|

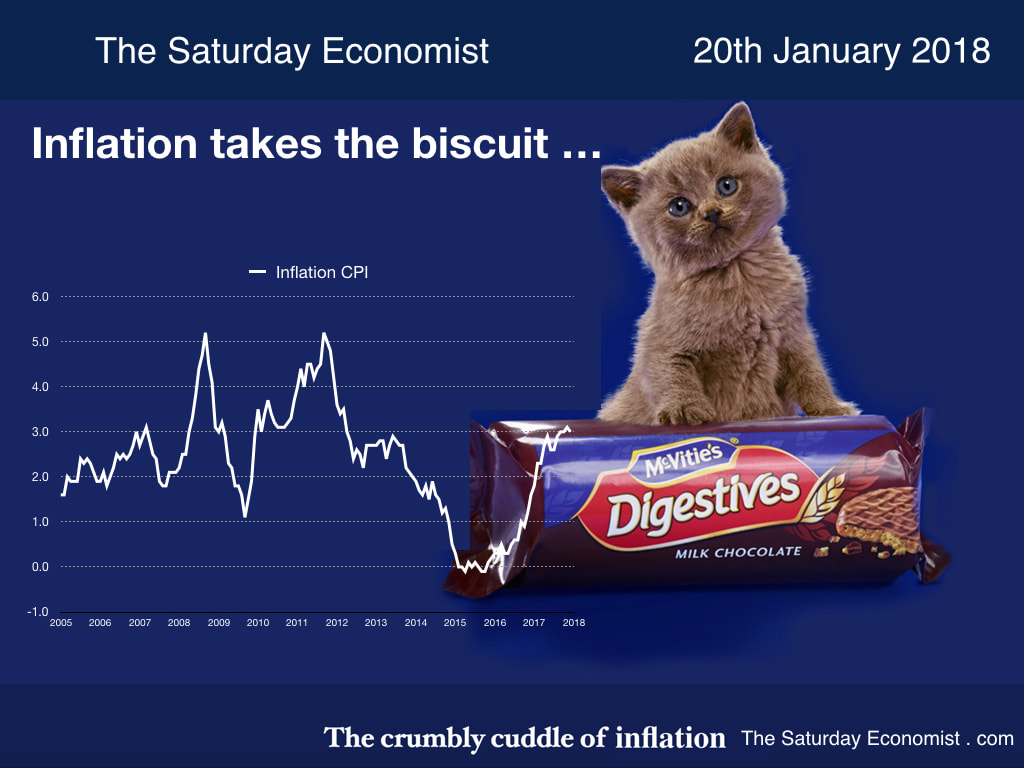

Inflation CPI eased back to 3.0% in December. The worst appears to be over. Or is it? Most analysts expect inflation to ease back to 2.4% by the end of 2018. It's a fair bet, though it may be slightly ambitious.

Goods inflation increased to 3.5% in December. Food inflation hit 4.1% but fish lovers were paying 9% more for the catch. Coffee addicts were shelling out nearly 10% more than the same fix, same time last year. Still smoking... that'll be nine per cent plus. Want to heat the house, you will be paying 6% extra. Using electricity, why that's up by 11% year on year. Planning to leave the house, transport costs are up by over 4%. Stay at home, read a book there's a 5% tariff this year. Time to renew the insurance policies, then allow 6% extra for that. So what does this really mean? It means inflation is endemic in the system. Don't be mislead by the headline number. The apparent fall in CPI inflation was achieved by a perceived fall in service sector inflation to 2.5%. Can that really be right? Producer prices in the UK increased to 3.3% in December from 3.1% prior month. Food prices increased by over 5%. Yes inflation does take the biscuit. McVities cut the pack size of digestives from 500g to just 400g. All to preserve a precious price point for household incomes under pressure. Manufacturing input prices increased by just 4.9% from over 7% prior month. The fall had been expected. Sterling has rallied from the post referendum lows, oil prices have rallied but further gains are unlikely given the advances in US shale output. There is some suggestion the fall may allow the MPC to pass on further rate hikes this year. Do not plan for that. The Fed is expected to hike rates at least three times this year. The US tax bill will flatter growth but increase the fiscal and trade deficits. The dollar is weakening. US ten year bonds are trading at 2.6% plus. The US bond market is well along the path to normalization as UK gilts languish at just 1.3%. Trump may talk tough on trade with China but hints of a Sino inspired bond strike could put further pressure on bond yields and on short rates. The MPC will probably follow with at least two rate increases this year despite the concerns about Brexit. Ironic this week Boris Johnson announced ambitions for a bridge with Europe across the Channel. Oh the irony. Jacob Rees-Mogg explained he is not in favour of a transition period to bridge the EU deal but would be in favour of an implementation period. In and out. Leaving Europe not leaving Europe. Building bridges not trenches. implementing not transitioning. Time to check the small print ... as always ... the riddle of Rashomon rules ... Schrödingers cat is not sitting on a packet of chocolate digestives this week-end ... So what of retail sales ... The riddle of retail appeared to bamboozle the ONS this week. Headlines tell the story retail sales fell by 1.4% in December compared to prior month. Don't get too alarmed. Compared to December 2017, sales volumes were actually up by 1.4%. In value terms retail sales increased by 4.4% prior year. A healthy increase sustained over the full final quarter of the year. The changing pattern of retail is changing the pattern of sales in the run up to Christmas a result. Long gone are the days when retail would hold off price cuts until the January sales. The January sale moved to Boxing Day. Blue Cross days pulled the cuts before Christmas. Then came the internet, Black Monday and Cyber Friday pulled the discounting and the volume into November. On line sale were up by 9% in December, accounting for 18% of retail activity. Clothing sales were up by 21% account accounting for almost one in five transactions. On line food sales were up by 12%, taking one in twenty transactions with a 5.5% share. It's a mixed bag on the high street. Waterstones and Halfords offered strong results. Carpetright announced a profit warning. Next and Kingfisher shares took a hit. Primark bucked the tends with good sales growth.Bonmarché share fell by 20 per cent as it warned of difficult market conditions. Overall sales in the final quarter fell by 6.9% in like for like sales despite a near 30% surge in on line sales. Lies, damn lies and seasonal adjustments are forcing radical readjustments to the ONS data. Don't be too alarmed by the headlines, like for like sales spending increased by 4.5% in the final quarter of the year. That's assuming we have captured all of the significant data ... and made the correct seasonal adjustments ...

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed