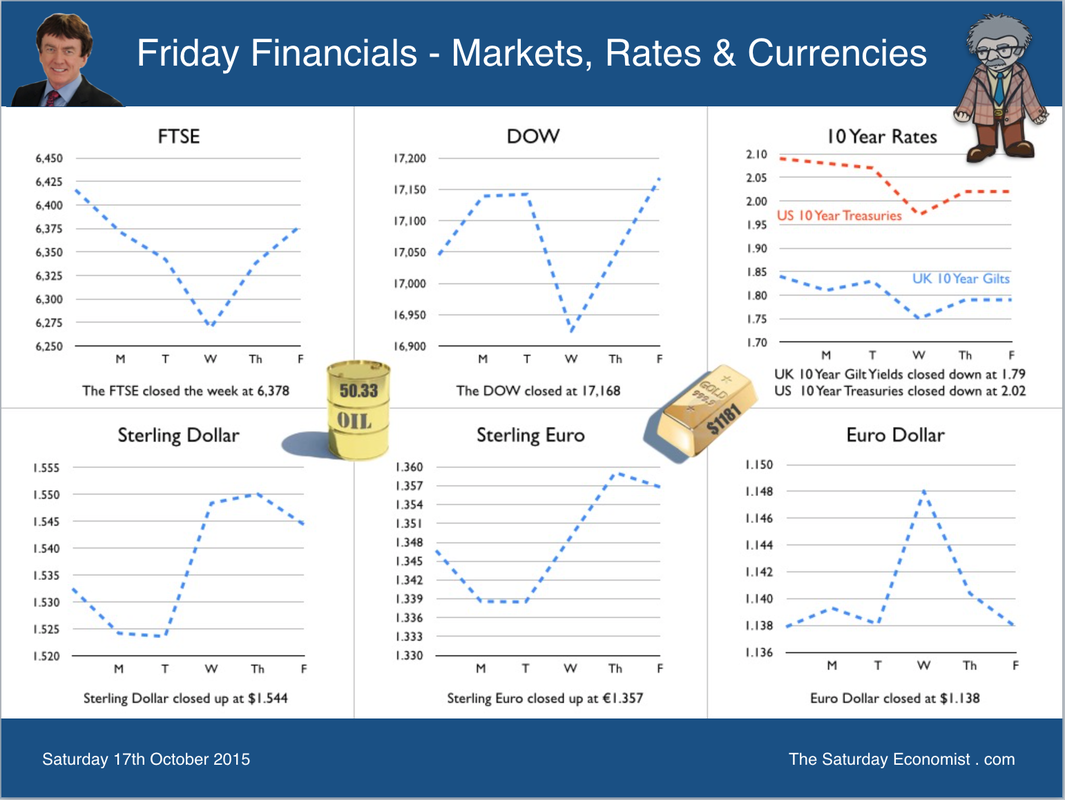

It isn’t supposed to be like this. Inflation is falling but so is unemployment. The jobs market is tightening with no discernible impact on inflation. The Monetary Policy Committee has mixed views on the need to tighten monetary policy. Has the relationship between unemployment and inflation broken down? Based on data over the past ten years, correlation is weak and incorrectly signed. Inflation appears to increase as unemployment increases. It really isn’t supposed to be like this. No wonder policy makers appear confused. So what of earnings and employment … The relationship between employment and earnings remains strong. Especially the relationship between real earnings and employment. Earnings and real earnings increase, as unemployment levels fall. The impact of inflation on real earnings is negative. As inflation rises, real incomes fall. As inflation falls, real incomes rise. The trade off is a by product. There is little or no inflation anticipation in the wage round. So what of earnings and inflation … The correlation between earnings and inflation is weak. Earnings rise but with no discernible impact on inflation. No wonder the MPC is loathe to act. Inflation is no longer a function of the Phillips Curve nor is it always and everywhere a monetary phenomenon. For the moment inflation is always and everywhere an international phenomenon. It’s about the strength of Sterling, the weakness of international trade, commodity and energy prices impacting on domestic price levels. But it won’t always be like this. At some stage, the strength of household expenditure and domestic demand fueled by high employment and rising earnings will impact on prices and the trade deficit. Then the MPC will have to act. Rate increases will rise more quickly and higher than is currently expected as a result. Implications for policy … Service sector inflation is above target, earnings are increasing especially in construction and the leisure sector. Real earnings adjusted for inflation are back at levels last seen pre recession. The jobs market is at levels last seen in 2008. The headline level of inflation is creating an illusion driven by low oil and commodity prices. A change in OPEC policy and a change in Sterling’s fortunes could see inflation increasing and quickly in 2016. Monetary policy could be the real basket case in 2016 unless rates begin to rise and soon. It really is time to consider the first move up in rates. So what happened to inflation … Inflation CPI basis fell by 0.1% in the year to September 2015, compared 0.0% in the year to August. A smaller than usual rise in clothing prices and falling motor fuel prices were the main contributors to the drop. Goods inflation pushed down the overall value, falling by -2.5% in the same period. Service sector inflation on the other hand was above target at 2.5% in the month, up from 2.3% in August. Inflation manufacturing prices … Factory gate inflation fell 1.8% in the year to September 2015, compared with a fall of 1.9% last month. Input costs for manufacturing fell by -13.3% compared to almost 15% month prior. Crude oil and imported metal prices were the major contributors to lower costs presenting a confusing picture for policy makers. Labour Market Trends … The economy continues to grow strongly as the latest jobs figures demonstrate. The unemployment rate in August fell to 5.4%, compared to 6% a year earlier. It has not been lower since early 2008. There were just 1.77 million unemployed people, 198,000 fewer than a year earlier. The claimant count fell to just over 700,000 in August a rate of 2.3%. Vacancies were steady at around 740,000. The U:V ratio i.e. the rate of claimants to vacancies was just 1.08 in line with trends at peak, immediately prior to the recession. Earnings continue to rise as the job market tightens. Average earnings increased to 3.1% in the month. Private sector pay increased by 3.5% with particularly high increases in construction (6.4%) and leisure (5.1%). The labour market is tightening, recruitment difficulties are increasing and household incomes are improving. Adjusted for inflation, real earnings are back to pre recession levels. No wonder households are confident and are spending. So what of oil prices … North Sea Brent crude oil prices averaged $48 per barrel in September. EIA forecasts Brent crude prices will average $54 dollars per barrel in 2015 and just $59 per barrel in 2016, according to the latest Short Term Economic Outlook. If prices do hover around the $54 mark, the deflationary impact will evaporate by the end of the year and into 2016. Energy costs could be rising by over 10% year on year as early as January. So what happened to Sterling this week? Sterling moved up against the Dollar to $1.544 from $1.532 and moved up against the Euro to €1.357 from €1.347 The Euro was unchanged against the Dollar at €1.138. Oil Price Brent Crude closed at $50.33 from $52.94. The average price in October last year was $87.43. The deflationary push continues. A $75 - $80 recovery by Q4 remains the base case in our outlook forecast. This appears unrealistic against the EIA forecast and the OPEC stance on output. Markets, up this week? The Dow closed at 17,168 from 17,045. The FTSE closed down at 6,378 from 6,416. Gilts - UK yields slipped. UK Ten year gilt yields were at 1.79 from 1.84. US Treasury yields moved down to 2.02 from 2.09. Gold moved up to $1,181 ($1,156). John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed