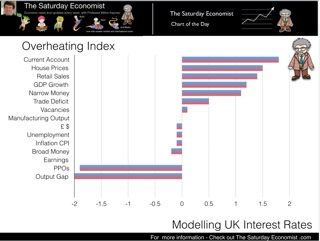

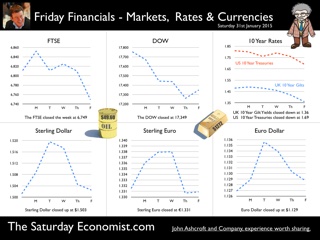

A strange question to ask you may think! Inflation is set to dip into negative territory in the next couple of months. The Governor is set to write a letter to the Chancellor explaining why the MPC has failed to keep inflation near target and for many analysts the first estimate of GDP in Q4 suggests growth was slowing during the whole of 2014. As for monetary policy, base rates are at the zero bound, ten year gilts are at 1.4% and Andy Haldane suggests we met never see interest rates above 2.5% in our lifetime. So should we really worry about overheating? The preliminary estimate of GDP Q4 … The preliminary estimate of GDP in the fourth quarter of 2014 was released this week. GDP was 2.7% higher in the final quarter of 2014 compared with the same quarter of 2013. For the year as a whole, GDP growth was up 2.6% on prior year. In the quarter, the service sector continued to lead the recovery with growth up by 3.3%. Once again there was particularly strong growth in leisure, distribution and business services with growth averaging 4.3%, across the private service sectors (sector weighted basis). Manufacturing output … Manufacturing output increased by just 2% and construction growth increased by 3.5%. Energy, utilities and extractives continue to have an overall negative impact on the performance of the economy. So what of 2015? … The provisional ONS estimate is slightly below our expectations in the final quarter and for the year as a whole, for that matter. In 2015 we expect strong growth to continue, based in part on the performance of The Manchester Index™. Output in the economy, will be assisted by a slight improvement in the trade account deficit, as a result of the oil price bonus. We continue to forecast GDP growth of 2.9% in 2015, sustained by continued strength in the service sector, a modest slow down in construction and continued average growth around 2.5% in the manufacturing sector. So why worry about overheating? So why worry about overheating? The labour market is reaching levels of unemployment and rates last seen immediately prior to recession. Vacancy rates are at an all time high. Earnings are rising. Private sector pay is increasing by over 2%. As for inflation, service sector inflation remains over 2%. The effects of oil, energy and commodity prices will drop out of the system by the end of the year, providing the basis of a goods inflation price rebound. We expect oil prices to return to $75 plus. CPI inflation will be significantly higher towards the end of the year and into the first quarter of 2016. Service sector growth is above trend rate. Private service sector growth was 4.3% in the final quarter. Construction was up by 6% in 2014. The slow down in the construction final quarter a result of a repair and maintenance relapse, as new work especially housing continued to surge. House prices are still increasing by 6% in January. A slow down to 4% by the end of the year would represent normality, rather than market weakness. Consumer confidence is increasing with propensities to spend approaching 2005 levels. Retail sales are soaring, albeit with weaker prices. Retail sales volumes were up by 5% in the final quarter of 2014 with internet sales up by 8% in December. For monetarists, narrow money is growing at over 5% a year, broad money growth is flat. Sterling is soft against the dollar but strong against the Euro, caught, as it is, in the Euro Dollar transatlantic matrix. The internal deficit (Government borrowing) is still too high and the external deficit (Current Account) is at crisis levels last seen in 1974 and 1989. In the wider world, US growth was 2.4% in 2014 with growth forecasts of over 3% this year. Strong growth continues in China and India, Europe is recovering, the prospects for South America and Eastern Europe remain weak but the world recovery continues, with the IMF expecting growth of 3.5%. It is a strange world. According to Christine Lagarde : It is “A world of asynchronous normalisation of monetary policy and increasing volatility of capital flows.” Ah yes … In the UK the Financial Policy Committee places great emphasis on the importance of “counter cyclical buffers in the banking sector”. But in a world of asynchronous sector growth in the UK alone, it is difficult to know where we are in the economic cycle. Economic policy making doesn’t come with an accurate GPS device, it comes with a dodgy compass and a dated map, updated frequently and violently by the ONS. So what about UK rates? At the last MPC meeting, unanimity returned to the aviary. All doves now, no one is voting for a rate rise now, in view of the deflationary impact of energy prices. It isn’t so much that rates should rise now, it is beginning to look as if they should have been increased some time ago. We have spent too long on Planet ZIRP. Soon it will be time to leave … why? Because the UK economy is overheating, as always it simmers gently at first …. So what happened to Sterling this week? Sterling held against the Dollar at $1.503 and against the Euro at €1.331. The Euro closed against the Dollar at €1.129. Oil Price Brent Crude closed steady at London close at $49.60 from $49.15. The average price in January last year was $108.126. Markets, closed down. The Dow closed down at 17,349 from 17,754 and the FTSE closed down at 6,749 from 6,811. UK Ten year gilt yields moved down to 1.36 from 1.48. US Treasury yields fell to 1.69 from 1.81. Gold closed at $1,272 ($1,298). That’s all for this week. Check out our Oil Market Update. Don’t miss the Great Manchester Business Conference in March, the Social Media Conference in July and the Economics Conference coming to Manchester in October. It’s a great line up for all our events! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed