treasury yields moved up to 1.94 from 1.84. Gold closed up at $1,206 ($1,200). That’s all for this week. Don’t miss The Big Social Media Conference in July and the Great Manchester Economics Conference in October. It’s a great line up for all events! On Monday we will be on TV to explain the UK productivity dilemma to the BBC Breakfast audience. The Saturday Economist, now the TV Economist is mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed