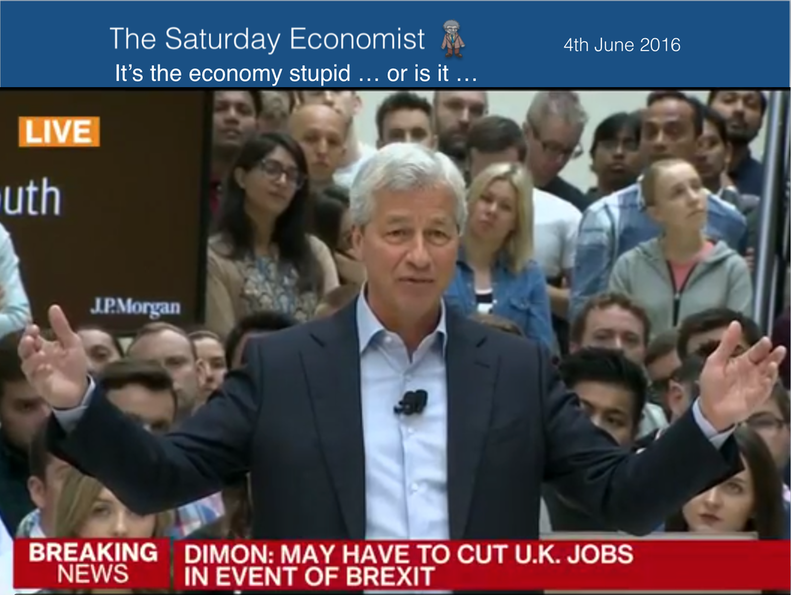

Bill Clinton’s 1992 presidential campaign was built on three key platforms, the economy, change and healthcare. It was for Clinton a winning trilogy. In the main, it was the economy. The economy and jobs determine votes. For the EU referendum, the economy may not be sufficient to bring victory to the Remain campaign. The business and economic arguments largely won, the sovereignty options, a Hobson’s choice for many. Immigration is proving to be a big issue with voters. Michael Gove on Sky this week, couldn’t give a guarantee about job retention if the “Leave” campaign was successful. “A group of UK MEPs (and the Prime Minister) may be on the list for starters” he jibed. Jamie Dimon at JP Morgan was explicit. A quarter of his London workforce, would face the chop if the UK were to leave the EU. For sure we know, more jobs in London financial services will go to Frankfurt and Paris if we vote “Leave” on the 23rd June. It’s immigration stupid … or is it? The referendum campaign is focusing on immigration. Control the borders, take England back, make Britain Great again. The prospect of 96 million Turks living in Torquay looms. Turkish accession will just open the doors to the Middle East and North Africa. Where will it all end for Southend? The EU offers a MENA option by the Syrian back door. No wonder voters are confused. Many are unable to distinguish between the immigration agenda and illegal immigrants crossing the Med. "Dinghies in Dover" with illegals aboard are not a function of EU membership. The “Remain” campaign must do better on the immigration. Growth, revenue and job creation are part of the immigration deal. Foreign workers in healthcare, farming and elsewhere are not taking “our jobs”. After all the UK economy created 400,000 new jobs last year. The economy and jobs are vote winners. The Remain campaign must demonstrate, immigration is a positive thing for both. Our forecasts for 2016 … This week we released our forecasts updates for 2016. Growth in 2015 was 2.3% down from 2.9% in 2014. We now expect growth of 2.2% in 2016, following the disappointing performance of manufacturing and construction in the first quarter. The inflation outlook is still muted, with the fall in world oil, energy, food and commodity prices continuing to dominate headline inflation. The UK economy grew by 2.0% in the first quarter, revisions to construction and manufacturing growth pulling total output lower. The service sector continues to drive growth. UK Inflation will average just 0.6% over the balance of the year 2016, with an increase in the second half. Unemployment will continue to fall, government borrowing will also fall. The service sector will lead the recovery as manufacturing and construction output falls slightly. We are forecasting a modest fall in manufacturing of around 0.2% in 2016 with a 0.9% fall in construction activity based on the latest data. The trade figures will continue to disappoint, offset by a further £2 billion oil dividend, despite a moderate oil price recovery. The challenge to the current account following the drop in overseas investment income continues and will present a significant problem to the outlook for sterling over the medium term, in or out of the EU. Growth in the economy is driven by household spending especially in the leisure and retail sector. Manufacturing, construction are foundering. Investment and government spending is slowing. The trade deficit is increasing, the current account deficit looms large. No time to “go it alone”. No re-balancing, no march of the makers, no export surge ... Sterling will be under pressure in or out of the EU. Our forecast is based on a "remain" referendum outcome. To access the update Check out The Saturday Economist Latest Forecast Page. and download the update. Over in the U.S.A … May’s non-farm payrolls figure increased by just 38,000, 73,000 after adjusting for 35,000 striking Verizon workers. The figure, the lowest since September 2010, were below consensus estimates by 122,000 jobs. A June rate hike from the Fed is now “very unlikely”, according to Paul Ashworth, chief US economist at Capital Economics. Job gains in the preceding two months were revised down by a cumulative 59,000. The weakness in May’s payrolls was widespread. Manufacturing lost 10,000 jobs, construction shed 15,000 jobs and temporary help fell by 21,000. The average monthly job gains are now around 110,000 since the start of the year. So what of rates? In the USA, the job figures would suggest a rate rise this month is off the agenda. July remains a possibility but we now may have to wait for the Autumn. In the UK, we still expect rates to be at least 0.75% by the end of the year, with two rate hikes to 1% a further (remote) possibility. So what happened to Sterling? Sterling closed down against the Dollar at $1.452 from $1.464 and down against the Euro at €1.281 from €1.314. The Euro moved down against the Dollar to 1.133 from €1.140. Oil Price Brent Crude closed at $49.45 from $49.22 The average price in May last year was $61.48. Markets, moved down - The Dow closed at 17,782 from 17,867. The FTSE closed at 6,209 from 6,270. Gilts - yields moved down. UK Ten year gilt yields closed at 1.28 from 1.43. US Treasury yields moved to 1.72 from 1.83. Gold closed at $1,239 from $1,213. John That's all for this week. Don't miss Our What the Papers Say, morning review! Follow @jkaonline and download The Saturday Economist App! Our review of the Brexit facts and figures out now! Download Here! John © 2016 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed